Xuanzhen Xu

Self-Adaptive Robust Motion Planning for High DoF Robot Manipulator using Deep MPC

Jul 17, 2024

Abstract:In contemporary control theory, self-adaptive methodologies are highly esteemed for their inherent flexibility and robustness in managing modeling uncertainties. Particularly, robust adaptive control stands out owing to its potent capability of leveraging robust optimization algorithms to approximate cost functions and relax the stringent constraints often associated with conventional self-adaptive control paradigms. Deep learning methods, characterized by their extensive layered architecture, offer significantly enhanced approximation prowess. Notwithstanding, the implementation of deep learning is replete with challenges, particularly the phenomena of vanishing and exploding gradients encountered during the training process. This paper introduces a self-adaptive control scheme integrating a deep MPC, governed by an innovative weight update law designed to mitigate the vanishing and exploding gradient predicament by employing the gradient sign exclusively. The proffered controller is a self-adaptive dynamic inversion mechanism, integrating an augmented state observer within an auxiliary estimation circuit to enhance the training phase. This approach enables the deep MPC to learn the entire plant model in real-time and the efficacy of the controller is demonstrated through simulations involving a high-DoF robot manipulator, wherein the controller adeptly learns the nonlinear plant dynamics expeditiously and exhibits commendable performance in the motion planning task.

Fine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Jun 19, 2024

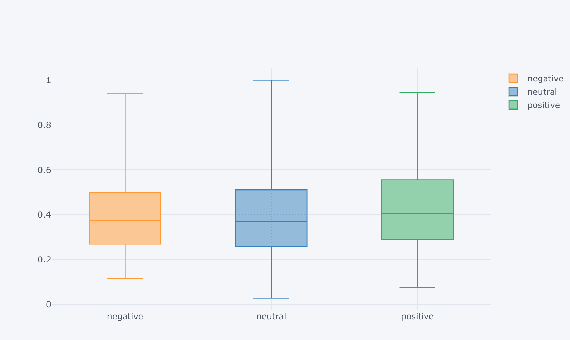

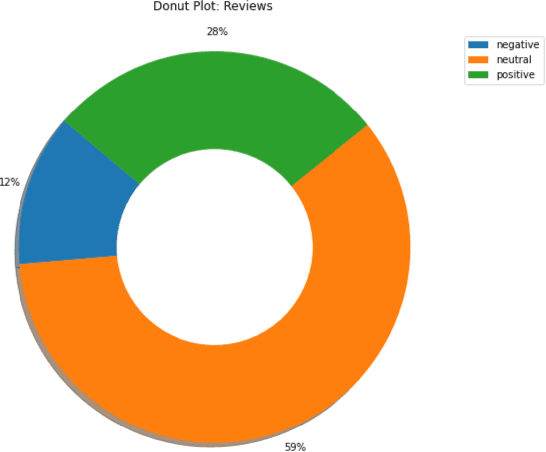

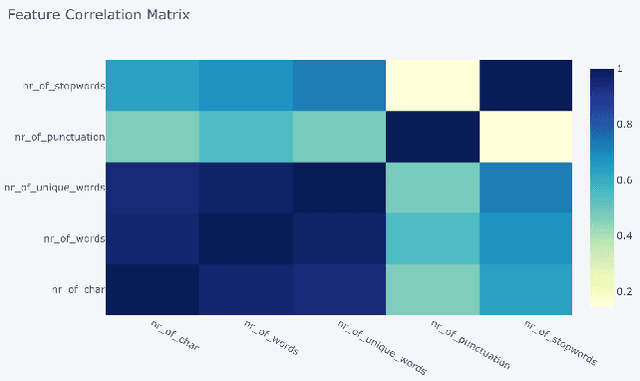

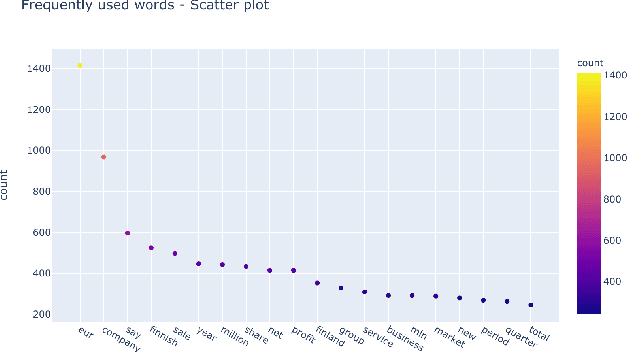

Abstract:In this study, we explore the application of sentiment analysis on financial news headlines to understand investor sentiment. By leveraging Natural Language Processing (NLP) and Large Language Models (LLM), we analyze sentiment from the perspective of retail investors. The FinancialPhraseBank dataset, which contains categorized sentiments of financial news headlines, serves as the basis for our analysis. We fine-tuned several models, including distilbert-base-uncased, Llama, and gemma-7b, to evaluate their effectiveness in sentiment classification. Our experiments demonstrate that the fine-tuned gemma-7b model outperforms others, achieving the highest precision, recall, and F1 score. Specifically, the gemma-7b model showed significant improvements in accuracy after fine-tuning, indicating its robustness in capturing the nuances of financial sentiment. This model can be instrumental in providing market insights, risk management, and aiding investment decisions by accurately predicting the sentiment of financial news. The results highlight the potential of advanced LLMs in transforming how we analyze and interpret financial information, offering a powerful tool for stakeholders in the financial industry.

Enhanced Detection Classification via Clustering SVM for Various Robot Collaboration Task

May 05, 2024Abstract:We introduce an advanced, swift pattern recognition strategy for various multiple robotics during curve negotiation. This method, leveraging a sophisticated k-means clustering-enhanced Support Vector Machine algorithm, distinctly categorizes robotics into flying or mobile robots. Initially, the paradigm considers robot locations and features as quintessential parameters indicative of divergent robot patterns. Subsequently, employing the k-means clustering technique facilitates the efficient segregation and consolidation of robotic data, significantly optimizing the support vector delineation process and expediting the recognition phase. Following this preparatory phase, the SVM methodology is adeptly applied to construct a discriminative hyperplane, enabling precise classification and prognostication of the robot category. To substantiate the efficacy and superiority of the k-means framework over traditional SVM approaches, a rigorous cross-validation experiment was orchestrated, evidencing the former's enhanced performance in robot group classification.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge