RMT-Net: Reject-aware Multi-Task Network for Modeling Missing-not-at-random Data in Financial Credit Scoring

Paper and Code

Jun 01, 2022

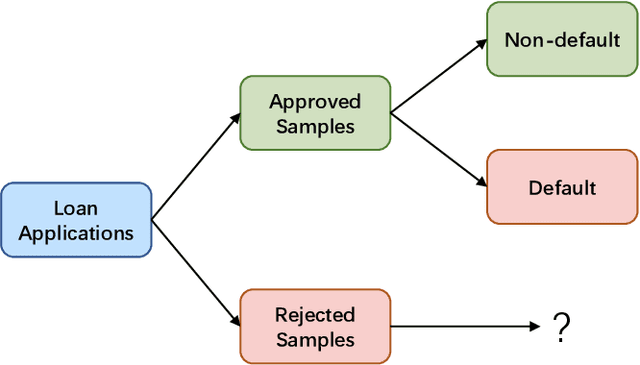

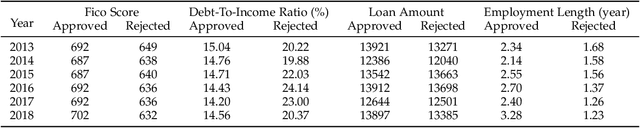

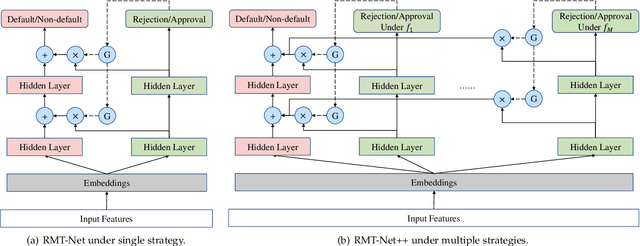

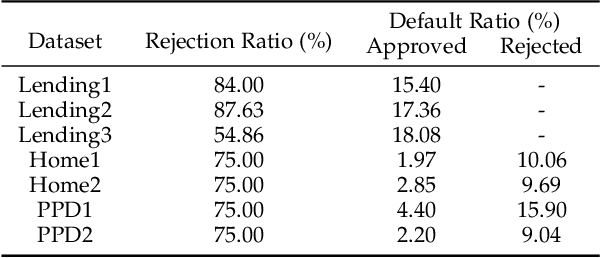

In financial credit scoring, loan applications may be approved or rejected. We can only observe default/non-default labels for approved samples but have no observations for rejected samples, which leads to missing-not-at-random selection bias. Machine learning models trained on such biased data are inevitably unreliable. In this work, we find that the default/non-default classification task and the rejection/approval classification task are highly correlated, according to both real-world data study and theoretical analysis. Consequently, the learning of default/non-default can benefit from rejection/approval. Accordingly, we for the first time propose to model the biased credit scoring data with Multi-Task Learning (MTL). Specifically, we propose a novel Reject-aware Multi-Task Network (RMT-Net), which learns the task weights that control the information sharing from the rejection/approval task to the default/non-default task by a gating network based on rejection probabilities. RMT-Net leverages the relation between the two tasks that the larger the rejection probability, the more the default/non-default task needs to learn from the rejection/approval task. Furthermore, we extend RMT-Net to RMT-Net++ for modeling scenarios with multiple rejection/approval strategies. Extensive experiments are conducted on several datasets, and strongly verifies the effectiveness of RMT-Net on both approved and rejected samples. In addition, RMT-Net++ further improves RMT-Net's performances.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge