Changsong Wei

Integration of Mamba and Transformer -- MAT for Long-Short Range Time Series Forecasting with Application to Weather Dynamics

Sep 13, 2024

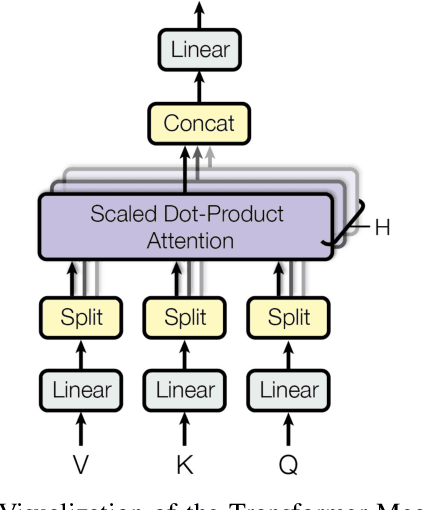

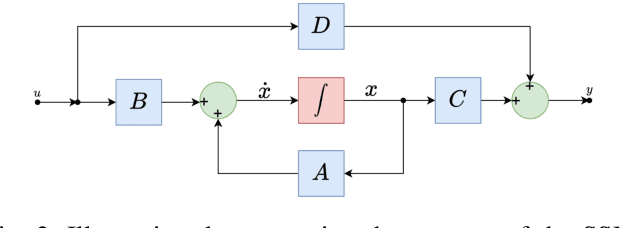

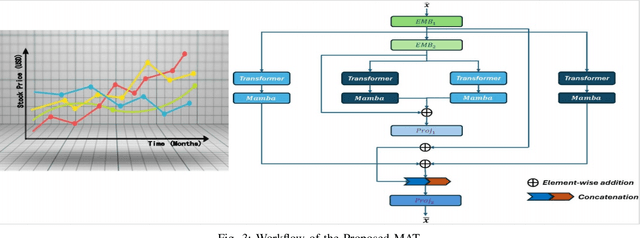

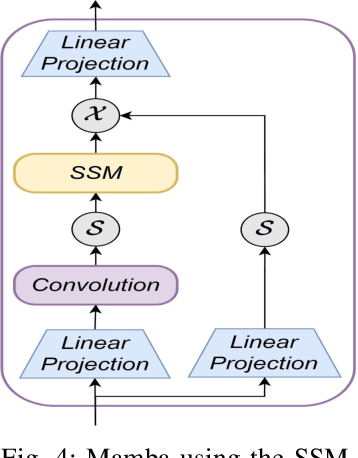

Abstract:Long-short range time series forecasting is essential for predicting future trends and patterns over extended periods. While deep learning models such as Transformers have made significant strides in advancing time series forecasting, they often encounter difficulties in capturing long-term dependencies and effectively managing sparse semantic features. The state-space model, Mamba, addresses these issues through its adept handling of selective input and parallel computing, striking a balance between computational efficiency and prediction accuracy. This article examines the advantages and disadvantages of both Mamba and Transformer models, and introduces a combined approach, MAT, which leverages the strengths of each model to capture unique long-short range dependencies and inherent evolutionary patterns in multivariate time series. Specifically, MAT harnesses the long-range dependency capabilities of Mamba and the short-range characteristics of Transformers. Experimental results on benchmark weather datasets demonstrate that MAT outperforms existing comparable methods in terms of prediction accuracy, scalability, and memory efficiency.

Research on Autonomous Driving Decision-making Strategies based Deep Reinforcement Learning

Aug 06, 2024

Abstract:The behavior decision-making subsystem is a key component of the autonomous driving system, which reflects the decision-making ability of the vehicle and the driver, and is an important symbol of the high-level intelligence of the vehicle. However, the existing rule-based decision-making schemes are limited by the prior knowledge of designers, and it is difficult to cope with complex and changeable traffic scenarios. In this work, an advanced deep reinforcement learning model is adopted, which can autonomously learn and optimize driving strategies in a complex and changeable traffic environment by modeling the driving decision-making process as a reinforcement learning problem. Specifically, we used Deep Q-Network (DQN) and Proximal Policy Optimization (PPO) for comparative experiments. DQN guides the agent to choose the best action by approximating the state-action value function, while PPO improves the decision-making quality by optimizing the policy function. We also introduce improvements in the design of the reward function to promote the robustness and adaptability of the model in real-world driving situations. Experimental results show that the decision-making strategy based on deep reinforcement learning has better performance than the traditional rule-based method in a variety of driving tasks.

Predicting Stock Prices with FinBERT-LSTM: Integrating News Sentiment Analysis

Jul 23, 2024

Abstract:The stock market's ascent typically mirrors the flourishing state of the economy, whereas its decline is often an indicator of an economic downturn. Therefore, for a long time, significant correlation elements for predicting trends in financial stock markets have been widely discussed, and people are becoming increasingly interested in the task of financial text mining. The inherent instability of stock prices makes them acutely responsive to fluctuations within the financial markets. In this article, we use deep learning networks, based on the history of stock prices and articles of financial, business, technical news that introduce market information to predict stock prices. We illustrate the enhancement of predictive precision by integrating weighted news categories into the forecasting model. We developed a pre-trained NLP model known as FinBERT, designed to discern the sentiments within financial texts. Subsequently, we advanced this model by incorporating the sophisticated Long Short Term Memory (LSTM) architecture, thus constructing the innovative FinBERT-LSTM model. This model utilizes news categories related to the stock market structure hierarchy, namely market, industry, and stock related news categories, combined with the stock market's stock price situation in the previous week for prediction. We selected NASDAQ-100 index stock data and trained the model on Benzinga news articles, and utilized Mean Absolute Error (MAE), Mean Absolute Percentage Error (MAPE), and Accuracy as the key metrics for the assessment and comparative analysis of the model's performance. The results indicate that FinBERT-LSTM performs the best, followed by LSTM, and DNN model ranks third in terms of effectiveness.

Exploiting Diffusion Prior for Out-of-Distribution Detection

Jun 16, 2024

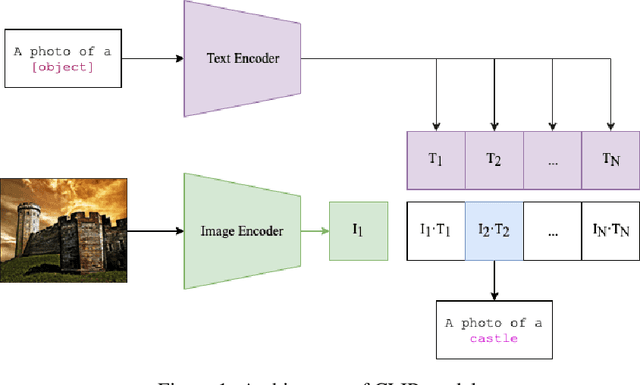

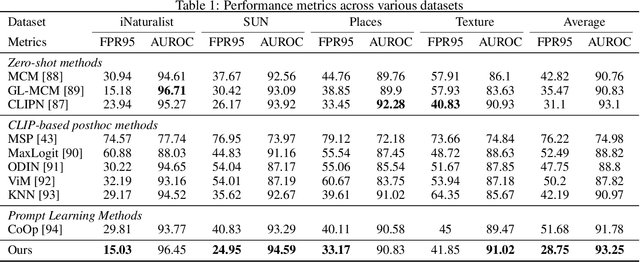

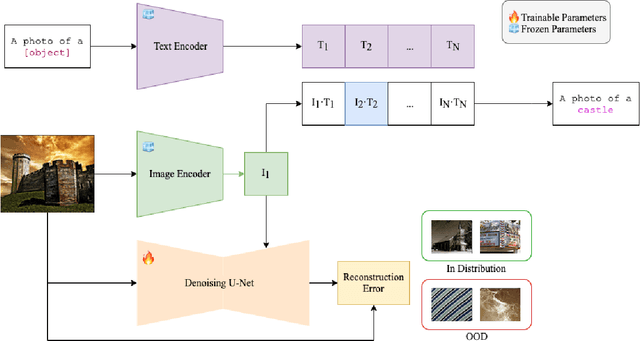

Abstract:Out-of-distribution (OOD) detection is crucial for deploying robust machine learning models, especially in areas where security is critical. However, traditional OOD detection methods often fail to capture complex data distributions from large scale date. In this paper, we present a novel approach for OOD detection that leverages the generative ability of diffusion models and the powerful feature extraction capabilities of CLIP. By using these features as conditional inputs to a diffusion model, we can reconstruct the images after encoding them with CLIP. The difference between the original and reconstructed images is used as a signal for OOD identification. The practicality and scalability of our method is increased by the fact that it does not require class-specific labeled ID data, as is the case with many other methods. Extensive experiments on several benchmark datasets demonstrates the robustness and effectiveness of our method, which have significantly improved the detection accuracy.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge