Jie Fang

Streamlining Biomedical Research with Specialized LLMs

Apr 15, 2025Abstract:In this paper, we propose a novel system that integrates state-of-the-art, domain-specific large language models with advanced information retrieval techniques to deliver comprehensive and context-aware responses. Our approach facilitates seamless interaction among diverse components, enabling cross-validation of outputs to produce accurate, high-quality responses enriched with relevant data, images, tables, and other modalities. We demonstrate the system's capability to enhance response precision by leveraging a robust question-answering model, significantly improving the quality of dialogue generation. The system provides an accessible platform for real-time, high-fidelity interactions, allowing users to benefit from efficient human-computer interaction, precise retrieval, and simultaneous access to a wide range of literature and data. This dramatically improves the research efficiency of professionals in the biomedical and pharmaceutical domains and facilitates faster, more informed decision-making throughout the R\&D process. Furthermore, the system proposed in this paper is available at https://synapse-chat.patsnap.com.

PharmaGPT: Domain-Specific Large Language Models for Bio-Pharmaceutical and Chemistry

Jul 03, 2024

Abstract:Large language models (LLMs) have revolutionized Natural Language Processing (NLP) by by minimizing the need for complex feature engineering. However, the application of LLMs in specialized domains like biopharmaceuticals and chemistry remains largely unexplored. These fields are characterized by intricate terminologies, specialized knowledge, and a high demand for precision areas where general purpose LLMs often fall short. In this study, we introduce PharmGPT, a suite of multilingual LLMs with 13 billion and 70 billion parameters, specifically trained on a comprehensive corpus of hundreds of billions of tokens tailored to the Bio-Pharmaceutical and Chemical sectors. Our evaluation shows that PharmGPT matches or surpasses existing general models on key benchmarks, such as NAPLEX, demonstrating its exceptional capability in domain-specific tasks. This advancement establishes a new benchmark for LLMs in the Bio-Pharmaceutical and Chemical fields, addressing the existing gap in specialized language modeling. Furthermore, this suggests a promising path for enhanced research and development in these specialized areas, paving the way for more precise and effective applications of NLP in specialized domains.

PharmGPT: Domain-Specific Large Language Models for Bio-Pharmaceutical and Chemistry

Jun 26, 2024

Abstract:Large language models (LLMs) have revolutionized Natural Language Processing (NLP) by by minimizing the need for complex feature engineering. However, the application of LLMs in specialized domains like biopharmaceuticals and chemistry remains largely unexplored. These fields are characterized by intricate terminologies, specialized knowledge, and a high demand for precision areas where general purpose LLMs often fall short. In this study, we introduce PharmGPT, a suite of multilingual LLMs with 13 billion and 70 billion parameters, specifically trained on a comprehensive corpus of hundreds of billions of tokens tailored to the Bio-Pharmaceutical and Chemical sectors. Our evaluation shows that PharmGPT matches or surpasses existing general models on key benchmarks, such as NAPLEX, demonstrating its exceptional capability in domain-specific tasks. This advancement establishes a new benchmark for LLMs in the Bio-Pharmaceutical and Chemical fields, addressing the existing gap in specialized language modeling. Furthermore, this suggests a promising path for enhanced research and development in these specialized areas, paving the way for more precise and effective applications of NLP in specialized domains.

PatentGPT: A Large Language Model for Intellectual Property

Apr 30, 2024

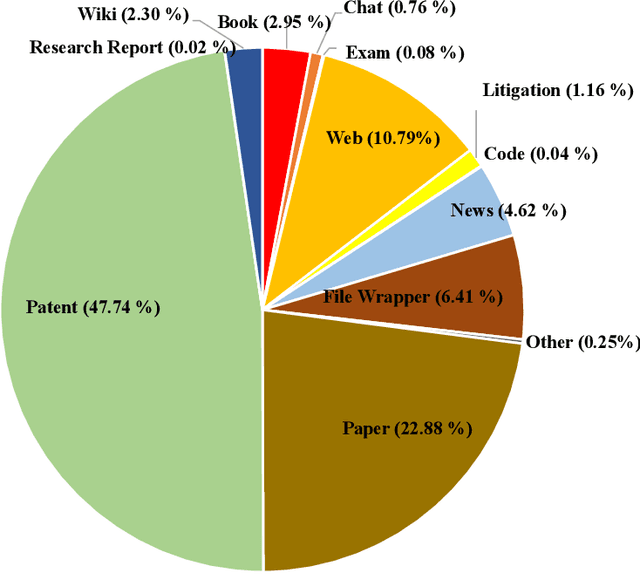

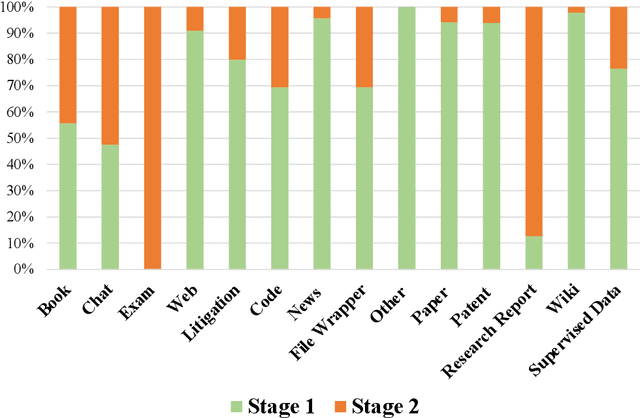

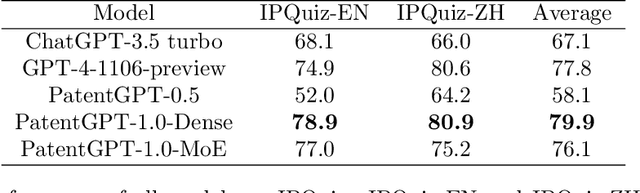

Abstract:In recent years, large language models have attracted significant attention due to their exceptional performance across a multitude of natural language process tasks, and have been widely applied in various fields. However, the application of large language models in the Intellectual Property (IP) space is challenging due to the strong need for specialized knowledge, privacy protection, processing of extremely long text in this field. In this technical report, we present for the first time a low-cost, standardized procedure for training IP-oriented LLMs, meeting the unique requirements of the IP domain. Using this standard process, we have trained the PatentGPT series models based on open-source pretrained models. By evaluating them on the open-source IP-oriented benchmark MOZIP, our domain-specific LLMs outperforms GPT-4, indicating the effectiveness of the proposed training procedure and the expertise of the PatentGPT models in the IP demain. What is impressive is that our model significantly outperformed GPT-4 on the 2019 China Patent Agent Qualification Examination by achieving a score of 65, reaching the level of human experts. Additionally, the PatentGPT model, which utilizes the SMoE architecture, achieves performance comparable to that of GPT-4 in the IP domain and demonstrates a better cost-performance ratio on long-text tasks, potentially serving as an alternative to GPT-4 within the IP domain.

A Map-matching Algorithm with Extraction of Multi-group Information for Low-frequency Data

Sep 18, 2022

Abstract:The growing use of probe vehicles generates a huge number of GNSS data. Limited by the satellite positioning technology, further improving the accuracy of map-matching is challenging work, especially for low-frequency trajectories. When matching a trajectory, the ego vehicle's spatial-temporal information of the present trip is the most useful with the least amount of data. In addition, there are a large amount of other data, e.g., other vehicles' state and past prediction results, but it is hard to extract useful information for matching maps and inferring paths. Most map-matching studies only used the ego vehicle's data and ignored other vehicles' data. Based on it, this paper designs a new map-matching method to make full use of "Big data". We first sort all data into four groups according to their spatial and temporal distance from the present matching probe which allows us to sort for their usefulness. Then we design three different methods to extract valuable information (scores) from them: a score for speed and bearing, a score for historical usage, and a score for traffic state using the spectral graph Markov neutral network. Finally, we use a modified top-K shortest-path method to search the candidate paths within an ellipse region and then use the fused score to infer the path (projected location). We test the proposed method against baseline algorithms using a real-world dataset in China. The results show that all scoring methods can enhance map-matching accuracy. Furthermore, our method outperforms the others, especially when GNSS probing frequency is less than 0.01 Hz.

Neural Network-based Automatic Factor Construction

Aug 14, 2020

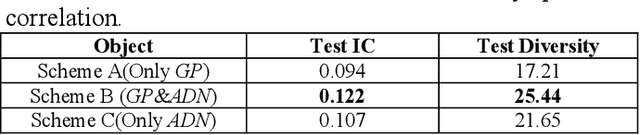

Abstract:Instead of conducting manual factor construction based on traditional and behavioural finance analysis, academic researchers and quantitative investment managers have leveraged Genetic Programming (GP) as an automatic feature construction tool in recent years, which builds reverse polish mathematical expressions from trading data into new factors. However, with the development of deep learning, more powerful feature extraction tools are available. This paper proposes Neural Network-based Automatic Factor Construction (NNAFC), a tailored neural network framework that can automatically construct diversified financial factors based on financial domain knowledge and a variety of neural network structures. The experiment results show that NNAFC can construct more informative and diversified factors than GP, to effectively enrich the current factor pool. For the current market, both fully connected and recurrent neural network structures are better at extracting information from financial time series than convolution neural network structures. Moreover, new factors constructed by NNAFC can always improve the return, Sharpe ratio, and the max draw-down of a multi-factor quantitative investment strategy due to their introducing more information and diversification to the existing factor pool.

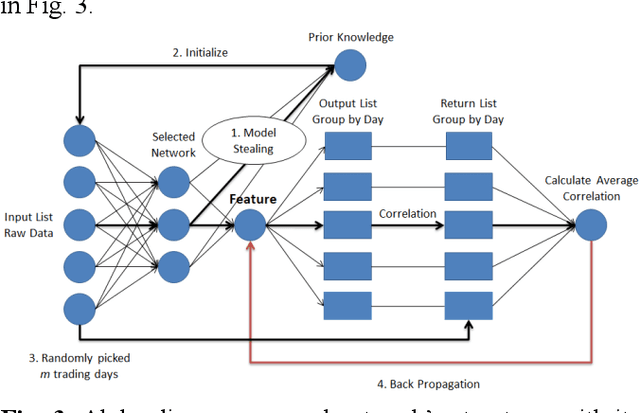

Prior knowledge distillation based on financial time series

Jun 17, 2020

Abstract:One of the major characteristics of financial time series is that they contain a large amount of non-stationary noise, which is challenging for deep neural networks. People normally use various features to address this problem. However, the performance of these features depends on the choice of hyper-parameters. In this paper, we propose to use neural networks to represent these indicators and train a large network constructed of smaller networks as feature layers to fine-tune the prior knowledge represented by the indicators. During back propagation, prior knowledge is transferred from human logic to machine logic via gradient descent. Prior knowledge is the deep belief of neural network and teaches the network to not be affected by non-stationary noise. Moreover, co-distillation is applied to distill the structure into a much smaller size to reduce redundant features and the risk of overfitting. In addition, the decisions of the smaller networks in terms of gradient descent are more robust and cautious than those of large networks. In numerical experiments, we find that our algorithm is faster and more accurate than traditional methods on real financial datasets. We also conduct experiments to verify and comprehend the method.

Automatic financial feature construction based on neural network

Jan 30, 2020

Abstract:In automatic financial feature construction task, the state of the art technic leverages reverse polish expression to represent the features, then use genetic programming (GP) to conduct its evolution process. In this paper, we propose a new framework based on neural network, alpha discovery neural network (ADNN). In this work, we made several contributions. Firstly, in this task, we make full use of neural network's overwhelming advantage in feature extraction to construct highly informative features. Secondly, we use domain knowledge to design the object function, batch size, and sampling rules. Thirdly, we use pre-training to replace the GP's evolution process. According to neural network's universal approximation theorem, pre-training can conduct a more effective and explainable evolution process. Experiment shows that ADNN can remarkably produce more diversified and higher informative features than GP. Besides, ADNN can serve as a data augmentation algorithm. It further improves the the performance of financial features constructed by GP.

Alpha Discovery Neural Network based on Prior Knowledge

Jan 03, 2020

Abstract:In financial automatic feature construction task, genetic programming is the state-of-the-art-technic. It uses reverse polish expression to represent features and then uses genetic programming to simulate the evolution process. With the development of deep learning, there are more powerful feature extractors for option. And we think that comprehending the relationship between different feature extractors and data shall be the key. In this work, we put prior knowledge into alpha discovery neural network, combined with different kinds of feature extractors to do this task. We find that in the same type of network, simple network structure can produce more informative features than sophisticated network structure, and it costs less training time. However, complex network is good at providing more diversified features. In both experiment and real business environment, fully-connected network and recurrent network are good at extracting information from financial time series, but convolution network structure can not effectively extract this information.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge