Lwin Khin Shar

Let the Trial Begin: A Mock-Court Approach to Vulnerability Detection using LLM-Based Agents

May 16, 2025Abstract:Detecting vulnerabilities in source code remains a critical yet challenging task, especially when benign and vulnerable functions share significant similarities. In this work, we introduce VulTrial, a courtroom-inspired multi-agent framework designed to enhance automated vulnerability detection. It employs four role-specific agents, which are security researcher, code author, moderator, and review board. Through extensive experiments using GPT-3.5 and GPT-4o we demonstrate that Vultrial outperforms single-agent and multi-agent baselines. Using GPT-4o, VulTrial improves the performance by 102.39% and 84.17% over its respective baseline. Additionally, we show that role-specific instruction tuning in multi-agent with small data (50 pair samples) improves the performance of VulTrial further by 139.89% and 118.30%. Furthermore, we analyze the impact of increasing the number of agent interactions on VulTrial's overall performance. While multi-agent setups inherently incur higher costs due to increased token usage, our findings reveal that applying VulTrial to a cost-effective model like GPT-3.5 can improve its performance by 69.89% compared to GPT-4o in a single-agent setting, at a lower overall cost.

Runtime Anomaly Detection for Drones: An Integrated Rule-Mining and Unsupervised-Learning Approach

May 03, 2025Abstract:UAVs, commonly referred to as drones, have witnessed a remarkable surge in popularity due to their versatile applications. These cyber-physical systems depend on multiple sensor inputs, such as cameras, GPS receivers, accelerometers, and gyroscopes, with faults potentially leading to physical instability and serious safety concerns. To mitigate such risks, anomaly detection has emerged as a crucial safeguarding mechanism, capable of identifying the physical manifestations of emerging issues and allowing operators to take preemptive action at runtime. Recent anomaly detection methods based on LSTM neural networks have shown promising results, but three challenges persist: the need for models that can generalise across the diverse mission profiles of drones; the need for interpretability, enabling operators to understand the nature of detected problems; and the need for capturing domain knowledge that is difficult to infer solely from log data. Motivated by these challenges, this paper introduces RADD, an integrated approach to anomaly detection in drones that combines rule mining and unsupervised learning. In particular, we leverage rules (or invariants) to capture expected relationships between sensors and actuators during missions, and utilise unsupervised learning techniques to cover more subtle relationships that the rules may have missed. We implement this approach using the ArduPilot drone software in the Gazebo simulator, utilising 44 rules derived across the main phases of drone missions, in conjunction with an ensemble of five unsupervised learning models. We find that our integrated approach successfully detects 93.84% of anomalies over six types of faults with a low false positive rate (2.33%), and can be deployed effectively at runtime. Furthermore, RADD outperforms a state-of-the-art LSTM-based method in detecting the different types of faults evaluated in our study.

R2Vul: Learning to Reason about Software Vulnerabilities with Reinforcement Learning and Structured Reasoning Distillation

Apr 07, 2025

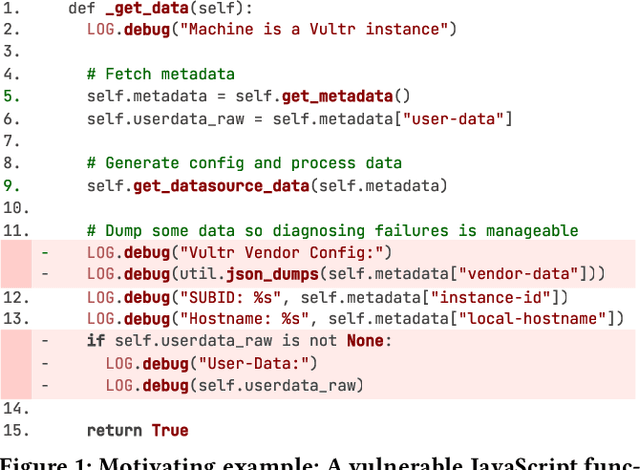

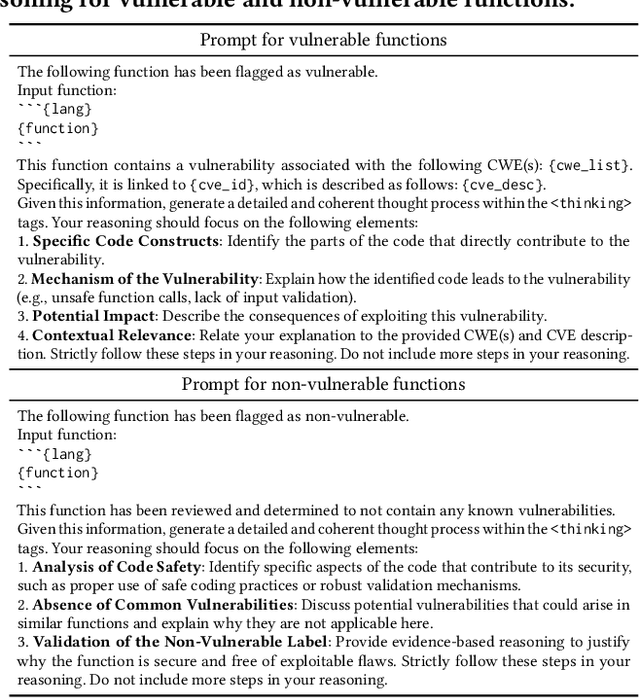

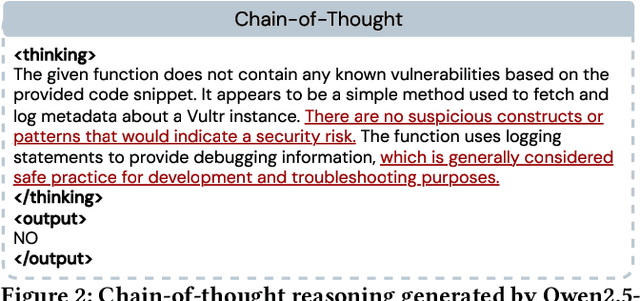

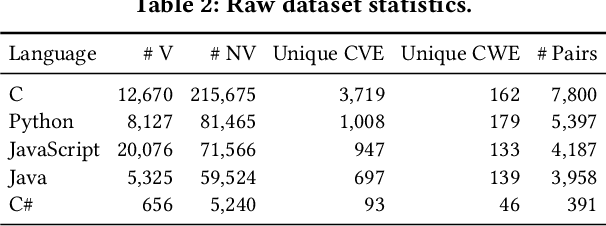

Abstract:Large language models (LLMs) have shown promising performance in software vulnerability detection (SVD), yet their reasoning capabilities remain unreliable. Existing approaches relying on chain-of-thought (CoT) struggle to provide relevant and actionable security assessments. Additionally, effective SVD requires not only generating coherent reasoning but also differentiating between well-founded and misleading yet plausible security assessments, an aspect overlooked in prior work. To this end, we introduce R2Vul, a novel approach that distills structured reasoning into small LLMs using reinforcement learning from AI feedback (RLAIF). Through RLAIF, R2Vul enables LLMs to produce structured, security-aware reasoning that is actionable and reliable while explicitly learning to distinguish valid assessments from misleading ones. We evaluate R2Vul across five languages against SAST tools, CoT, instruction tuning, and classification-based baselines. Our results show that R2Vul with structured reasoning distillation enables a 1.5B student LLM to rival larger models while improving generalization to out-of-distribution vulnerabilities. Beyond model improvements, we contribute a large-scale, multilingual preference dataset featuring structured reasoning to support future research in SVD.

Sustainable LLM Inference for Edge AI: Evaluating Quantized LLMs for Energy Efficiency, Output Accuracy, and Inference Latency

Apr 04, 2025

Abstract:Deploying Large Language Models (LLMs) on edge devices presents significant challenges due to computational constraints, memory limitations, inference speed, and energy consumption. Model quantization has emerged as a key technique to enable efficient LLM inference by reducing model size and computational overhead. In this study, we conduct a comprehensive analysis of 28 quantized LLMs from the Ollama library, which applies by default Post-Training Quantization (PTQ) and weight-only quantization techniques, deployed on an edge device (Raspberry Pi 4 with 4GB RAM). We evaluate energy efficiency, inference performance, and output accuracy across multiple quantization levels and task types. Models are benchmarked on five standardized datasets (CommonsenseQA, BIG-Bench Hard, TruthfulQA, GSM8K, and HumanEval), and we employ a high-resolution, hardware-based energy measurement tool to capture real-world power consumption. Our findings reveal the trade-offs between energy efficiency, inference speed, and accuracy in different quantization settings, highlighting configurations that optimize LLM deployment for resource-constrained environments. By integrating hardware-level energy profiling with LLM benchmarking, this study provides actionable insights for sustainable AI, bridging a critical gap in existing research on energy-aware LLM deployment.

Deep Learning Approaches for Anti-Money Laundering on Mobile Transactions: Review, Framework, and Directions

Mar 13, 2025Abstract:Money laundering is a financial crime that obscures the origin of illicit funds, necessitating the development and enforcement of anti-money laundering (AML) policies by governments and organizations. The proliferation of mobile payment platforms and smart IoT devices has significantly complicated AML investigations. As payment networks become more interconnected, there is an increasing need for efficient real-time detection to process large volumes of transaction data on heterogeneous payment systems by different operators such as digital currencies, cryptocurrencies and account-based payments. Most of these mobile payment networks are supported by connected devices, many of which are considered loT devices in the FinTech space that constantly generate data. Furthermore, the growing complexity and unpredictability of transaction patterns across these networks contribute to a higher incidence of false positives. While machine learning solutions have the potential to enhance detection efficiency, their application in AML faces unique challenges, such as addressing privacy concerns tied to sensitive financial data and managing the real-world constraint of limited data availability due to data regulations. Existing surveys in the AML literature broadly review machine learning approaches for money laundering detection, but they often lack an in-depth exploration of advanced deep learning techniques - an emerging field with significant potential. To address this gap, this paper conducts a comprehensive review of deep learning solutions and the challenges associated with their use in AML. Additionally, we propose a novel framework that applies the least-privilege principle by integrating machine learning techniques, codifying AML red flags, and employing account profiling to provide context for predictions and enable effective fraud detection under limited data availability....

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge