Zhihao Cen

Accelerate Neural Subspace-Based Reduced-Order Solver of Deformable Simulation by Lipschitz Optimization

Sep 05, 2024

Abstract:Reduced-order simulation is an emerging method for accelerating physical simulations with high DOFs, and recently developed neural-network-based methods with nonlinear subspaces have been proven effective in diverse applications as more concise subspaces can be detected. However, the complexity and landscape of simulation objectives within the subspace have not been optimized, which leaves room for enhancement of the convergence speed. This work focuses on this point by proposing a general method for finding optimized subspace mappings, enabling further acceleration of neural reduced-order simulations while capturing comprehensive representations of the configuration manifolds. We achieve this by optimizing the Lipschitz energy of the elasticity term in the simulation objective, and incorporating the cubature approximation into the training process to manage the high memory and time demands associated with optimizing the newly introduced energy. Our method is versatile and applicable to both supervised and unsupervised settings for optimizing the parameterizations of the configuration manifolds. We demonstrate the effectiveness of our approach through general cases in both quasi-static and dynamics simulations. Our method achieves acceleration factors of up to 6.83 while consistently preserving comparable simulation accuracy in various cases, including large twisting, bending, and rotational deformations with collision handling. This novel approach offers significant potential for accelerating physical simulations, and can be a good add-on to existing neural-network-based solutions in modeling complex deformable objects.

Offline Reinforcement Learning for Optimizing Production Bidding Policies

Oct 13, 2023Abstract:The online advertising market, with its thousands of auctions run per second, presents a daunting challenge for advertisers who wish to optimize their spend under a budget constraint. Thus, advertising platforms typically provide automated agents to their customers, which act on their behalf to bid for impression opportunities in real time at scale. Because these proxy agents are owned by the platform but use advertiser funds to operate, there is a strong practical need to balance reliability and explainability of the agent with optimizing power. We propose a generalizable approach to optimizing bidding policies in production environments by learning from real data using offline reinforcement learning. This approach can be used to optimize any differentiable base policy (practically, a heuristic policy based on principles which the advertiser can easily understand), and only requires data generated by the base policy itself. We use a hybrid agent architecture that combines arbitrary base policies with deep neural networks, where only the optimized base policy parameters are eventually deployed, and the neural network part is discarded after training. We demonstrate that such an architecture achieves statistically significant performance gains in both simulated and at-scale production bidding environments. Our approach does not incur additional infrastructure, safety, or explainability costs, as it directly optimizes parameters of existing production routines without replacing them with black box-style models like neural networks.

Hedonic Prices and Quality Adjusted Price Indices Powered by AI

Apr 28, 2023

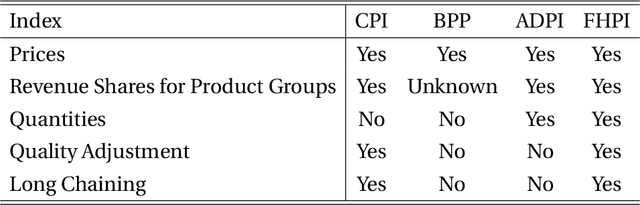

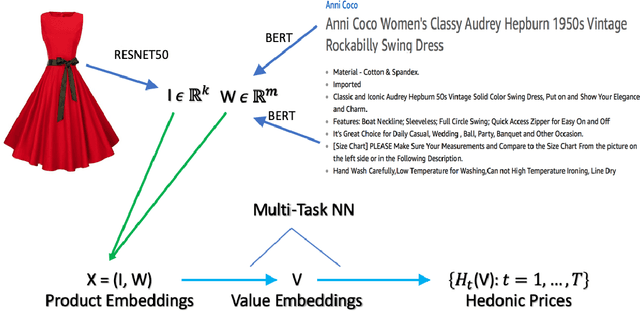

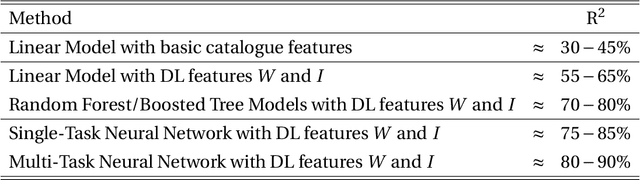

Abstract:Accurate, real-time measurements of price index changes using electronic records are essential for tracking inflation and productivity in today's economic environment. We develop empirical hedonic models that can process large amounts of unstructured product data (text, images, prices, quantities) and output accurate hedonic price estimates and derived indices. To accomplish this, we generate abstract product attributes, or ``features,'' from text descriptions and images using deep neural networks, and then use these attributes to estimate the hedonic price function. Specifically, we convert textual information about the product to numeric features using large language models based on transformers, trained or fine-tuned using product descriptions, and convert the product image to numeric features using a residual network model. To produce the estimated hedonic price function, we again use a multi-task neural network trained to predict a product's price in all time periods simultaneously. To demonstrate the performance of this approach, we apply the models to Amazon's data for first-party apparel sales and estimate hedonic prices. The resulting models have high predictive accuracy, with $R^2$ ranging from $80\%$ to $90\%$. Finally, we construct the AI-based hedonic Fisher price index, chained at the year-over-year frequency. We contrast the index with the CPI and other electronic indices.

Periodic-GP: Learning Periodic World with Gaussian Process Bandits

Jun 09, 2021

Abstract:We consider the sequential decision optimization on the periodic environment, that occurs in a wide variety of real-world applications when the data involves seasonality, such as the daily demand of drivers in ride-sharing and dynamic traffic patterns in transportation. In this work, we focus on learning the stochastic periodic world by leveraging this seasonal law. To deal with the general action space, we use the bandit based on Gaussian process (GP) as the base model due to its flexibility and generality, and propose the Periodic-GP method with a temporal periodic kernel based on the upper confidence bound. Theoretically, we provide a new regret bound of the proposed method, by explicitly characterizing the periodic kernel in the periodic stationary model. Empirically, the proposed algorithm significantly outperforms the existing methods in both synthetic data experiments and a real data application on Madrid traffic pollution.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge