Xinyi Zhu

Tracking large chemical reaction networks and rare events by neural networks

Dec 13, 2025Abstract:Chemical reaction networks are widely used to model stochastic dynamics in chemical kinetics, systems biology and epidemiology. Solving the chemical master equation that governs these systems poses a significant challenge due to the large state space exponentially growing with system sizes. The development of autoregressive neural networks offers a flexible framework for this problem; however, its efficiency is limited especially for high-dimensional systems and in scenarios with rare events. Here, we push the frontier of neural-network approach by exploiting faster optimizations such as natural gradient descent and time-dependent variational principle, achieving a 5- to 22-fold speedup, and by leveraging enhanced-sampling strategies to capture rare events. We demonstrate reduced computational cost and higher accuracy over the previous neural-network method in challenging reaction networks, including the mitogen-activated protein kinase (MAPK) cascade network, the hitherto largest biological network handled by the previous approaches of solving the chemical master equation. We further apply the approach to spatially extended reaction-diffusion systems, the Schlögl model with rare events, on two-dimensional lattices, beyond the recent tensor-network approach that handles one-dimensional lattices. The present approach thus enables efficient modeling of chemical reaction networks in general.

EXP-Bench: Can AI Conduct AI Research Experiments?

May 30, 2025

Abstract:Automating AI research holds immense potential for accelerating scientific progress, yet current AI agents struggle with the complexities of rigorous, end-to-end experimentation. We introduce EXP-Bench, a novel benchmark designed to systematically evaluate AI agents on complete research experiments sourced from influential AI publications. Given a research question and incomplete starter code, EXP-Bench challenges AI agents to formulate hypotheses, design and implement experimental procedures, execute them, and analyze results. To enable the creation of such intricate and authentic tasks with high-fidelity, we design a semi-autonomous pipeline to extract and structure crucial experimental details from these research papers and their associated open-source code. With the pipeline, EXP-Bench curated 461 AI research tasks from 51 top-tier AI research papers. Evaluations of leading LLM-based agents, such as OpenHands and IterativeAgent on EXP-Bench demonstrate partial capabilities: while scores on individual experimental aspects such as design or implementation correctness occasionally reach 20-35%, the success rate for complete, executable experiments was a mere 0.5%. By identifying these bottlenecks and providing realistic step-by-step experiment procedures, EXP-Bench serves as a vital tool for future AI agents to improve their ability to conduct AI research experiments. EXP-Bench is open-sourced at https://github.com/Just-Curieous/Curie/tree/main/benchmark/exp_bench.

Finetuning Large Language Model for Personalized Ranking

May 25, 2024Abstract:Large Language Models (LLMs) have demonstrated remarkable performance across various domains, motivating researchers to investigate their potential use in recommendation systems. However, directly applying LLMs to recommendation tasks has proven challenging due to the significant disparity between the data used for pre-training LLMs and the specific requirements of recommendation tasks. In this study, we introduce Direct Multi-Preference Optimization (DMPO), a streamlined framework designed to bridge the gap and enhance the alignment of LLMs for recommendation tasks. DMPO enhances the performance of LLM-based recommenders by simultaneously maximizing the probability of positive samples and minimizing the probability of multiple negative samples. We conducted experimental evaluations to compare DMPO against traditional recommendation methods and other LLM-based recommendation approaches. The results demonstrate that DMPO significantly improves the recommendation capabilities of LLMs across three real-world public datasets in few-shot scenarios. Additionally, the experiments indicate that DMPO exhibits superior generalization ability in cross-domain recommendations. A case study elucidates the reasons behind these consistent improvements and also underscores DMPO's potential as an explainable recommendation system.

Methods for Acquiring and Incorporating Knowledge into Stock Price Prediction: A Survey

Aug 09, 2023

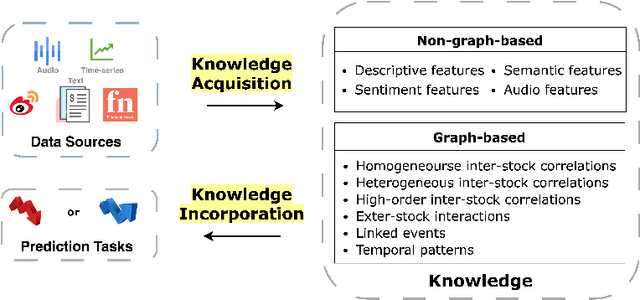

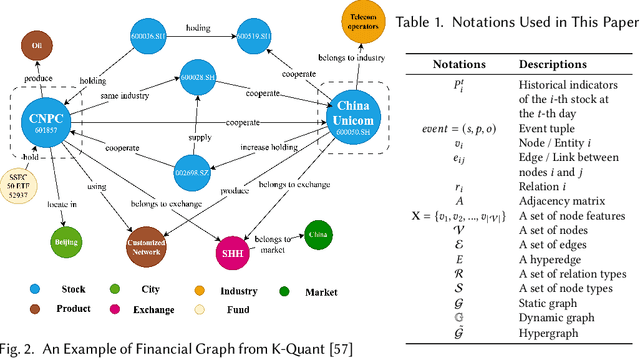

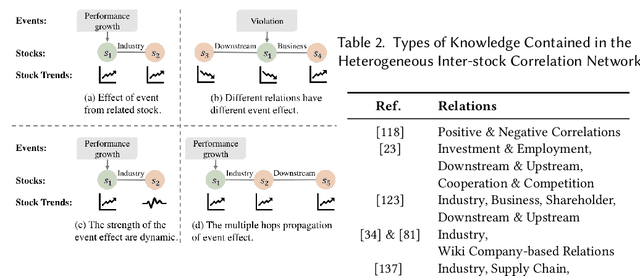

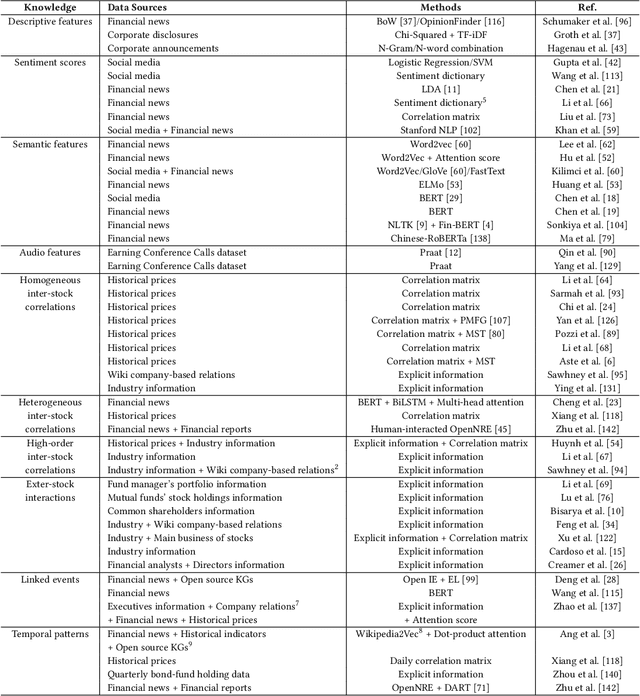

Abstract:Predicting stock prices presents a challenging research problem due to the inherent volatility and non-linear nature of the stock market. In recent years, knowledge-enhanced stock price prediction methods have shown groundbreaking results by utilizing external knowledge to understand the stock market. Despite the importance of these methods, there is a scarcity of scholarly works that systematically synthesize previous studies from the perspective of external knowledge types. Specifically, the external knowledge can be modeled in different data structures, which we group into non-graph-based formats and graph-based formats: 1) non-graph-based knowledge captures contextual information and multimedia descriptions specifically associated with an individual stock; 2) graph-based knowledge captures interconnected and interdependent information in the stock market. This survey paper aims to provide a systematic and comprehensive description of methods for acquiring external knowledge from various unstructured data sources and then incorporating it into stock price prediction models. We also explore fusion methods for combining external knowledge with historical price features. Moreover, this paper includes a compilation of relevant datasets and delves into potential future research directions in this domain.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge