Qianqian Xie

EHRNavigator: A Multi-Agent System for Patient-Level Clinical Question Answering over Heterogeneous Electronic Health Records

Jan 15, 2026Abstract:Clinical decision-making increasingly relies on timely and context-aware access to patient information within Electronic Health Records (EHRs), yet most existing natural language question-answering (QA) systems are evaluated solely on benchmark datasets, limiting their practical relevance. To overcome this limitation, we introduce EHRNavigator, a multi-agent framework that harnesses AI agents to perform patient-level question answering across heterogeneous and multimodal EHR data. We assessed its performance using both public benchmark and institutional datasets under realistic hospital conditions characterized by diverse schemas, temporal reasoning demands, and multimodal evidence integration. Through quantitative evaluation and clinician-validated chart review, EHRNavigator demonstrated strong generalization, achieving 86% accuracy on real-world cases while maintaining clinically acceptable response times. Overall, these findings confirm that EHRNavigator effectively bridges the gap between benchmark evaluation and clinical deployment, offering a robust, adaptive, and efficient solution for real-world EHR question answering.

RAAR: Retrieval Augmented Agentic Reasoning for Cross-Domain Misinformation Detection

Jan 08, 2026Abstract:Cross-domain misinformation detection is challenging, as misinformation arises across domains with substantial differences in knowledge and discourse. Existing methods often rely on single-perspective cues and struggle to generalize to challenging or underrepresented domains, while reasoning large language models (LLMs), though effective on complex tasks, are limited to same-distribution data. To address these gaps, we introduce RAAR, the first retrieval-augmented agentic reasoning framework for cross-domain misinformation detection. To enable cross-domain transfer beyond same-distribution assumptions, RAAR retrieves multi-perspective source-domain evidence aligned with each target sample's semantics, sentiment, and writing style. To overcome single-perspective modeling and missing systematic reasoning, RAAR constructs verifiable multi-step reasoning paths through specialized multi-agent collaboration, where perspective-specific agents produce complementary analyses and a summary agent integrates them under verifier guidance. RAAR further applies supervised fine-tuning and reinforcement learning to train a single multi-task verifier to enhance verification and reasoning capabilities. Based on RAAR, we trained the RAAR-8b and RAAR-14b models. Evaluation on three cross-domain misinformation detection tasks shows that RAAR substantially enhances the capabilities of the base models and outperforms other cross-domain methods, advanced LLMs, and LLM-based adaptation approaches. The project will be released at https://github.com/lzw108/RAAR.

MisSpans: Fine-Grained False Span Identification in Cross-Domain Fake News

Jan 08, 2026Abstract:Online misinformation is increasingly pervasive, yet most existing benchmarks and methods evaluate veracity at the level of whole claims or paragraphs using coarse binary labels, obscuring how true and false details often co-exist within single sentences. These simplifications also limit interpretability: global explanations cannot identify which specific segments are misleading or differentiate how a detail is false (e.g., distorted vs. fabricated). To address these gaps, we introduce MisSpans, the first multi-domain, human-annotated benchmark for span-level misinformation detection and analysis, consisting of paired real and fake news stories. MisSpans defines three complementary tasks: MisSpansIdentity for pinpointing false spans within sentences, MisSpansType for categorising false spans by misinformation type, and MisSpansExplanation for providing rationales grounded in identified spans. Together, these tasks enable fine-grained localisation, nuanced characterisation beyond true/false and actionable explanations. Expert annotators were guided by standardised guidelines and consistency checks, leading to high inter-annotator agreement. We evaluate 15 representative LLMs, including reasoning-enhanced and non-reasoning variants, under zero-shot and one-shot settings. Results reveal the challenging nature of fine-grained misinformation identification and analysis, and highlight the need for a deeper understanding of how performance may be influenced by multiple interacting factors, including model size and reasoning capabilities, along with domain-specific textual features. This project will be available at https://github.com/lzw108/MisSpans.

MentraSuite: Post-Training Large Language Models for Mental Health Reasoning and Assessment

Dec 16, 2025Abstract:Mental health disorders affect hundreds of millions globally, and the Web now serves as a primary medium for accessing support, information, and assessment. Large language models (LLMs) offer scalable and accessible assistance, yet their deployment in mental-health settings remains risky when their reasoning is incomplete, inconsistent, or ungrounded. Existing psychological LLMs emphasize emotional understanding or knowledge recall but overlook the step-wise, clinically aligned reasoning required for appraisal, diagnosis, intervention planning, abstraction, and verification. To address these issues, we introduce MentraSuite, a unified framework for advancing reliable mental-health reasoning. We propose MentraBench, a comprehensive benchmark spanning five core reasoning aspects, six tasks, and 13 datasets, evaluating both task performance and reasoning quality across five dimensions: conciseness, coherence, hallucination avoidance, task understanding, and internal consistency. We further present Mindora, a post-trained model optimized through a hybrid SFT-RL framework with an inconsistency-detection reward to enforce faithful and coherent reasoning. To support training, we construct high-quality trajectories using a novel reasoning trajectory generation strategy, that strategically filters difficult samples and applies a structured, consistency-oriented rewriting process to produce concise, readable, and well-balanced trajectories. Across 20 evaluated LLMs, Mindora achieves the highest average performance on MentraBench and shows remarkable performances in reasoning reliability, demonstrating its effectiveness for complex mental-health scenarios.

Human or LLM as Standardized Patients? A Comparative Study for Medical Education

Nov 12, 2025Abstract:Standardized Patients (SP) are indispensable for clinical skills training but remain expensive, inflexible, and difficult to scale. Existing large-language-model (LLM)-based SP simulators promise lower cost yet show inconsistent behavior and lack rigorous comparison with human SP. We present EasyMED, a multi-agent framework combining a Patient Agent for realistic dialogue, an Auxiliary Agent for factual consistency, and an Evaluation Agent that delivers actionable feedback. To support systematic assessment, we introduce SPBench, a benchmark of real SP-doctor interactions spanning 14 specialties and eight expert-defined evaluation criteria. Experiments demonstrate that EasyMED matches human SP learning outcomes while producing greater skill gains for lower-baseline students and offering improved flexibility, psychological safety, and cost efficiency.

Plan Then Retrieve: Reinforcement Learning-Guided Complex Reasoning over Knowledge Graphs

Oct 23, 2025

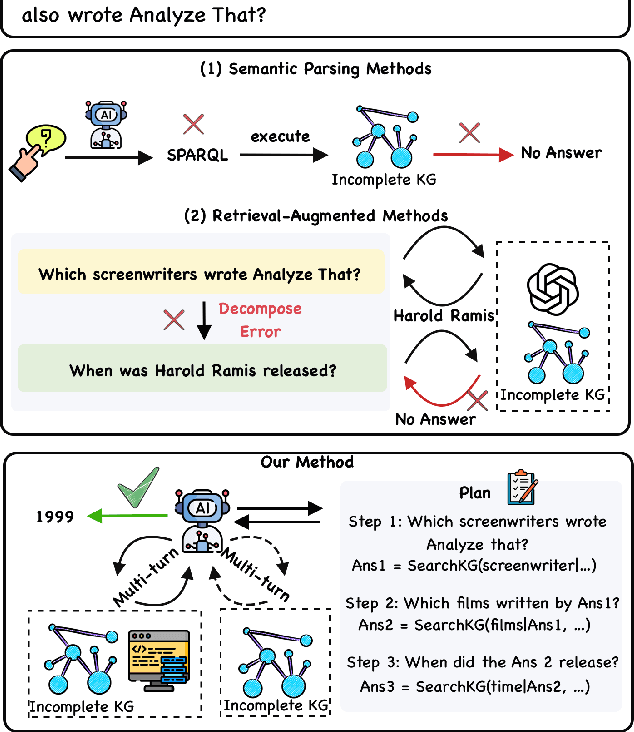

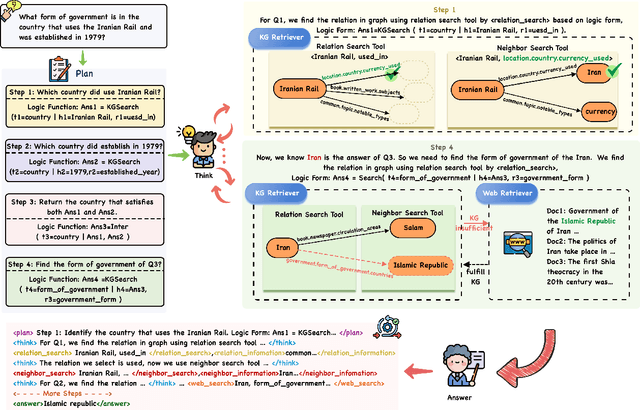

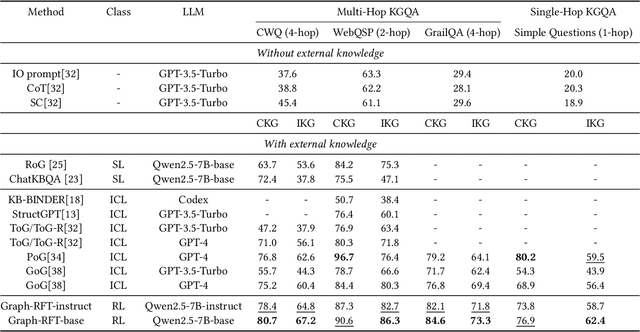

Abstract:Knowledge Graph Question Answering aims to answer natural language questions by reasoning over structured knowledge graphs. While large language models have advanced KGQA through their strong reasoning capabilities, existing methods continue to struggle to fully exploit both the rich knowledge encoded in KGs and the reasoning capabilities of LLMs, particularly in complex scenarios. They often assume complete KG coverage and lack mechanisms to judge when external information is needed, and their reasoning remains locally myopic, failing to maintain coherent multi-step planning, leading to reasoning failures even when relevant knowledge exists. We propose Graph-RFT, a novel two-stage reinforcement fine-tuning KGQA framework with a 'plan-KGsearch-and-Websearch-during-think' paradigm, that enables LLMs to perform autonomous planning and adaptive retrieval scheduling across KG and web sources under incomplete knowledge conditions. Graph-RFT introduces a chain-of-thought fine-tuning method with a customized plan-retrieval dataset activates structured reasoning and resolves the GRPO cold-start problem. It then introduces a novel plan-retrieval guided reinforcement learning process integrates explicit planning and retrieval actions with a multi-reward design, enabling coverage-aware retrieval scheduling. It employs a Cartesian-inspired planning module to decompose complex questions into ordered subquestions, and logical expression to guide tool invocation for globally consistent multi-step reasoning. This reasoning retrieval process is optimized with a multi-reward combining outcome and retrieval specific signals, enabling the model to learn when and how to combine KG and web retrieval effectively.

Memorization in Large Language Models in Medicine: Prevalence, Characteristics, and Implications

Sep 10, 2025Abstract:Large Language Models (LLMs) have demonstrated significant potential in medicine. To date, LLMs have been widely applied to tasks such as diagnostic assistance, medical question answering, and clinical information synthesis. However, a key open question remains: to what extent do LLMs memorize medical training data. In this study, we present the first comprehensive evaluation of memorization of LLMs in medicine, assessing its prevalence (how frequently it occurs), characteristics (what is memorized), volume (how much content is memorized), and potential downstream impacts (how memorization may affect medical applications). We systematically analyze common adaptation scenarios: (1) continued pretraining on medical corpora, (2) fine-tuning on standard medical benchmarks, and (3) fine-tuning on real-world clinical data, including over 13,000 unique inpatient records from Yale New Haven Health System. The results demonstrate that memorization is prevalent across all adaptation scenarios and significantly higher than reported in the general domain. Memorization affects both the development and adoption of LLMs in medicine and can be categorized into three types: beneficial (e.g., accurate recall of clinical guidelines and biomedical references), uninformative (e.g., repeated disclaimers or templated medical document language), and harmful (e.g., regeneration of dataset-specific or sensitive clinical content). Based on these findings, we offer practical recommendations to facilitate beneficial memorization that enhances domain-specific reasoning and factual accuracy, minimize uninformative memorization to promote deeper learning beyond surface-level patterns, and mitigate harmful memorization to prevent the leakage of sensitive or identifiable patient information.

A Retrieval-Augmented Multi-Agent Framework for Psychiatry Diagnosis

Jun 04, 2025Abstract:The application of AI in psychiatric diagnosis faces significant challenges, including the subjective nature of mental health assessments, symptom overlap across disorders, and privacy constraints limiting data availability. To address these issues, we present MoodAngels, the first specialized multi-agent framework for mood disorder diagnosis. Our approach combines granular-scale analysis of clinical assessments with a structured verification process, enabling more accurate interpretation of complex psychiatric data. Complementing this framework, we introduce MoodSyn, an open-source dataset of 1,173 synthetic psychiatric cases that preserves clinical validity while ensuring patient privacy. Experimental results demonstrate that MoodAngels outperforms conventional methods, with our baseline agent achieving 12.3% higher accuracy than GPT-4o on real-world cases, and our full multi-agent system delivering further improvements. Evaluation in the MoodSyn dataset demonstrates exceptional fidelity, accurately reproducing both the core statistical patterns and complex relationships present in the original data while maintaining strong utility for machine learning applications. Together, these contributions provide both an advanced diagnostic tool and a critical research resource for computational psychiatry, bridging important gaps in AI-assisted mental health assessment.

MMAFFBen: A Multilingual and Multimodal Affective Analysis Benchmark for Evaluating LLMs and VLMs

May 30, 2025

Abstract:Large language models and vision-language models (which we jointly call LMs) have transformed NLP and CV, demonstrating remarkable potential across various fields. However, their capabilities in affective analysis (i.e. sentiment analysis and emotion detection) remain underexplored. This gap is largely due to the absence of comprehensive evaluation benchmarks, and the inherent complexity of affective analysis tasks. In this paper, we introduce MMAFFBen, the first extensive open-source benchmark for multilingual multimodal affective analysis. MMAFFBen encompasses text, image, and video modalities across 35 languages, covering four key affective analysis tasks: sentiment polarity, sentiment intensity, emotion classification, and emotion intensity. Moreover, we construct the MMAFFIn dataset for fine-tuning LMs on affective analysis tasks, and further develop MMAFFLM-3b and MMAFFLM-7b based on it. We evaluate various representative LMs, including GPT-4o-mini, providing a systematic comparison of their affective understanding capabilities. This project is available at https://github.com/lzw108/MMAFFBen.

FinTagging: An LLM-ready Benchmark for Extracting and Structuring Financial Information

May 27, 2025Abstract:We introduce FinTagging, the first full-scope, table-aware XBRL benchmark designed to evaluate the structured information extraction and semantic alignment capabilities of large language models (LLMs) in the context of XBRL-based financial reporting. Unlike prior benchmarks that oversimplify XBRL tagging as flat multi-class classification and focus solely on narrative text, FinTagging decomposes the XBRL tagging problem into two subtasks: FinNI for financial entity extraction and FinCL for taxonomy-driven concept alignment. It requires models to jointly extract facts and align them with the full 10k+ US-GAAP taxonomy across both unstructured text and structured tables, enabling realistic, fine-grained evaluation. We assess a diverse set of LLMs under zero-shot settings, systematically analyzing their performance on both subtasks and overall tagging accuracy. Our results reveal that, while LLMs demonstrate strong generalization in information extraction, they struggle with fine-grained concept alignment, particularly in disambiguating closely related taxonomy entries. These findings highlight the limitations of existing LLMs in fully automating XBRL tagging and underscore the need for improved semantic reasoning and schema-aware modeling to meet the demands of accurate financial disclosure. Code is available at our GitHub repository and data is at our Hugging Face repository.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge