Jingyu Zhang

FedLAD: A Modular and Adaptive Testbed for Federated Log Anomaly Detection

Dec 09, 2025Abstract:Log-based anomaly detection (LAD) is critical for ensuring the reliability of large-scale distributed systems. However, most existing LAD approaches assume centralized training, which is often impractical due to privacy constraints and the decentralized nature of system logs. While federated learning (FL) offers a promising alternative, there is a lack of dedicated testbeds tailored to the needs of LAD in federated settings. To address this, we present FedLAD, a unified platform for training and evaluating LAD models under FL constraints. FedLAD supports plug-and-play integration of diverse LAD models, benchmark datasets, and aggregation strategies, while offering runtime support for validation logging (self-monitoring), parameter tuning (self-configuration), and adaptive strategy control (self-adaptation). By enabling reproducible and scalable experimentation, FedLAD bridges the gap between FL frameworks and LAD requirements, providing a solid foundation for future research. Project code is publicly available at: https://github.com/AA-cityu/FedLAD.

Advancing Autonomous Driving System Testing: Demands, Challenges, and Future Directions

Dec 09, 2025Abstract:Autonomous driving systems (ADSs) promise improved transportation efficiency and safety, yet ensuring their reliability in complex real-world environments remains a critical challenge. Effective testing is essential to validate ADS performance and reduce deployment risks. This study investigates current ADS testing practices for both modular and end-to-end systems, identifies key demands from industry practitioners and academic researchers, and analyzes the gaps between existing research and real-world requirements. We review major testing techniques and further consider emerging factors such as Vehicle-to-Everything (V2X) communication and foundation models, including large language models and vision foundation models, to understand their roles in enhancing ADS testing. We conducted a large-scale survey with 100 participants from both industry and academia. Survey questions were refined through expert discussions, followed by quantitative and qualitative analyses to reveal key trends, challenges, and unmet needs. Our results show that existing ADS testing techniques struggle to comprehensively evaluate real-world performance, particularly regarding corner case diversity, the simulation to reality gap, the lack of systematic testing criteria, exposure to potential attacks, practical challenges in V2X deployment, and the high computational cost of foundation model-based testing. By further analyzing participant responses together with 105 representative studies, we summarize the current research landscape and highlight major limitations. This study consolidates critical research gaps in ADS testing and outlines key future research directions, including comprehensive testing criteria, cross-model collaboration in V2X systems, cross-modality adaptation for foundation model-based testing, and scalable validation frameworks for large-scale ADS evaluation.

Jailbreak Distillation: Renewable Safety Benchmarking

May 28, 2025Abstract:Large language models (LLMs) are rapidly deployed in critical applications, raising urgent needs for robust safety benchmarking. We propose Jailbreak Distillation (JBDistill), a novel benchmark construction framework that "distills" jailbreak attacks into high-quality and easily-updatable safety benchmarks. JBDistill utilizes a small set of development models and existing jailbreak attack algorithms to create a candidate prompt pool, then employs prompt selection algorithms to identify an effective subset of prompts as safety benchmarks. JBDistill addresses challenges in existing safety evaluation: the use of consistent evaluation prompts across models ensures fair comparisons and reproducibility. It requires minimal human effort to rerun the JBDistill pipeline and produce updated benchmarks, alleviating concerns on saturation and contamination. Extensive experiments demonstrate our benchmarks generalize robustly to 13 diverse evaluation models held out from benchmark construction, including proprietary, specialized, and newer-generation LLMs, significantly outperforming existing safety benchmarks in effectiveness while maintaining high separability and diversity. Our framework thus provides an effective, sustainable, and adaptable solution for streamlining safety evaluation.

Certified Mitigation of Worst-Case LLM Copyright Infringement

Apr 22, 2025

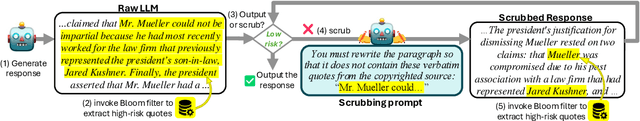

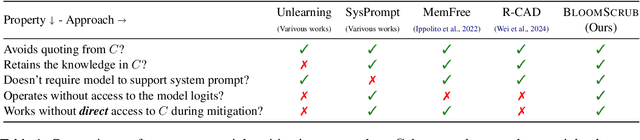

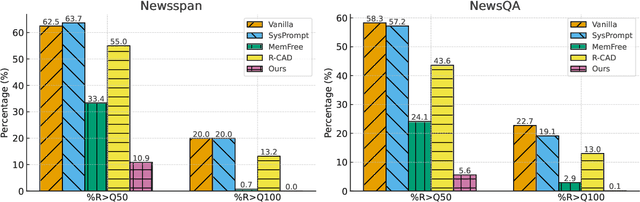

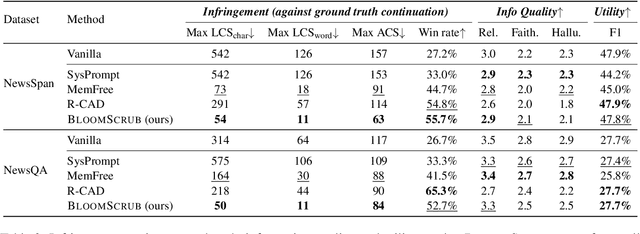

Abstract:The exposure of large language models (LLMs) to copyrighted material during pre-training raises concerns about unintentional copyright infringement post deployment. This has driven the development of "copyright takedown" methods, post-training approaches aimed at preventing models from generating content substantially similar to copyrighted ones. While current mitigation approaches are somewhat effective for average-case risks, we demonstrate that they overlook worst-case copyright risks exhibits by the existence of long, verbatim quotes from copyrighted sources. We propose BloomScrub, a remarkably simple yet highly effective inference-time approach that provides certified copyright takedown. Our method repeatedly interleaves quote detection with rewriting techniques to transform potentially infringing segments. By leveraging efficient data sketches (Bloom filters), our approach enables scalable copyright screening even for large-scale real-world corpora. When quotes beyond a length threshold cannot be removed, the system can abstain from responding, offering certified risk reduction. Experimental results show that BloomScrub reduces infringement risk, preserves utility, and accommodates different levels of enforcement stringency with adaptive abstention. Our results suggest that lightweight, inference-time methods can be surprisingly effective for copyright prevention.

Can A Society of Generative Agents Simulate Human Behavior and Inform Public Health Policy? A Case Study on Vaccine Hesitancy

Mar 12, 2025Abstract:Can we simulate a sandbox society with generative agents to model human behavior, thereby reducing the over-reliance on real human trials for assessing public policies? In this work, we investigate the feasibility of simulating health-related decision-making, using vaccine hesitancy, defined as the delay in acceptance or refusal of vaccines despite the availability of vaccination services (MacDonald, 2015), as a case study. To this end, we introduce the VacSim framework with 100 generative agents powered by Large Language Models (LLMs). VacSim simulates vaccine policy outcomes with the following steps: 1) instantiate a population of agents with demographics based on census data; 2) connect the agents via a social network and model vaccine attitudes as a function of social dynamics and disease-related information; 3) design and evaluate various public health interventions aimed at mitigating vaccine hesitancy. To align with real-world results, we also introduce simulation warmup and attitude modulation to adjust agents' attitudes. We propose a series of evaluations to assess the reliability of various LLM simulations. Experiments indicate that models like Llama and Qwen can simulate aspects of human behavior but also highlight real-world alignment challenges, such as inconsistent responses with demographic profiles. This early exploration of LLM-driven simulations is not meant to serve as definitive policy guidance; instead, it serves as a call for action to examine social simulation for policy development.

DSRC: Learning Density-insensitive and Semantic-aware Collaborative Representation against Corruptions

Dec 14, 2024

Abstract:As a potential application of Vehicle-to-Everything (V2X) communication, multi-agent collaborative perception has achieved significant success in 3D object detection. While these methods have demonstrated impressive results on standard benchmarks, the robustness of such approaches in the face of complex real-world environments requires additional verification. To bridge this gap, we introduce the first comprehensive benchmark designed to evaluate the robustness of collaborative perception methods in the presence of natural corruptions typical of real-world environments. Furthermore, we propose DSRC, a robustness-enhanced collaborative perception method aiming to learn Density-insensitive and Semantic-aware collaborative Representation against Corruptions. DSRC consists of two key designs: i) a semantic-guided sparse-to-dense distillation framework, which constructs multi-view dense objects painted by ground truth bounding boxes to effectively learn density-insensitive and semantic-aware collaborative representation; ii) a feature-to-point cloud reconstruction approach to better fuse critical collaborative representation across agents. To thoroughly evaluate DSRC, we conduct extensive experiments on real-world and simulated datasets. The results demonstrate that our method outperforms SOTA collaborative perception methods in both clean and corrupted conditions. Code is available at https://github.com/Terry9a/DSRC.

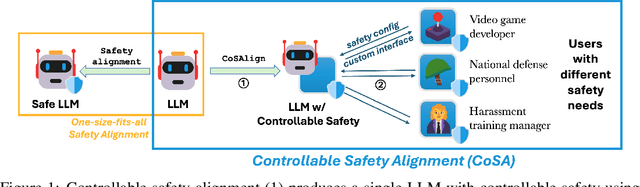

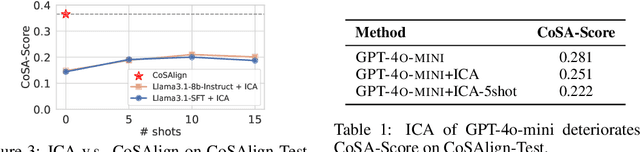

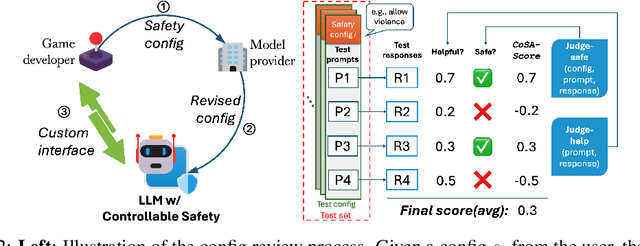

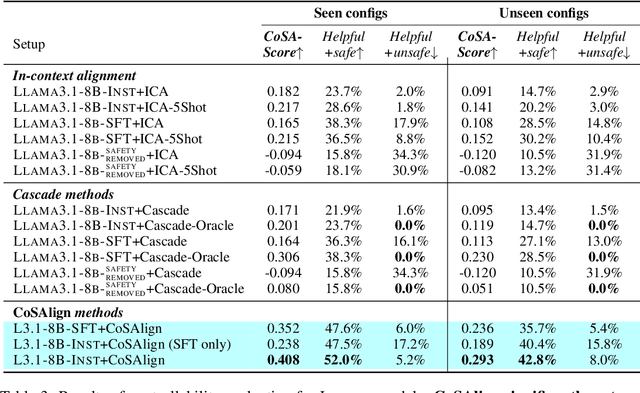

Controllable Safety Alignment: Inference-Time Adaptation to Diverse Safety Requirements

Oct 11, 2024

Abstract:The current paradigm for safety alignment of large language models (LLMs) follows a one-size-fits-all approach: the model refuses to interact with any content deemed unsafe by the model provider. This approach lacks flexibility in the face of varying social norms across cultures and regions. In addition, users may have diverse safety needs, making a model with static safety standards too restrictive to be useful, as well as too costly to be re-aligned. We propose Controllable Safety Alignment (CoSA), a framework designed to adapt models to diverse safety requirements without re-training. Instead of aligning a fixed model, we align models to follow safety configs -- free-form natural language descriptions of the desired safety behaviors -- that are provided as part of the system prompt. To adjust model safety behavior, authorized users only need to modify such safety configs at inference time. To enable that, we propose CoSAlign, a data-centric method for aligning LLMs to easily adapt to diverse safety configs. Furthermore, we devise a novel controllability evaluation protocol that considers both helpfulness and configured safety, summarizing them into CoSA-Score, and construct CoSApien, a human-authored benchmark that consists of real-world LLM use cases with diverse safety requirements and corresponding evaluation prompts. We show that CoSAlign leads to substantial gains of controllability over strong baselines including in-context alignment. Our framework encourages better representation and adaptation to pluralistic human values in LLMs, and thereby increasing their practicality.

RATIONALYST: Pre-training Process-Supervision for Improving Reasoning

Oct 01, 2024

Abstract:The reasoning steps generated by LLMs might be incomplete, as they mimic logical leaps common in everyday communication found in their pre-training data: underlying rationales are frequently left implicit (unstated). To address this challenge, we introduce RATIONALYST, a model for process-supervision of reasoning based on pre-training on a vast collection of rationale annotations extracted from unlabeled data. We extract 79k rationales from web-scale unlabelled dataset (the Pile) and a combination of reasoning datasets with minimal human intervention. This web-scale pre-training for reasoning allows RATIONALYST to consistently generalize across diverse reasoning tasks, including mathematical, commonsense, scientific, and logical reasoning. Fine-tuned from LLaMa-3-8B, RATIONALYST improves the accuracy of reasoning by an average of 3.9% on 7 representative reasoning benchmarks. It also demonstrates superior performance compared to significantly larger verifiers like GPT-4 and similarly sized models fine-tuned on matching training sets.

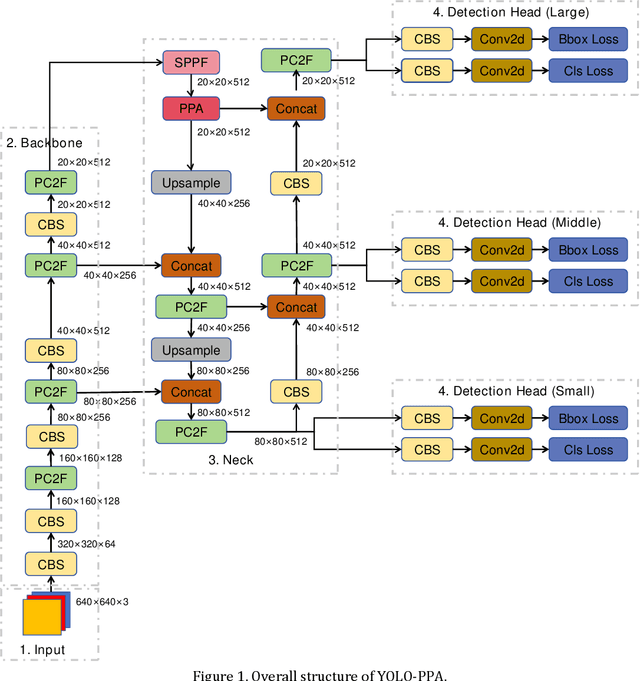

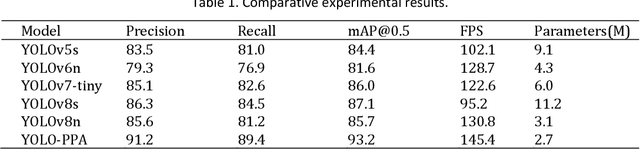

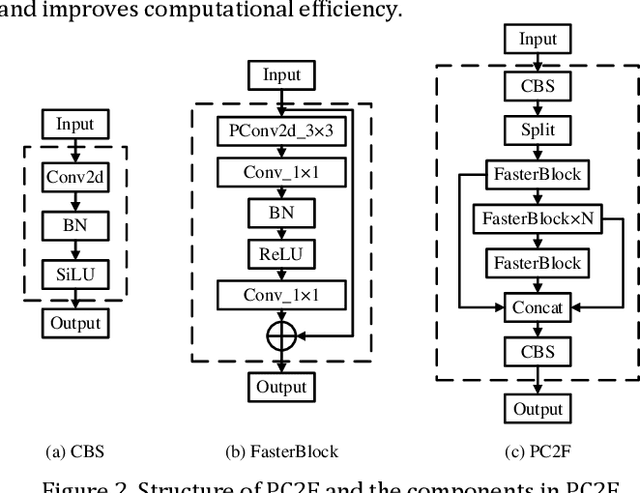

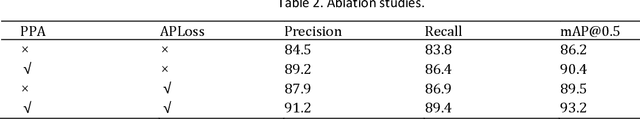

YOLO-PPA based Efficient Traffic Sign Detection for Cruise Control in Autonomous Driving

Sep 05, 2024

Abstract:It is very important to detect traffic signs efficiently and accurately in autonomous driving systems. However, the farther the distance, the smaller the traffic signs. Existing object detection algorithms can hardly detect these small scaled signs.In addition, the performance of embedded devices on vehicles limits the scale of detection models.To address these challenges, a YOLO PPA based traffic sign detection algorithm is proposed in this paper.The experimental results on the GTSDB dataset show that compared to the original YOLO, the proposed method improves inference efficiency by 11.2%. The mAP 50 is also improved by 93.2%, which demonstrates the effectiveness of the proposed YOLO PPA.

Explain EEG-based End-to-end Deep Learning Models in the Frequency Domain

Jul 25, 2024

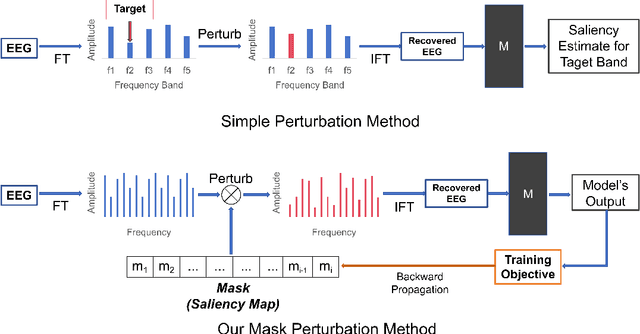

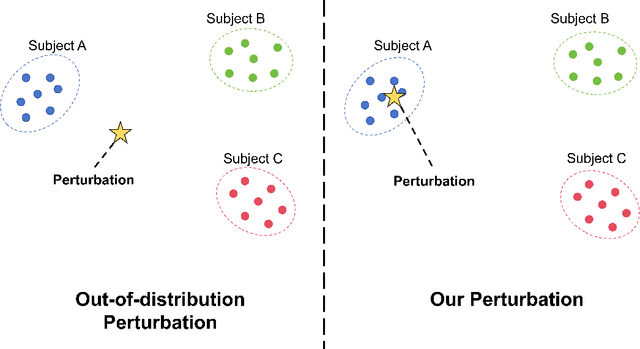

Abstract:The recent rise of EEG-based end-to-end deep learning models presents a significant challenge in elucidating how these models process raw EEG signals and generate predictions in the frequency domain. This challenge limits the transparency and credibility of EEG-based end-to-end models, hindering their application in security-sensitive areas. To address this issue, we propose a mask perturbation method to explain the behavior of end-to-end models in the frequency domain. Considering the characteristics of EEG data, we introduce a target alignment loss to mitigate the out-of-distribution problem associated with perturbation operations. Additionally, we develop a perturbation generator to define perturbation generation in the frequency domain. Our explanation method is validated through experiments on multiple representative end-to-end deep learning models in the EEG decoding field, using an established EEG benchmark dataset. The results demonstrate the effectiveness and superiority of our method, and highlight its potential to advance research in EEG-based end-to-end models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge