Pedro Bizarro

Mind the truncation gap: challenges of learning on dynamic graphs with recurrent architectures

Dec 30, 2024

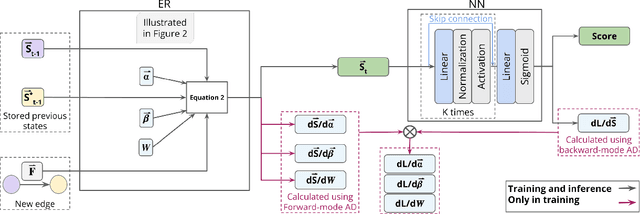

Abstract:Systems characterized by evolving interactions, prevalent in social, financial, and biological domains, are effectively modeled as continuous-time dynamic graphs (CTDGs). To manage the scale and complexity of these graph datasets, machine learning (ML) approaches have become essential. However, CTDGs pose challenges for ML because traditional static graph methods do not naturally account for event timings. Newer approaches, such as graph recurrent neural networks (GRNNs), are inherently time-aware and offer advantages over static methods for CTDGs. However, GRNNs face another issue: the short truncation of backpropagation-through-time (BPTT), whose impact has not been properly examined until now. In this work, we demonstrate that this truncation can limit the learning of dependencies beyond a single hop, resulting in reduced performance. Through experiments on a novel synthetic task and real-world datasets, we reveal a performance gap between full backpropagation-through-time (F-BPTT) and the truncated backpropagation-through-time (T-BPTT) commonly used to train GRNN models. We term this gap the "truncation gap" and argue that understanding and addressing it is essential as the importance of CTDGs grows, discussing potential future directions for research in this area.

Fair-OBNC: Correcting Label Noise for Fairer Datasets

Oct 08, 2024

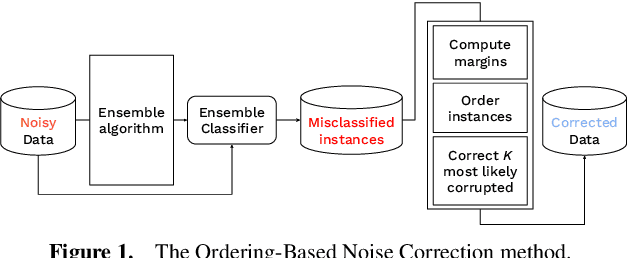

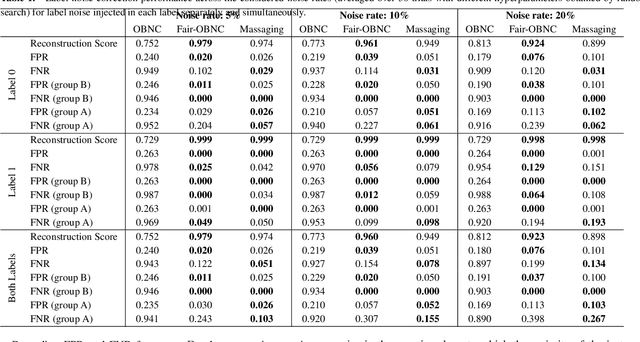

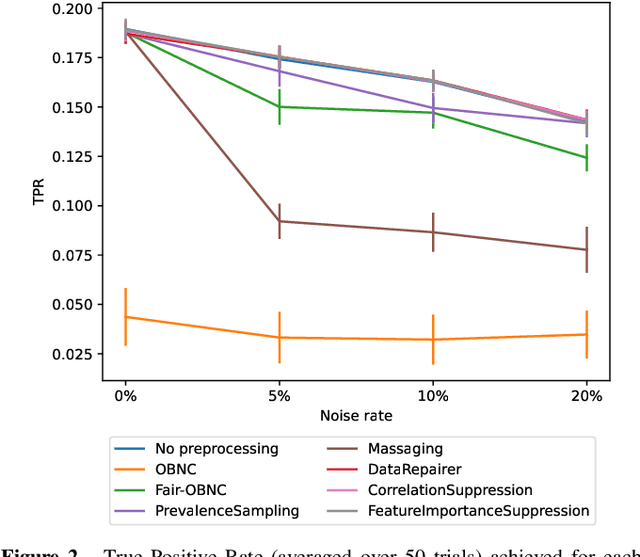

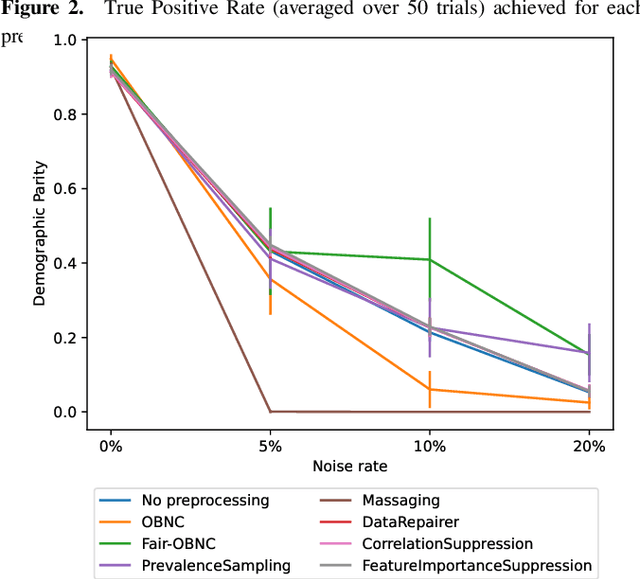

Abstract:Data used by automated decision-making systems, such as Machine Learning models, often reflects discriminatory behavior that occurred in the past. These biases in the training data are sometimes related to label noise, such as in COMPAS, where more African-American offenders are wrongly labeled as having a higher risk of recidivism when compared to their White counterparts. Models trained on such biased data may perpetuate or even aggravate the biases with respect to sensitive information, such as gender, race, or age. However, while multiple label noise correction approaches are available in the literature, these focus on model performance exclusively. In this work, we propose Fair-OBNC, a label noise correction method with fairness considerations, to produce training datasets with measurable demographic parity. The presented method adapts Ordering-Based Noise Correction, with an adjusted criterion of ordering, based both on the margin of error of an ensemble, and the potential increase in the observed demographic parity of the dataset. We evaluate Fair-OBNC against other different pre-processing techniques, under different scenarios of controlled label noise. Our results show that the proposed method is the overall better alternative within the pool of label correction methods, being capable of attaining better reconstructions of the original labels. Models trained in the corrected data have an increase, on average, of 150% in demographic parity, when compared to models trained in data with noisy labels, across the considered levels of label noise.

Show Me What's Wrong!: Combining Charts and Text to Guide Data Analysis

Oct 02, 2024Abstract:Analyzing and finding anomalies in multi-dimensional datasets is a cumbersome but vital task across different domains. In the context of financial fraud detection, analysts must quickly identify suspicious activity among transactional data. This is an iterative process made of complex exploratory tasks such as recognizing patterns, grouping, and comparing. To mitigate the information overload inherent to these steps, we present a tool combining automated information highlights, Large Language Model generated textual insights, and visual analytics, facilitating exploration at different levels of detail. We perform a segmentation of the data per analysis area and visually represent each one, making use of automated visual cues to signal which require more attention. Upon user selection of an area, our system provides textual and graphical summaries. The text, acting as a link between the high-level and detailed views of the chosen segment, allows for a quick understanding of relevant details. A thorough exploration of the data comprising the selection can be done through graphical representations. The feedback gathered in a study performed with seven domain experts suggests our tool effectively supports and guides exploratory analysis, easing the identification of suspicious information.

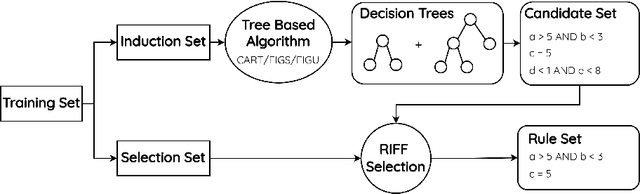

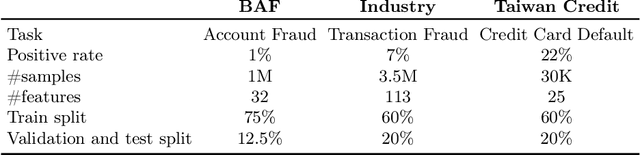

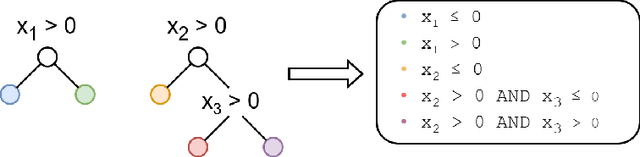

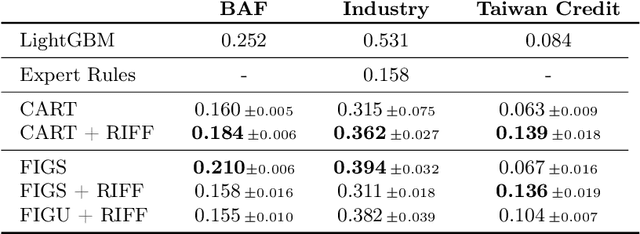

RIFF: Inducing Rules for Fraud Detection from Decision Trees

Aug 23, 2024

Abstract:Financial fraud is the cause of multi-billion dollar losses annually. Traditionally, fraud detection systems rely on rules due to their transparency and interpretability, key features in domains where decisions need to be explained. However, rule systems require significant input from domain experts to create and tune, an issue that rule induction algorithms attempt to mitigate by inferring rules directly from data. We explore the application of these algorithms to fraud detection, where rule systems are constrained to have a low false positive rate (FPR) or alert rate, by proposing RIFF, a rule induction algorithm that distills a low FPR rule set directly from decision trees. Our experiments show that the induced rules are often able to maintain or improve performance of the original models for low FPR tasks, while substantially reducing their complexity and outperforming rules hand-tuned by experts.

Deep-Graph-Sprints: Accelerated Representation Learning in Continuous-Time Dynamic Graphs

Jul 10, 2024

Abstract:Continuous-time dynamic graphs (CTDGs) are essential for modeling interconnected, evolving systems. Traditional methods for extracting knowledge from these graphs often depend on feature engineering or deep learning. Feature engineering is limited by the manual and time-intensive nature of crafting features, while deep learning approaches suffer from high inference latency, making them impractical for real-time applications. This paper introduces Deep-Graph-Sprints (DGS), a novel deep learning architecture designed for efficient representation learning on CTDGs with low-latency inference requirements. We benchmark DGS against state-of-the-art feature engineering and graph neural network methods using five diverse datasets. The results indicate that DGS achieves competitive performance while improving inference speed up to 12x compared to other deep learning approaches on our tested benchmarks. Our method effectively bridges the gap between deep representation learning and low-latency application requirements for CTDGs.

Aequitas Flow: Streamlining Fair ML Experimentation

May 09, 2024Abstract:Aequitas Flow is an open-source framework for end-to-end Fair Machine Learning (ML) experimentation in Python. This package fills the existing integration gaps in other Fair ML packages of complete and accessible experimentation. It provides a pipeline for fairness-aware model training, hyperparameter optimization, and evaluation, enabling rapid and simple experiments and result analysis. Aimed at ML practitioners and researchers, the framework offers implementations of methods, datasets, metrics, and standard interfaces for these components to improve extensibility. By facilitating the development of fair ML practices, Aequitas Flow seeks to enhance the adoption of these concepts in AI technologies.

Cost-Sensitive Learning to Defer to Multiple Experts with Workload Constraints

Mar 21, 2024

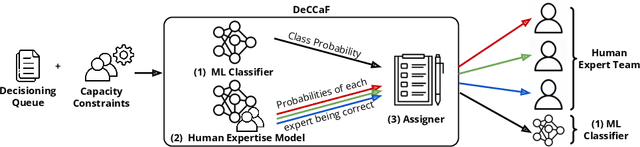

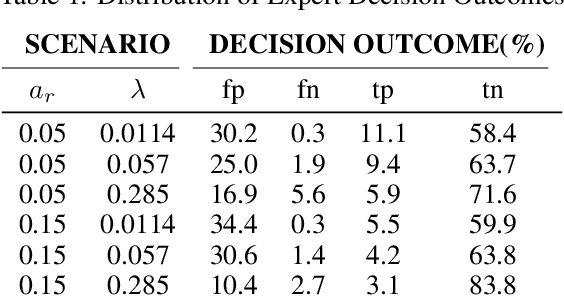

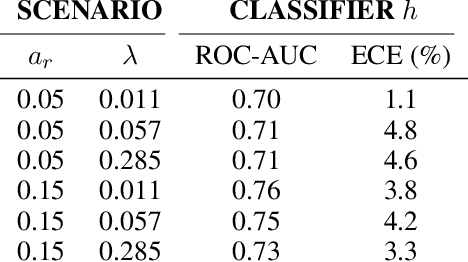

Abstract:Learning to defer (L2D) aims to improve human-AI collaboration systems by learning how to defer decisions to humans when they are more likely to be correct than an ML classifier. Existing research in L2D overlooks key aspects of real-world systems that impede its practical adoption, namely: i) neglecting cost-sensitive scenarios, where type 1 and type 2 errors have different costs; ii) requiring concurrent human predictions for every instance of the training dataset and iii) not dealing with human work capacity constraints. To address these issues, we propose the deferral under cost and capacity constraints framework (DeCCaF). DeCCaF is a novel L2D approach, employing supervised learning to model the probability of human error under less restrictive data requirements (only one expert prediction per instance) and using constraint programming to globally minimize the error cost subject to workload limitations. We test DeCCaF in a series of cost-sensitive fraud detection scenarios with different teams of 9 synthetic fraud analysts, with individual work capacity constraints. The results demonstrate that our approach performs significantly better than the baselines in a wide array of scenarios, achieving an average 8.4% reduction in the misclassification cost.

DiConStruct: Causal Concept-based Explanations through Black-Box Distillation

Jan 26, 2024

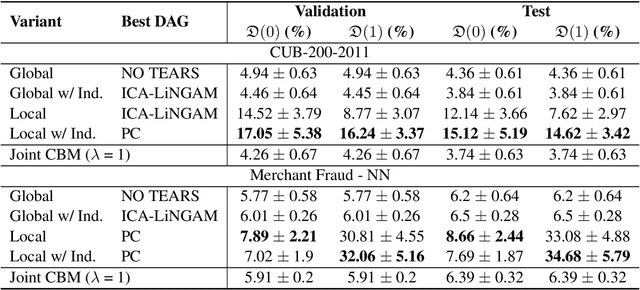

Abstract:Model interpretability plays a central role in human-AI decision-making systems. Ideally, explanations should be expressed using human-interpretable semantic concepts. Moreover, the causal relations between these concepts should be captured by the explainer to allow for reasoning about the explanations. Lastly, explanation methods should be efficient and not compromise the performance of the predictive task. Despite the rapid advances in AI explainability in recent years, as far as we know to date, no method fulfills these three properties. Indeed, mainstream methods for local concept explainability do not produce causal explanations and incur a trade-off between explainability and prediction performance. We present DiConStruct, an explanation method that is both concept-based and causal, with the goal of creating more interpretable local explanations in the form of structural causal models and concept attributions. Our explainer works as a distillation model to any black-box machine learning model by approximating its predictions while producing the respective explanations. Because of this, DiConStruct generates explanations efficiently while not impacting the black-box prediction task. We validate our method on an image dataset and a tabular dataset, showing that DiConStruct approximates the black-box models with higher fidelity than other concept explainability baselines, while providing explanations that include the causal relations between the concepts.

FiFAR: A Fraud Detection Dataset for Learning to Defer

Dec 20, 2023Abstract:Public dataset limitations have significantly hindered the development and benchmarking of learning to defer (L2D) algorithms, which aim to optimally combine human and AI capabilities in hybrid decision-making systems. In such systems, human availability and domain-specific concerns introduce difficulties, while obtaining human predictions for training and evaluation is costly. Financial fraud detection is a high-stakes setting where algorithms and human experts often work in tandem; however, there are no publicly available datasets for L2D concerning this important application of human-AI teaming. To fill this gap in L2D research, we introduce the Financial Fraud Alert Review Dataset (FiFAR), a synthetic bank account fraud detection dataset, containing the predictions of a team of 50 highly complex and varied synthetic fraud analysts, with varied bias and feature dependence. We also provide a realistic definition of human work capacity constraints, an aspect of L2D systems that is often overlooked, allowing for extensive testing of assignment systems under real-world conditions. We use our dataset to develop a capacity-aware L2D method and rejection learning approach under realistic data availability conditions, and benchmark these baselines under an array of 300 distinct testing scenarios. We believe that this dataset will serve as a pivotal instrument in facilitating a systematic, rigorous, reproducible, and transparent evaluation and comparison of L2D methods, thereby fostering the development of more synergistic human-AI collaboration in decision-making systems. The public dataset and detailed synthetic expert information are available at: https://github.com/feedzai/fifar-dataset

Adversarial training for tabular data with attack propagation

Jul 28, 2023Abstract:Adversarial attacks are a major concern in security-centered applications, where malicious actors continuously try to mislead Machine Learning (ML) models into wrongly classifying fraudulent activity as legitimate, whereas system maintainers try to stop them. Adversarially training ML models that are robust against such attacks can prevent business losses and reduce the work load of system maintainers. In such applications data is often tabular and the space available for attackers to manipulate undergoes complex feature engineering transformations, to provide useful signals for model training, to a space attackers cannot access. Thus, we propose a new form of adversarial training where attacks are propagated between the two spaces in the training loop. We then test this method empirically on a real world dataset in the domain of credit card fraud detection. We show that our method can prevent about 30% performance drops under moderate attacks and is essential under very aggressive attacks, with a trade-off loss in performance under no attacks smaller than 7%.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge