Liyang Wang

Research on Optimizing Real-Time Data Processing in High-Frequency Trading Algorithms using Machine Learning

Dec 02, 2024Abstract:High-frequency trading (HFT) represents a pivotal and intensely competitive domain within the financial markets. The velocity and accuracy of data processing exert a direct influence on profitability, underscoring the significance of this field. The objective of this work is to optimise the real-time processing of data in high-frequency trading algorithms. The dynamic feature selection mechanism is responsible for monitoring and analysing market data in real time through clustering and feature weight analysis, with the objective of automatically selecting the most relevant features. This process employs an adaptive feature extraction method, which enables the system to respond and adjust its feature set in a timely manner when the data input changes, thus ensuring the efficient utilisation of data. The lightweight neural networks are designed in a modular fashion, comprising fast convolutional layers and pruning techniques that facilitate the expeditious completion of data processing and output prediction. In contrast to conventional deep learning models, the neural network architecture has been specifically designed to minimise the number of parameters and computational complexity, thereby markedly reducing the inference time. The experimental results demonstrate that the model is capable of maintaining consistent performance in the context of varying market conditions, thereby illustrating its advantages in terms of processing speed and revenue enhancement.

Design and Optimization of Big Data and Machine Learning-Based Risk Monitoring System in Financial Markets

Jul 28, 2024

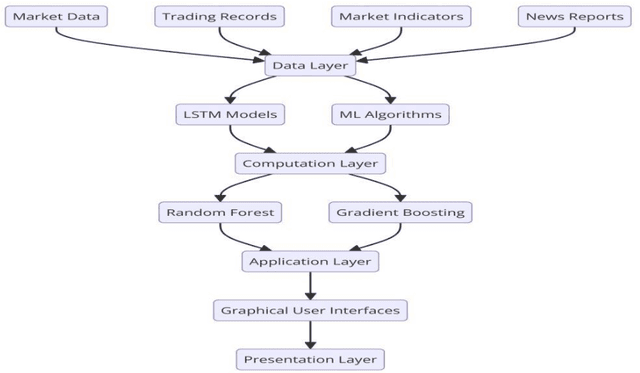

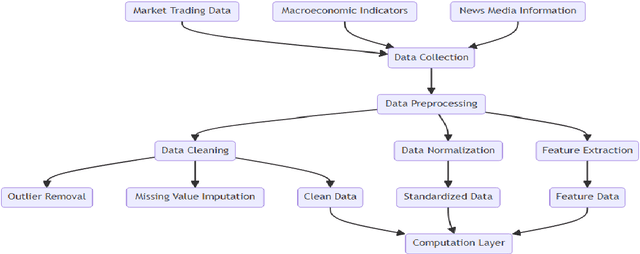

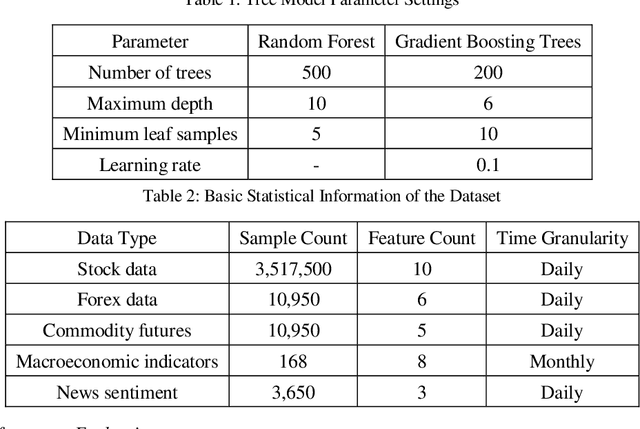

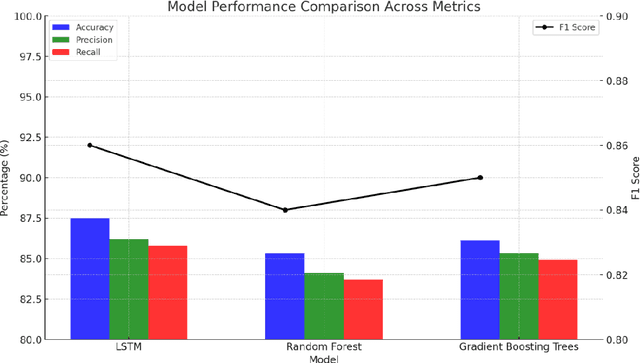

Abstract:With the increasing complexity of financial markets and rapid growth in data volume, traditional risk monitoring methods no longer suffice for modern financial institutions. This paper designs and optimizes a risk monitoring system based on big data and machine learning. By constructing a four-layer architecture, it effectively integrates large-scale financial data and advanced machine learning algorithms. Key technologies employed in the system include Long Short-Term Memory (LSTM) networks, Random Forest, Gradient Boosting Trees, and real-time data processing platform Apache Flink, ensuring the real-time and accurate nature of risk monitoring. Research findings demonstrate that the system significantly enhances efficiency and accuracy in risk management, particularly excelling in identifying and warning against market crash risks.

Research on Edge Detection of LiDAR Images Based on Artificial Intelligence Technology

Jun 14, 2024

Abstract:With the widespread application of Light Detection and Ranging (LiDAR) technology in fields such as autonomous driving, robot navigation, and terrain mapping, the importance of edge detection in LiDAR images has become increasingly prominent. Traditional edge detection methods often face challenges in accuracy and computational complexity when processing LiDAR images. To address these issues, this study proposes an edge detection method for LiDAR images based on artificial intelligence technology. This paper first reviews the current state of research on LiDAR technology and image edge detection, introducing common edge detection algorithms and their applications in LiDAR image processing. Subsequently, a deep learning-based edge detection model is designed and implemented, optimizing the model training process through preprocessing and enhancement of the LiDAR image dataset. Experimental results indicate that the proposed method outperforms traditional methods in terms of detection accuracy and computational efficiency, showing significant practical application value. Finally, improvement strategies are proposed for the current method's shortcomings, and the improvements are validated through experiments.

Application of Natural Language Processing in Financial Risk Detection

Jun 14, 2024Abstract:This paper explores the application of Natural Language Processing (NLP) in financial risk detection. By constructing an NLP-based financial risk detection model, this study aims to identify and predict potential risks in financial documents and communications. First, the fundamental concepts of NLP and its theoretical foundation, including text mining methods, NLP model design principles, and machine learning algorithms, are introduced. Second, the process of text data preprocessing and feature extraction is described. Finally, the effectiveness and predictive performance of the model are validated through empirical research. The results show that the NLP-based financial risk detection model performs excellently in risk identification and prediction, providing effective risk management tools for financial institutions. This study offers valuable references for the field of financial risk management, utilizing advanced NLP techniques to improve the accuracy and efficiency of financial risk detection.

Optimization of Worker Scheduling at Logistics Depots Using Genetic Algorithms and Simulated Annealing

May 20, 2024

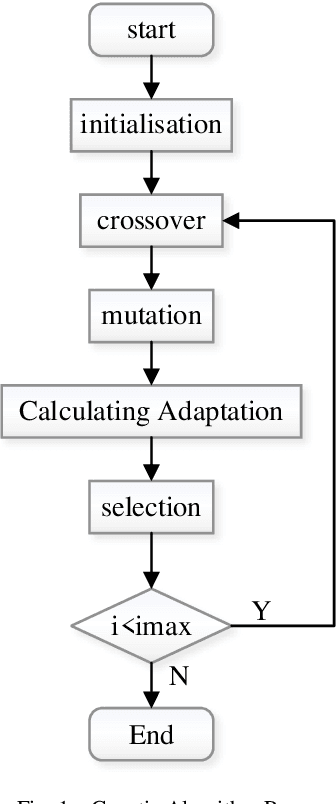

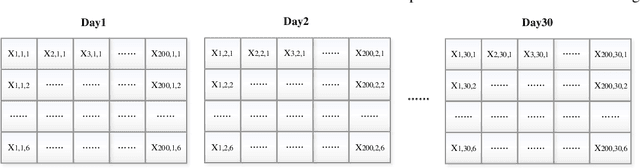

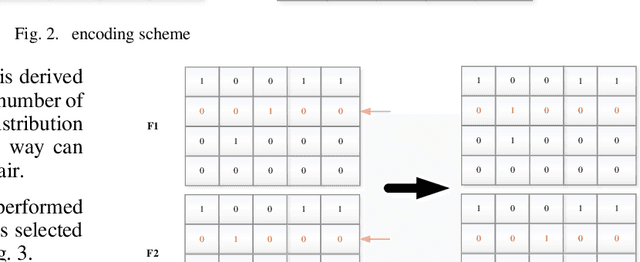

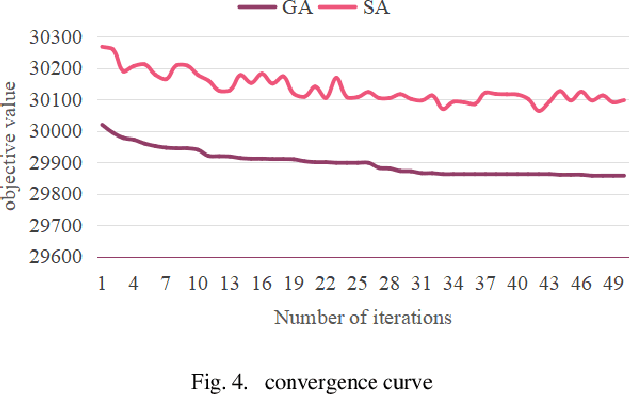

Abstract:This paper addresses the optimization of scheduling for workers at a logistics depot using a combination of genetic algorithm and simulated annealing algorithm. The efficient scheduling of permanent and temporary workers is crucial for optimizing the efficiency of the logistics depot while minimizing labor usage. The study begins by establishing a 0-1 integer linear programming model, with decision variables determining the scheduling of permanent and temporary workers for each time slot on a given day. The objective function aims to minimize person-days, while constraints ensure fulfillment of hourly labor requirements, limit workers to one time slot per day, cap consecutive working days for permanent workers, and maintain non-negativity and integer constraints. The model is then solved using genetic algorithms and simulated annealing. Results indicate that, for this problem, genetic algorithms outperform simulated annealing in terms of solution quality. The optimal solution reveals a minimum of 29857 person-days.

Research on Credit Risk Early Warning Model of Commercial Banks Based on Neural Network Algorithm

May 17, 2024

Abstract:In the realm of globalized financial markets, commercial banks are confronted with an escalating magnitude of credit risk, thereby imposing heightened requisites upon the security of bank assets and financial stability. This study harnesses advanced neural network techniques, notably the Backpropagation (BP) neural network, to pioneer a novel model for preempting credit risk in commercial banks. The discourse initially scrutinizes conventional financial risk preemptive models, such as ARMA, ARCH, and Logistic regression models, critically analyzing their real-world applications. Subsequently, the exposition elaborates on the construction process of the BP neural network model, encompassing network architecture design, activation function selection, parameter initialization, and objective function construction. Through comparative analysis, the superiority of neural network models in preempting credit risk in commercial banks is elucidated. The experimental segment selects specific bank data, validating the model's predictive accuracy and practicality. Research findings evince that this model efficaciously enhances the foresight and precision of credit risk management.

Research on Splicing Image Detection Algorithms Based on Natural Image Statistical Characteristics

Apr 26, 2024Abstract:With the development and widespread application of digital image processing technology, image splicing has become a common method of image manipulation, raising numerous security and legal issues. This paper introduces a new splicing image detection algorithm based on the statistical characteristics of natural images, aimed at improving the accuracy and efficiency of splicing image detection. By analyzing the limitations of traditional methods, we have developed a detection framework that integrates advanced statistical analysis techniques and machine learning methods. The algorithm has been validated using multiple public datasets, showing high accuracy in detecting spliced edges and locating tampered areas, as well as good robustness. Additionally, we explore the potential applications and challenges faced by the algorithm in real-world scenarios. This research not only provides an effective technological means for the field of image tampering detection but also offers new ideas and methods for future related research.

Research on Detection of Floating Objects in River and Lake Based on AI Intelligent Image Recognition

Apr 10, 2024Abstract:With the rapid advancement of artificial intelligence technology, AI-enabled image recognition has emerged as a potent tool for addressing challenges in traditional environmental monitoring. This study focuses on the detection of floating objects in river and lake environments, exploring an innovative approach based on deep learning. By intricately analyzing the technical pathways for detecting static and dynamic features and considering the characteristics of river and lake debris, a comprehensive image acquisition and processing workflow has been developed. The study highlights the application and performance comparison of three mainstream deep learning models -SSD, Faster-RCNN, and YOLOv5- in debris identification. Additionally, a detection system for floating objects has been designed and implemented, encompassing both hardware platform construction and software framework development. Through rigorous experimental validation, the proposed system has demonstrated its ability to significantly enhance the accuracy and efficiency of debris detection, thus offering a new technological avenue for water quality monitoring in rivers and lakes

AES: Autonomous Excavator System for Real-World and Hazardous Environments

Nov 10, 2020

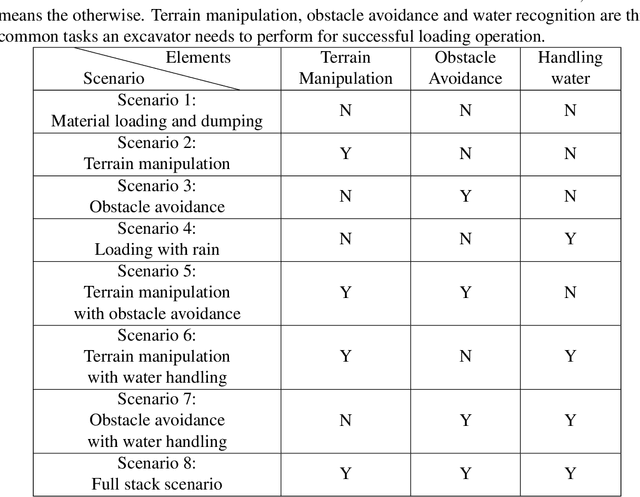

Abstract:Excavators are widely used for material-handling applications in unstructured environments, including mining and construction. The size of the global market of excavators is 44.12 Billion USD in 2018 and is predicted to grow to 63.14 Billion USD by 2026. Operating excavators in a real-world environment can be challenging due to extreme conditions and rock sliding, ground collapse, or exceeding dust. Multiple fatalities and injuries occur each year during excavations. An autonomous excavator that can substitute human operators in these hazardous environments would substantially lower the number of injuries and can improve the overall productivity.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge