Michael Curry

Scalable Mechanism Design for Multi-Agent Path Finding

Jan 30, 2024Abstract:Multi-Agent Path Finding (MAPF) involves determining paths for multiple agents to travel simultaneously through a shared area toward particular goal locations. This problem is computationally complex, especially when dealing with large numbers of agents, as is common in realistic applications like autonomous vehicle coordination. Finding an optimal solution is often computationally infeasible, making the use of approximate algorithms essential. Adding to the complexity, agents might act in a self-interested and strategic way, possibly misrepresenting their goals to the MAPF algorithm if it benefits them. Although the field of mechanism design offers tools to align incentives, using these tools without careful consideration can fail when only having access to approximately optimal outcomes. Since approximations are crucial for scalable MAPF algorithms, this poses a significant challenge. In this work, we introduce the problem of scalable mechanism design for MAPF and propose three strategyproof mechanisms, two of which even use approximate MAPF algorithms. We test our mechanisms on realistic MAPF domains with problem sizes ranging from dozens to hundreds of agents. Our findings indicate that they improve welfare beyond a simple baseline.

Neural Auctions Compromise Bidder Information

Feb 28, 2023

Abstract:Single-shot auctions are commonly used as a means to sell goods, for example when selling ad space or allocating radio frequencies, however devising mechanisms for auctions with multiple bidders and multiple items can be complicated. It has been shown that neural networks can be used to approximate optimal mechanisms while satisfying the constraints that an auction be strategyproof and individually rational. We show that despite such auctions maximizing revenue, they do so at the cost of revealing private bidder information. While randomness is often used to build in privacy, in this context it comes with complications if done without care. Specifically, it can violate rationality and feasibility constraints, fundamentally change the incentive structure of the mechanism, and/or harm top-level metrics such as revenue and social welfare. We propose a method that employs stochasticity to improve privacy while meeting the requirements for auction mechanisms with only a modest sacrifice in revenue. We analyze the cost to the auction house that comes with introducing varying degrees of privacy in common auction settings. Our results show that despite current neural auctions' ability to approximate optimal mechanisms, the resulting vulnerability that comes with relying on neural networks must be accounted for.

Certified Neural Network Watermarks with Randomized Smoothing

Jul 16, 2022

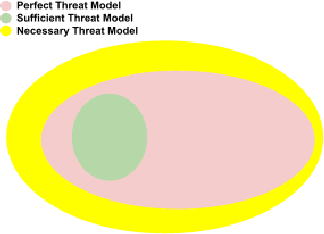

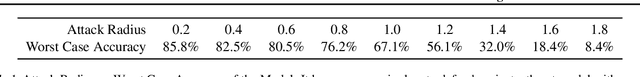

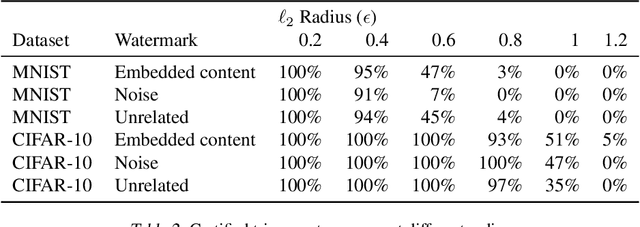

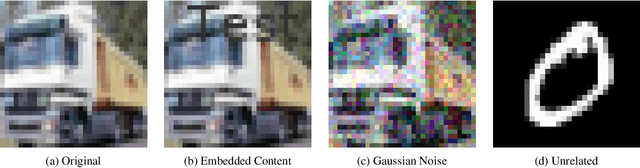

Abstract:Watermarking is a commonly used strategy to protect creators' rights to digital images, videos and audio. Recently, watermarking methods have been extended to deep learning models -- in principle, the watermark should be preserved when an adversary tries to copy the model. However, in practice, watermarks can often be removed by an intelligent adversary. Several papers have proposed watermarking methods that claim to be empirically resistant to different types of removal attacks, but these new techniques often fail in the face of new or better-tuned adversaries. In this paper, we propose a certifiable watermarking method. Using the randomized smoothing technique proposed in Chiang et al., we show that our watermark is guaranteed to be unremovable unless the model parameters are changed by more than a certain l2 threshold. In addition to being certifiable, our watermark is also empirically more robust compared to previous watermarking methods. Our experiments can be reproduced with code at https://github.com/arpitbansal297/Certified_Watermarks

* ICML 2022

Differentiable Economics for Randomized Affine Maximizer Auctions

Feb 06, 2022

Abstract:A recent approach to automated mechanism design, differentiable economics, represents auctions by rich function approximators and optimizes their performance by gradient descent. The ideal auction architecture for differentiable economics would be perfectly strategyproof, support multiple bidders and items, and be rich enough to represent the optimal (i.e. revenue-maximizing) mechanism. So far, such an architecture does not exist. There are single-bidder approaches (MenuNet, RochetNet) which are always strategyproof and can represent optimal mechanisms. RegretNet is multi-bidder and can approximate any mechanism, but is only approximately strategyproof. We present an architecture that supports multiple bidders and is perfectly strategyproof, but cannot necessarily represent the optimal mechanism. This architecture is the classic affine maximizer auction (AMA), modified to offer lotteries. By using the gradient-based optimization tools of differentiable economics, we can now train lottery AMAs, competing with or outperforming prior approaches in revenue.

Finding General Equilibria in Many-Agent Economic Simulations Using Deep Reinforcement Learning

Jan 03, 2022

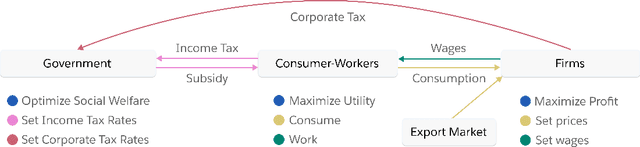

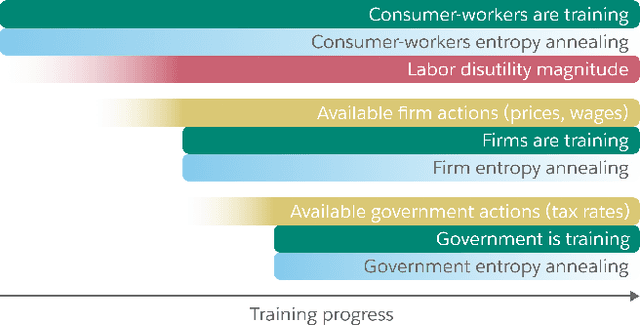

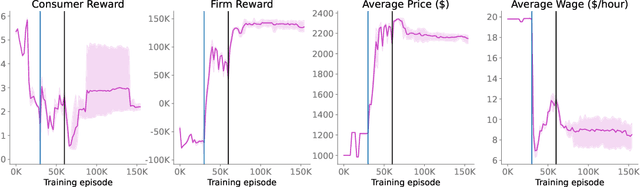

Abstract:Real economies can be seen as a sequential imperfect-information game with many heterogeneous, interacting strategic agents of various agent types, such as consumers, firms, and governments. Dynamic general equilibrium models are common economic tools to model the economic activity, interactions, and outcomes in such systems. However, existing analytical and computational methods struggle to find explicit equilibria when all agents are strategic and interact, while joint learning is unstable and challenging. Amongst others, a key reason is that the actions of one economic agent may change the reward function of another agent, e.g., a consumer's expendable income changes when firms change prices or governments change taxes. We show that multi-agent deep reinforcement learning (RL) can discover stable solutions that are epsilon-Nash equilibria for a meta-game over agent types, in economic simulations with many agents, through the use of structured learning curricula and efficient GPU-only simulation and training. Conceptually, our approach is more flexible and does not need unrealistic assumptions, e.g., market clearing, that are commonly used for analytical tractability. Our GPU implementation enables training and analyzing economies with a large number of agents within reasonable time frames, e.g., training completes within a day. We demonstrate our approach in real-business-cycle models, a representative family of DGE models, with 100 worker-consumers, 10 firms, and a government who taxes and redistributes. We validate the learned meta-game epsilon-Nash equilibria through approximate best-response analyses, show that RL policies align with economic intuitions, and that our approach is constructive, e.g., by explicitly learning a spectrum of meta-game epsilon-Nash equilibria in open RBC models.

Improving Policy-Constrained Kidney Exchange via Pre-Screening

Oct 22, 2020

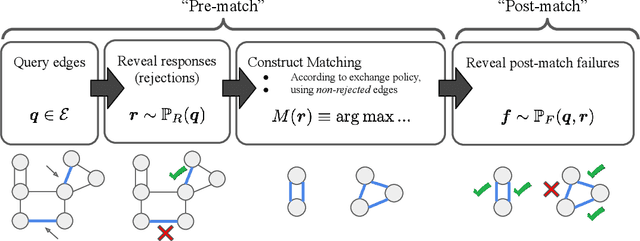

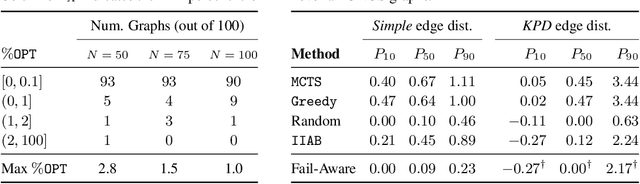

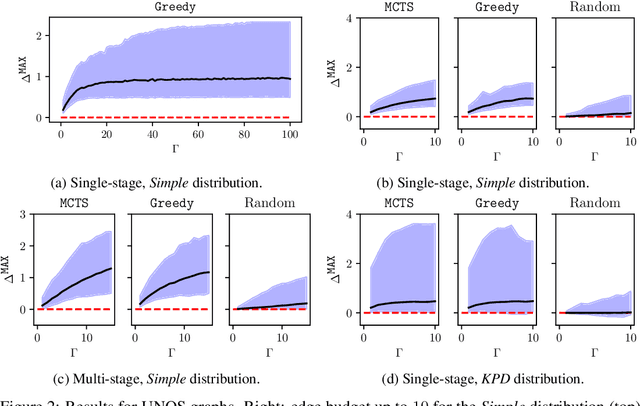

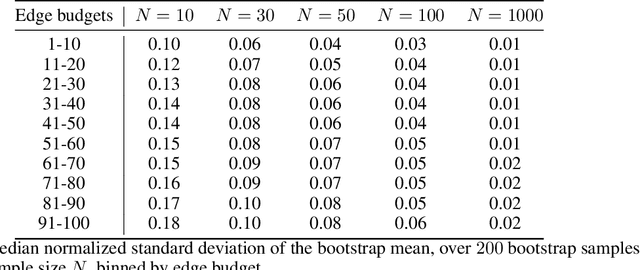

Abstract:In barter exchanges, participants swap goods with one another without exchanging money; exchanges are often facilitated by a central clearinghouse, with the goal of maximizing the aggregate quality (or number) of swaps. Barter exchanges are subject to many forms of uncertainty--in participant preferences, the feasibility and quality of various swaps, and so on. Our work is motivated by kidney exchange, a real-world barter market in which patients in need of a kidney transplant swap their willing living donors, in order to find a better match. Modern exchanges include 2- and 3-way swaps, making the kidney exchange clearing problem NP-hard. Planned transplants often fail for a variety of reasons--if the donor organ is refused by the recipient's medical team, or if the donor and recipient are found to be medically incompatible. Due to 2- and 3-way swaps, failed transplants can "cascade" through an exchange; one US-based exchange estimated that about 85% of planned transplants failed in 2019. Many optimization-based approaches have been designed to avoid these failures; however most exchanges cannot implement these methods due to legal and policy constraints. Instead we consider a setting where exchanges can query the preferences of certain donors and recipients--asking whether they would accept a particular transplant. We characterize this as a two-stage decision problem, in which the exchange program (a) queries a small number of transplants before committing to a matching, and (b) constructs a matching according to fixed policy. We show that selecting these edges is a challenging combinatorial problem, which is non-monotonic and non-submodular, in addition to being NP-hard. We propose both a greedy heuristic and a Monte Carlo tree search, which outperforms previous approaches, using experiments on both synthetic data and real kidney exchange data from the United Network for Organ Sharing.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge