Chenxi Hu

Resilient Load Forecasting under Climate Change: Adaptive Conditional Neural Processes for Few-Shot Extreme Load Forecasting

Feb 04, 2026Abstract:Extreme weather can substantially change electricity consumption behavior, causing load curves to exhibit sharp spikes and pronounced volatility. If forecasts are inaccurate during those periods, power systems are more likely to face supply shortfalls or localized overloads, forcing emergency actions such as load shedding and increasing the risk of service disruptions and public-safety impacts. This problem is inherently difficult because extreme events can trigger abrupt regime shifts in load patterns, while relevant extreme samples are rare and irregular, making reliable learning and calibration challenging. We propose AdaCNP, a probabilistic forecasting model for data-scarce condition. AdaCNP learns similarity in a shared embedding space. For each target data, it evaluates how relevant each historical context segment is to the current condition and reweights the context information accordingly. This design highlights the most informative historical evidence even when extreme samples are rare. It enables few-shot adaptation to previously unseen extreme patterns. AdaCNP also produces predictive distributions for risk-aware decision-making without expensive fine-tuning on the target domain. We evaluate AdaCNP on real-world power-system load data and compare it against a range of representative baselines. The results show that AdaCNP is more robust during extreme periods, reducing the mean squared error by 22\% relative to the strongest baseline while achieving the lowest negative log-likelihood, indicating more reliable probabilistic outputs. These findings suggest that AdaCNP can effectively mitigate the combined impact of abrupt distribution shifts and scarce extreme samples, providing a more trustworthy forecasting for resilient power system operation under extreme events.

Mentor3AD: Feature Reconstruction-based 3D Anomaly Detection via Multi-modality Mentor Learning

May 27, 2025Abstract:Multimodal feature reconstruction is a promising approach for 3D anomaly detection, leveraging the complementary information from dual modalities. We further advance this paradigm by utilizing multi-modal mentor learning, which fuses intermediate features to further distinguish normal from feature differences. To address these challenges, we propose a novel method called Mentor3AD, which utilizes multi-modal mentor learning. By leveraging the shared features of different modalities, Mentor3AD can extract more effective features and guide feature reconstruction, ultimately improving detection performance. Specifically, Mentor3AD includes a Mentor of Fusion Module (MFM) that merges features extracted from RGB and 3D modalities to create a mentor feature. Additionally, we have designed a Mentor of Guidance Module (MGM) to facilitate cross-modal reconstruction, supported by the mentor feature. Lastly, we introduce a Voting Module (VM) to more accurately generate the final anomaly score. Extensive comparative and ablation studies on MVTec 3D-AD and Eyecandies have verified the effectiveness of the proposed method.

Towards Universal Learning-based Model for Cardiac Image Reconstruction: Summary of the CMRxRecon2024 Challenge

Mar 05, 2025Abstract:Cardiovascular magnetic resonance (CMR) offers diverse imaging contrasts for assessment of cardiac function and tissue characterization. However, acquiring each single CMR modality is often time-consuming, and comprehensive clinical protocols require multiple modalities with various sampling patterns, further extending the overall acquisition time and increasing susceptibility to motion artifacts. Existing deep learning-based reconstruction methods are often designed for specific acquisition parameters, which limits their ability to generalize across a variety of scan scenarios. As part of the CMRxRecon Series, the CMRxRecon2024 challenge provides diverse datasets encompassing multi-modality multi-view imaging with various sampling patterns, and a platform for the international community to develop and benchmark reconstruction solutions in two well-crafted tasks. Task 1 is a modality-universal setting, evaluating the out-of-distribution generalization of the reconstructed model, while Task 2 follows sampling-universal setting assessing the one-for-all adaptability of the universal model. Main contributions include providing the first and largest publicly available multi-modality, multi-view cardiac k-space dataset; developing a benchmarking platform that simulates clinical acceleration protocols, with a shared code library and tutorial for various k-t undersampling patterns and data processing; giving technical insights of enhanced data consistency based on physic-informed networks and adaptive prompt-learning embedding to be versatile to different clinical settings; additional finding on evaluation metrics to address the limitations of conventional ground-truth references in universal reconstruction tasks.

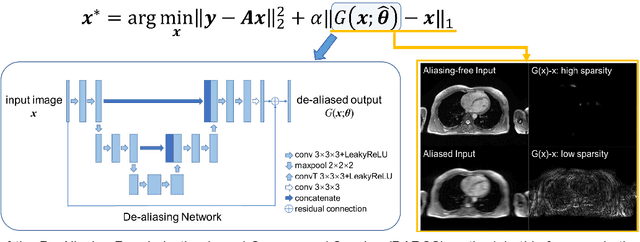

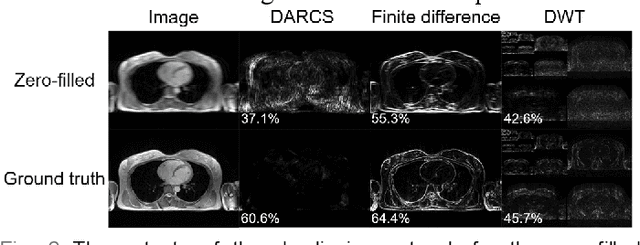

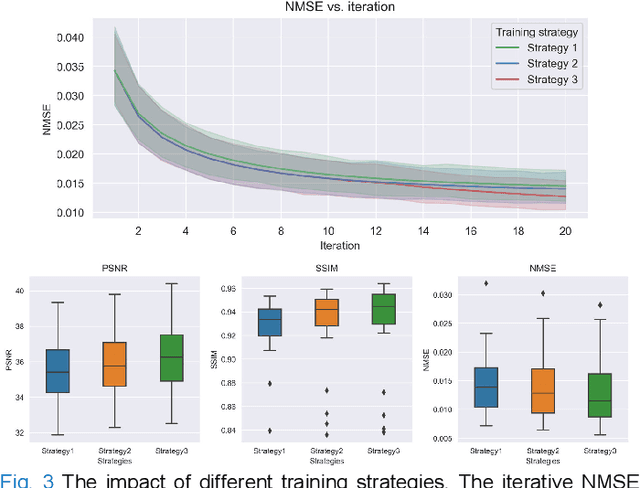

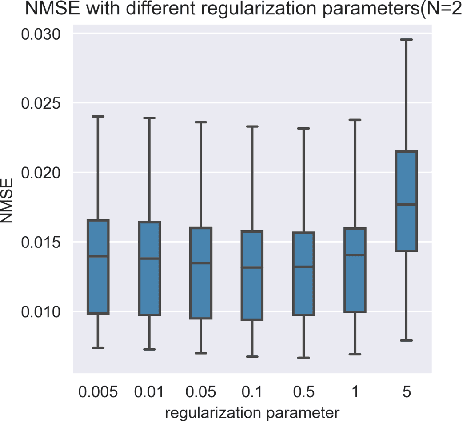

DARCS: Memory-Efficient Deep Compressed Sensing Reconstruction for Acceleration of 3D Whole-Heart Coronary MR Angiography

Feb 02, 2024

Abstract:Three-dimensional coronary magnetic resonance angiography (CMRA) demands reconstruction algorithms that can significantly suppress the artifacts from a heavily undersampled acquisition. While unrolling-based deep reconstruction methods have achieved state-of-the-art performance on 2D image reconstruction, their application to 3D reconstruction is hindered by the large amount of memory needed to train an unrolled network. In this study, we propose a memory-efficient deep compressed sensing method by employing a sparsifying transform based on a pre-trained artifact estimation network. The motivation is that the artifact image estimated by a well-trained network is sparse when the input image is artifact-free, and less sparse when the input image is artifact-affected. Thus, the artifact-estimation network can be used as an inherent sparsifying transform. The proposed method, named De-Aliasing Regularization based Compressed Sensing (DARCS), was compared with a traditional compressed sensing method, de-aliasing generative adversarial network (DAGAN), model-based deep learning (MoDL), and plug-and-play for accelerations of 3D CMRA. The results demonstrate that the proposed method improved the reconstruction quality relative to the compared methods by a large margin. Furthermore, the proposed method well generalized for different undersampling rates and noise levels. The memory usage of the proposed method was only 63% of that needed by MoDL. In conclusion, the proposed method achieves improved reconstruction quality for 3D CMRA with reduced memory burden.

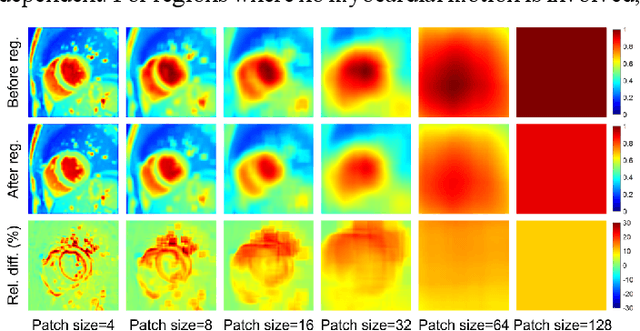

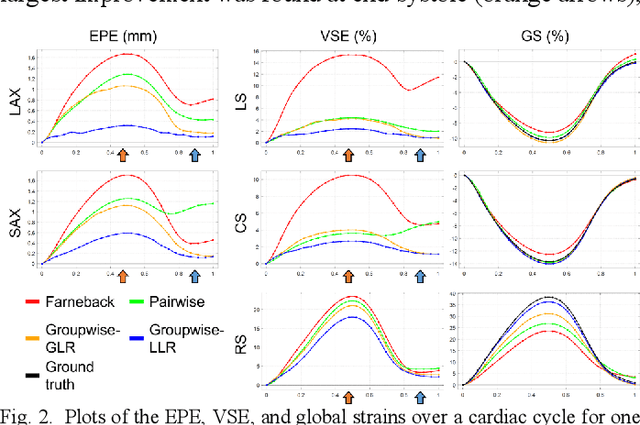

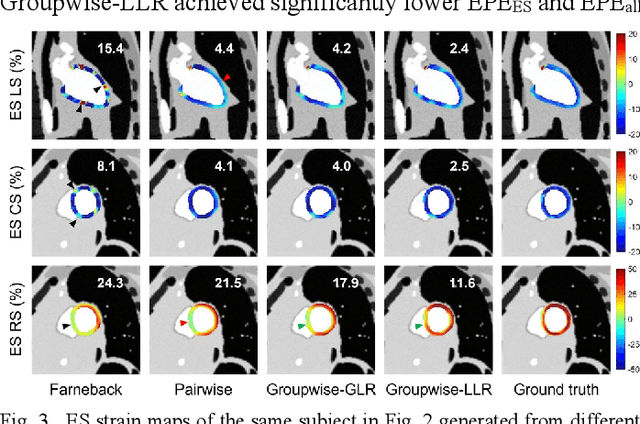

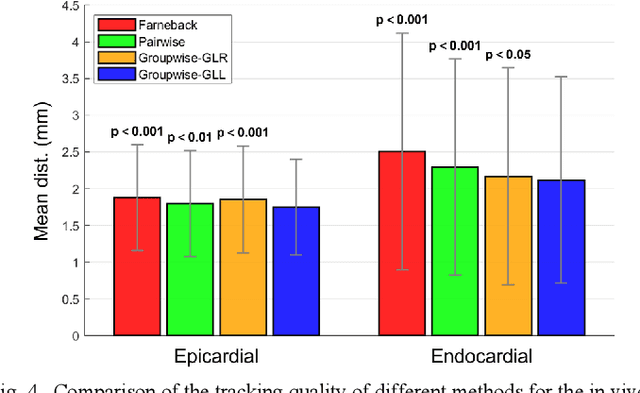

Deformable Groupwise Registration Using a Locally Low-Rank Dissimilarity Metric for Myocardial Strain Estimation from Cardiac Cine MRI Images

Nov 13, 2023

Abstract:Objective: Cardiovascular magnetic resonance-feature tracking (CMR-FT) represents a group of methods for myocardial strain estimation from cardiac cine MRI images. Established CMR-FT methods are mainly based on optical flow or pairwise registration. However, these methods suffer from either inaccurate estimation of large motion or drift effect caused by accumulative tracking errors. In this work, we propose a deformable groupwise registration method using a locally low-rank (LLR) dissimilarity metric for CMR-FT. Methods: The proposed method (Groupwise-LLR) tracks the feature points by a groupwise registration-based two-step strategy. Unlike the globally low-rank (GLR) dissimilarity metric, the proposed LLR metric imposes low-rankness on local image patches rather than the whole image. We quantitatively compared Groupwise-LLR with the Farneback optical flow, a pairwise registration method, and a GLR-based groupwise registration method on simulated and in vivo datasets. Results: Results from the simulated dataset showed that Groupwise-LLR achieved more accurate tracking and strain estimation compared with the other methods. Results from the in vivo dataset showed that Groupwise-LLR achieved more accurate tracking and elimination of the drift effect in late-diastole. Inter-observer reproducibility of strain estimates was similar between all studied methods. Conclusion: The proposed method estimates myocardial strains more accurately due to the application of a groupwise registration-based tracking strategy and an LLR-based dissimilarity metric. Significance: The proposed CMR-FT method may facilitate more accurate estimation of myocardial strains, especially in diastole, for clinical assessments of cardiac dysfunction.

Predict the Future from the Past? On the Temporal Data Distribution Shift in Financial Sentiment Classifications

Oct 19, 2023Abstract:Temporal data distribution shift is prevalent in the financial text. How can a financial sentiment analysis system be trained in a volatile market environment that can accurately infer sentiment and be robust to temporal data distribution shifts? In this paper, we conduct an empirical study on the financial sentiment analysis system under temporal data distribution shifts using a real-world financial social media dataset that spans three years. We find that the fine-tuned models suffer from general performance degradation in the presence of temporal distribution shifts. Furthermore, motivated by the unique temporal nature of the financial text, we propose a novel method that combines out-of-distribution detection with time series modeling for temporal financial sentiment analysis. Experimental results show that the proposed method enhances the model's capability to adapt to evolving temporal shifts in a volatile financial market.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge