Jiajia Huang

AuditWen:An Open-Source Large Language Model for Audit

Oct 09, 2024

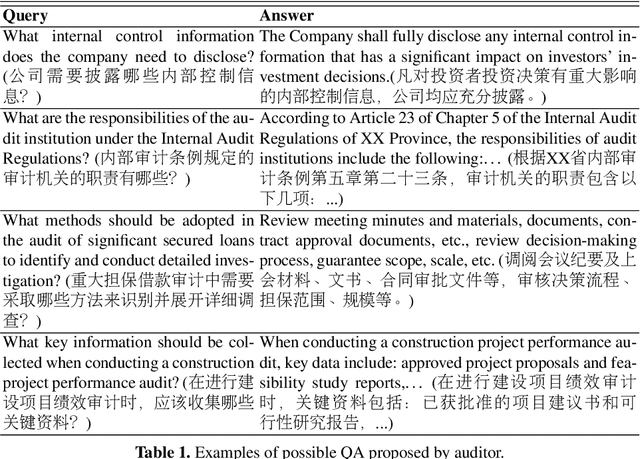

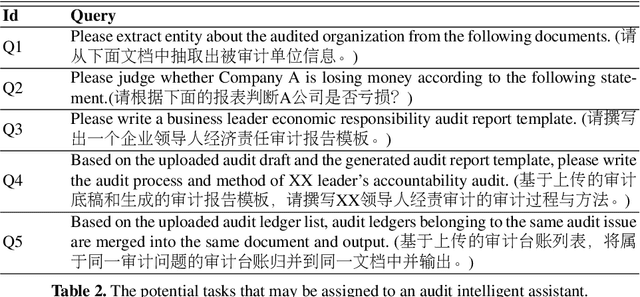

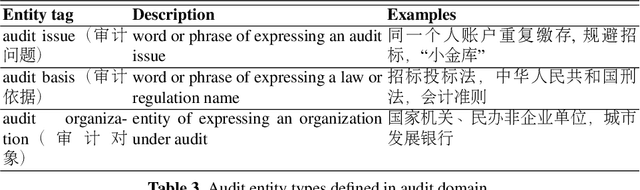

Abstract:Intelligent auditing represents a crucial advancement in modern audit practices, enhancing both the quality and efficiency of audits within the realm of artificial intelligence. With the rise of large language model (LLM), there is enormous potential for intelligent models to contribute to audit domain. However, general LLMs applied in audit domain face the challenges of lacking specialized knowledge and the presence of data biases. To overcome these challenges, this study introduces AuditWen, an open-source audit LLM by fine-tuning Qwen with constructing instruction data from audit domain. We first outline the application scenarios for LLMs in the audit and extract requirements that shape the development of LLMs tailored for audit purposes. We then propose an audit LLM, called AuditWen, by fine-tuning Qwen with constructing 28k instruction dataset from 15 audit tasks and 3 layers. In evaluation stage, we proposed a benchmark with 3k instructions that covers a set of critical audit tasks derived from the application scenarios. With the benchmark, we compare AuditWen with other existing LLMs from information extraction, question answering and document generation. The experimental results demonstrate superior performance of AuditWen both in question understanding and answer generation, making it an immediately valuable tool for audit.

The FinBen: An Holistic Financial Benchmark for Large Language Models

Feb 20, 2024

Abstract:LLMs have transformed NLP and shown promise in various fields, yet their potential in finance is underexplored due to a lack of thorough evaluations and the complexity of financial tasks. This along with the rapid development of LLMs, highlights the urgent need for a systematic financial evaluation benchmark for LLMs. In this paper, we introduce FinBen, the first comprehensive open-sourced evaluation benchmark, specifically designed to thoroughly assess the capabilities of LLMs in the financial domain. FinBen encompasses 35 datasets across 23 financial tasks, organized into three spectrums of difficulty inspired by the Cattell-Horn-Carroll theory, to evaluate LLMs' cognitive abilities in inductive reasoning, associative memory, quantitative reasoning, crystallized intelligence, and more. Our evaluation of 15 representative LLMs, including GPT-4, ChatGPT, and the latest Gemini, reveals insights into their strengths and limitations within the financial domain. The findings indicate that GPT-4 leads in quantification, extraction, numerical reasoning, and stock trading, while Gemini shines in generation and forecasting; however, both struggle with complex extraction and forecasting, showing a clear need for targeted enhancements. Instruction tuning boosts simple task performance but falls short in improving complex reasoning and forecasting abilities. FinBen seeks to continuously evaluate LLMs in finance, fostering AI development with regular updates of tasks and models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge