RIFF: Inducing Rules for Fraud Detection from Decision Trees

Paper and Code

Aug 23, 2024

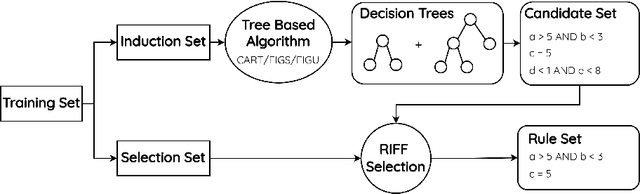

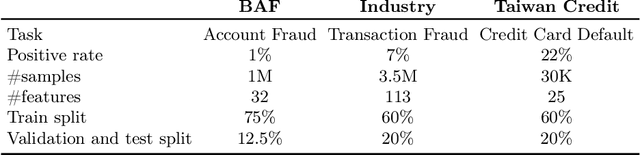

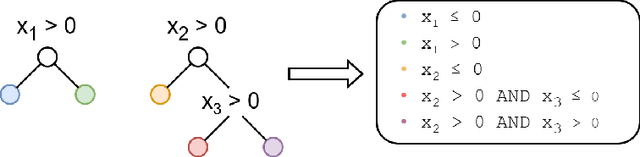

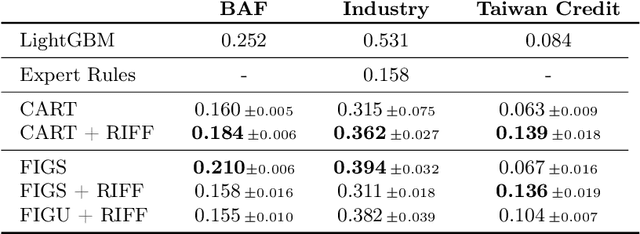

Financial fraud is the cause of multi-billion dollar losses annually. Traditionally, fraud detection systems rely on rules due to their transparency and interpretability, key features in domains where decisions need to be explained. However, rule systems require significant input from domain experts to create and tune, an issue that rule induction algorithms attempt to mitigate by inferring rules directly from data. We explore the application of these algorithms to fraud detection, where rule systems are constrained to have a low false positive rate (FPR) or alert rate, by proposing RIFF, a rule induction algorithm that distills a low FPR rule set directly from decision trees. Our experiments show that the induced rules are often able to maintain or improve performance of the original models for low FPR tasks, while substantially reducing their complexity and outperforming rules hand-tuned by experts.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge