Yuhan Cheng

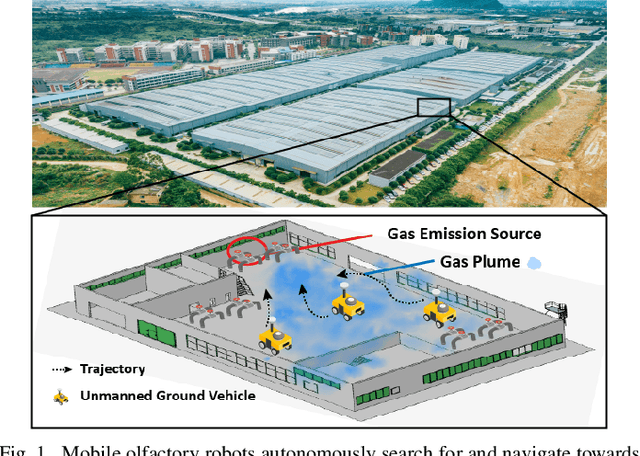

SniffySquad: Patchiness-Aware Gas Source Localization with Multi-Robot Collaboration

Nov 09, 2024

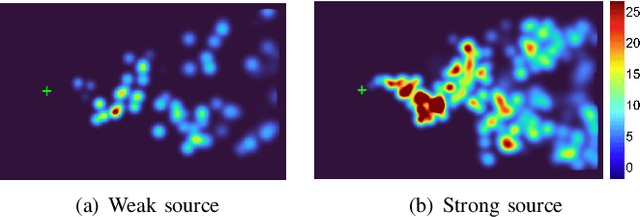

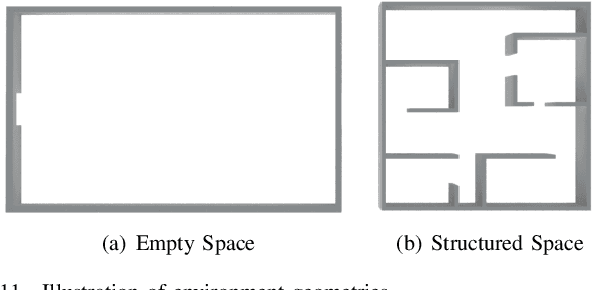

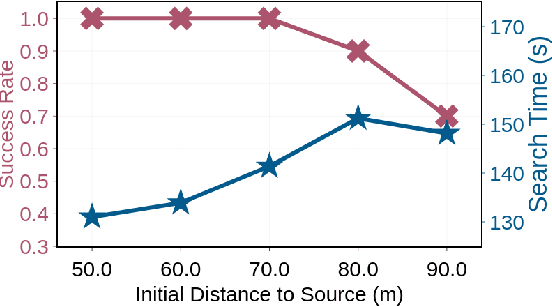

Abstract:Gas source localization is pivotal for the rapid mitigation of gas leakage disasters, where mobile robots emerge as a promising solution. However, existing methods predominantly schedule robots' movements based on reactive stimuli or simplified gas plume models. These approaches typically excel in idealized, simulated environments but fall short in real-world gas environments characterized by their patchy distribution. In this work, we introduce SniffySquad, a multi-robot olfaction-based system designed to address the inherent patchiness in gas source localization. SniffySquad incorporates a patchiness-aware active sensing approach that enhances the quality of data collection and estimation. Moreover, it features an innovative collaborative role adaptation strategy to boost the efficiency of source-seeking endeavors. Extensive evaluations demonstrate that our system achieves an increase in the success rate by $20\%+$ and an improvement in path efficiency by $30\%+$, outperforming state-of-the-art gas source localization solutions.

Simulating Financial Market via Large Language Model based Agents

Jun 28, 2024

Abstract:Most economic theories typically assume that financial market participants are fully rational individuals and use mathematical models to simulate human behavior in financial markets. However, human behavior is often not entirely rational and is challenging to predict accurately with mathematical models. In this paper, we propose \textbf{A}gent-based \textbf{S}imulated \textbf{F}inancial \textbf{M}arket (ASFM), which first constructs a simulated stock market with a real order matching system. Then, we propose a large language model based agent as the stock trader, which contains the profile, observation, and tool-learning based action module. The trading agent can comprehensively understand current market dynamics and financial policy information, and make decisions that align with their trading strategy. In the experiments, we first verify that the reactions of our ASFM are consistent with the real stock market in two controllable scenarios. In addition, we also conduct experiments in two popular economics research directions, and we find that conclusions drawn in our \model align with the preliminary findings in economics research. Based on these observations, we believe our proposed ASFM provides a new paradigm for economic research.

Towards Generalizable Diabetic Retinopathy Grading in Unseen Domains

Jul 21, 2023Abstract:Diabetic Retinopathy (DR) is a common complication of diabetes and a leading cause of blindness worldwide. Early and accurate grading of its severity is crucial for disease management. Although deep learning has shown great potential for automated DR grading, its real-world deployment is still challenging due to distribution shifts among source and target domains, known as the domain generalization problem. Existing works have mainly attributed the performance degradation to limited domain shifts caused by simple visual discrepancies, which cannot handle complex real-world scenarios. Instead, we present preliminary evidence suggesting the existence of three-fold generalization issues: visual and degradation style shifts, diagnostic pattern diversity, and data imbalance. To tackle these issues, we propose a novel unified framework named Generalizable Diabetic Retinopathy Grading Network (GDRNet). GDRNet consists of three vital components: fundus visual-artifact augmentation (FundusAug), dynamic hybrid-supervised loss (DahLoss), and domain-class-aware re-balancing (DCR). FundusAug generates realistic augmented images via visual transformation and image degradation, while DahLoss jointly leverages pixel-level consistency and image-level semantics to capture the diverse diagnostic patterns and build generalizable feature representations. Moreover, DCR mitigates the data imbalance from a domain-class view and avoids undesired over-emphasis on rare domain-class pairs. Finally, we design a publicly available benchmark for fair evaluations. Extensive comparison experiments against advanced methods and exhaustive ablation studies demonstrate the effectiveness and generalization ability of GDRNet.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge