Jiechao Gao

They Said Memes Were Harmless-We Found the Ones That Hurt: Decoding Jokes, Symbols, and Cultural References

Feb 03, 2026Abstract:Meme-based social abuse detection is challenging because harmful intent often relies on implicit cultural symbolism and subtle cross-modal incongruence. Prior approaches, from fusion-based methods to in-context learning with Large Vision-Language Models (LVLMs), have made progress but remain limited by three factors: i) cultural blindness (missing symbolic context), ii) boundary ambiguity (satire vs. abuse confusion), and iii) lack of interpretability (opaque model reasoning). We introduce CROSS-ALIGN+, a three-stage framework that systematically addresses these limitations: (1) Stage I mitigates cultural blindness by enriching multimodal representations with structured knowledge from ConceptNet, Wikidata, and Hatebase; (2) Stage II reduces boundary ambiguity through parameter-efficient LoRA adapters that sharpen decision boundaries; and (3) Stage III enhances interpretability by generating cascaded explanations. Extensive experiments on five benchmarks and eight LVLMs demonstrate that CROSS-ALIGN+ consistently outperforms state-of-the-art methods, achieving up to 17% relative F1 improvement while providing interpretable justifications for each decision.

Revealing the Truth with ConLLM for Detecting Multi-Modal Deepfakes

Jan 24, 2026Abstract:The rapid rise of deepfake technology poses a severe threat to social and political stability by enabling hyper-realistic synthetic media capable of manipulating public perception. However, existing detection methods struggle with two core limitations: (1) modality fragmentation, which leads to poor generalization across diverse and adversarial deepfake modalities; and (2) shallow inter-modal reasoning, resulting in limited detection of fine-grained semantic inconsistencies. To address these, we propose ConLLM (Contrastive Learning with Large Language Models), a hybrid framework for robust multimodal deepfake detection. ConLLM employs a two-stage architecture: stage 1 uses Pre-Trained Models (PTMs) to extract modality-specific embeddings; stage 2 aligns these embeddings via contrastive learning to mitigate modality fragmentation, and refines them using LLM-based reasoning to address shallow inter-modal reasoning by capturing semantic inconsistencies. ConLLM demonstrates strong performance across audio, video, and audio-visual modalities. It reduces audio deepfake EER by up to 50%, improves video accuracy by up to 8%, and achieves approximately 9% accuracy gains in audio-visual tasks. Ablation studies confirm that PTM-based embeddings contribute 9%-10% consistent improvements across modalities.

Do Clinical Question Answering Systems Really Need Specialised Medical Fine Tuning?

Jan 19, 2026Abstract:Clinical Question-Answering (CQA) industry systems are increasingly rely on Large Language Models (LLMs), yet their deployment is often guided by the assumption that domain-specific fine-tuning is essential. Although specialised medical LLMs such as BioBERT, BioGPT, and PubMedBERT remain popular, they face practical limitations including narrow coverage, high retraining costs, and limited adaptability. Efforts based on Supervised Fine-Tuning (SFT) have attempted to address these assumptions but continue to reinforce what we term the SPECIALISATION FALLACY-the belief that specialised medical LLMs are inherently superior for CQA. To address this assumption, we introduce MEDASSESS-X, a deployment-industry-oriented CQA framework that applies alignment at inference time rather than through SFT. MEDASSESS-X uses lightweight steering vectors to guide model activations toward medically consistent reasoning without updating model weights or requiring domain-specific retraining. This inference-time alignment layer stabilises CQA performance across both general-purpose and specialised medical LLMs, thereby resolving the SPECIALISATION FALLACY. Empirically, MEDASSESS-X delivers consistent gains across all LLM families, improving Accuracy by up to +6%, Factual Consistency by +7%, and reducing Safety Error Rate by as much as 50%.

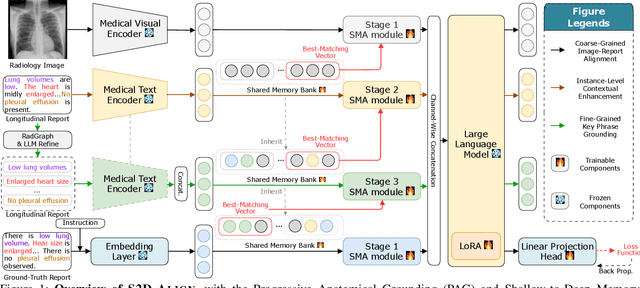

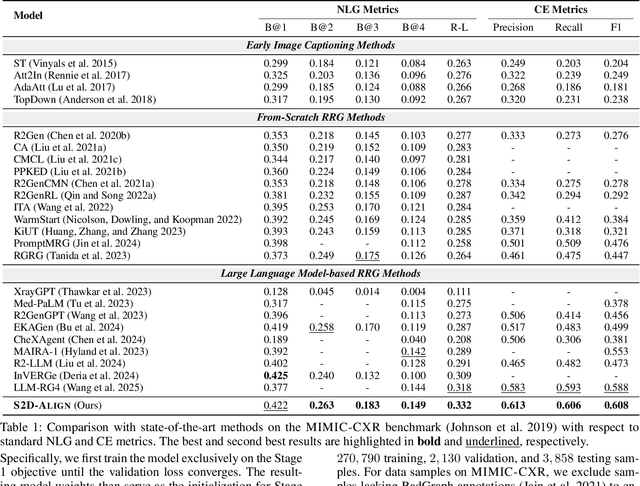

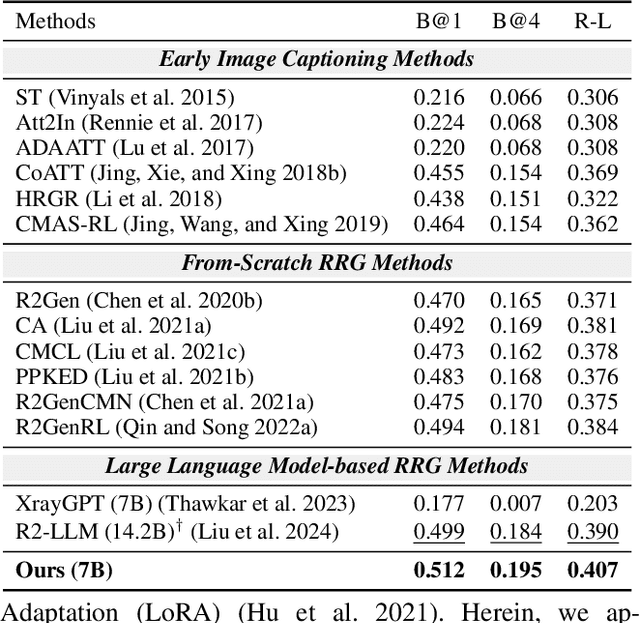

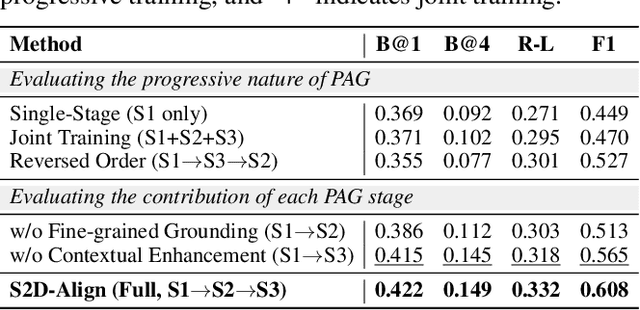

S2D-ALIGN: Shallow-to-Deep Auxiliary Learning for Anatomically-Grounded Radiology Report Generation

Nov 14, 2025

Abstract:Radiology Report Generation (RRG) aims to automatically generate diagnostic reports from radiology images. To achieve this, existing methods have leveraged the powerful cross-modal generation capabilities of Multimodal Large Language Models (MLLMs), primarily focusing on optimizing cross-modal alignment between radiographs and reports through Supervised Fine-Tuning (SFT). However, by only performing instance-level alignment with the image-text pairs, the standard SFT paradigm fails to establish anatomically-grounded alignment, where the templated nature of reports often leads to sub-optimal generation quality. To address this, we propose \textsc{S2D-Align}, a novel SFT paradigm that establishes anatomically-grounded alignment by leveraging auxiliary signals of varying granularities. \textsc{S2D-Align} implements a shallow-to-deep strategy, progressively enriching the alignment process: it begins with the coarse radiograph-report pairing, then introduces reference reports for instance-level guidance, and ultimately utilizes key phrases to ground the generation in specific anatomical details. To bridge the different alignment stages, we introduce a memory-based adapter that empowers feature sharing, thereby integrating coarse and fine-grained guidance. For evaluation, we conduct experiments on the public \textsc{MIMIC-CXR} and \textsc{IU X-Ray} benchmarks, where \textsc{S2D-Align} achieves state-of-the-art performance compared to existing methods. Ablation studies validate the effectiveness of our multi-stage, auxiliary-guided approach, highlighting a promising direction for enhancing grounding capabilities in complex, multi-modal generation tasks.

FT-MDT: Extracting Decision Trees from Medical Texts via a Novel Low-rank Adaptation Method

Oct 06, 2025Abstract:Knowledge of the medical decision process, which can be modeled as medical decision trees (MDTs), is critical to building clinical decision support systems. However, current MDT construction methods rely heavily on time-consuming and laborious manual annotation. To address this challenge, we propose PI-LoRA (Path-Integrated LoRA), a novel low-rank adaptation method for automatically extracting MDTs from clinical guidelines and textbooks. We integrate gradient path information to capture synergistic effects between different modules, enabling more effective and reliable rank allocation. This framework ensures that the most critical modules receive appropriate rank allocations while less important ones are pruned, resulting in a more efficient and accurate model for extracting medical decision trees from clinical texts. Extensive experiments on medical guideline datasets demonstrate that our PI-LoRA method significantly outperforms existing parameter-efficient fine-tuning approaches for the Text2MDT task, achieving better accuracy with substantially reduced model complexity. The proposed method achieves state-of-the-art results while maintaining a lightweight architecture, making it particularly suitable for clinical decision support systems where computational resources may be limited.

AMAS: Adaptively Determining Communication Topology for LLM-based Multi-Agent System

Oct 02, 2025Abstract:Although large language models (LLMs) have revolutionized natural language processing capabilities, their practical implementation as autonomous multi-agent systems (MAS) for industrial problem-solving encounters persistent barriers. Conventional MAS architectures are fundamentally restricted by inflexible, hand-crafted graph topologies that lack contextual responsiveness, resulting in diminished efficacy across varied academic and commercial workloads. To surmount these constraints, we introduce AMAS, a paradigm-shifting framework that redefines LLM-based MAS through a novel dynamic graph designer. This component autonomously identifies task-specific optimal graph configurations via lightweight LLM adaptation, eliminating the reliance on monolithic, universally applied structural templates. Instead, AMAS exploits the intrinsic properties of individual inputs to intelligently direct query trajectories through task-optimized agent pathways. Rigorous validation across question answering, mathematical deduction, and code generation benchmarks confirms that AMAS systematically exceeds state-of-the-art single-agent and multi-agent approaches across diverse LLM architectures. Our investigation establishes that context-sensitive structural adaptability constitutes a foundational requirement for high-performance LLM MAS deployments.

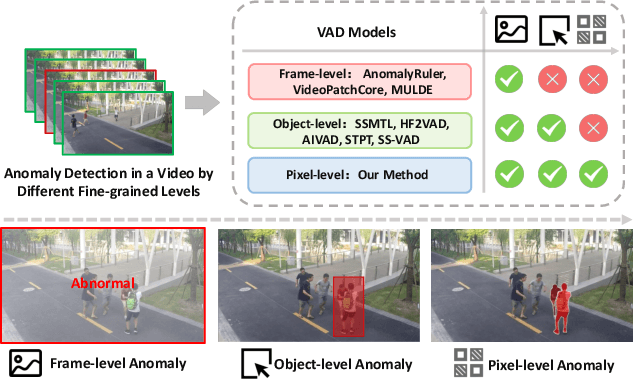

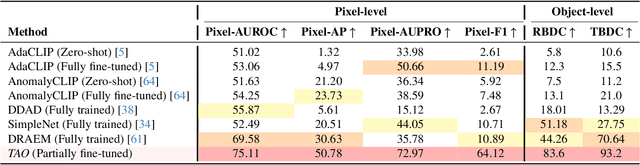

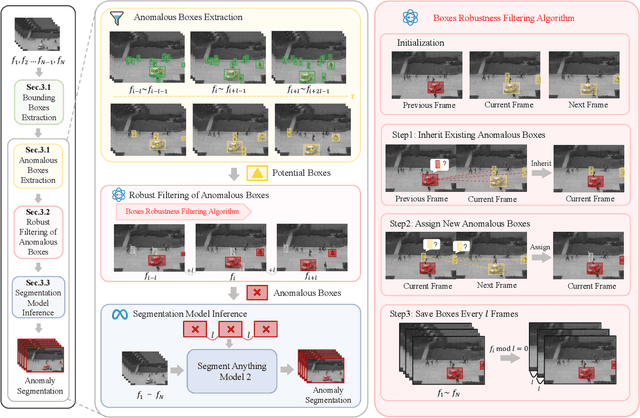

Track Any Anomalous Object: A Granular Video Anomaly Detection Pipeline

Jun 05, 2025

Abstract:Video anomaly detection (VAD) is crucial in scenarios such as surveillance and autonomous driving, where timely detection of unexpected activities is essential. Although existing methods have primarily focused on detecting anomalous objects in videos -- either by identifying anomalous frames or objects -- they often neglect finer-grained analysis, such as anomalous pixels, which limits their ability to capture a broader range of anomalies. To address this challenge, we propose a new framework called Track Any Anomalous Object (TAO), which introduces a granular video anomaly detection pipeline that, for the first time, integrates the detection of multiple fine-grained anomalous objects into a unified framework. Unlike methods that assign anomaly scores to every pixel, our approach transforms the problem into pixel-level tracking of anomalous objects. By linking anomaly scores to downstream tasks such as segmentation and tracking, our method removes the need for threshold tuning and achieves more precise anomaly localization in long and complex video sequences. Experiments demonstrate that TAO sets new benchmarks in accuracy and robustness. Project page available online.

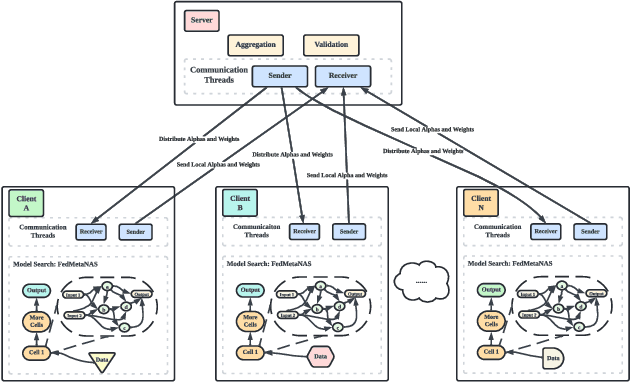

Federated Neural Architecture Search with Model-Agnostic Meta Learning

Apr 08, 2025

Abstract:Federated Learning (FL) often struggles with data heterogeneity due to the naturally uneven distribution of user data across devices. Federated Neural Architecture Search (NAS) enables collaborative search for optimal model architectures tailored to heterogeneous data to achieve higher accuracy. However, this process is time-consuming due to extensive search space and retraining. To overcome this, we introduce FedMetaNAS, a framework that integrates meta-learning with NAS within the FL context to expedite the architecture search by pruning the search space and eliminating the retraining stage. Our approach first utilizes the Gumbel-Softmax reparameterization to facilitate relaxation of the mixed operations in the search space. We then refine the local search process by incorporating Model-Agnostic Meta-Learning, where a task-specific learner adapts both weights and architecture parameters (alphas) for individual tasks, while a meta learner adjusts the overall model weights and alphas based on the gradient information from task learners. Following the meta-update, we propose soft pruning using the same trick on search space to gradually sparsify the architecture, ensuring that the performance of the chosen architecture remains robust after pruning which allows for immediate use of the model without retraining. Experimental evaluations demonstrate that FedMetaNAS significantly accelerates the search process by more than 50\% with higher accuracy compared to FedNAS.

Learning Novel Transformer Architecture for Time-series Forecasting

Feb 19, 2025

Abstract:Despite the success of Transformer-based models in the time-series prediction (TSP) tasks, the existing Transformer architecture still face limitations and the literature lacks comprehensive explorations into alternative architectures. To address these challenges, we propose AutoFormer-TS, a novel framework that leverages a comprehensive search space for Transformer architectures tailored to TSP tasks. Our framework introduces a differentiable neural architecture search (DNAS) method, AB-DARTS, which improves upon existing DNAS approaches by enhancing the identification of optimal operations within the architecture. AutoFormer-TS systematically explores alternative attention mechanisms, activation functions, and encoding operations, moving beyond the traditional Transformer design. Extensive experiments demonstrate that AutoFormer-TS consistently outperforms state-of-the-art baselines across various TSP benchmarks, achieving superior forecasting accuracy while maintaining reasonable training efficiency.

Adapting Large Language Models for Time Series Modeling via a Novel Parameter-efficient Adaptation Method

Feb 19, 2025

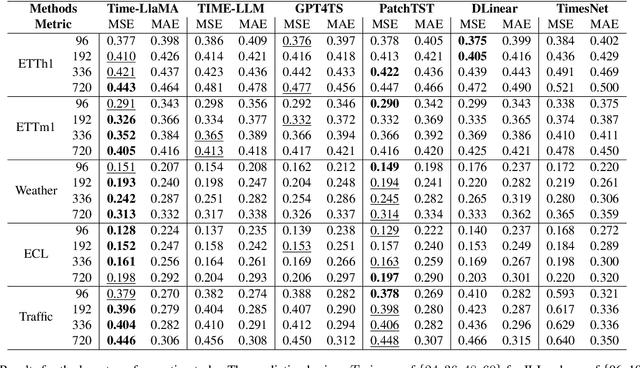

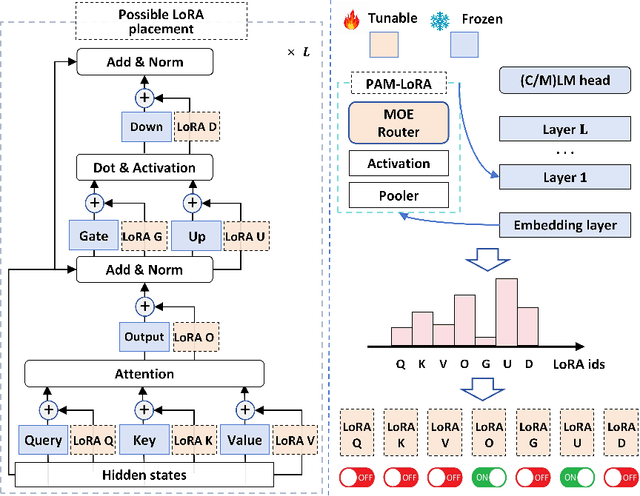

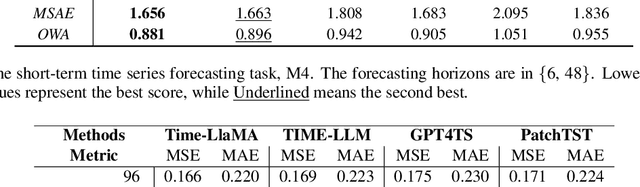

Abstract:Time series modeling holds significant importance in many real-world applications and has been extensively studied. While pre-trained foundation models have made impressive strides in the fields of natural language processing (NLP) and computer vision (CV), their development in time series domains has been constrained by data sparsity. A series of recent studies have demonstrated that large language models (LLMs) possess robust pattern recognition and reasoning abilities over complex sequences of tokens. However, the current literature have yet striked a high-quality balance between (a) effectively aligning the time series and natural language modalities, and (b) keeping the inference efficiency. To address the above issues, we now propose the Time-LlaMA framework. Time-LlaMA first converts the time series input into token embeddings through a linear tokenization mechanism. Second, the time series token embeddings are aligned with the text prompts. Third, to further adapt the LLM backbone for time series modeling, we have developed a dynamic low-rank adaptation technique (D-LoRA). D-LoRA dynamically chooses the most suitable LoRA modules at each layer of the Transformer backbone for each time series input, enhancing the model's predictive capabilities. Our experimental results on an extensive collection of challenging real-world time series tasks confirm that our proposed method achieves the state-of-the-art (SOTA) performance.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge