Keiko Harimoto

Incorporating Pre-trained Model Prompting in Multimodal Stock Volume Movement Prediction

Sep 11, 2023Abstract:Multimodal stock trading volume movement prediction with stock-related news is one of the fundamental problems in the financial area. Existing multimodal works that train models from scratch face the problem of lacking universal knowledge when modeling financial news. In addition, the models ability may be limited by the lack of domain-related knowledge due to insufficient data in the datasets. To handle this issue, we propose the Prompt-based MUltimodal Stock volumE prediction model (ProMUSE) to process text and time series modalities. We use pre-trained language models for better comprehension of financial news and adopt prompt learning methods to leverage their capability in universal knowledge to model textual information. Besides, simply fusing two modalities can cause harm to the unimodal representations. Thus, we propose a novel cross-modality contrastive alignment while reserving the unimodal heads beside the fusion head to mitigate this problem. Extensive experiments demonstrate that our proposed ProMUSE outperforms existing baselines. Comprehensive analyses further validate the effectiveness of our architecture compared to potential variants and learning mechanisms.

Distributional Correlation--Aware Knowledge Distillation for Stock Trading Volume Prediction

Aug 04, 2022

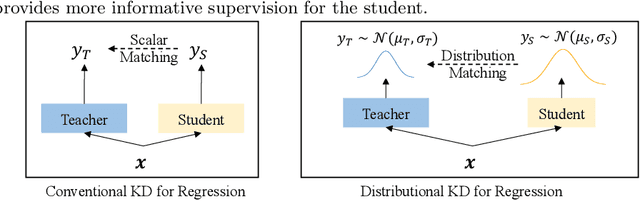

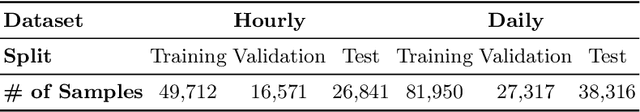

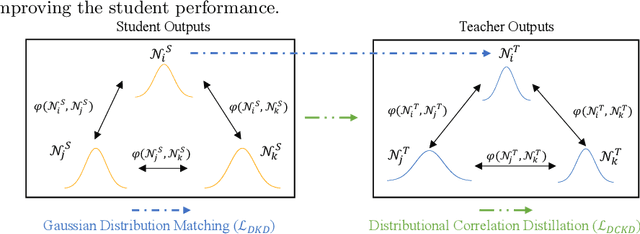

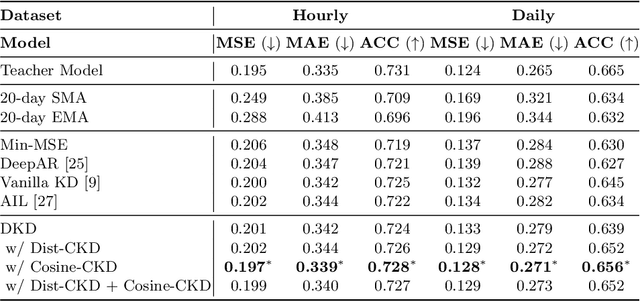

Abstract:Traditional knowledge distillation in classification problems transfers the knowledge via class correlations in the soft label produced by teacher models, which are not available in regression problems like stock trading volume prediction. To remedy this, we present a novel distillation framework for training a light-weight student model to perform trading volume prediction given historical transaction data. Specifically, we turn the regression model into a probabilistic forecasting model, by training models to predict a Gaussian distribution to which the trading volume belongs. The student model can thus learn from the teacher at a more informative distributional level, by matching its predicted distributions to that of the teacher. Two correlational distillation objectives are further introduced to encourage the student to produce consistent pair-wise relationships with the teacher model. We evaluate the framework on a real-world stock volume dataset with two different time window settings. Experiments demonstrate that our framework is superior to strong baseline models, compressing the model size by $5\times$ while maintaining $99.6\%$ prediction accuracy. The extensive analysis further reveals that our framework is more effective than vanilla distillation methods under low-resource scenarios.

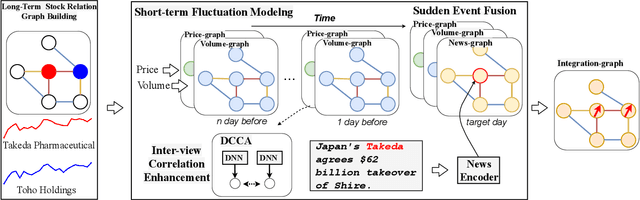

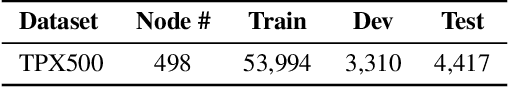

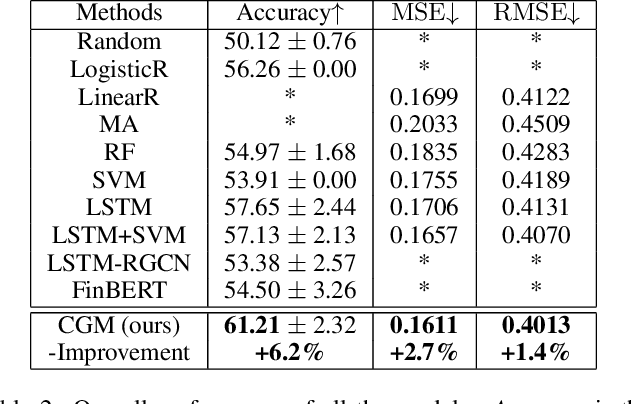

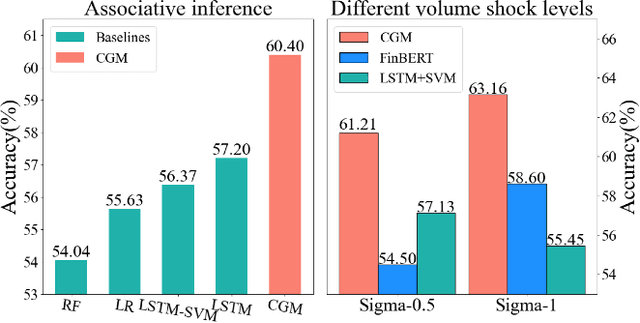

Long-term, Short-term and Sudden Event: Trading Volume Movement Prediction with Graph-based Multi-view Modeling

Aug 23, 2021

Abstract:Trading volume movement prediction is the key in a variety of financial applications. Despite its importance, there is few research on this topic because of its requirement for comprehensive understanding of information from different sources. For instance, the relation between multiple stocks, recent transaction data and suddenly released events are all essential for understanding trading market. However, most of the previous methods only take the fluctuation information of the past few weeks into consideration, thus yielding poor performance. To handle this issue, we propose a graphbased approach that can incorporate multi-view information, i.e., long-term stock trend, short-term fluctuation and sudden events information jointly into a temporal heterogeneous graph. Besides, our method is equipped with deep canonical analysis to highlight the correlations between different perspectives of fluctuation for better prediction. Experiment results show that our method outperforms strong baselines by a large margin.

ASAT: Adaptively Scaled Adversarial Training in Time Series

Aug 20, 2021

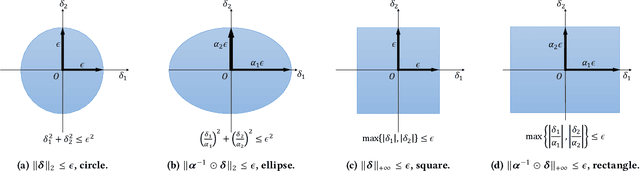

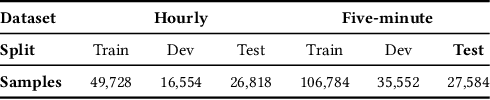

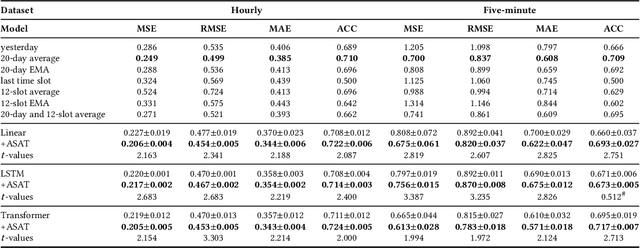

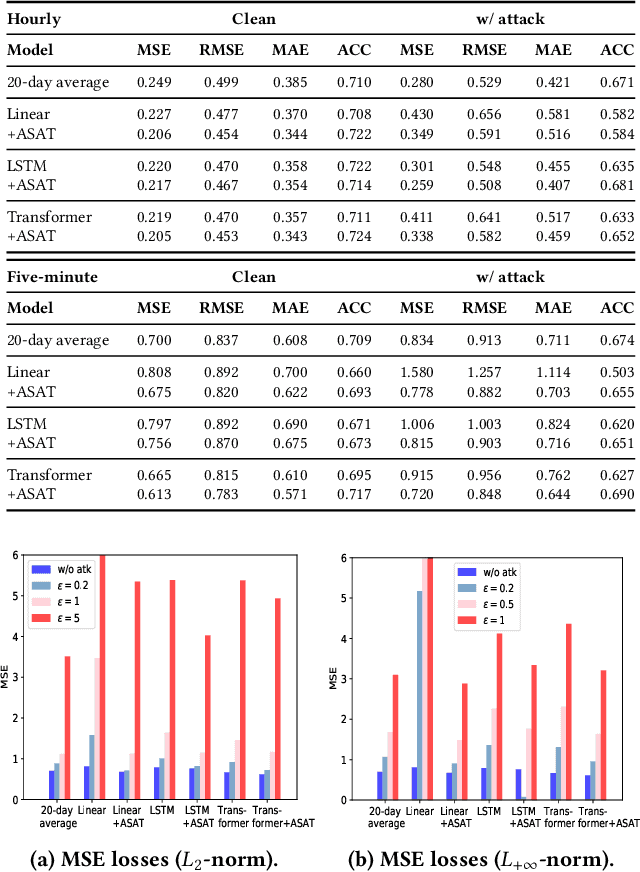

Abstract:Adversarial training is a method for enhancing neural networks to improve the robustness against adversarial examples. Besides the security concerns of potential adversarial examples, adversarial training can also improve the performance of the neural networks, train robust neural networks, and provide interpretability for neural networks. In this work, we take the first step to introduce adversarial training in time series analysis by taking the finance field as an example. Rethinking existing researches of adversarial training, we propose the adaptively scaled adversarial training (ASAT) in time series analysis, by treating data at different time slots with time-dependent importance weights. Experimental results show that the proposed ASAT can improve both the accuracy and the adversarial robustness of neural networks. Besides enhancing neural networks, we also propose the dimension-wise adversarial sensitivity indicator to probe the sensitivities and importance of input dimensions. With the proposed indicator, we can explain the decision bases of black box neural networks.

Learning Robust Representation for Clustering through Locality Preserving Variational Discriminative Network

Dec 25, 2020

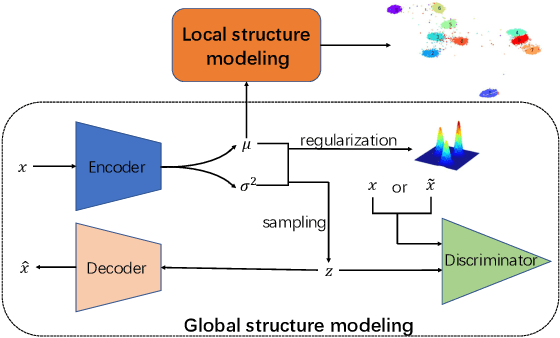

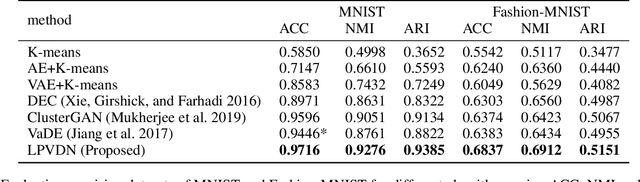

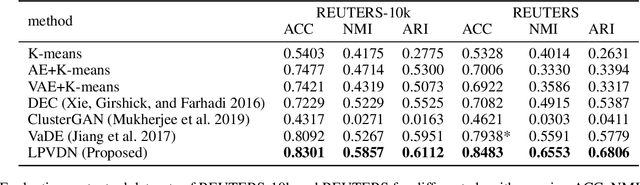

Abstract:Clustering is one of the fundamental problems in unsupervised learning. Recent deep learning based methods focus on learning clustering oriented representations. Among those methods, Variational Deep Embedding achieves great success in various clustering tasks by specifying a Gaussian Mixture prior to the latent space. However, VaDE suffers from two problems: 1) it is fragile to the input noise; 2) it ignores the locality information between the neighboring data points. In this paper, we propose a joint learning framework that improves VaDE with a robust embedding discriminator and a local structure constraint, which are both helpful to improve the robustness of our model. Experiment results on various vision and textual datasets demonstrate that our method outperforms the state-of-the-art baseline models in all metrics. Further detailed analysis shows that our proposed model is very robust to the adversarial inputs, which is a desirable property for practical applications.

Group, Extract and Aggregate: Summarizing a Large Amount of Finance News for Forex Movement Prediction

Oct 11, 2019

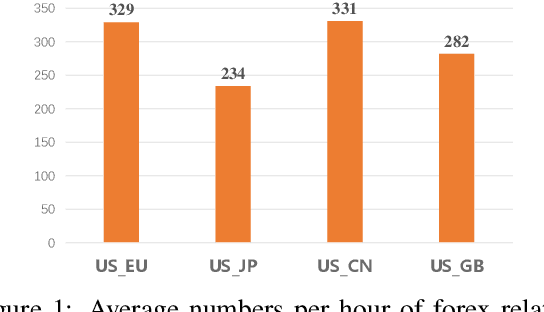

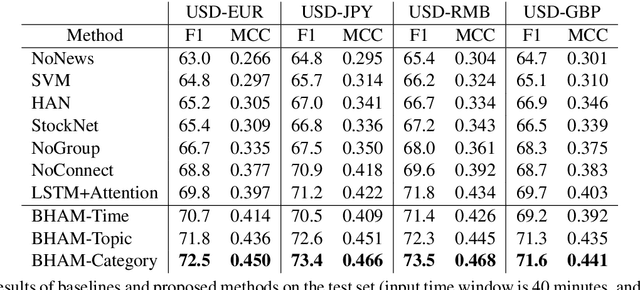

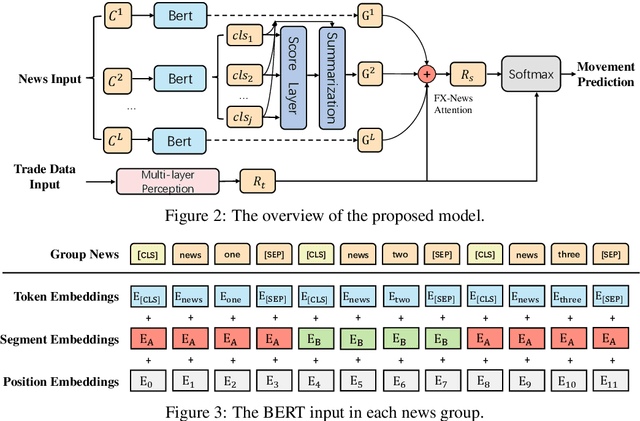

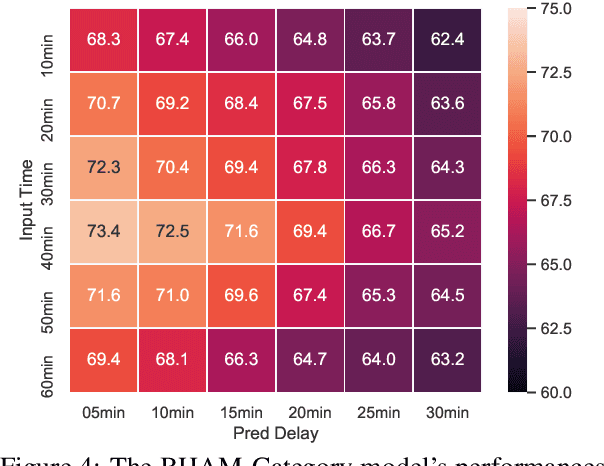

Abstract:Incorporating related text information has proven successful in stock market prediction. However, it is a huge challenge to utilize texts in the enormous forex (foreign currency exchange) market because the associated texts are too redundant. In this work, we propose a BERT-based Hierarchical Aggregation Model to summarize a large amount of finance news to predict forex movement. We firstly group news from different aspects: time, topic and category. Then we extract the most crucial news in each group by the SOTA extractive summarization method. Finally, we conduct interaction between the news and the trade data with attention to predict the forex movement. The experimental results show that the category based method performs best among three grouping methods and outperforms all the baselines. Besides, we study the influence of essential news attributes (category and region) by statistical analysis and summarize the influence patterns for different currency pairs.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge