Yupeng Cao

MERMAID: Memory-Enhanced Retrieval and Reasoning with Multi-Agent Iterative Knowledge Grounding for Veracity Assessment

Jan 29, 2026Abstract:Assessing the veracity of online content has become increasingly critical. Large language models (LLMs) have recently enabled substantial progress in automated veracity assessment, including automated fact-checking and claim verification systems. Typical veracity assessment pipelines break down complex claims into sub-claims, retrieve external evidence, and then apply LLM reasoning to assess veracity. However, existing methods often treat evidence retrieval as a static, isolated step and do not effectively manage or reuse retrieved evidence across claims. In this work, we propose MERMAID, a memory-enhanced multi-agent veracity assessment framework that tightly couples the retrieval and reasoning processes. MERMAID integrates agent-driven search, structured knowledge representations, and a persistent memory module within a Reason-Action style iterative process, enabling dynamic evidence acquisition and cross-claim evidence reuse. By retaining retrieved evidence in an evidence memory, the framework reduces redundant searches and improves verification efficiency and consistency. We evaluate MERMAID on three fact-checking benchmarks and two claim-verification datasets using multiple LLMs, including GPT, LLaMA, and Qwen families. Experimental results show that MERMAID achieves state-of-the-art performance while improving the search efficiency, demonstrating the effectiveness of synergizing retrieval, reasoning, and memory for reliable veracity assessment.

All That Glisters Is Not Gold: A Benchmark for Reference-Free Counterfactual Financial Misinformation Detection

Jan 08, 2026Abstract:We introduce RFC Bench, a benchmark for evaluating large language models on financial misinformation under realistic news. RFC Bench operates at the paragraph level and captures the contextual complexity of financial news where meaning emerges from dispersed cues. The benchmark defines two complementary tasks: reference free misinformation detection and comparison based diagnosis using paired original perturbed inputs. Experiments reveal a consistent pattern: performance is substantially stronger when comparative context is available, while reference free settings expose significant weaknesses, including unstable predictions and elevated invalid outputs. These results indicate that current models struggle to maintain coherent belief states without external grounding. By highlighting this gap, RFC Bench provides a structured testbed for studying reference free reasoning and advancing more reliable financial misinformation detection in real world settings.

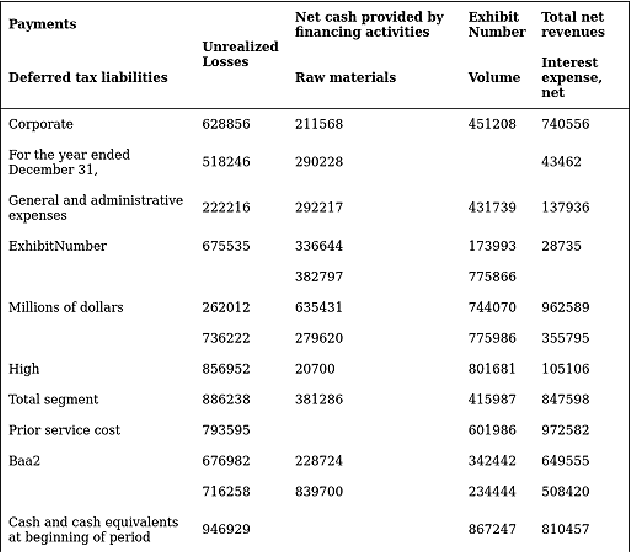

FinCriticalED: A Visual Benchmark for Financial Fact-Level OCR Evaluation

Nov 19, 2025Abstract:We introduce FinCriticalED (Financial Critical Error Detection), a visual benchmark for evaluating OCR and vision language models on financial documents at the fact level. Financial documents contain visually dense and table heavy layouts where numerical and temporal information is tightly coupled with structure. In high stakes settings, small OCR mistakes such as sign inversion or shifted dates can lead to materially different interpretations, while traditional OCR metrics like ROUGE and edit distance capture only surface level text similarity. \ficriticaled provides 500 image-HTML pairs with expert annotated financial facts covering over seven hundred numerical and temporal facts. It introduces three key contributions. First, it establishes the first fact level evaluation benchmark for financial document understanding, shifting evaluation from lexical overlap to domain critical factual correctness. Second, all annotations are created and verified by financial experts with strict quality control over signs, magnitudes, and temporal expressions. Third, we develop an LLM-as-Judge evaluation pipeline that performs structured fact extraction and contextual verification for visually complex financial documents. We benchmark OCR systems, open source vision language models, and proprietary models on FinCriticalED. Results show that although the strongest proprietary models achieve the highest factual accuracy, substantial errors remain in visually intricate numerical and temporal contexts. Through quantitative evaluation and expert case studies, FinCriticalED provides a rigorous foundation for advancing visual factual precision in financial and other precision critical domains.

Enhancing Scene Transition Awareness in Video Generation via Post-Training

Jul 24, 2025Abstract:Recent advances in AI-generated video have shown strong performance on \emph{text-to-video} tasks, particularly for short clips depicting a single scene. However, current models struggle to generate longer videos with coherent scene transitions, primarily because they cannot infer when a transition is needed from the prompt. Most open-source models are trained on datasets consisting of single-scene video clips, which limits their capacity to learn and respond to prompts requiring multiple scenes. Developing scene transition awareness is essential for multi-scene generation, as it allows models to identify and segment videos into distinct clips by accurately detecting transitions. To address this, we propose the \textbf{Transition-Aware Video} (TAV) dataset, which consists of preprocessed video clips with multiple scene transitions. Our experiment shows that post-training on the \textbf{TAV} dataset improves prompt-based scene transition understanding, narrows the gap between required and generated scenes, and maintains image quality.

Can AI Validate Science? Benchmarking LLMs for Accurate Scientific Claim $\rightarrow$ Evidence Reasoning

Jun 09, 2025Abstract:Large language models (LLMs) are increasingly being used for complex research tasks such as literature review, idea generation, and scientific paper analysis, yet their ability to truly understand and process the intricate relationships within complex research papers, such as the logical links between claims and supporting evidence remains largely unexplored. In this study, we present CLAIM-BENCH, a comprehensive benchmark for evaluating LLMs' capabilities in scientific claim-evidence extraction and validation, a task that reflects deeper comprehension of scientific argumentation. We systematically compare three approaches which are inspired by divide and conquer approaches, across six diverse LLMs, highlighting model-specific strengths and weaknesses in scientific comprehension. Through evaluation involving over 300 claim-evidence pairs across multiple research domains, we reveal significant limitations in LLMs' ability to process complex scientific content. Our results demonstrate that closed-source models like GPT-4 and Claude consistently outperform open-source counterparts in precision and recall across claim-evidence identification tasks. Furthermore, strategically designed three-pass and one-by-one prompting approaches significantly improve LLMs' abilities to accurately link dispersed evidence with claims, although this comes at increased computational cost. CLAIM-BENCH sets a new standard for evaluating scientific comprehension in LLMs, offering both a diagnostic tool and a path forward for building systems capable of deeper, more reliable reasoning across full-length papers.

Truth Neurons

May 18, 2025Abstract:Despite their remarkable success and deployment across diverse workflows, language models sometimes produce untruthful responses. Our limited understanding of how truthfulness is mechanistically encoded within these models jeopardizes their reliability and safety. In this paper, we propose a method for identifying representations of truthfulness at the neuron level. We show that language models contain truth neurons, which encode truthfulness in a subject-agnostic manner. Experiments conducted across models of varying scales validate the existence of truth neurons, confirming that the encoding of truthfulness at the neuron level is a property shared by many language models. The distribution patterns of truth neurons over layers align with prior findings on the geometry of truthfulness. Selectively suppressing the activations of truth neurons found through the TruthfulQA dataset degrades performance both on TruthfulQA and on other benchmarks, showing that the truthfulness mechanisms are not tied to a specific dataset. Our results offer novel insights into the mechanisms underlying truthfulness in language models and highlight potential directions toward improving their trustworthiness and reliability.

FinAudio: A Benchmark for Audio Large Language Models in Financial Applications

Mar 26, 2025Abstract:Audio Large Language Models (AudioLLMs) have received widespread attention and have significantly improved performance on audio tasks such as conversation, audio understanding, and automatic speech recognition (ASR). Despite these advancements, there is an absence of a benchmark for assessing AudioLLMs in financial scenarios, where audio data, such as earnings conference calls and CEO speeches, are crucial resources for financial analysis and investment decisions. In this paper, we introduce \textsc{FinAudio}, the first benchmark designed to evaluate the capacity of AudioLLMs in the financial domain. We first define three tasks based on the unique characteristics of the financial domain: 1) ASR for short financial audio, 2) ASR for long financial audio, and 3) summarization of long financial audio. Then, we curate two short and two long audio datasets, respectively, and develop a novel dataset for financial audio summarization, comprising the \textsc{FinAudio} benchmark. Then, we evaluate seven prevalent AudioLLMs on \textsc{FinAudio}. Our evaluation reveals the limitations of existing AudioLLMs in the financial domain and offers insights for improving AudioLLMs. All datasets and codes will be released.

FLAG-Trader: Fusion LLM-Agent with Gradient-based Reinforcement Learning for Financial Trading

Feb 19, 2025

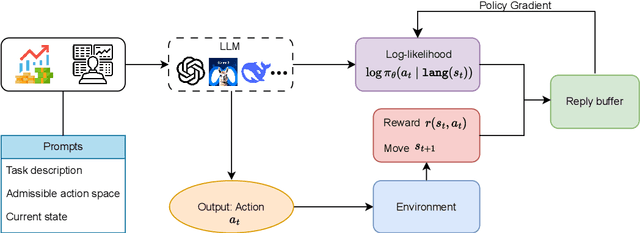

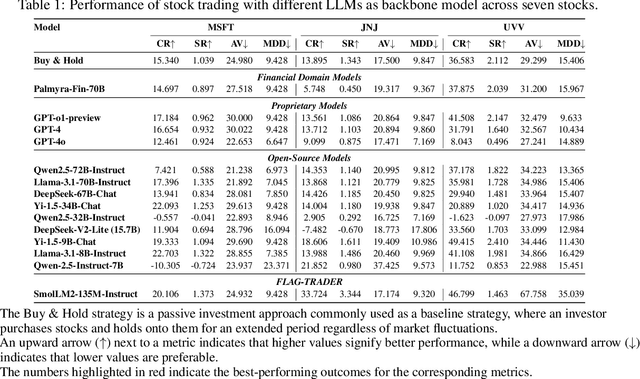

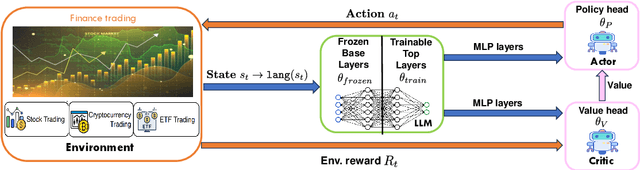

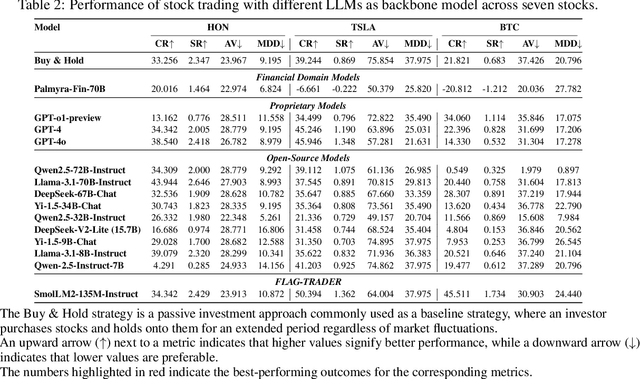

Abstract:Large language models (LLMs) fine-tuned on multimodal financial data have demonstrated impressive reasoning capabilities in various financial tasks. However, they often struggle with multi-step, goal-oriented scenarios in interactive financial markets, such as trading, where complex agentic approaches are required to improve decision-making. To address this, we propose \textsc{FLAG-Trader}, a unified architecture integrating linguistic processing (via LLMs) with gradient-driven reinforcement learning (RL) policy optimization, in which a partially fine-tuned LLM acts as the policy network, leveraging pre-trained knowledge while adapting to the financial domain through parameter-efficient fine-tuning. Through policy gradient optimization driven by trading rewards, our framework not only enhances LLM performance in trading but also improves results on other financial-domain tasks. We present extensive empirical evidence to validate these enhancements.

INVESTORBENCH: A Benchmark for Financial Decision-Making Tasks with LLM-based Agent

Dec 24, 2024

Abstract:Recent advancements have underscored the potential of large language model (LLM)-based agents in financial decision-making. Despite this progress, the field currently encounters two main challenges: (1) the lack of a comprehensive LLM agent framework adaptable to a variety of financial tasks, and (2) the absence of standardized benchmarks and consistent datasets for assessing agent performance. To tackle these issues, we introduce \textsc{InvestorBench}, the first benchmark specifically designed for evaluating LLM-based agents in diverse financial decision-making contexts. InvestorBench enhances the versatility of LLM-enabled agents by providing a comprehensive suite of tasks applicable to different financial products, including single equities like stocks, cryptocurrencies and exchange-traded funds (ETFs). Additionally, we assess the reasoning and decision-making capabilities of our agent framework using thirteen different LLMs as backbone models, across various market environments and tasks. Furthermore, we have curated a diverse collection of open-source, multi-modal datasets and developed a comprehensive suite of environments for financial decision-making. This establishes a highly accessible platform for evaluating financial agents' performance across various scenarios.

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications

Aug 20, 2024

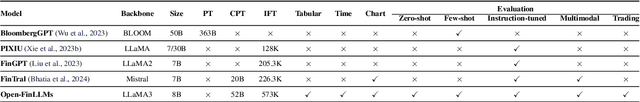

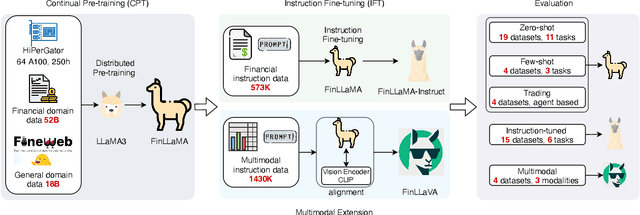

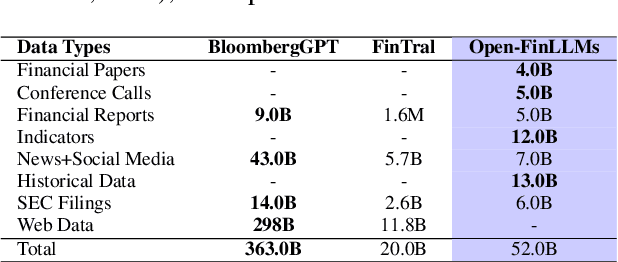

Abstract:Large language models (LLMs) have advanced financial applications, yet they often lack sufficient financial knowledge and struggle with tasks involving multi-modal inputs like tables and time series data. To address these limitations, we introduce \textit{Open-FinLLMs}, a series of Financial LLMs. We begin with FinLLaMA, pre-trained on a 52 billion token financial corpus, incorporating text, tables, and time-series data to embed comprehensive financial knowledge. FinLLaMA is then instruction fine-tuned with 573K financial instructions, resulting in FinLLaMA-instruct, which enhances task performance. Finally, we present FinLLaVA, a multimodal LLM trained with 1.43M image-text instructions to handle complex financial data types. Extensive evaluations demonstrate FinLLaMA's superior performance over LLaMA3-8B, LLaMA3.1-8B, and BloombergGPT in both zero-shot and few-shot settings across 19 and 4 datasets, respectively. FinLLaMA-instruct outperforms GPT-4 and other Financial LLMs on 15 datasets. FinLLaVA excels in understanding tables and charts across 4 multimodal tasks. Additionally, FinLLaMA achieves impressive Sharpe Ratios in trading simulations, highlighting its robust financial application capabilities. We will continually maintain and improve our models and benchmarks to support ongoing innovation in academia and industry.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge