Zhenyu Cui

Bi-C2R: Bidirectional Continual Compatible Representation for Re-indexing Free Lifelong Person Re-identification

Dec 31, 2025Abstract:Lifelong person Re-IDentification (L-ReID) exploits sequentially collected data to continuously train and update a ReID model, focusing on the overall performance of all data. Its main challenge is to avoid the catastrophic forgetting problem of old knowledge while training on new data. Existing L-ReID methods typically re-extract new features for all historical gallery images for inference after each update, known as "re-indexing". However, historical gallery data typically suffers from direct saving due to the data privacy issue and the high re-indexing costs for large-scale gallery images. As a result, it inevitably leads to incompatible retrieval between query features extracted by the updated model and gallery features extracted by those before the update, greatly impairing the re-identification performance. To tackle the above issue, this paper focuses on a new task called Re-index Free Lifelong person Re-IDentification (RFL-ReID), which requires performing lifelong person re-identification without re-indexing historical gallery images. Therefore, RFL-ReID is more challenging than L-ReID, requiring continuous learning and balancing new and old knowledge in diverse streaming data, and making the features output by the new and old models compatible with each other. To this end, we propose a Bidirectional Continuous Compatible Representation (Bi-C2R) framework to continuously update the gallery features extracted by the old model to perform efficient L-ReID in a compatible manner. We verify our proposed Bi-C2R method through theoretical analysis and extensive experiments on multiple benchmarks, which demonstrate that the proposed method can achieve leading performance on both the introduced RFL-ReID task and the traditional L-ReID task.

CKDA: Cross-modality Knowledge Disentanglement and Alignment for Visible-Infrared Lifelong Person Re-identification

Nov 19, 2025Abstract:Lifelong person Re-IDentification (LReID) aims to match the same person employing continuously collected individual data from different scenarios. To achieve continuous all-day person matching across day and night, Visible-Infrared Lifelong person Re-IDentification (VI-LReID) focuses on sequential training on data from visible and infrared modalities and pursues average performance over all data. To this end, existing methods typically exploit cross-modal knowledge distillation to alleviate the catastrophic forgetting of old knowledge. However, these methods ignore the mutual interference of modality-specific knowledge acquisition and modality-common knowledge anti-forgetting, where conflicting knowledge leads to collaborative forgetting. To address the above problems, this paper proposes a Cross-modality Knowledge Disentanglement and Alignment method, called CKDA, which explicitly separates and preserves modality-specific knowledge and modality-common knowledge in a balanced way. Specifically, a Modality-Common Prompting (MCP) module and a Modality-Specific Prompting (MSP) module are proposed to explicitly disentangle and purify discriminative information that coexists and is specific to different modalities, avoiding the mutual interference between both knowledge. In addition, a Cross-modal Knowledge Alignment (CKA) module is designed to further align the disentangled new knowledge with the old one in two mutually independent inter- and intra-modality feature spaces based on dual-modality prototypes in a balanced manner. Extensive experiments on four benchmark datasets verify the effectiveness and superiority of our CKDA against state-of-the-art methods. The source code of this paper is available at https://github.com/PKU-ICST-MIPL/CKDA-AAAI2026.

GAPrompt: Geometry-Aware Point Cloud Prompt for 3D Vision Model

May 07, 2025

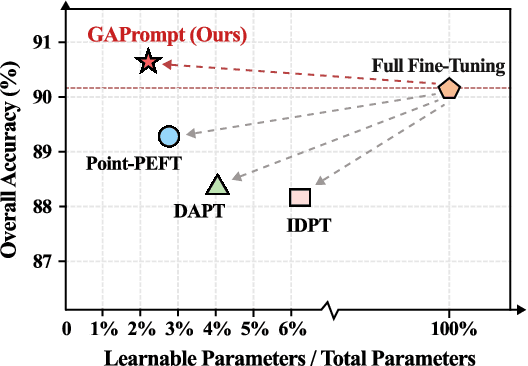

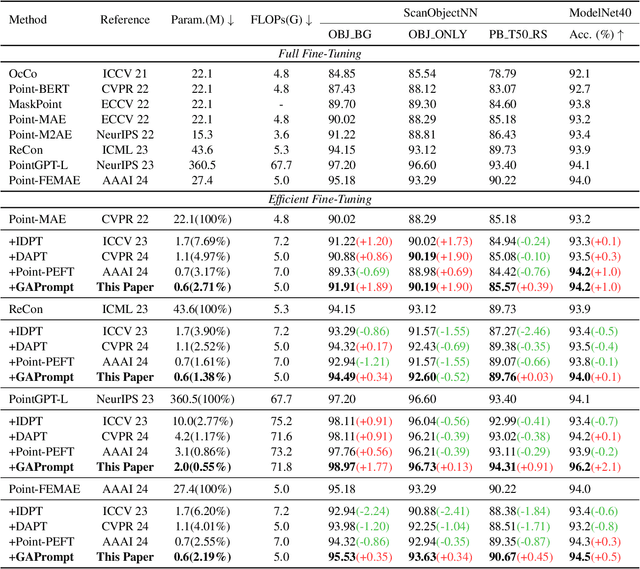

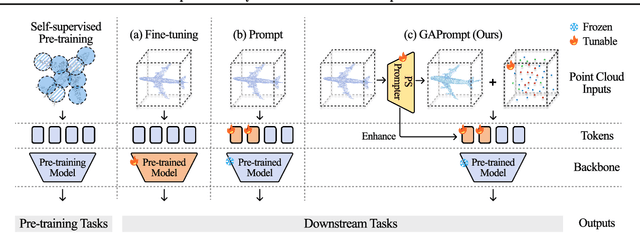

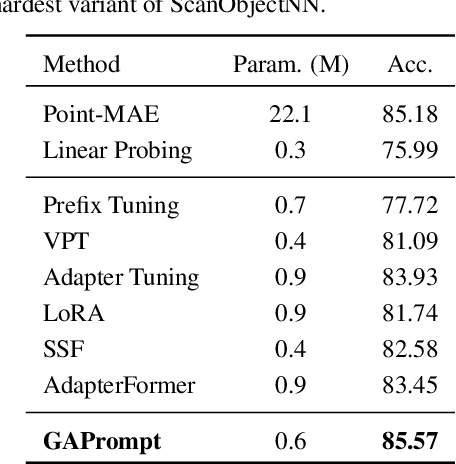

Abstract:Pre-trained 3D vision models have gained significant attention for their promising performance on point cloud data. However, fully fine-tuning these models for downstream tasks is computationally expensive and storage-intensive. Existing parameter-efficient fine-tuning (PEFT) approaches, which focus primarily on input token prompting, struggle to achieve competitive performance due to their limited ability to capture the geometric information inherent in point clouds. To address this challenge, we propose a novel Geometry-Aware Point Cloud Prompt (GAPrompt) that leverages geometric cues to enhance the adaptability of 3D vision models. First, we introduce a Point Prompt that serves as an auxiliary input alongside the original point cloud, explicitly guiding the model to capture fine-grained geometric details. Additionally, we present a Point Shift Prompter designed to extract global shape information from the point cloud, enabling instance-specific geometric adjustments at the input level. Moreover, our proposed Prompt Propagation mechanism incorporates the shape information into the model's feature extraction process, further strengthening its ability to capture essential geometric characteristics. Extensive experiments demonstrate that GAPrompt significantly outperforms state-of-the-art PEFT methods and achieves competitive results compared to full fine-tuning on various benchmarks, while utilizing only 2.19% of trainable parameters. Our code is available at https://github.com/zhoujiahuan1991/ICML2025-VGP.

Selective Visual Prompting in Vision Mamba

Dec 12, 2024Abstract:Pre-trained Vision Mamba (Vim) models have demonstrated exceptional performance across various computer vision tasks in a computationally efficient manner, attributed to their unique design of selective state space models. To further extend their applicability to diverse downstream vision tasks, Vim models can be adapted using the efficient fine-tuning technique known as visual prompting. However, existing visual prompting methods are predominantly tailored for Vision Transformer (ViT)-based models that leverage global attention, neglecting the distinctive sequential token-wise compression and propagation characteristics of Vim. Specifically, existing prompt tokens prefixed to the sequence are insufficient to effectively activate the input and forget gates across the entire sequence, hindering the extraction and propagation of discriminative information. To address this limitation, we introduce a novel Selective Visual Prompting (SVP) method specifically for the efficient fine-tuning of Vim. To prevent the loss of discriminative information during state space propagation, SVP employs lightweight selective prompters for token-wise prompt generation, ensuring adaptive activation of the update and forget gates within Mamba blocks to promote discriminative information propagation. Moreover, considering that Vim propagates both shared cross-layer information and specific inner-layer information, we further refine SVP with a dual-path structure: Cross-Prompting and Inner-Prompting. Cross-Prompting utilizes shared parameters across layers, while Inner-Prompting employs distinct parameters, promoting the propagation of both shared and specific information, respectively. Extensive experimental results on various large-scale benchmarks demonstrate that our proposed SVP significantly outperforms state-of-the-art methods. Our code is available at https://github.com/zhoujiahuan1991/AAAI2025-SVP.

Odyssey: Empowering Agents with Open-World Skills

Jul 22, 2024

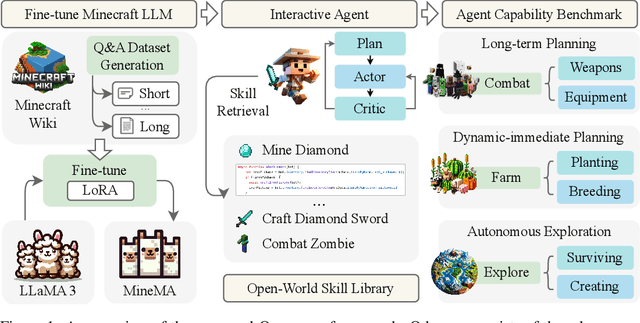

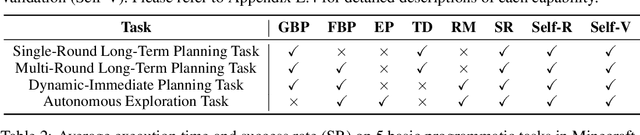

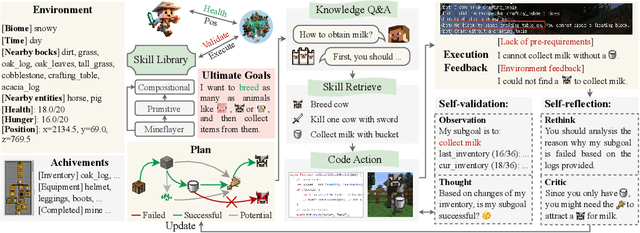

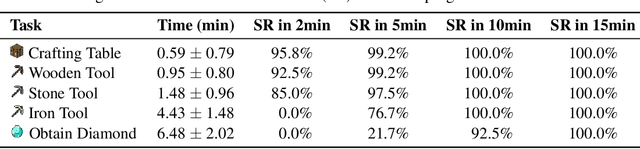

Abstract:Recent studies have delved into constructing generalist agents for open-world embodied environments like Minecraft. Despite the encouraging results, existing efforts mainly focus on solving basic programmatic tasks, e.g., material collection and tool-crafting following the Minecraft tech-tree, treating the ObtainDiamond task as the ultimate goal. This limitation stems from the narrowly defined set of actions available to agents, requiring them to learn effective long-horizon strategies from scratch. Consequently, discovering diverse gameplay opportunities in the open world becomes challenging. In this work, we introduce ODYSSEY, a new framework that empowers Large Language Model (LLM)-based agents with open-world skills to explore the vast Minecraft world. ODYSSEY comprises three key parts: (1) An interactive agent with an open-world skill library that consists of 40 primitive skills and 183 compositional skills. (2) A fine-tuned LLaMA-3 model trained on a large question-answering dataset with 390k+ instruction entries derived from the Minecraft Wiki. (3) A new open-world benchmark includes thousands of long-term planning tasks, tens of dynamic-immediate planning tasks, and one autonomous exploration task. Extensive experiments demonstrate that the proposed ODYSSEY framework can effectively evaluate the planning and exploration capabilities of agents. All datasets, model weights, and code are publicly available to motivate future research on more advanced autonomous agent solutions.

FinCon: A Synthesized LLM Multi-Agent System with Conceptual Verbal Reinforcement for Enhanced Financial Decision Making

Jul 10, 2024

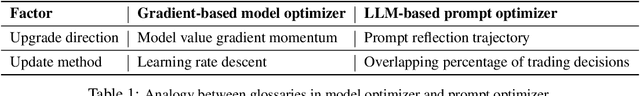

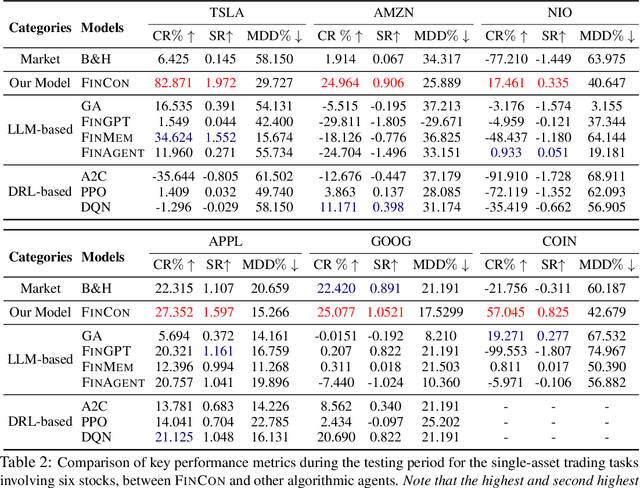

Abstract:Large language models (LLMs) have demonstrated notable potential in conducting complex tasks and are increasingly utilized in various financial applications. However, high-quality sequential financial investment decision-making remains challenging. These tasks require multiple interactions with a volatile environment for every decision, demanding sufficient intelligence to maximize returns and manage risks. Although LLMs have been used to develop agent systems that surpass human teams and yield impressive investment returns, opportunities to enhance multi-sourced information synthesis and optimize decision-making outcomes through timely experience refinement remain unexplored. Here, we introduce the FinCon, an LLM-based multi-agent framework with CONceptual verbal reinforcement tailored for diverse FINancial tasks. Inspired by effective real-world investment firm organizational structures, FinCon utilizes a manager-analyst communication hierarchy. This structure allows for synchronized cross-functional agent collaboration towards unified goals through natural language interactions and equips each agent with greater memory capacity than humans. Additionally, a risk-control component in FinCon enhances decision quality by episodically initiating a self-critiquing mechanism to update systematic investment beliefs. The conceptualized beliefs serve as verbal reinforcement for the future agent's behavior and can be selectively propagated to the appropriate node that requires knowledge updates. This feature significantly improves performance while reducing unnecessary peer-to-peer communication costs. Moreover, FinCon demonstrates strong generalization capabilities in various financial tasks, including single stock trading and portfolio management.

A unified consensus-based parallel ADMM algorithm for high-dimensional regression with combined regularizations

Nov 21, 2023Abstract:The parallel alternating direction method of multipliers (ADMM) algorithm is widely recognized for its effectiveness in handling large-scale datasets stored in a distributed manner, making it a popular choice for solving statistical learning models. However, there is currently limited research on parallel algorithms specifically designed for high-dimensional regression with combined (composite) regularization terms. These terms, such as elastic-net, sparse group lasso, sparse fused lasso, and their nonconvex variants, have gained significant attention in various fields due to their ability to incorporate prior information and promote sparsity within specific groups or fused variables. The scarcity of parallel algorithms for combined regularizations can be attributed to the inherent nonsmoothness and complexity of these terms, as well as the absence of closed-form solutions for certain proximal operators associated with them. In this paper, we propose a unified constrained optimization formulation based on the consensus problem for these types of convex and nonconvex regression problems and derive the corresponding parallel ADMM algorithms. Furthermore, we prove that the proposed algorithm not only has global convergence but also exhibits linear convergence rate. Extensive simulation experiments, along with a financial example, serve to demonstrate the reliability, stability, and scalability of our algorithm. The R package for implementing the proposed algorithms can be obtained at https://github.com/xfwu1016/CPADMM.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge