FinML-Chain: A Blockchain-Integrated Dataset for Enhanced Financial Machine Learning

Paper and Code

Nov 25, 2024

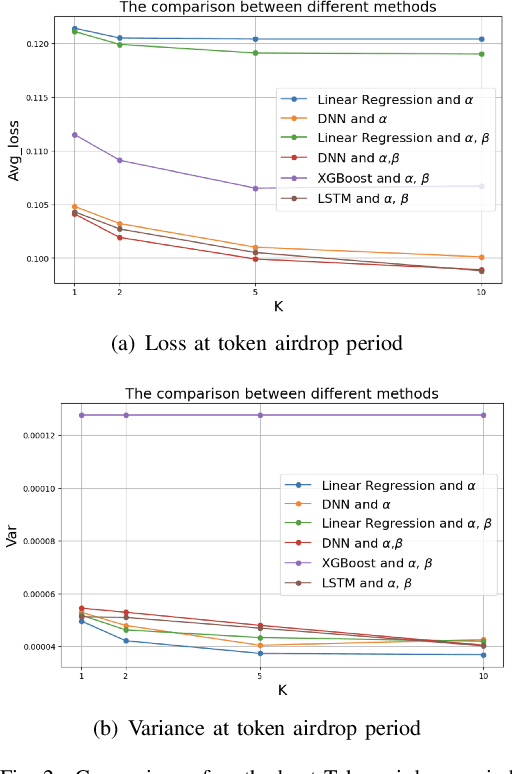

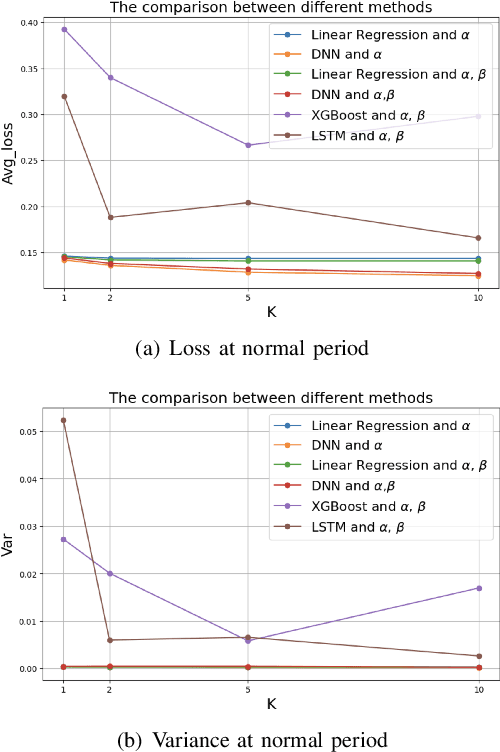

Machine learning is critical for innovation and efficiency in financial markets, offering predictive models and data-driven decision-making. However, challenges such as missing data, lack of transparency, untimely updates, insecurity, and incompatible data sources limit its effectiveness. Blockchain technology, with its transparency, immutability, and real-time updates, addresses these challenges. We present a framework for integrating high-frequency on-chain data with low-frequency off-chain data, providing a benchmark for addressing novel research questions in economic mechanism design. This framework generates modular, extensible datasets for analyzing economic mechanisms such as the Transaction Fee Mechanism, enabling multi-modal insights and fairness-driven evaluations. Using four machine learning techniques, including linear regression, deep neural networks, XGBoost, and LSTM models, we demonstrate the framework's ability to produce datasets that advance financial research and improve understanding of blockchain-driven systems. Our contributions include: (1) proposing a research scenario for the Transaction Fee Mechanism and demonstrating how the framework addresses previously unexplored questions in economic mechanism design; (2) providing a benchmark for financial machine learning by open-sourcing a sample dataset generated by the framework and the code for the pipeline, enabling continuous dataset expansion; and (3) promoting reproducibility, transparency, and collaboration by fully open-sourcing the framework and its outputs. This initiative supports researchers in extending our work and developing innovative financial machine-learning models, fostering advancements at the intersection of machine learning, blockchain, and economics.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge