Hong Jin

Tabular Foundation Models are Strong Graph Anomaly Detectors

Jan 24, 2026Abstract:Graph anomaly detection (GAD), which aims to identify abnormal nodes that deviate from the majority, has become increasingly important in high-stakes Web domains. However, existing GAD methods follow a "one model per dataset" paradigm, leading to high computational costs, substantial data demands, and poor generalization when transferred to new datasets. This calls for a foundation model that enables a "one-for-all" GAD solution capable of detecting anomalies across diverse graphs without retraining. Yet, achieving this is challenging due to the large structural and feature heterogeneity across domains. In this paper, we propose TFM4GAD, a simple yet effective framework that adapts tabular foundation models (TFMs) for graph anomaly detection. Our key insight is that the core challenges of foundation GAD, handling heterogeneous features, generalizing across domains, and operating with scarce labels, are the exact problems that modern TFMs are designed to solve via synthetic pre-training and powerful in-context learning. The primary challenge thus becomes structural: TFMs are agnostic to graph topology. TFM4GAD bridges this gap by "flattening" the graph, constructing an augmented feature table that enriches raw node features with Laplacian embeddings, local and global structural characteristics, and anomaly-sensitive neighborhood aggregations. This augmented table is processed by a TFM in a fully in-context regime. Extensive experiments on multiple datasets with various TFM backbones reveal that TFM4GAD surprisingly achieves significant performance gains over specialized GAD models trained from scratch. Our work offers a new perspective and a practical paradigm for leveraging TFMs as powerful, generalist graph anomaly detectors.

Multi-Granular Attention based Heterogeneous Hypergraph Neural Network

May 07, 2025

Abstract:Heterogeneous graph neural networks (HeteGNNs) have demonstrated strong abilities to learn node representations by effectively extracting complex structural and semantic information in heterogeneous graphs. Most of the prevailing HeteGNNs follow the neighborhood aggregation paradigm, leveraging meta-path based message passing to learn latent node representations. However, due to the pairwise nature of meta-paths, these models fail to capture high-order relations among nodes, resulting in suboptimal performance. Additionally, the challenge of ``over-squashing'', where long-range message passing in HeteGNNs leads to severe information distortion, further limits the efficacy of these models. To address these limitations, this paper proposes MGA-HHN, a Multi-Granular Attention based Heterogeneous Hypergraph Neural Network for heterogeneous graph representation learning. MGA-HHN introduces two key innovations: (1) a novel approach for constructing meta-path based heterogeneous hypergraphs that explicitly models higher-order semantic information in heterogeneous graphs through multiple views, and (2) a multi-granular attention mechanism that operates at both the node and hyperedge levels. This mechanism enables the model to capture fine-grained interactions among nodes sharing the same semantic context within a hyperedge type, while preserving the diversity of semantics across different hyperedge types. As such, MGA-HHN effectively mitigates long-range message distortion and generates more expressive node representations. Extensive experiments on real-world benchmark datasets demonstrate that MGA-HHN outperforms state-of-the-art models, showcasing its effectiveness in node classification, node clustering and visualization tasks.

Hetero$^2$Net: Heterophily-aware Representation Learning on Heterogenerous Graphs

Oct 18, 2023

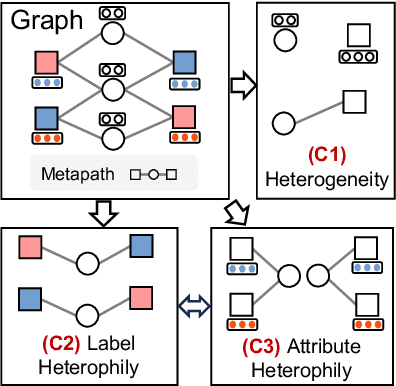

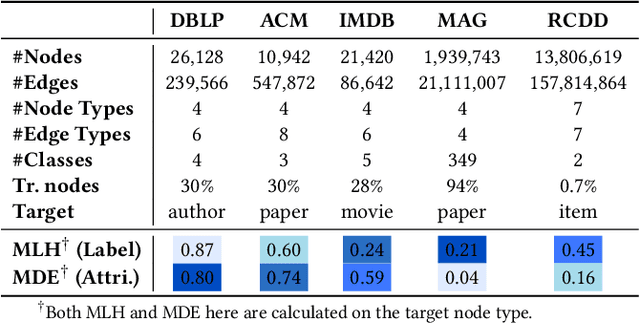

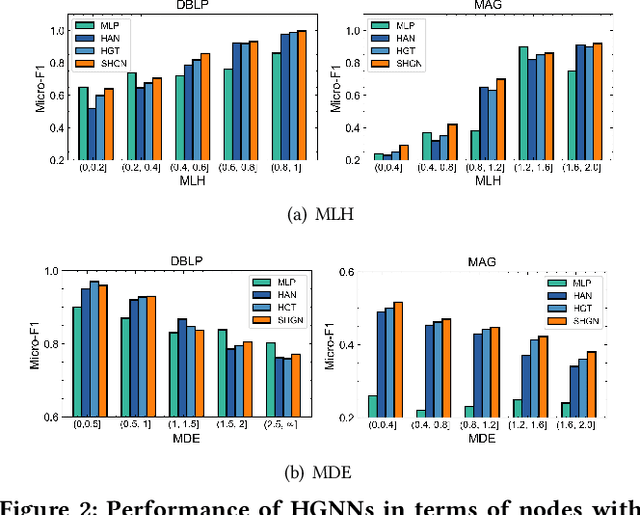

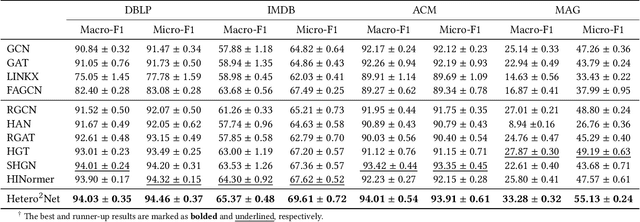

Abstract:Real-world graphs are typically complex, exhibiting heterogeneity in the global structure, as well as strong heterophily within local neighborhoods. While a growing body of literature has revealed the limitations of common graph neural networks (GNNs) in handling homogeneous graphs with heterophily, little work has been conducted on investigating the heterophily properties in the context of heterogeneous graphs. To bridge this research gap, we identify the heterophily in heterogeneous graphs using metapaths and propose two practical metrics to quantitatively describe the levels of heterophily. Through in-depth investigations on several real-world heterogeneous graphs exhibiting varying levels of heterophily, we have observed that heterogeneous graph neural networks (HGNNs), which inherit many mechanisms from GNNs designed for homogeneous graphs, fail to generalize to heterogeneous graphs with heterophily or low level of homophily. To address the challenge, we present Hetero$^2$Net, a heterophily-aware HGNN that incorporates both masked metapath prediction and masked label prediction tasks to effectively and flexibly handle both homophilic and heterophilic heterogeneous graphs. We evaluate the performance of Hetero$^2$Net on five real-world heterogeneous graph benchmarks with varying levels of heterophily. The results demonstrate that Hetero$^2$Net outperforms strong baselines in the semi-supervised node classification task, providing valuable insights into effectively handling more complex heterogeneous graphs.

GRANDE: a neural model over directed multigraphs with application to anti-money laundering

Feb 04, 2023Abstract:The application of graph representation learning techniques to the area of financial risk management (FRM) has attracted significant attention recently. However, directly modeling transaction networks using graph neural models remains challenging: Firstly, transaction networks are directed multigraphs by nature, which could not be properly handled with most of the current off-the-shelf graph neural networks (GNN). Secondly, a crucial problem in FRM scenarios like anti-money laundering (AML) is to identify risky transactions and is most naturally cast into an edge classification problem with rich edge-level features, which are not fully exploited by the prevailing GNN design that follows node-centric message passing protocols. In this paper, we present a systematic investigation of design aspects of neural models over directed multigraphs and develop a novel GNN protocol that overcomes the above challenges via efficiently incorporating directional information, as well as proposing an enhancement that targets edge-related tasks using a novel message passing scheme over an extension of edge-to-node dual graph. A concrete GNN architecture called GRANDE is derived using the proposed protocol, with several further improvements and generalizations to temporal dynamic graphs. We apply the GRANDE model to both a real-world anti-money laundering task and public datasets. Experimental evaluations show the superiority of the proposed GRANDE architecture over recent state-of-the-art models on dynamic graph modeling and directed graph modeling.

SplitGNN: Splitting GNN for Node Classification with Heterogeneous Attention

Jan 27, 2023

Abstract:With the frequent happening of privacy leakage and the enactment of privacy laws across different countries, data owners are reluctant to directly share their raw data and labels with any other party. In reality, a lot of these raw data are stored in the graph database, especially for finance. For collaboratively building graph neural networks(GNNs), federated learning(FL) may not be an ideal choice for the vertically partitioned setting where privacy and efficiency are the main concerns. Moreover, almost all the existing federated GNNs are mainly designed for homogeneous graphs, which simplify various types of relations as the same type, thus largely limits their performance. We bridge this gap by proposing a split learning-based GNN(SplitGNN), where this model is divided into two sub-models: the local GNN model includes all the private data related computation to generate local node embeddings, whereas the global model calculates global embeddings by aggregating all the participants' local embeddings. Our SplitGNN allows the isolated heterogeneous neighborhood to be collaboratively utilized. To better capture representations, we propose a novel Heterogeneous Attention(HAT) algorithm and use both node-based and path-based attention mechanisms to learn various types of nodes and edges with multi-hop relation features. We demonstrate the effectiveness of our SplitGNN on node classification tasks for two standard public datasets and the real-world dataset. Extensive experimental results validate that our proposed SplitGNN significantly outperforms the state-of-the-art(SOTA) methods.

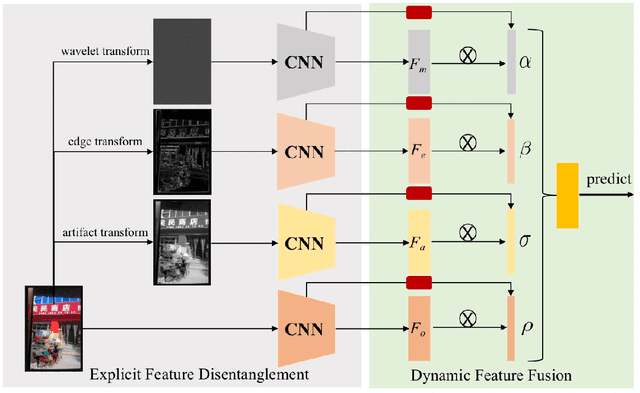

Learning Feature Disentanglement and Dynamic Fusion for Recaptured Image Forensic

Jun 13, 2022

Abstract:Image recapture seriously breaks the fairness of artificial intelligent (AI) systems, which deceives the system by recapturing others' images. Most of the existing recapture models can only address a single pattern of recapture (e.g., moire, edge, artifact, and others) based on the datasets with simulated recaptured images using fixed electronic devices. In this paper, we explicitly redefine image recapture forensic task as four patterns of image recapture recognition, i.e., moire recapture, edge recapture, artifact recapture, and other recapture. Meanwhile, we propose a novel Feature Disentanglement and Dynamic Fusion (FDDF) model to adaptively learn the most effective recapture feature representation for covering different recapture pattern recognition. Furthermore, we collect a large-scale Real-scene Universal Recapture (RUR) dataset containing various recapture patterns, which is about five times the number of previously published datasets. To the best of our knowledge, we are the first to propose a general model and a general real-scene large-scale dataset for recaptured image forensic. Extensive experiments show that our proposed FDDF can achieve state-of-the-art performance on the RUR dataset.

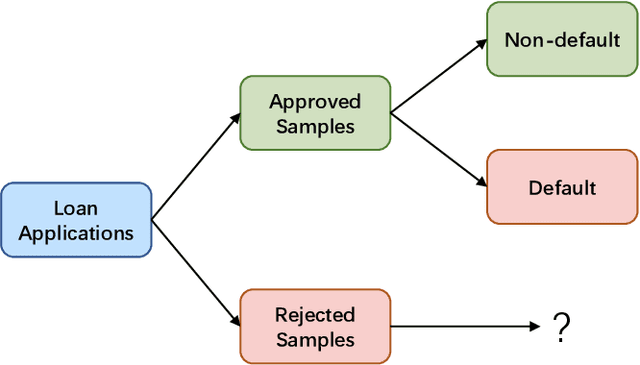

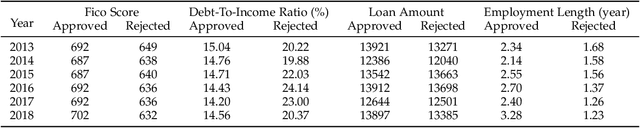

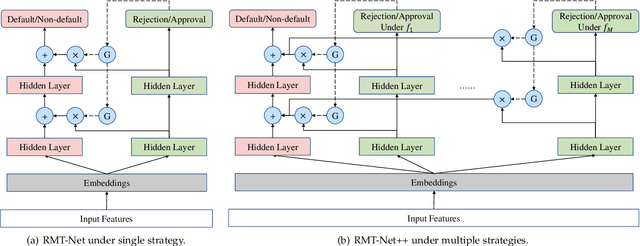

RMT-Net: Reject-aware Multi-Task Network for Modeling Missing-not-at-random Data in Financial Credit Scoring

Jun 01, 2022

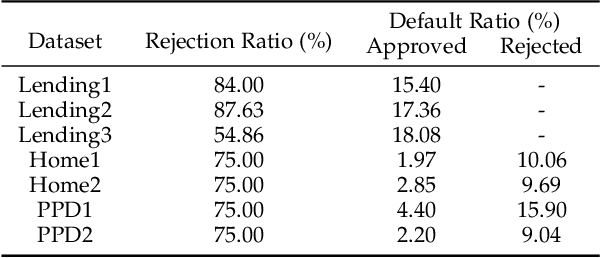

Abstract:In financial credit scoring, loan applications may be approved or rejected. We can only observe default/non-default labels for approved samples but have no observations for rejected samples, which leads to missing-not-at-random selection bias. Machine learning models trained on such biased data are inevitably unreliable. In this work, we find that the default/non-default classification task and the rejection/approval classification task are highly correlated, according to both real-world data study and theoretical analysis. Consequently, the learning of default/non-default can benefit from rejection/approval. Accordingly, we for the first time propose to model the biased credit scoring data with Multi-Task Learning (MTL). Specifically, we propose a novel Reject-aware Multi-Task Network (RMT-Net), which learns the task weights that control the information sharing from the rejection/approval task to the default/non-default task by a gating network based on rejection probabilities. RMT-Net leverages the relation between the two tasks that the larger the rejection probability, the more the default/non-default task needs to learn from the rejection/approval task. Furthermore, we extend RMT-Net to RMT-Net++ for modeling scenarios with multiple rejection/approval strategies. Extensive experiments are conducted on several datasets, and strongly verifies the effectiveness of RMT-Net on both approved and rejected samples. In addition, RMT-Net++ further improves RMT-Net's performances.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge