Yuelin Zou

Dissecting Fine-Tuning Unlearning in Large Language Models

Oct 09, 2024Abstract:Fine-tuning-based unlearning methods prevail for preventing targeted harmful, sensitive, or copyrighted information within large language models while preserving overall capabilities. However, the true effectiveness of these methods is unclear. In this paper, we delve into the limitations of fine-tuning-based unlearning through activation patching and parameter restoration experiments. Our findings reveal that these methods alter the model's knowledge retrieval process, rather than genuinely erasing the problematic knowledge embedded in the model parameters. Furthermore, behavioral tests demonstrate that the unlearning mechanisms inevitably impact the global behavior of the models, affecting unrelated knowledge or capabilities. Our work advocates the development of more resilient unlearning techniques for truly erasing knowledge. Our code is released at https://github.com/yihuaihong/Dissecting-FT-Unlearning.

Fine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Jun 19, 2024

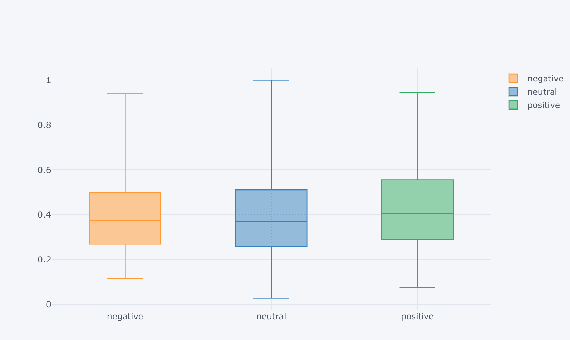

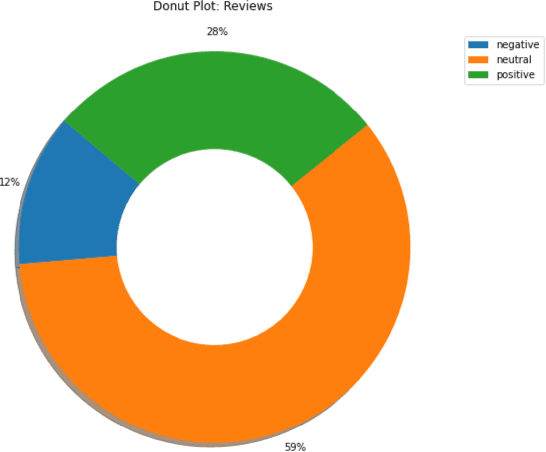

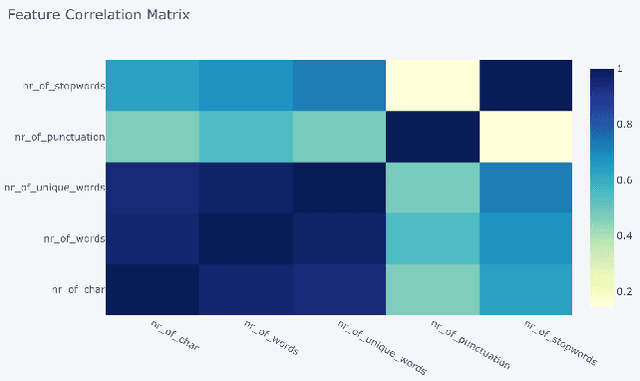

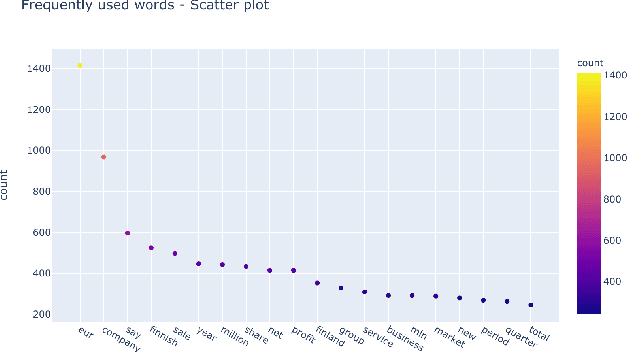

Abstract:In this study, we explore the application of sentiment analysis on financial news headlines to understand investor sentiment. By leveraging Natural Language Processing (NLP) and Large Language Models (LLM), we analyze sentiment from the perspective of retail investors. The FinancialPhraseBank dataset, which contains categorized sentiments of financial news headlines, serves as the basis for our analysis. We fine-tuned several models, including distilbert-base-uncased, Llama, and gemma-7b, to evaluate their effectiveness in sentiment classification. Our experiments demonstrate that the fine-tuned gemma-7b model outperforms others, achieving the highest precision, recall, and F1 score. Specifically, the gemma-7b model showed significant improvements in accuracy after fine-tuning, indicating its robustness in capturing the nuances of financial sentiment. This model can be instrumental in providing market insights, risk management, and aiding investment decisions by accurately predicting the sentiment of financial news. The results highlight the potential of advanced LLMs in transforming how we analyze and interpret financial information, offering a powerful tool for stakeholders in the financial industry.

TD3 Based Collision Free Motion Planning for Robot Navigation

May 24, 2024

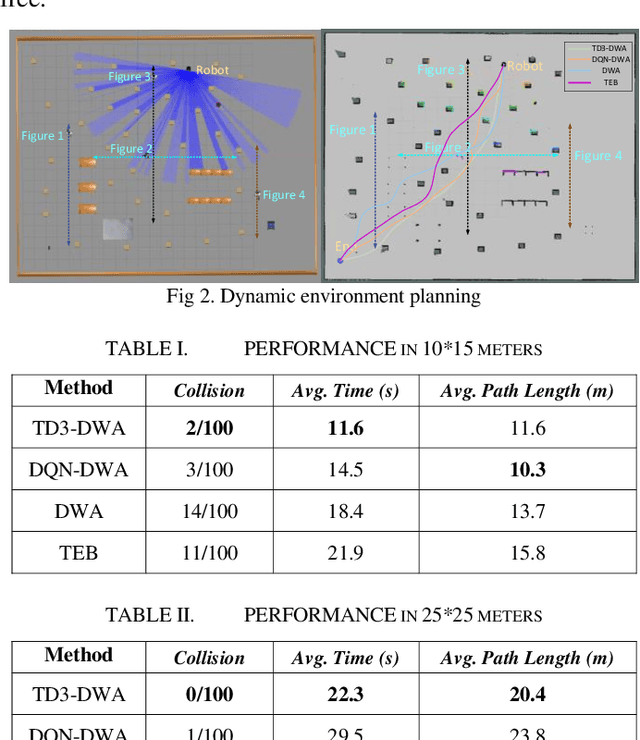

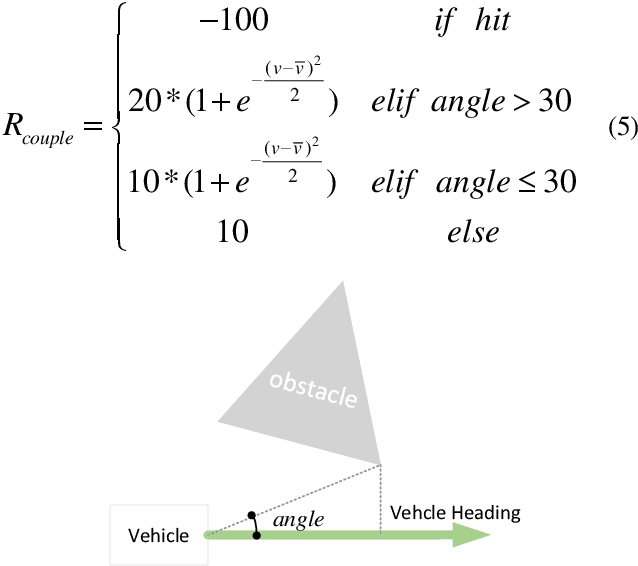

Abstract:This paper addresses the challenge of collision-free motion planning in automated navigation within complex environments. Utilizing advancements in Deep Reinforcement Learning (DRL) and sensor technologies like LiDAR, we propose the TD3-DWA algorithm, an innovative fusion of the traditional Dynamic Window Approach (DWA) with the Twin Delayed Deep Deterministic Policy Gradient (TD3). This hybrid algorithm enhances the efficiency of robotic path planning by optimizing the sampling interval parameters of DWA to effectively navigate around both static and dynamic obstacles. The performance of the TD3-DWA algorithm is validated through various simulation experiments, demonstrating its potential to significantly improve the reliability and safety of autonomous navigation systems.

Adaptive speed planning for Unmanned Vehicle Based on Deep Reinforcement Learning

Apr 26, 2024

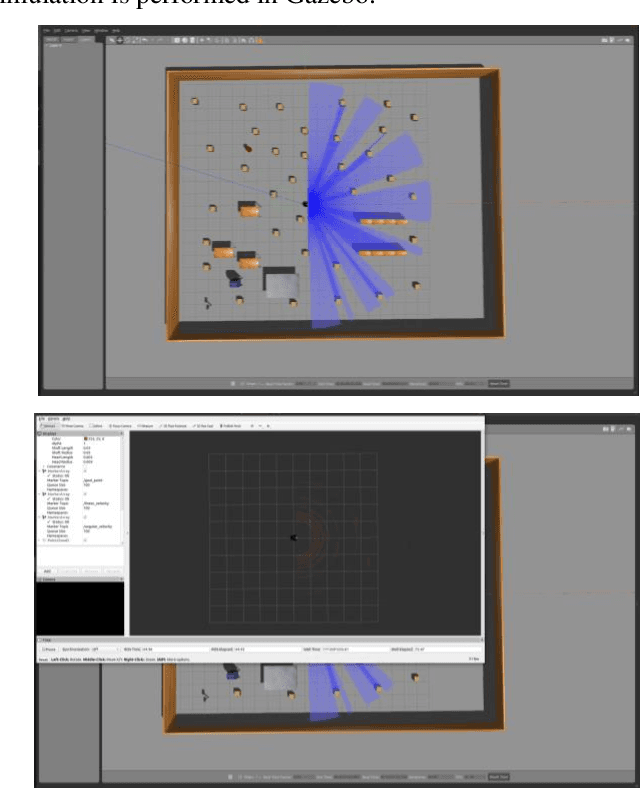

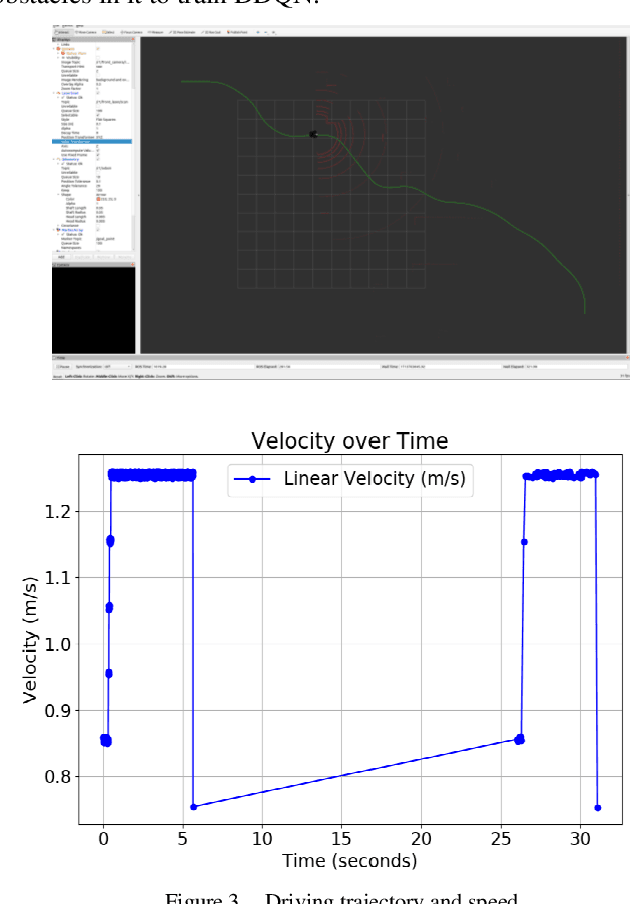

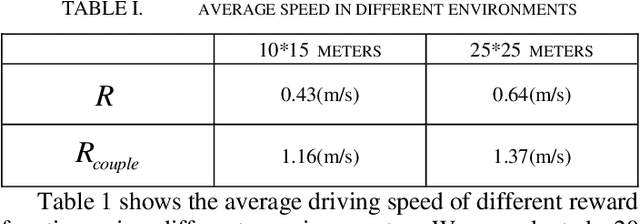

Abstract:In order to solve the problem of frequent deceleration of unmanned vehicles when approaching obstacles, this article uses a Deep Q-Network (DQN) and its extension, the Double Deep Q-Network (DDQN), to develop a local navigation system that adapts to obstacles while maintaining optimal speed planning. By integrating improved reward functions and obstacle angle determination methods, the system demonstrates significant enhancements in maneuvering capabilities without frequent decelerations. Experiments conducted in simulated environments with varying obstacle densities confirm the effectiveness of the proposed method in achieving more stable and efficient path planning.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge