Jianwu Lin

Market Making with Deep Reinforcement Learning from Limit Order Books

May 25, 2023

Abstract:Market making (MM) is an important research topic in quantitative finance, the agent needs to continuously optimize ask and bid quotes to provide liquidity and make profits. The limit order book (LOB) contains information on all active limit orders, which is an essential basis for decision-making. The modeling of evolving, high-dimensional and low signal-to-noise ratio LOB data is a critical challenge. Traditional MM strategy relied on strong assumptions such as price process, order arrival process, etc. Previous reinforcement learning (RL) works handcrafted market features, which is insufficient to represent the market. This paper proposes a RL agent for market making with LOB data. We leverage a neural network with convolutional filters and attention mechanism (Attn-LOB) for feature extraction from LOB. We design a new continuous action space and a hybrid reward function for the MM task. Finally, we conduct comprehensive experiments on latency and interpretability, showing that our agent has good applicability.

Neural Network-based Automatic Factor Construction

Aug 14, 2020

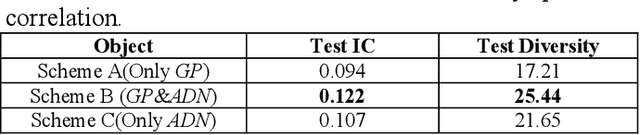

Abstract:Instead of conducting manual factor construction based on traditional and behavioural finance analysis, academic researchers and quantitative investment managers have leveraged Genetic Programming (GP) as an automatic feature construction tool in recent years, which builds reverse polish mathematical expressions from trading data into new factors. However, with the development of deep learning, more powerful feature extraction tools are available. This paper proposes Neural Network-based Automatic Factor Construction (NNAFC), a tailored neural network framework that can automatically construct diversified financial factors based on financial domain knowledge and a variety of neural network structures. The experiment results show that NNAFC can construct more informative and diversified factors than GP, to effectively enrich the current factor pool. For the current market, both fully connected and recurrent neural network structures are better at extracting information from financial time series than convolution neural network structures. Moreover, new factors constructed by NNAFC can always improve the return, Sharpe ratio, and the max draw-down of a multi-factor quantitative investment strategy due to their introducing more information and diversification to the existing factor pool.

Prior knowledge distillation based on financial time series

Jun 17, 2020

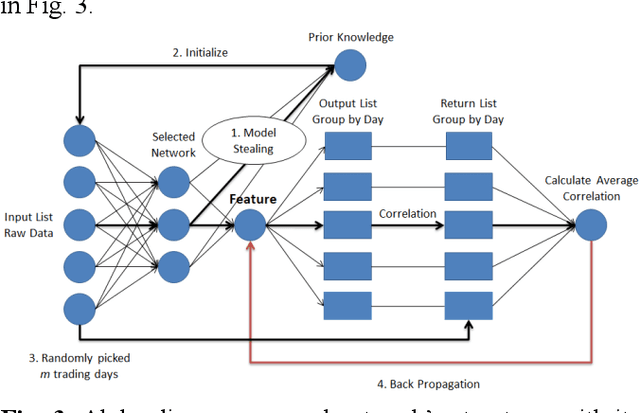

Abstract:One of the major characteristics of financial time series is that they contain a large amount of non-stationary noise, which is challenging for deep neural networks. People normally use various features to address this problem. However, the performance of these features depends on the choice of hyper-parameters. In this paper, we propose to use neural networks to represent these indicators and train a large network constructed of smaller networks as feature layers to fine-tune the prior knowledge represented by the indicators. During back propagation, prior knowledge is transferred from human logic to machine logic via gradient descent. Prior knowledge is the deep belief of neural network and teaches the network to not be affected by non-stationary noise. Moreover, co-distillation is applied to distill the structure into a much smaller size to reduce redundant features and the risk of overfitting. In addition, the decisions of the smaller networks in terms of gradient descent are more robust and cautious than those of large networks. In numerical experiments, we find that our algorithm is faster and more accurate than traditional methods on real financial datasets. We also conduct experiments to verify and comprehend the method.

Automatic financial feature construction based on neural network

Jan 30, 2020

Abstract:In automatic financial feature construction task, the state of the art technic leverages reverse polish expression to represent the features, then use genetic programming (GP) to conduct its evolution process. In this paper, we propose a new framework based on neural network, alpha discovery neural network (ADNN). In this work, we made several contributions. Firstly, in this task, we make full use of neural network's overwhelming advantage in feature extraction to construct highly informative features. Secondly, we use domain knowledge to design the object function, batch size, and sampling rules. Thirdly, we use pre-training to replace the GP's evolution process. According to neural network's universal approximation theorem, pre-training can conduct a more effective and explainable evolution process. Experiment shows that ADNN can remarkably produce more diversified and higher informative features than GP. Besides, ADNN can serve as a data augmentation algorithm. It further improves the the performance of financial features constructed by GP.

Alpha Discovery Neural Network based on Prior Knowledge

Jan 03, 2020

Abstract:In financial automatic feature construction task, genetic programming is the state-of-the-art-technic. It uses reverse polish expression to represent features and then uses genetic programming to simulate the evolution process. With the development of deep learning, there are more powerful feature extractors for option. And we think that comprehending the relationship between different feature extractors and data shall be the key. In this work, we put prior knowledge into alpha discovery neural network, combined with different kinds of feature extractors to do this task. We find that in the same type of network, simple network structure can produce more informative features than sophisticated network structure, and it costs less training time. However, complex network is good at providing more diversified features. In both experiment and real business environment, fully-connected network and recurrent network are good at extracting information from financial time series, but convolution network structure can not effectively extract this information.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge