Chung-Chi Chen

Confidence-Driven Multi-Scale Model Selection for Cost-Efficient Inference

Feb 25, 2026Abstract:Large Language Models (LLMs) have revolutionized inference across diverse natural language tasks, with larger models performing better but at higher computational costs. We propose a confidence-driven strategy that dynamically selects the most suitable model based on confidence estimates. By assessing a model's confidence in handling the task and response accuracy, tasks that are likely to be solved correctly are retained, while more uncertain or complex cases are delegated to a larger model, ensuring reliability while minimizing computation. Specifically, we evaluate a model's likelihood of knowing the correct answer and the probability that its response is accurate. Experiments on the Massive Multitask Language Understanding (MMLU) benchmark show that our approach achieves accuracy comparable to the largest model while reducing computational costs by 20\% to 40\%. When applied to GPT-4o API calls, it reduces token usage by approximately 60\%, further improving cost efficiency. These findings indicate the potential of confidence-based model selection to enhance real-world LLM deployment, particularly in resource-constrained settings such as edge devices and commercial API applications.

Evaluating Large Language Models as Expert Annotators

Aug 11, 2025Abstract:Textual data annotation, the process of labeling or tagging text with relevant information, is typically costly, time-consuming, and labor-intensive. While large language models (LLMs) have demonstrated their potential as direct alternatives to human annotators for general domains natural language processing (NLP) tasks, their effectiveness on annotation tasks in domains requiring expert knowledge remains underexplored. In this paper, we investigate: whether top-performing LLMs, which might be perceived as having expert-level proficiency in academic and professional benchmarks, can serve as direct alternatives to human expert annotators? To this end, we evaluate both individual LLMs and multi-agent approaches across three highly specialized domains: finance, biomedicine, and law. Specifically, we propose a multi-agent discussion framework to simulate a group of human annotators, where LLMs are tasked to engage in discussions by considering others' annotations and justifications before finalizing their labels. Additionally, we incorporate reasoning models (e.g., o3-mini) to enable a more comprehensive comparison. Our empirical results reveal that: (1) Individual LLMs equipped with inference-time techniques (e.g., chain-of-thought (CoT), self-consistency) show only marginal or even negative performance gains, contrary to prior literature suggesting their broad effectiveness. (2) Overall, reasoning models do not demonstrate statistically significant improvements over non-reasoning models in most settings. This suggests that extended long CoT provides relatively limited benefits for data annotation in specialized domains. (3) Certain model behaviors emerge in the multi-agent discussion environment. For instance, Claude 3.7 Sonnet with thinking rarely changes its initial annotations, even when other agents provide correct annotations or valid reasoning.

Modeling Professionalism in Expert Questioning through Linguistic Differentiation

Jul 27, 2025Abstract:Professionalism is a crucial yet underexplored dimension of expert communication, particularly in high-stakes domains like finance. This paper investigates how linguistic features can be leveraged to model and evaluate professionalism in expert questioning. We introduce a novel annotation framework to quantify structural and pragmatic elements in financial analyst questions, such as discourse regulators, prefaces, and request types. Using both human-authored and large language model (LLM)-generated questions, we construct two datasets: one annotated for perceived professionalism and one labeled by question origin. We show that the same linguistic features correlate strongly with both human judgments and authorship origin, suggesting a shared stylistic foundation. Furthermore, a classifier trained solely on these interpretable features outperforms gemini-2.0 and SVM baselines in distinguishing expert-authored questions. Our findings demonstrate that professionalism is a learnable, domain-general construct that can be captured through linguistically grounded modeling.

Decision-Oriented Text Evaluation

Jul 03, 2025

Abstract:Natural language generation (NLG) is increasingly deployed in high-stakes domains, yet common intrinsic evaluation methods, such as n-gram overlap or sentence plausibility, weakly correlate with actual decision-making efficacy. We propose a decision-oriented framework for evaluating generated text by directly measuring its influence on human and large language model (LLM) decision outcomes. Using market digest texts--including objective morning summaries and subjective closing-bell analyses--as test cases, we assess decision quality based on the financial performance of trades executed by human investors and autonomous LLM agents informed exclusively by these texts. Our findings reveal that neither humans nor LLM agents consistently surpass random performance when relying solely on summaries. However, richer analytical commentaries enable collaborative human-LLM teams to outperform individual human or agent baselines significantly. Our approach underscores the importance of evaluating generated text by its ability to facilitate synergistic decision-making between humans and LLMs, highlighting critical limitations of traditional intrinsic metrics.

Refining Financial Consumer Complaints through Multi-Scale Model Interaction

Apr 14, 2025Abstract:Legal writing demands clarity, formality, and domain-specific precision-qualities often lacking in documents authored by individuals without legal training. To bridge this gap, this paper explores the task of legal text refinement that transforms informal, conversational inputs into persuasive legal arguments. We introduce FinDR, a Chinese dataset of financial dispute records, annotated with official judgments on claim reasonableness. Our proposed method, Multi-Scale Model Interaction (MSMI), leverages a lightweight classifier to evaluate outputs and guide iterative refinement by Large Language Models (LLMs). Experimental results demonstrate that MSMI significantly outperforms single-pass prompting strategies. Additionally, we validate the generalizability of MSMI on several short-text benchmarks, showing improved adversarial robustness. Our findings reveal the potential of multi-model collaboration for enhancing legal document generation and broader text refinement tasks.

The Impact and Feasibility of Self-Confidence Shaping for AI-Assisted Decision-Making

Feb 20, 2025Abstract:In AI-assisted decision-making, it is crucial but challenging for humans to appropriately rely on AI, especially in high-stakes domains such as finance and healthcare. This paper addresses this problem from a human-centered perspective by presenting an intervention for self-confidence shaping, designed to calibrate self-confidence at a targeted level. We first demonstrate the impact of self-confidence shaping by quantifying the upper-bound improvement in human-AI team performance. Our behavioral experiments with 121 participants show that self-confidence shaping can improve human-AI team performance by nearly 50% by mitigating both over- and under-reliance on AI. We then introduce a self-confidence prediction task to identify when our intervention is needed. Our results show that simple machine-learning models achieve 67% accuracy in predicting self-confidence. We further illustrate the feasibility of such interventions. The observed relationship between sentiment and self-confidence suggests that modifying sentiment could be a viable strategy for shaping self-confidence. Finally, we outline future research directions to support the deployment of self-confidence shaping in a real-world scenario for effective human-AI collaboration.

Observing Micromotives and Macrobehavior of Large Language Models

Dec 10, 2024Abstract:Thomas C. Schelling, awarded the 2005 Nobel Memorial Prize in Economic Sciences, pointed out that ``individuals decisions (micromotives), while often personal and localized, can lead to societal outcomes (macrobehavior) that are far more complex and different from what the individuals intended.'' The current research related to large language models' (LLMs') micromotives, such as preferences or biases, assumes that users will make more appropriate decisions once LLMs are devoid of preferences or biases. Consequently, a series of studies has focused on removing bias from LLMs. In the NLP community, while there are many discussions on LLMs' micromotives, previous studies have seldom conducted a systematic examination of how LLMs may influence society's macrobehavior. In this paper, we follow the design of Schelling's model of segregation to observe the relationship between the micromotives and macrobehavior of LLMs. Our results indicate that, regardless of the level of bias in LLMs, a highly segregated society will emerge as more people follow LLMs' suggestions. We hope our discussion will spark further consideration of the fundamental assumption regarding the mitigation of LLMs' micromotives and encourage a reevaluation of how LLMs may influence users and society.

Paraphrase-Aligned Machine Translation

Dec 08, 2024Abstract:Large Language Models (LLMs) have demonstrated significant capabilities in machine translation. However, their translation quality is sometimes questioned, as the generated outputs may deviate from expressions typically used by native speakers. These deviations often arise from differences in sentence structure between language systems. To address this issue, we propose ParaAlign Translator, a method that fine-tunes LLMs to paraphrase sentences, aligning their structures with those of the target language systems. This approach improves the performance of subsequent translations. Experimental results demonstrate that the proposed method enhances the LLaMA-3-8B model's performance in both resource-rich and low-resource scenarios and achieves parity with or surpassing the much larger LLaMA-3-70B model.

ML-Promise: A Multilingual Dataset for Corporate Promise Verification

Nov 07, 2024

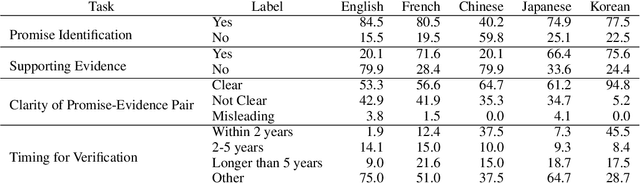

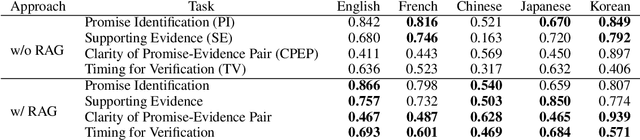

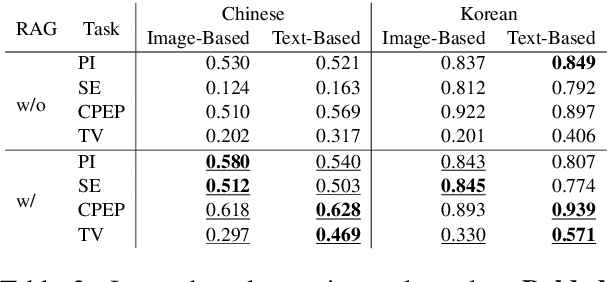

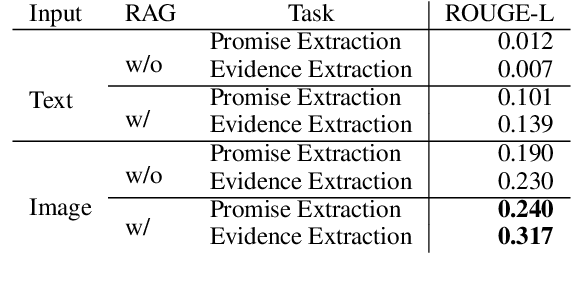

Abstract:Promises made by politicians, corporate leaders, and public figures have a significant impact on public perception, trust, and institutional reputation. However, the complexity and volume of such commitments, coupled with difficulties in verifying their fulfillment, necessitate innovative methods for assessing their credibility. This paper introduces the concept of Promise Verification, a systematic approach involving steps such as promise identification, evidence assessment, and the evaluation of timing for verification. We propose the first multilingual dataset, ML-Promise, which includes English, French, Chinese, Japanese, and Korean, aimed at facilitating in-depth verification of promises, particularly in the context of Environmental, Social, and Governance (ESG) reports. Given the growing emphasis on corporate environmental contributions, this dataset addresses the challenge of evaluating corporate promises, especially in light of practices like greenwashing. Our findings also explore textual and image-based baselines, with promising results from retrieval-augmented generation (RAG) approaches. This work aims to foster further discourse on the accountability of public commitments across multiple languages and domains.

Are Expert-Level Language Models Expert-Level Annotators?

Oct 04, 2024

Abstract:Data annotation refers to the labeling or tagging of textual data with relevant information. A large body of works have reported positive results on leveraging LLMs as an alternative to human annotators. However, existing studies focus on classic NLP tasks, and the extent to which LLMs as data annotators perform in domains requiring expert knowledge remains underexplored. In this work, we investigate comprehensive approaches across three highly specialized domains and discuss practical suggestions from a cost-effectiveness perspective. To the best of our knowledge, we present the first systematic evaluation of LLMs as expert-level data annotators.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge