Zhiyuan Yao

$V_0$: A Generalist Value Model for Any Policy at State Zero

Feb 03, 2026Abstract:Policy gradient methods rely on a baseline to measure the relative advantage of an action, ensuring the model reinforces behaviors that outperform its current average capability. In the training of Large Language Models (LLMs) using Actor-Critic methods (e.g., PPO), this baseline is typically estimated by a Value Model (Critic) often as large as the policy model itself. However, as the policy continuously evolves, the value model requires expensive, synchronous incremental training to accurately track the shifting capabilities of the policy. To avoid this overhead, Group Relative Policy Optimization (GRPO) eliminates the coupled value model by using the average reward of a group of rollouts as the baseline; yet, this approach necessitates extensive sampling to maintain estimation stability. In this paper, we propose $V_0$, a Generalist Value Model capable of estimating the expected performance of any model on unseen prompts without requiring parameter updates. We reframe value estimation by treating the policy's dynamic capability as an explicit context input; specifically, we leverage a history of instruction-performance pairs to dynamically profile the model, departing from the traditional paradigm that relies on parameter fitting to perceive capability shifts. Focusing on value estimation at State Zero (i.e., the initial prompt, hence $V_0$), our model serves as a critical resource scheduler. During GRPO training, $V_0$ predicts success rates prior to rollout, allowing for efficient sampling budget allocation; during deployment, it functions as a router, dispatching instructions to the most cost-effective and suitable model. Empirical results demonstrate that $V_0$ significantly outperforms heuristic budget allocation and achieves a Pareto-optimal trade-off between performance and cost in LLM routing tasks.

CoBA-RL: Capability-Oriented Budget Allocation for Reinforcement Learning in LLMs

Feb 03, 2026Abstract:Reinforcement Learning with Verifiable Rewards (RLVR) has emerged as a key approach for enhancing LLM reasoning.However, standard frameworks like Group Relative Policy Optimization (GRPO) typically employ a uniform rollout budget, leading to resource inefficiency. Moreover, existing adaptive methods often rely on instance-level metrics, such as task pass rates, failing to capture the model's dynamic learning state. To address these limitations, we propose CoBA-RL, a reinforcement learning algorithm designed to adaptively allocate rollout budgets based on the model's evolving capability. Specifically, CoBA-RL utilizes a Capability-Oriented Value function to map tasks to their potential training gains and employs a heap-based greedy strategy to efficiently self-calibrate the distribution of computational resources to samples with high training value. Extensive experiments demonstrate that our approach effectively orchestrates the trade-off between exploration and exploitation, delivering consistent generalization improvements across multiple challenging benchmarks. These findings underscore that quantifying sample training value and optimizing budget allocation are pivotal for advancing LLM post-training efficiency.

LongCat-Flash-Thinking-2601 Technical Report

Jan 23, 2026Abstract:We introduce LongCat-Flash-Thinking-2601, a 560-billion-parameter open-source Mixture-of-Experts (MoE) reasoning model with superior agentic reasoning capability. LongCat-Flash-Thinking-2601 achieves state-of-the-art performance among open-source models on a wide range of agentic benchmarks, including agentic search, agentic tool use, and tool-integrated reasoning. Beyond benchmark performance, the model demonstrates strong generalization to complex tool interactions and robust behavior under noisy real-world environments. Its advanced capability stems from a unified training framework that combines domain-parallel expert training with subsequent fusion, together with an end-to-end co-design of data construction, environments, algorithms, and infrastructure spanning from pre-training to post-training. In particular, the model's strong generalization capability in complex tool-use are driven by our in-depth exploration of environment scaling and principled task construction. To optimize long-tailed, skewed generation and multi-turn agentic interactions, and to enable stable training across over 10,000 environments spanning more than 20 domains, we systematically extend our asynchronous reinforcement learning framework, DORA, for stable and efficient large-scale multi-environment training. Furthermore, recognizing that real-world tasks are inherently noisy, we conduct a systematic analysis and decomposition of real-world noise patterns, and design targeted training procedures to explicitly incorporate such imperfections into the training process, resulting in improved robustness for real-world applications. To further enhance performance on complex reasoning tasks, we introduce a Heavy Thinking mode that enables effective test-time scaling by jointly expanding reasoning depth and width through intensive parallel thinking.

ToolACE-MCP: Generalizing History-Aware Routing from MCP Tools to the Agent Web

Jan 13, 2026Abstract:With the rise of the Agent Web and Model Context Protocol (MCP), the agent ecosystem is evolving into an open collaborative network, exponentially increasing accessible tools. However, current architectures face severe scalability and generality bottlenecks. To address this, we propose ToolACE-MCP, a pipeline for training history-aware routers to empower precise navigation in large-scale ecosystems. By leveraging a dependency-rich candidate Graph to synthesize multi-turn trajectories, we effectively train routers with dynamic context understanding to create the plug-and-play Light Routing Agent. Experiments on the real-world benchmarks MCP-Universe and MCP-Mark demonstrate superior performance. Notably, ToolACE-MCP exhibits critical properties for the future Agent Web: it not only generalizes to multi-agent collaboration with minimal adaptation but also maintains exceptional robustness against noise and scales effectively to massive candidate spaces. These findings provide a strong empirical foundation for universal orchestration in open-ended ecosystems.

RealMem: Benchmarking LLMs in Real-World Memory-Driven Interaction

Jan 11, 2026Abstract:As Large Language Models (LLMs) evolve from static dialogue interfaces to autonomous general agents, effective memory is paramount to ensuring long-term consistency. However, existing benchmarks primarily focus on casual conversation or task-oriented dialogue, failing to capture **"long-term project-oriented"** interactions where agents must track evolving goals. To bridge this gap, we introduce **RealMem**, the first benchmark grounded in realistic project scenarios. RealMem comprises over 2,000 cross-session dialogues across eleven scenarios, utilizing natural user queries for evaluation. We propose a synthesis pipeline that integrates Project Foundation Construction, Multi-Agent Dialogue Generation, and Memory and Schedule Management to simulate the dynamic evolution of memory. Experiments reveal that current memory systems face significant challenges in managing the long-term project states and dynamic context dependencies inherent in real-world projects. Our code and datasets are available at [https://github.com/AvatarMemory/RealMemBench](https://github.com/AvatarMemory/RealMemBench).

Does Memory Need Graphs? A Unified Framework and Empirical Analysis for Long-Term Dialog Memory

Jan 07, 2026Abstract:Graph structures are increasingly used in dialog memory systems, but empirical findings on their effectiveness remain inconsistent, making it unclear which design choices truly matter. We present an experimental, system-oriented analysis of long-term dialog memory architectures. We introduce a unified framework that decomposes dialog memory systems into core components and supports both graph-based and non-graph approaches. Under this framework, we conduct controlled, stage-wise experiments on LongMemEval and HaluMem, comparing common design choices in memory representation, organization, maintenance, and retrieval. Our results show that many performance differences are driven by foundational system settings rather than specific architectural innovations. Based on these findings, we identify stable and reliable strong baselines for future dialog memory research.

Octopus: Agentic Multimodal Reasoning with Six-Capability Orchestration

Nov 19, 2025Abstract:Existing multimodal reasoning models and frameworks suffer from fundamental architectural limitations: most lack the human-like ability to autonomously explore diverse reasoning pathways-whether in direct inference, tool-driven visual exploration, programmatic visual manipulation, or intrinsic visual imagination. Consequently, they struggle to adapt to dynamically changing capability requirements in real-world tasks. Meanwhile, humans exhibit a complementary set of thinking abilities when addressing such tasks, whereas existing methods typically cover only a subset of these dimensions. Inspired by this, we propose Octopus: Agentic Multimodal Reasoning with Six-Capability Orchestration, a new paradigm for multimodal agentic reasoning. We define six core capabilities essential for multimodal reasoning and organize a comprehensive evaluation benchmark, Octopus-Bench, accordingly. Octopus is capable of autonomously exploring during reasoning and dynamically selecting the most appropriate capability based on the current state. Experimental results show that Octopus achieves the best performance on the vast majority of tasks in Octopus-Bench, highlighting the crucial role of capability coordination in agentic multimodal reasoning.

Inverse Knowledge Search over Verifiable Reasoning: Synthesizing a Scientific Encyclopedia from a Long Chains-of-Thought Knowledge Base

Oct 30, 2025

Abstract:Most scientific materials compress reasoning, presenting conclusions while omitting the derivational chains that justify them. This compression hinders verification by lacking explicit, step-wise justifications and inhibits cross-domain links by collapsing the very pathways that establish the logical and causal connections between concepts. We introduce a scalable framework that decompresses scientific reasoning, constructing a verifiable Long Chain-of-Thought (LCoT) knowledge base and projecting it into an emergent encyclopedia, SciencePedia. Our pipeline operationalizes an endpoint-driven, reductionist strategy: a Socratic agent, guided by a curriculum of around 200 courses, generates approximately 3 million first-principles questions. To ensure high fidelity, multiple independent solver models generate LCoTs, which are then rigorously filtered by prompt sanitization and cross-model answer consensus, retaining only those with verifiable endpoints. This verified corpus powers the Brainstorm Search Engine, which performs inverse knowledge search -- retrieving diverse, first-principles derivations that culminate in a target concept. This engine, in turn, feeds the Plato synthesizer, which narrates these verified chains into coherent articles. The initial SciencePedia comprises approximately 200,000 fine-grained entries spanning mathematics, physics, chemistry, biology, engineering, and computation. In evaluations across six disciplines, Plato-synthesized articles (conditioned on retrieved LCoTs) exhibit substantially higher knowledge-point density and significantly lower factual error rates than an equally-prompted baseline without retrieval (as judged by an external LLM). Built on this verifiable LCoT knowledge base, this reasoning-centric approach enables trustworthy, cross-domain scientific synthesis at scale and establishes the foundation for an ever-expanding encyclopedia.

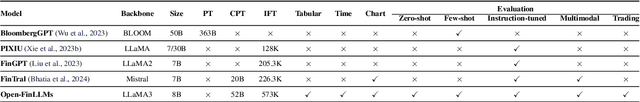

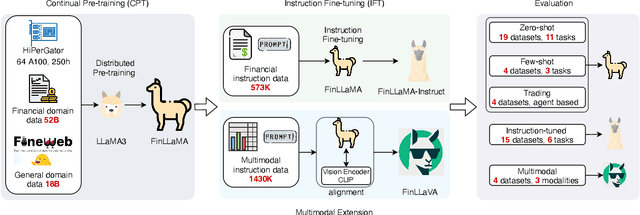

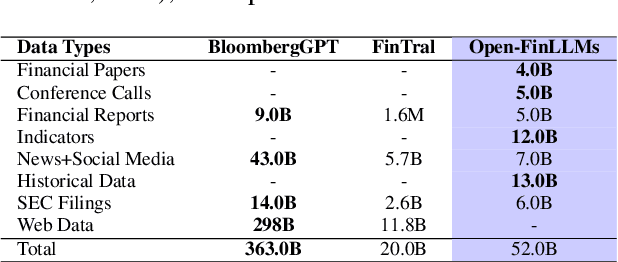

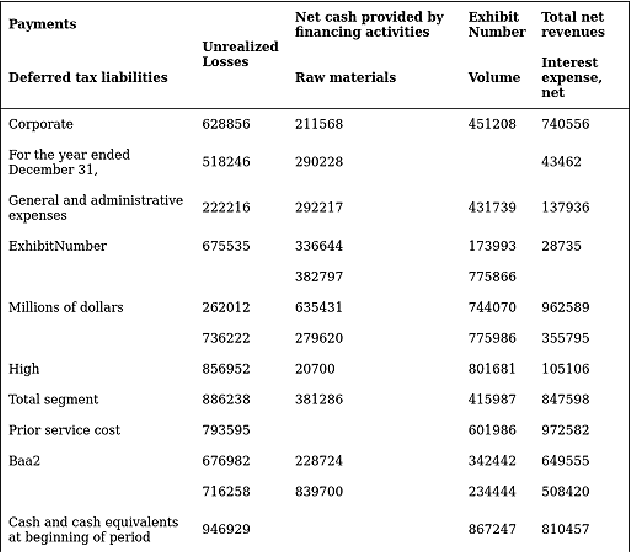

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications

Aug 20, 2024

Abstract:Large language models (LLMs) have advanced financial applications, yet they often lack sufficient financial knowledge and struggle with tasks involving multi-modal inputs like tables and time series data. To address these limitations, we introduce \textit{Open-FinLLMs}, a series of Financial LLMs. We begin with FinLLaMA, pre-trained on a 52 billion token financial corpus, incorporating text, tables, and time-series data to embed comprehensive financial knowledge. FinLLaMA is then instruction fine-tuned with 573K financial instructions, resulting in FinLLaMA-instruct, which enhances task performance. Finally, we present FinLLaVA, a multimodal LLM trained with 1.43M image-text instructions to handle complex financial data types. Extensive evaluations demonstrate FinLLaMA's superior performance over LLaMA3-8B, LLaMA3.1-8B, and BloombergGPT in both zero-shot and few-shot settings across 19 and 4 datasets, respectively. FinLLaMA-instruct outperforms GPT-4 and other Financial LLMs on 15 datasets. FinLLaVA excels in understanding tables and charts across 4 multimodal tasks. Additionally, FinLLaMA achieves impressive Sharpe Ratios in trading simulations, highlighting its robust financial application capabilities. We will continually maintain and improve our models and benchmarks to support ongoing innovation in academia and industry.

FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making

Jul 10, 2024

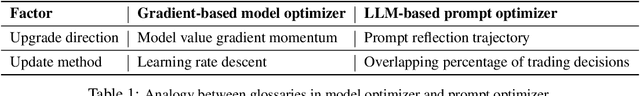

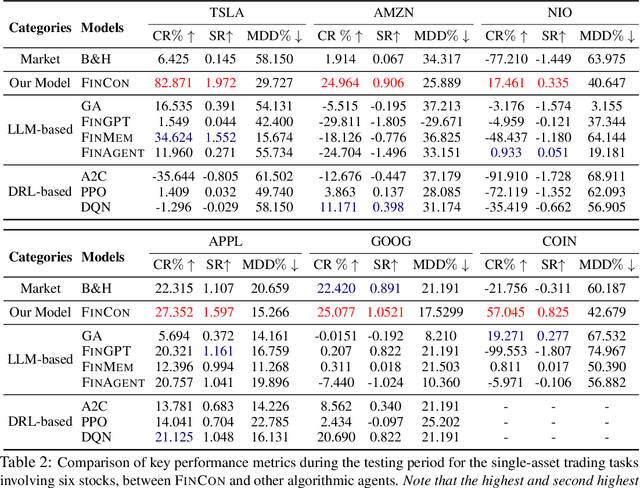

Abstract:Large language models (LLMs) have demonstrated notable potential in conducting complex tasks and are increasingly utilized in various financial applications. However, high-quality sequential financial investment decision-making remains challenging. These tasks require multiple interactions with a volatile environment for every decision, demanding sufficient intelligence to maximize returns and manage risks. Although LLMs have been used to develop agent systems that surpass human teams and yield impressive investment returns, opportunities to enhance multi-sourced information synthesis and optimize decision-making outcomes through timely experience refinement remain unexplored. Here, we introduce the FinCon, an LLM-based multi-agent framework with CONceptual verbal reinforcement tailored for diverse FINancial tasks. Inspired by effective real-world investment firm organizational structures, FinCon utilizes a manager-analyst communication hierarchy. This structure allows for synchronized cross-functional agent collaboration towards unified goals through natural language interactions and equips each agent with greater memory capacity than humans. Additionally, a risk-control component in FinCon enhances decision quality by episodically initiating a self-critiquing mechanism to update systematic investment beliefs. The conceptualized beliefs serve as verbal reinforcement for the future agent's behavior and can be selectively propagated to the appropriate node that requires knowledge updates. This feature significantly improves performance while reducing unnecessary peer-to-peer communication costs. Moreover, FinCon demonstrates strong generalization capabilities in various financial tasks, including single stock trading and portfolio management.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge