Kangtong Mo

Causality-Aware Temporal Projection for Video Understanding in Video-LLMs

Jan 05, 2026Abstract:Recent Video Large Language Models (Video-LLMs) have shown strong multimodal reasoning capabilities, yet remain challenged by video understanding tasks that require consistent temporal ordering and causal coherence. Many parameter-efficient Video-LLMs rely on unconstrained bidirectional projectors to model inter-frame interactions, which can blur temporal ordering by allowing later frames to influence earlier representations, without explicit architectural mechanisms to respect the directional nature of video reasoning. To address this limitation, we propose V-CORE, a parameter-efficient framework that introduces explicit temporal ordering constraints for video understanding. V-CORE consists of two key components: (1) Learnable Spatial Aggregation (LSA), which adaptively selects salient spatial tokens to reduce redundancy, and (2) a Causality-Aware Temporal Projector (CATP), which enforces structured unidirectional information flow via block-causal attention and a terminal dynamic summary token acting as a causal sink. This design preserves intra-frame spatial interactions while ensuring that temporal information is aggregated in a strictly ordered manner. With 4-bit QLoRA and a frozen LLM backbone, V-CORE can be trained efficiently on a single consumer GPU. Experiments show that V-CORE achieves strong performance on the challenging NExT-QA benchmark, reaching 61.2% accuracy, and remains competitive across MSVD-QA, MSRVTT-QA, and TGIF-QA, with gains concentrated in temporal and causal reasoning subcategories (+3.5% and +5.2% respectively), directly validating the importance of explicit temporal ordering constraints.

Optimized Coordination Strategy for Multi-Aerospace Systems in Pick-and-Place Tasks By Deep Neural Network

Dec 13, 2024Abstract:In this paper, we present an advanced strategy for the coordinated control of a multi-agent aerospace system, utilizing Deep Neural Networks (DNNs) within a reinforcement learning framework. Our approach centers on optimizing autonomous task assignment to enhance the system's operational efficiency in object relocation tasks, framed as an aerospace-oriented pick-and-place scenario. By modeling this coordination challenge within a MuJoCo environment, we employ a deep reinforcement learning algorithm to train a DNN-based policy to maximize task completion rates across the multi-agent system. The objective function is explicitly designed to maximize effective object transfer rates, leveraging neural network capabilities to handle complex state and action spaces in high-dimensional aerospace environments. Through extensive simulation, we benchmark the proposed method against a heuristic combinatorial approach rooted in game-theoretic principles, demonstrating a marked performance improvement, with the trained policy achieving up to 16\% higher task efficiency. Experimental validation is conducted on a multi-agent hardware setup to substantiate the efficacy of our approach in a real-world aerospace scenario.

Maximum Solar Energy Tracking Leverage High-DoF Robotics System with Deep Reinforcement Learning

Nov 21, 2024

Abstract:Solar trajectory monitoring is a pivotal challenge in solar energy systems, underpinning applications such as autonomous energy harvesting and environmental sensing. A prevalent failure mode in sustained solar tracking arises when the predictive algorithm erroneously diverges from the solar locus, erroneously anchoring to extraneous celestial or terrestrial features. This phenomenon is attributable to an inadequate assimilation of solar-specific objectness attributes within the tracking paradigm. To mitigate this deficiency inherent in extant methodologies, we introduce an innovative objectness regularization framework that compels tracking points to remain confined within the delineated boundaries of the solar entity. By encapsulating solar objectness indicators during the training phase, our approach obviates the necessity for explicit solar mask computation during operational deployment. Furthermore, we leverage the high-DoF robot arm to integrate our method to improve its robustness and flexibility in different outdoor environments.

DRAL: Deep Reinforcement Adaptive Learning for Multi-UAVs Navigation in Unknown Indoor Environment

Sep 05, 2024

Abstract:Autonomous indoor navigation of UAVs presents numerous challenges, primarily due to the limited precision of GPS in enclosed environments. Additionally, UAVs' limited capacity to carry heavy or power-intensive sensors, such as overheight packages, exacerbates the difficulty of achieving autonomous navigation indoors. This paper introduces an advanced system in which a drone autonomously navigates indoor spaces to locate a specific target, such as an unknown Amazon package, using only a single camera. Employing a deep learning approach, a deep reinforcement adaptive learning algorithm is trained to develop a control strategy that emulates the decision-making process of an expert pilot. We demonstrate the efficacy of our system through real-time simulations conducted in various indoor settings. We apply multiple visualization techniques to gain deeper insights into our trained network. Furthermore, we extend our approach to include an adaptive control algorithm for coordinating multiple drones to lift an object in an indoor environment collaboratively. Integrating our DRAL algorithm enables multiple UAVs to learn optimal control strategies that adapt to dynamic conditions and uncertainties. This innovation enhances the robustness and flexibility of indoor navigation and opens new possibilities for complex multi-drone operations in confined spaces. The proposed framework highlights significant advancements in adaptive control and deep reinforcement learning, offering robust solutions for complex multi-agent systems in real-world applications.

Self-Adaptive Robust Motion Planning for High DoF Robot Manipulator using Deep MPC

Jul 17, 2024

Abstract:In contemporary control theory, self-adaptive methodologies are highly esteemed for their inherent flexibility and robustness in managing modeling uncertainties. Particularly, robust adaptive control stands out owing to its potent capability of leveraging robust optimization algorithms to approximate cost functions and relax the stringent constraints often associated with conventional self-adaptive control paradigms. Deep learning methods, characterized by their extensive layered architecture, offer significantly enhanced approximation prowess. Notwithstanding, the implementation of deep learning is replete with challenges, particularly the phenomena of vanishing and exploding gradients encountered during the training process. This paper introduces a self-adaptive control scheme integrating a deep MPC, governed by an innovative weight update law designed to mitigate the vanishing and exploding gradient predicament by employing the gradient sign exclusively. The proffered controller is a self-adaptive dynamic inversion mechanism, integrating an augmented state observer within an auxiliary estimation circuit to enhance the training phase. This approach enables the deep MPC to learn the entire plant model in real-time and the efficacy of the controller is demonstrated through simulations involving a high-DoF robot manipulator, wherein the controller adeptly learns the nonlinear plant dynamics expeditiously and exhibits commendable performance in the motion planning task.

Fine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Jun 19, 2024

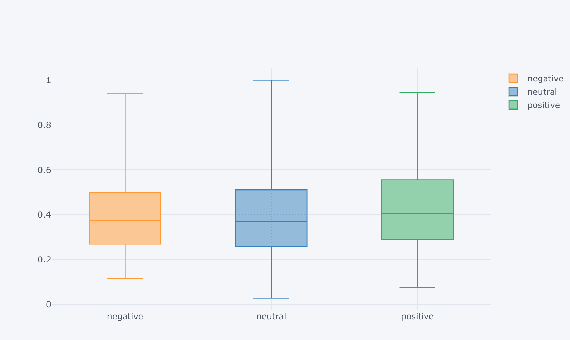

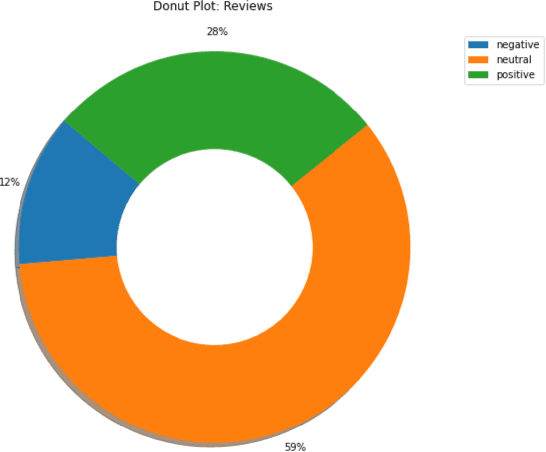

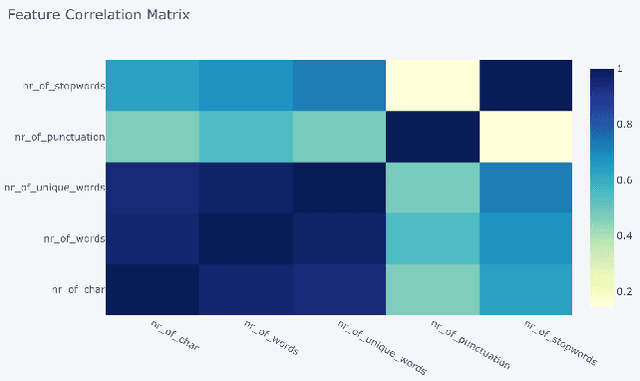

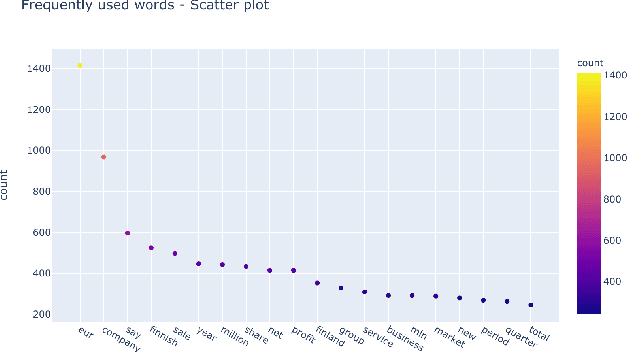

Abstract:In this study, we explore the application of sentiment analysis on financial news headlines to understand investor sentiment. By leveraging Natural Language Processing (NLP) and Large Language Models (LLM), we analyze sentiment from the perspective of retail investors. The FinancialPhraseBank dataset, which contains categorized sentiments of financial news headlines, serves as the basis for our analysis. We fine-tuned several models, including distilbert-base-uncased, Llama, and gemma-7b, to evaluate their effectiveness in sentiment classification. Our experiments demonstrate that the fine-tuned gemma-7b model outperforms others, achieving the highest precision, recall, and F1 score. Specifically, the gemma-7b model showed significant improvements in accuracy after fine-tuning, indicating its robustness in capturing the nuances of financial sentiment. This model can be instrumental in providing market insights, risk management, and aiding investment decisions by accurately predicting the sentiment of financial news. The results highlight the potential of advanced LLMs in transforming how we analyze and interpret financial information, offering a powerful tool for stakeholders in the financial industry.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge