Yuqi Pan

LLM Active Alignment: A Nash Equilibrium Perspective

Feb 06, 2026Abstract:We develop a game-theoretic framework for predicting and steering the behavior of populations of large language models (LLMs) through Nash equilibrium (NE) analysis. To avoid the intractability of equilibrium computation in open-ended text spaces, we model each agent's action as a mixture over human subpopulations. Agents choose actively and strategically which groups to align with, yielding an interpretable and behaviorally substantive policy class. We derive closed-form NE characterizations, adopting standard concave-utility assumptions to enable analytical system-level predictions and give explicit, actionable guidance for shifting alignment targets toward socially desirable outcomes. The method functions as an active alignment layer on top of existing alignment pipelines such as RLHF. In a social-media setting, we show that a population of LLMs, especially reasoning-based models, may exhibit political exclusion, pathologies where some subpopulations are ignored by all LLM agents, which can be avoided by our method, illustrating the promise of applying the method to regulate multi-agent LLM dynamics across domains.

Parallel Training in Spiking Neural Networks

Feb 01, 2026Abstract:The bio-inspired integrate-fire-reset mechanism of spiking neurons constitutes the foundation for efficient processing in Spiking Neural Networks (SNNs). Recent progress in large models demands that spiking neurons support highly parallel computation to scale efficiently on modern GPUs. This work proposes a novel functional perspective that provides general guidance for designing parallel spiking neurons. We argue that the reset mechanism, which induces complex temporal dependencies and hinders parallel training, should be removed. However, any such modification should satisfy two principles: 1) preserving the functions of reset as a core biological mechanism; and 2) enabling parallel training without sacrificing the serial inference ability of spiking neurons, which underpins their efficiency at test time. To this end, we identify the functions of the reset and analyze how to reconcile parallel training with serial inference, upon which we propose a dynamic decay spiking neuron. We conduct comprehensive testing of our method in terms of: 1) Training efficiency and extrapolation capability. On 16k-length sequences, we achieve a 25.6x training speedup over the pioneering parallel spiking neuron, and our models trained on 2k-length can stably perform inference on sequences as long as 30k. 2) Generality. We demonstrate the consistent effectiveness of the proposed method across five task categories (image classification, neuromorphic event processing, time-series forecasting, language modeling, and reinforcement learning), three network architectures (spiking CNN/Transformer/SSMs), and two spike activation modes (spike/integer activation). 3) Energy consumption. The spiking firing of our neuron is lower than that of vanilla and existing parallel spiking neurons.

Beyond Majority Voting: LLM Aggregation by Leveraging Higher-Order Information

Oct 01, 2025Abstract:With the rapid progress of multi-agent large language model (LLM) reasoning, how to effectively aggregate answers from multiple LLMs has emerged as a fundamental challenge. Standard majority voting treats all answers equally, failing to consider latent heterogeneity and correlation across models. In this work, we design two new aggregation algorithms called Optimal Weight (OW) and Inverse Surprising Popularity (ISP), leveraging both first-order and second-order information. Our theoretical analysis shows these methods provably mitigate inherent limitations of majority voting under mild assumptions, leading to more reliable collective decisions. We empirically validate our algorithms on synthetic datasets, popular LLM fine-tuning benchmarks such as UltraFeedback and MMLU, and a real-world healthcare setting ARMMAN. Across all cases, our methods consistently outperform majority voting, offering both practical performance gains and conceptual insights for the design of robust multi-agent LLM pipelines.

SpikingBrain Technical Report: Spiking Brain-inspired Large Models

Sep 05, 2025Abstract:Mainstream Transformer-based large language models face major efficiency bottlenecks: training computation scales quadratically with sequence length, and inference memory grows linearly, limiting long-context processing. Building large models on non-NVIDIA platforms also poses challenges for stable and efficient training. To address this, we introduce SpikingBrain, a family of brain-inspired models designed for efficient long-context training and inference. SpikingBrain leverages the MetaX GPU cluster and focuses on three aspects: (1) Model Architecture: linear and hybrid-linear attention architectures with adaptive spiking neurons; (2) Algorithmic Optimizations: an efficient, conversion-based training pipeline and a dedicated spike coding framework; (3) System Engineering: customized training frameworks, operator libraries, and parallelism strategies tailored to MetaX hardware. Using these techniques, we develop two models: SpikingBrain-7B, a linear LLM, and SpikingBrain-76B, a hybrid-linear MoE LLM. These models demonstrate the feasibility of large-scale LLM development on non-NVIDIA platforms. SpikingBrain achieves performance comparable to open-source Transformer baselines while using only about 150B tokens for continual pre-training. Our models significantly improve long-sequence training efficiency and deliver inference with (partially) constant memory and event-driven spiking behavior. For example, SpikingBrain-7B attains over 100x speedup in Time to First Token for 4M-token sequences. Training remains stable for weeks on hundreds of MetaX C550 GPUs, with the 7B model reaching a Model FLOPs Utilization of 23.4 percent. The proposed spiking scheme achieves 69.15 percent sparsity, enabling low-power operation. Overall, this work demonstrates the potential of brain-inspired mechanisms to drive the next generation of efficient and scalable large model design.

Scaling Linear Attention with Sparse State Expansion

Jul 22, 2025Abstract:The Transformer architecture, despite its widespread success, struggles with long-context scenarios due to quadratic computation and linear memory growth. While various linear attention variants mitigate these efficiency constraints by compressing context into fixed-size states, they often degrade performance in tasks such as in-context retrieval and reasoning. To address this limitation and achieve more effective context compression, we propose two key innovations. First, we introduce a row-sparse update formulation for linear attention by conceptualizing state updating as information classification. This enables sparse state updates via softmax-based top-$k$ hard classification, thereby extending receptive fields and reducing inter-class interference. Second, we present Sparse State Expansion (SSE) within the sparse framework, which expands the contextual state into multiple partitions, effectively decoupling parameter size from state capacity while maintaining the sparse classification paradigm. Our design, supported by efficient parallelized implementations, yields effective classification and discriminative state representations. We extensively validate SSE in both pure linear and hybrid (SSE-H) architectures across language modeling, in-context retrieval, and mathematical reasoning benchmarks. SSE demonstrates strong retrieval performance and scales favorably with state size. Moreover, after reinforcement learning (RL) training, our 2B SSE-H model achieves state-of-the-art mathematical reasoning performance among small reasoning models, scoring 64.7 on AIME24 and 51.3 on AIME25, significantly outperforming similarly sized open-source Transformers. These results highlight SSE as a promising and efficient architecture for long-context modeling.

A Survey on Latent Reasoning

Jul 08, 2025

Abstract:Large Language Models (LLMs) have demonstrated impressive reasoning capabilities, especially when guided by explicit chain-of-thought (CoT) reasoning that verbalizes intermediate steps. While CoT improves both interpretability and accuracy, its dependence on natural language reasoning limits the model's expressive bandwidth. Latent reasoning tackles this bottleneck by performing multi-step inference entirely in the model's continuous hidden state, eliminating token-level supervision. To advance latent reasoning research, this survey provides a comprehensive overview of the emerging field of latent reasoning. We begin by examining the foundational role of neural network layers as the computational substrate for reasoning, highlighting how hierarchical representations support complex transformations. Next, we explore diverse latent reasoning methodologies, including activation-based recurrence, hidden state propagation, and fine-tuning strategies that compress or internalize explicit reasoning traces. Finally, we discuss advanced paradigms such as infinite-depth latent reasoning via masked diffusion models, which enable globally consistent and reversible reasoning processes. By unifying these perspectives, we aim to clarify the conceptual landscape of latent reasoning and chart future directions for research at the frontier of LLM cognition. An associated GitHub repository collecting the latest papers and repos is available at: https://github.com/multimodal-art-projection/LatentCoT-Horizon/.

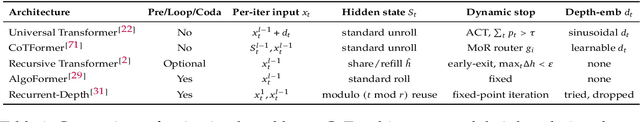

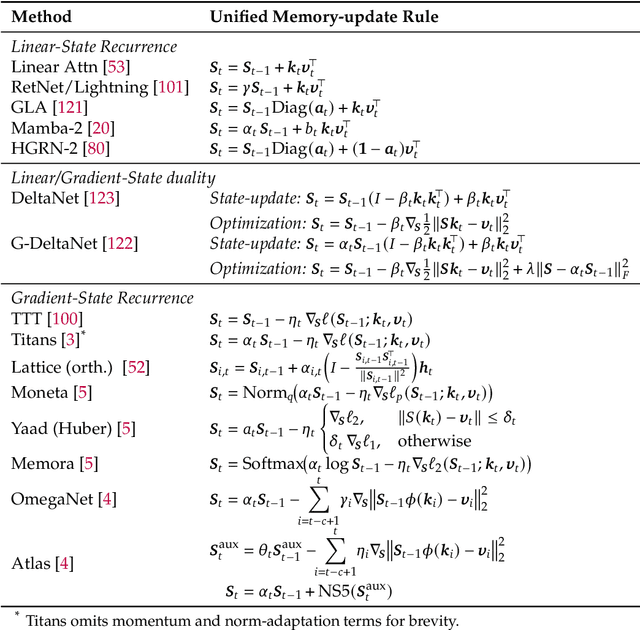

A Systematic Analysis of Hybrid Linear Attention

Jul 08, 2025Abstract:Transformers face quadratic complexity and memory issues with long sequences, prompting the adoption of linear attention mechanisms using fixed-size hidden states. However, linear models often suffer from limited recall performance, leading to hybrid architectures that combine linear and full attention layers. Despite extensive hybrid architecture research, the choice of linear attention component has not been deeply explored. We systematically evaluate various linear attention models across generations - vector recurrences to advanced gating mechanisms - both standalone and hybridized. To enable this comprehensive analysis, we trained and open-sourced 72 models: 36 at 340M parameters (20B tokens) and 36 at 1.3B parameters (100B tokens), covering six linear attention variants across five hybridization ratios. Benchmarking on standard language modeling and recall tasks reveals that superior standalone linear models do not necessarily excel in hybrids. While language modeling remains stable across linear-to-full attention ratios, recall significantly improves with increased full attention layers, particularly below a 3:1 ratio. Our study highlights selective gating, hierarchical recurrence, and controlled forgetting as critical for effective hybrid models. We recommend architectures such as HGRN-2 or GatedDeltaNet with a linear-to-full ratio between 3:1 and 6:1 to achieve Transformer-level recall efficiently. Our models are open-sourced at https://huggingface.co/collections/m-a-p/hybrid-linear-attention-research-686c488a63d609d2f20e2b1e.

Adaptive Frontier Exploration on Graphs with Applications to Network-Based Disease Testing

May 27, 2025Abstract:We study a sequential decision-making problem on a $n$-node graph $G$ where each node has an unknown label from a finite set $\mathbf{\Sigma}$, drawn from a joint distribution $P$ that is Markov with respect to $G$. At each step, selecting a node reveals its label and yields a label-dependent reward. The goal is to adaptively choose nodes to maximize expected accumulated discounted rewards. We impose a frontier exploration constraint, where actions are limited to neighbors of previously selected nodes, reflecting practical constraints in settings such as contact tracing and robotic exploration. We design a Gittins index-based policy that applies to general graphs and is provably optimal when $G$ is a forest. Our implementation runs in $O(n^2 \cdot |\mathbf{\Sigma}|^2)$ time while using $O(n \cdot |\mathbf{\Sigma}|^2)$ oracle calls to $P$ and $O(n^2 \cdot |\mathbf{\Sigma}|)$ space. Experiments on synthetic and real-world graphs show that our method consistently outperforms natural baselines, including in non-tree, budget-limited, and undiscounted settings. For example, in HIV testing simulations on real-world sexual interaction networks, our policy detects nearly all positive cases with only half the population tested, substantially outperforming other baselines.

SVL: Spike-based Vision-language Pretraining for Efficient 3D Open-world Understanding

May 23, 2025Abstract:Spiking Neural Networks (SNNs) provide an energy-efficient way to extract 3D spatio-temporal features. However, existing SNNs still exhibit a significant performance gap compared to Artificial Neural Networks (ANNs) due to inadequate pre-training strategies. These limitations manifest as restricted generalization ability, task specificity, and a lack of multimodal understanding, particularly in challenging tasks such as multimodal question answering and zero-shot 3D classification. To overcome these challenges, we propose a Spike-based Vision-Language (SVL) pretraining framework that empowers SNNs with open-world 3D understanding while maintaining spike-driven efficiency. SVL introduces two key components: (i) Multi-scale Triple Alignment (MTA) for label-free triplet-based contrastive learning across 3D, image, and text modalities, and (ii) Re-parameterizable Vision-Language Integration (Rep-VLI) to enable lightweight inference without relying on large text encoders. Extensive experiments show that SVL achieves a top-1 accuracy of 85.4% in zero-shot 3D classification, surpassing advanced ANN models, and consistently outperforms prior SNNs on downstream tasks, including 3D classification (+6.1%), DVS action recognition (+2.1%), 3D detection (+1.1%), and 3D segmentation (+2.1%) with remarkable efficiency. Moreover, SVL enables SNNs to perform open-world 3D question answering, sometimes outperforming ANNs. To the best of our knowledge, SVL represents the first scalable, generalizable, and hardware-friendly paradigm for 3D open-world understanding, effectively bridging the gap between SNNs and ANNs in complex open-world understanding tasks. Code is available https://github.com/bollossom/SVL.

Finite-Horizon Single-Pull Restless Bandits: An Efficient Index Policy For Scarce Resource Allocation

Jan 10, 2025Abstract:Restless multi-armed bandits (RMABs) have been highly successful in optimizing sequential resource allocation across many domains. However, in many practical settings with highly scarce resources, where each agent can only receive at most one resource, such as healthcare intervention programs, the standard RMAB framework falls short. To tackle such scenarios, we introduce Finite-Horizon Single-Pull RMABs (SPRMABs), a novel variant in which each arm can only be pulled once. This single-pull constraint introduces additional complexity, rendering many existing RMAB solutions suboptimal or ineffective. %To address this, we propose using dummy states to duplicate the system, ensuring that once an arm is activated, it transitions exclusively within the dummy states. To address this shortcoming, we propose using \textit{dummy states} that expand the system and enforce the one-pull constraint. We then design a lightweight index policy for this expanded system. For the first time, we demonstrate that our index policy achieves a sub-linearly decaying average optimality gap of $\tilde{\mathcal{O}}\left(\frac{1}{\rho^{1/2}}\right)$ for a finite number of arms, where $\rho$ is the scaling factor for each arm cluster. Extensive simulations validate the proposed method, showing robust performance across various domains compared to existing benchmarks.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge