Luyao Zhang

DriveLiDAR4D: Sequential and Controllable LiDAR Scene Generation for Autonomous Driving

Nov 17, 2025Abstract:The generation of realistic LiDAR point clouds plays a crucial role in the development and evaluation of autonomous driving systems. Although recent methods for 3D LiDAR point cloud generation have shown significant improvements, they still face notable limitations, including the lack of sequential generation capabilities and the inability to produce accurately positioned foreground objects and realistic backgrounds. These shortcomings hinder their practical applicability. In this paper, we introduce DriveLiDAR4D, a novel LiDAR generation pipeline consisting of multimodal conditions and a novel sequential noise prediction model LiDAR4DNet, capable of producing temporally consistent LiDAR scenes with highly controllable foreground objects and realistic backgrounds. To the best of our knowledge, this is the first work to address the sequential generation of LiDAR scenes with full scene manipulation capability in an end-to-end manner. We evaluated DriveLiDAR4D on the nuScenes and KITTI datasets, where we achieved an FRD score of 743.13 and an FVD score of 16.96 on the nuScenes dataset, surpassing the current state-of-the-art (SOTA) method, UniScene, with an performance boost of 37.2% in FRD and 24.1% in FVD, respectively.

LINR Bridge: Vector Graphic Animation via Neural Implicits and Video Diffusion Priors

Sep 09, 2025Abstract:Vector graphics, known for their scalability and user-friendliness, provide a unique approach to visual content compared to traditional pixel-based images. Animation of these graphics, driven by the motion of their elements, offers enhanced comprehensibility and controllability but often requires substantial manual effort. To automate this process, we propose a novel method that integrates implicit neural representations with text-to-video diffusion models for vector graphic animation. Our approach employs layered implicit neural representations to reconstruct vector graphics, preserving their inherent properties such as infinite resolution and precise color and shape constraints, which effectively bridges the large domain gap between vector graphics and diffusion models. The neural representations are then optimized using video score distillation sampling, which leverages motion priors from pretrained text-to-video diffusion models. Finally, the vector graphics are warped to match the representations resulting in smooth animation. Experimental results validate the effectiveness of our method in generating vivid and natural vector graphic animations, demonstrating significant improvement over existing techniques that suffer from limitations in flexibility and animation quality.

Parallel Branch Model Predictive Control on GPUs

Jun 16, 2025Abstract:We present a parallel GPU-accelerated solver for branch Model Predictive Control problems. Based on iterative LQR methods, our solver exploits the tree-sparse structure and implements temporal parallelism using the parallel scan algorithm. Consequently, the proposed solver enables parallelism across both the prediction horizon and the scenarios. In addition, we utilize an augmented Lagrangian method to handle general inequality constraints. We compare our solver with state-of-the-art numerical solvers in two automated driving applications. The numerical results demonstrate that, compared to CPU-based solvers, our solver achieves competitive performance for problems with short horizons and small-scale trees, while outperforming other solvers on large-scale problems.

EthosGPT: Mapping Human Value Diversity to Advance Sustainable Development Goals (SDGs)

Apr 14, 2025Abstract:Large language models (LLMs) are transforming global decision-making and societal systems by processing diverse data at unprecedented scales. However, their potential to homogenize human values poses critical risks, similar to biodiversity loss undermining ecological resilience. Rooted in the ancient Greek concept of ethos, meaning both individual character and the shared moral fabric of communities, EthosGPT draws on a tradition that spans from Aristotle's virtue ethics to Adam Smith's moral sentiments as the ethical foundation of economic cooperation. These traditions underscore the vital role of value diversity in fostering social trust, institutional legitimacy, and long-term prosperity. EthosGPT addresses the challenge of value homogenization by introducing an open-source framework for mapping and evaluating LLMs within a global scale of human values. Using international survey data on cultural indices, prompt-based assessments, and comparative statistical analyses, EthosGPT reveals both the adaptability and biases of LLMs across regions and cultures. It offers actionable insights for developing inclusive LLMs, such as diversifying training data and preserving endangered cultural heritage to ensure representation in AI systems. These contributions align with the United Nations Sustainable Development Goals (SDGs), especially SDG 10 (Reduced Inequalities), SDG 11.4 (Cultural Heritage Preservation), and SDG 16 (Peace, Justice and Strong Institutions). Through interdisciplinary collaboration, EthosGPT promotes AI systems that are both technically robust and ethically inclusive, advancing value plurality as a cornerstone for sustainable and equitable futures.

FinML-Chain: A Blockchain-Integrated Dataset for Enhanced Financial Machine Learning

Nov 25, 2024

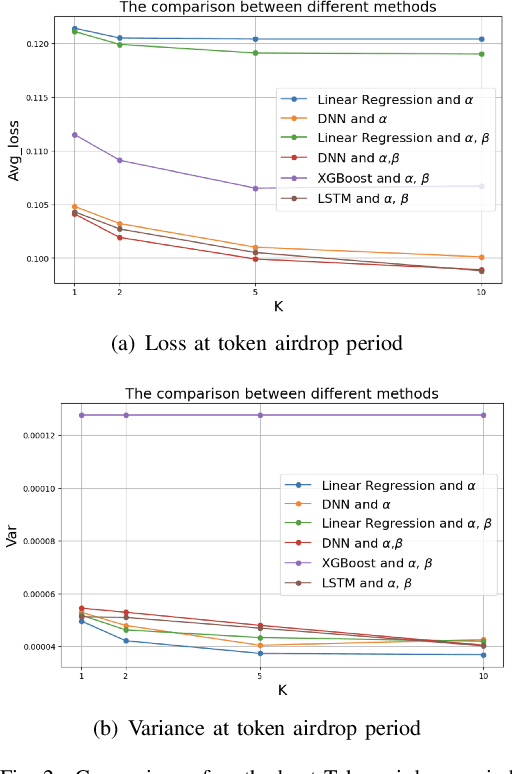

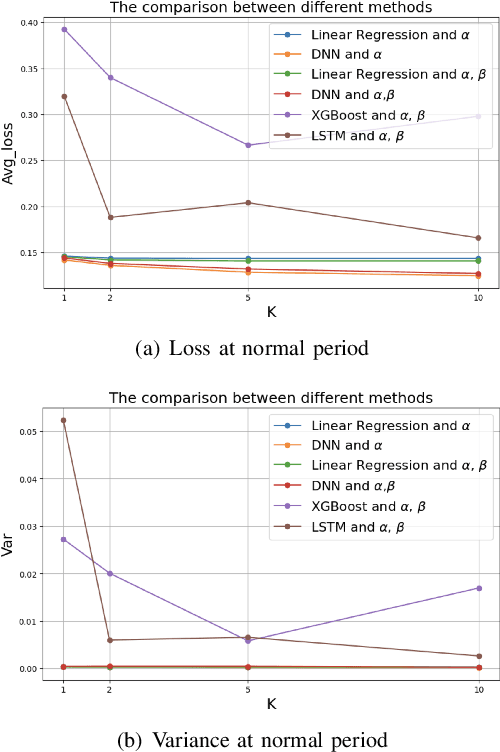

Abstract:Machine learning is critical for innovation and efficiency in financial markets, offering predictive models and data-driven decision-making. However, challenges such as missing data, lack of transparency, untimely updates, insecurity, and incompatible data sources limit its effectiveness. Blockchain technology, with its transparency, immutability, and real-time updates, addresses these challenges. We present a framework for integrating high-frequency on-chain data with low-frequency off-chain data, providing a benchmark for addressing novel research questions in economic mechanism design. This framework generates modular, extensible datasets for analyzing economic mechanisms such as the Transaction Fee Mechanism, enabling multi-modal insights and fairness-driven evaluations. Using four machine learning techniques, including linear regression, deep neural networks, XGBoost, and LSTM models, we demonstrate the framework's ability to produce datasets that advance financial research and improve understanding of blockchain-driven systems. Our contributions include: (1) proposing a research scenario for the Transaction Fee Mechanism and demonstrating how the framework addresses previously unexplored questions in economic mechanism design; (2) providing a benchmark for financial machine learning by open-sourcing a sample dataset generated by the framework and the code for the pipeline, enabling continuous dataset expansion; and (3) promoting reproducibility, transparency, and collaboration by fully open-sourcing the framework and its outputs. This initiative supports researchers in extending our work and developing innovative financial machine-learning models, fostering advancements at the intersection of machine learning, blockchain, and economics.

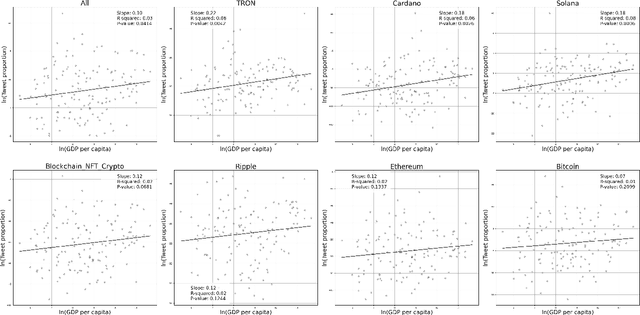

Global Public Sentiment on Decentralized Finance: A Spatiotemporal Analysis of Geo-tagged Tweets from 150 Countries

Sep 01, 2024

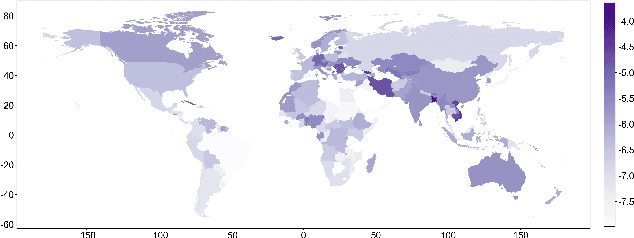

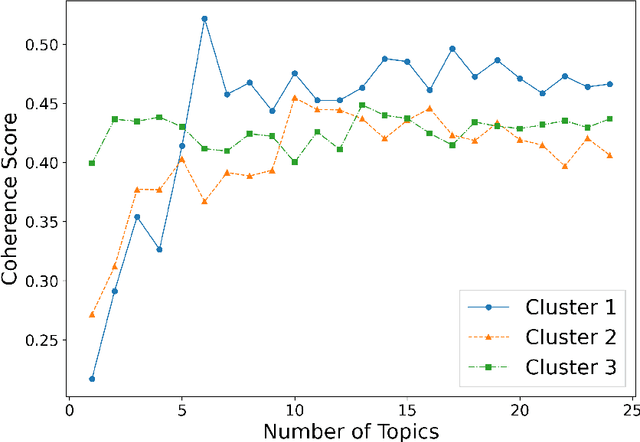

Abstract:In the digital era, blockchain technology, cryptocurrencies, and non-fungible tokens (NFTs) have transformed financial and decentralized systems. However, existing research often neglects the spatiotemporal variations in public sentiment toward these technologies, limiting macro-level insights into their global impact. This study leverages Twitter data to explore public attention and sentiment across 150 countries, analyzing over 150 million geotagged tweets from 2012 to 2022. Sentiment scores were derived using a BERT-based multilingual sentiment model trained on 7.4 billion tweets. The analysis integrates global cryptocurrency regulations and economic indicators from the World Development Indicators database. Results reveal significant global sentiment variations influenced by economic factors, with more developed nations engaging more in discussions, while less developed countries show higher sentiment levels. Geographically weighted regression indicates that GDP-tweet engagement correlation intensifies following Bitcoin price surges. Topic modeling shows that countries within similar economic clusters share discussion trends, while different clusters focus on distinct topics. This study highlights global disparities in sentiment toward decentralized finance, shaped by economic and regional factors, with implications for poverty alleviation, cryptocurrency crime, and sustainable development. The dataset and code are publicly available on GitHub.

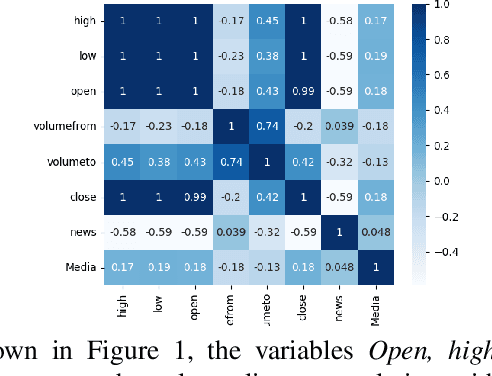

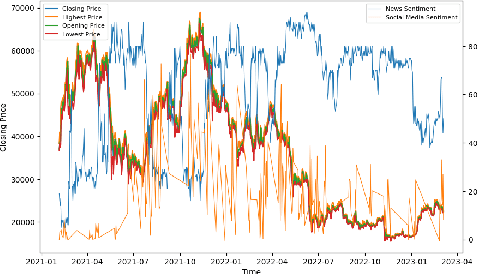

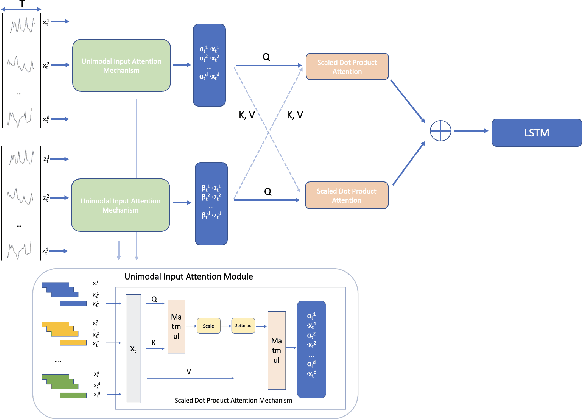

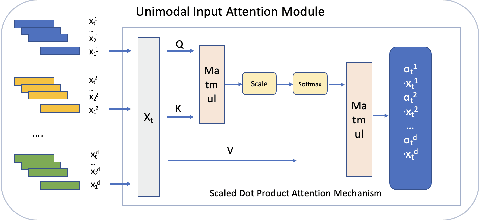

DAM: A Universal Dual Attention Mechanism for Multimodal Timeseries Cryptocurrency Trend Forecasting

May 01, 2024

Abstract:In the distributed systems landscape, Blockchain has catalyzed the rise of cryptocurrencies, merging enhanced security and decentralization with significant investment opportunities. Despite their potential, current research on cryptocurrency trend forecasting often falls short by simplistically merging sentiment data without fully considering the nuanced interplay between financial market dynamics and external sentiment influences. This paper presents a novel Dual Attention Mechanism (DAM) for forecasting cryptocurrency trends using multimodal time-series data. Our approach, which integrates critical cryptocurrency metrics with sentiment data from news and social media analyzed through CryptoBERT, addresses the inherent volatility and prediction challenges in cryptocurrency markets. By combining elements of distributed systems, natural language processing, and financial forecasting, our method outperforms conventional models like LSTM and Transformer by up to 20\% in prediction accuracy. This advancement deepens the understanding of distributed systems and has practical implications in financial markets, benefiting stakeholders in cryptocurrency and blockchain technologies. Moreover, our enhanced forecasting approach can significantly support decentralized science (DeSci) by facilitating strategic planning and the efficient adoption of blockchain technologies, improving operational efficiency and financial risk management in the rapidly evolving digital asset domain, thus ensuring optimal resource allocation.

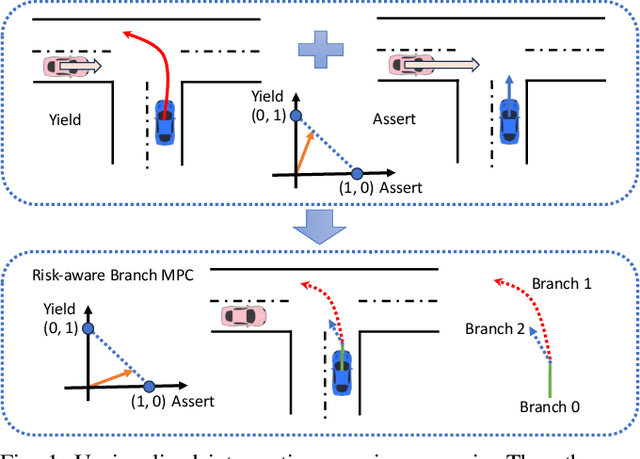

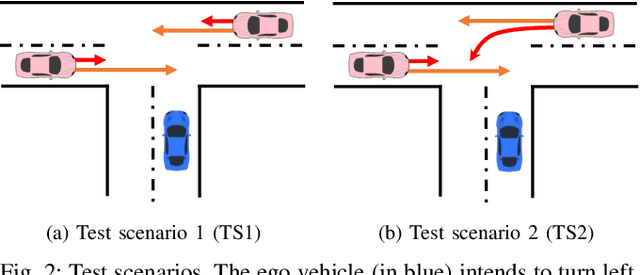

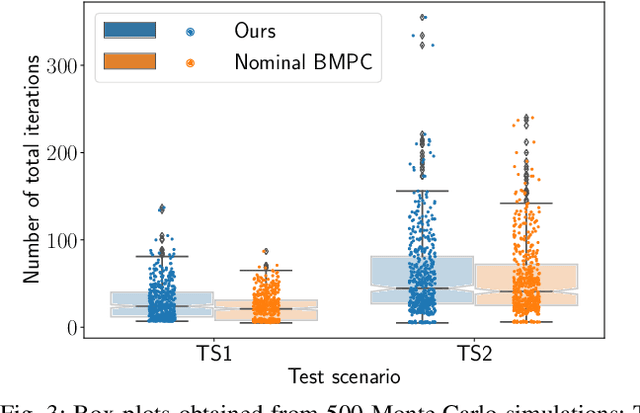

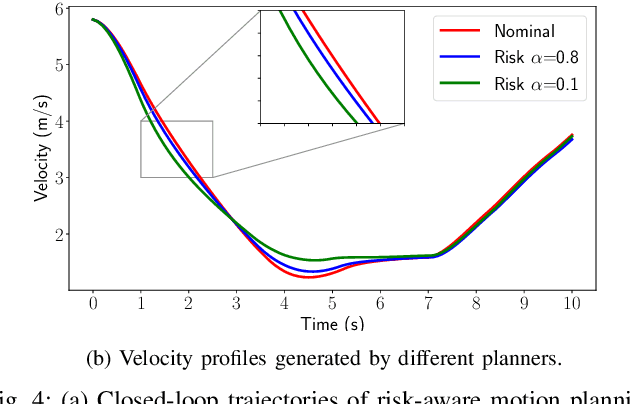

An Efficient Risk-aware Branch MPC for Automated Driving that is Robust to Uncertain Vehicle Behaviors

Mar 27, 2024

Abstract:One of the critical challenges in automated driving is ensuring safety of automated vehicles despite the unknown behavior of the other vehicles. Although motion prediction modules are able to generate a probability distribution associated with various behavior modes, their probabilistic estimates are often inaccurate, thus leading to a possibly unsafe trajectory. To overcome this challenge, we propose a risk-aware motion planning framework that appropriately accounts for the ambiguity in the estimated probability distribution. We formulate the risk-aware motion planning problem as a min-max optimization problem and develop an efficient iterative method by incorporating a regularization term in the probability update step. Via extensive numerical studies, we validate the convergence of our method and demonstrate its advantages compared to the state-of-the-art approaches.

An Efficient Game-Theoretic Planner for Automated Lane Merging with Multi-Modal Behavior Understanding

Dec 02, 2023Abstract:In this paper, we propose a novel behavior planner that combines game theory with search-based planning for automated lane merging. Specifically, inspired by human drivers, we model the interaction between vehicles as a gap selection process. To overcome the challenge of multi-modal behavior exhibited by the surrounding vehicles, we formulate the trajectory selection as a matrix game and compute an equilibrium. Next, we validate our proposed planner in the high-fidelity simulator CARLA and demonstrate its effectiveness in handling interactions in dense traffic scenarios.

Monotonicity for AI ethics and society: An empirical study of the monotonic neural additive model in criminology, education, health care, and finance

Jan 17, 2023Abstract:Algorithm fairness in the application of artificial intelligence (AI) is essential for a better society. As the foundational axiom of social mechanisms, fairness consists of multiple facets. Although the machine learning (ML) community has focused on intersectionality as a matter of statistical parity, especially in discrimination issues, an emerging body of literature addresses another facet -- monotonicity. Based on domain expertise, monotonicity plays a vital role in numerous fairness-related areas, where violations could misguide human decisions and lead to disastrous consequences. In this paper, we first systematically evaluate the significance of applying monotonic neural additive models (MNAMs), which use a fairness-aware ML algorithm to enforce both individual and pairwise monotonicity principles, for the fairness of AI ethics and society. We have found, through a hybrid method of theoretical reasoning, simulation, and extensive empirical analysis, that considering monotonicity axioms is essential in all areas of fairness, including criminology, education, health care, and finance. Our research contributes to the interdisciplinary research at the interface of AI ethics, explainable AI (XAI), and human-computer interactions (HCIs). By evidencing the catastrophic consequences if monotonicity is not met, we address the significance of monotonicity requirements in AI applications. Furthermore, we demonstrate that MNAMs are an effective fairness-aware ML approach by imposing monotonicity restrictions integrating human intelligence.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge