Ao Xiang

User Behavior Analysis in Privacy Protection with Large Language Models: A Study on Privacy Preferences with Limited Data

May 08, 2025Abstract:With the widespread application of large language models (LLMs), user privacy protection has become a significant research topic. Existing privacy preference modeling methods often rely on large-scale user data, making effective privacy preference analysis challenging in data-limited environments. This study explores how LLMs can analyze user behavior related to privacy protection in scenarios with limited data and proposes a method that integrates Few-shot Learning and Privacy Computing to model user privacy preferences. The research utilizes anonymized user privacy settings data, survey responses, and simulated data, comparing the performance of traditional modeling approaches with LLM-based methods. Experimental results demonstrate that, even with limited data, LLMs significantly improve the accuracy of privacy preference modeling. Additionally, incorporating Differential Privacy and Federated Learning further reduces the risk of user data exposure. The findings provide new insights into the application of LLMs in privacy protection and offer theoretical support for advancing privacy computing and user behavior analysis.

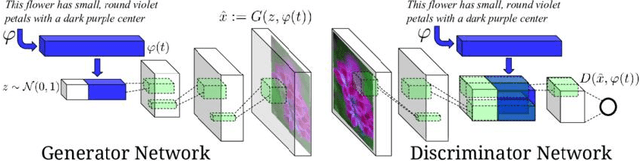

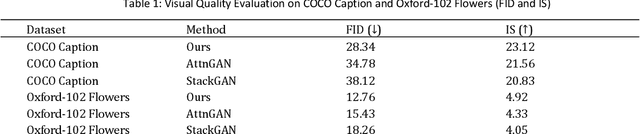

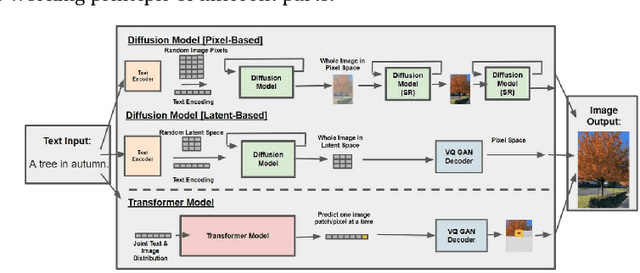

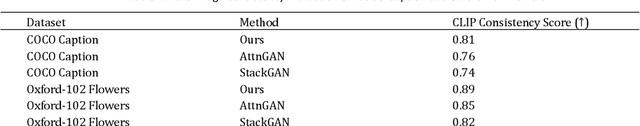

Generating Multimodal Images with GAN: Integrating Text, Image, and Style

Jan 04, 2025

Abstract:In the field of computer vision, multimodal image generation has become a research hotspot, especially the task of integrating text, image, and style. In this study, we propose a multimodal image generation method based on Generative Adversarial Networks (GAN), capable of effectively combining text descriptions, reference images, and style information to generate images that meet multimodal requirements. This method involves the design of a text encoder, an image feature extractor, and a style integration module, ensuring that the generated images maintain high quality in terms of visual content and style consistency. We also introduce multiple loss functions, including adversarial loss, text-image consistency loss, and style matching loss, to optimize the generation process. Experimental results show that our method produces images with high clarity and consistency across multiple public datasets, demonstrating significant performance improvements compared to existing methods. The outcomes of this study provide new insights into multimodal image generation and present broad application prospects.

Detecting and Classifying Defective Products in Images Using YOLO

Dec 22, 2024

Abstract:With the continuous advancement of industrial automation, product quality inspection has become increasingly important in the manufacturing process. Traditional inspection methods, which often rely on manual checks or simple machine vision techniques, suffer from low efficiency and insufficient accuracy. In recent years, deep learning technology, especially the YOLO (You Only Look Once) algorithm, has emerged as a prominent solution in the field of product defect detection due to its efficient real-time detection capabilities and excellent classification performance. This study aims to use the YOLO algorithm to detect and classify defects in product images. By constructing and training a YOLO model, we conducted experiments on multiple industrial product datasets. The results demonstrate that this method can achieve real-time detection while maintaining high detection accuracy, significantly improving the efficiency and accuracy of product quality inspection. This paper further analyzes the advantages and limitations of the YOLO algorithm in practical applications and explores future research directions.

DTSGAN: Learning Dynamic Textures via Spatiotemporal Generative Adversarial Network

Dec 22, 2024

Abstract:Dynamic texture synthesis aims to generate sequences that are visually similar to a reference video texture and exhibit specific stationary properties in time. In this paper, we introduce a spatiotemporal generative adversarial network (DTSGAN) that can learn from a single dynamic texture by capturing its motion and content distribution. With the pipeline of DTSGAN, a new video sequence is generated from the coarsest scale to the finest one. To avoid mode collapse, we propose a novel strategy for data updates that helps improve the diversity of generated results. Qualitative and quantitative experiments show that our model is able to generate high quality dynamic textures and natural motion.

Real-time Video Target Tracking Algorithm Utilizing Convolutional Neural Networks (CNN)

Nov 27, 2024

Abstract:Thispaperaimstoresearchandimplementa real-timevideotargettrackingalgorithmbasedon ConvolutionalNeuralNetworks(CNN),enhancingthe accuracyandrobustnessoftargettrackingincomplex scenarios.Addressingthelimitationsoftraditionaltracking algorithmsinhandlingissuessuchastargetocclusion,morphologicalchanges,andbackgroundinterference,our approachintegratestargetdetectionandtrackingstrategies.It continuouslyupdatesthetargetmodelthroughanonline learningmechanismtoadapttochangesinthetarget's appearance.Experimentalresultsdemonstratethat,when dealingwithsituationsinvolvingrapidmotion,partial occlusion,andcomplexbackgrounds,theproposedalgorithm exhibitshighertrackingsuccessratesandlowerfailurerates comparedtoseveralmainstreamtrackingalgorithms.This studysuccessfullyappliesCNNtoreal-timevideotarget tracking,improvingtheaccuracyandstabilityofthetracking algorithmwhilemaintaininghighprocessingspeeds,thus meetingthedemandsofreal-timeapplications.Thisalgorithm isexpectedtoprovidenewsolutionsfortargettrackingtasksin videosurveillanceandintelligenttransportationdomains.

Analysis of Financial Risk Behavior Prediction Using Deep Learning and Big Data Algorithms

Oct 25, 2024

Abstract:As the complexity and dynamism of financial markets continue to grow, traditional financial risk prediction methods increasingly struggle to handle large datasets and intricate behavior patterns. This paper explores the feasibility and effectiveness of using deep learning and big data algorithms for financial risk behavior prediction. First, the application and advantages of deep learning and big data algorithms in the financial field are analyzed. Then, a deep learning-based big data risk prediction framework is designed and experimentally validated on actual financial datasets. The experimental results show that this method significantly improves the accuracy of financial risk behavior prediction and provides valuable support for risk management in financial institutions. Challenges in the application of deep learning are also discussed, along with potential directions for future research.

A Neural Matrix Decomposition Recommender System Model based on the Multimodal Large Language Model

Jul 12, 2024

Abstract:Recommendation systems have become an important solution to information search problems. This article proposes a neural matrix factorization recommendation system model based on the multimodal large language model called BoNMF. This model combines BoBERTa's powerful capabilities in natural language processing, ViT in computer in vision, and neural matrix decomposition technology. By capturing the potential characteristics of users and items, and after interacting with a low-dimensional matrix composed of user and item IDs, the neural network outputs the results. recommend. Cold start and ablation experimental results show that the BoNMF model exhibits excellent performance on large public data sets and significantly improves the accuracy of recommendations.

Research on Edge Detection of LiDAR Images Based on Artificial Intelligence Technology

Jun 14, 2024

Abstract:With the widespread application of Light Detection and Ranging (LiDAR) technology in fields such as autonomous driving, robot navigation, and terrain mapping, the importance of edge detection in LiDAR images has become increasingly prominent. Traditional edge detection methods often face challenges in accuracy and computational complexity when processing LiDAR images. To address these issues, this study proposes an edge detection method for LiDAR images based on artificial intelligence technology. This paper first reviews the current state of research on LiDAR technology and image edge detection, introducing common edge detection algorithms and their applications in LiDAR image processing. Subsequently, a deep learning-based edge detection model is designed and implemented, optimizing the model training process through preprocessing and enhancement of the LiDAR image dataset. Experimental results indicate that the proposed method outperforms traditional methods in terms of detection accuracy and computational efficiency, showing significant practical application value. Finally, improvement strategies are proposed for the current method's shortcomings, and the improvements are validated through experiments.

Application of Natural Language Processing in Financial Risk Detection

Jun 14, 2024Abstract:This paper explores the application of Natural Language Processing (NLP) in financial risk detection. By constructing an NLP-based financial risk detection model, this study aims to identify and predict potential risks in financial documents and communications. First, the fundamental concepts of NLP and its theoretical foundation, including text mining methods, NLP model design principles, and machine learning algorithms, are introduced. Second, the process of text data preprocessing and feature extraction is described. Finally, the effectiveness and predictive performance of the model are validated through empirical research. The results show that the NLP-based financial risk detection model performs excellently in risk identification and prediction, providing effective risk management tools for financial institutions. This study offers valuable references for the field of financial risk management, utilizing advanced NLP techniques to improve the accuracy and efficiency of financial risk detection.

Research on Credit Risk Early Warning Model of Commercial Banks Based on Neural Network Algorithm

May 17, 2024

Abstract:In the realm of globalized financial markets, commercial banks are confronted with an escalating magnitude of credit risk, thereby imposing heightened requisites upon the security of bank assets and financial stability. This study harnesses advanced neural network techniques, notably the Backpropagation (BP) neural network, to pioneer a novel model for preempting credit risk in commercial banks. The discourse initially scrutinizes conventional financial risk preemptive models, such as ARMA, ARCH, and Logistic regression models, critically analyzing their real-world applications. Subsequently, the exposition elaborates on the construction process of the BP neural network model, encompassing network architecture design, activation function selection, parameter initialization, and objective function construction. Through comparative analysis, the superiority of neural network models in preempting credit risk in commercial banks is elucidated. The experimental segment selects specific bank data, validating the model's predictive accuracy and practicality. Research findings evince that this model efficaciously enhances the foresight and precision of credit risk management.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge