Andi Chen

A Tensor Residual Circuit Neural Network Factorized with Matrix Product Operation

Nov 12, 2025Abstract:It is challenging to reduce the complexity of neural networks while maintaining their generalization ability and robustness, especially for practical applications. Conventional solutions for this problem incorporate quantum-inspired neural networks with Kronecker products and hybrid tensor neural networks with MPO factorization and fully-connected layers. Nonetheless, the generalization power and robustness of the fully-connected layers are not as outstanding as circuit models in quantum computing. In this paper, we propose a novel tensor circuit neural network (TCNN) that takes advantage of the characteristics of tensor neural networks and residual circuit models to achieve generalization ability and robustness with low complexity. The proposed activation operation and parallelism of the circuit in complex number field improves its non-linearity and efficiency for feature learning. Moreover, since the feature information exists in the parameters in both the real and imaginary parts in TCNN, an information fusion layer is proposed for merging features stored in those parameters to enhance the generalization capability. Experimental results confirm that TCNN showcases more outstanding generalization and robustness with its average accuracies on various datasets 2\%-3\% higher than those of the state-of-the-art compared models. More significantly, while other models fail to learn features under noise parameter attacking, TCNN still showcases prominent learning capability owing to its ability to prevent gradient explosion. Furthermore, it is comparable to the compared models on the number of trainable parameters and the CPU running time. An ablation study also indicates the advantage of the activation operation, the parallelism architecture and the information fusion layer.

Enhancing Exchange Rate Forecasting with Explainable Deep Learning Models

Oct 25, 2024

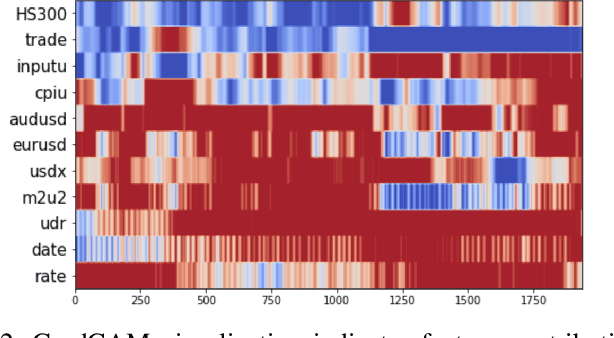

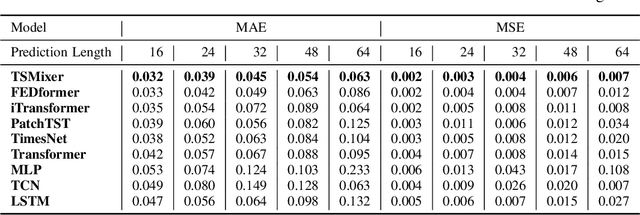

Abstract:Accurate exchange rate prediction is fundamental to financial stability and international trade, positioning it as a critical focus in economic and financial research. Traditional forecasting models often falter when addressing the inherent complexities and non-linearities of exchange rate data. This study explores the application of advanced deep learning models, including LSTM, CNN, and transformer-based architectures, to enhance the predictive accuracy of the RMB/USD exchange rate. Utilizing 40 features across 6 categories, the analysis identifies TSMixer as the most effective model for this task. A rigorous feature selection process emphasizes the inclusion of key economic indicators, such as China-U.S. trade volumes and exchange rates of other major currencies like the euro-RMB and yen-dollar pairs. The integration of grad-CAM visualization techniques further enhances model interpretability, allowing for clearer identification of the most influential features and bolstering the credibility of the predictions. These findings underscore the pivotal role of fundamental economic data in exchange rate forecasting and highlight the substantial potential of machine learning models to deliver more accurate and reliable predictions, thereby serving as a valuable tool for financial analysis and decision-making.

Harnessing Earnings Reports for Stock Predictions: A QLoRA-Enhanced LLM Approach

Aug 13, 2024

Abstract:Accurate stock market predictions following earnings reports are crucial for investors. Traditional methods, particularly classical machine learning models, struggle with these predictions because they cannot effectively process and interpret extensive textual data contained in earnings reports and often overlook nuances that influence market movements. This paper introduces an advanced approach by employing Large Language Models (LLMs) instruction fine-tuned with a novel combination of instruction-based techniques and quantized low-rank adaptation (QLoRA) compression. Our methodology integrates 'base factors', such as financial metric growth and earnings transcripts, with 'external factors', including recent market indices performances and analyst grades, to create a rich, supervised dataset. This comprehensive dataset enables our models to achieve superior predictive performance in terms of accuracy, weighted F1, and Matthews correlation coefficient (MCC), especially evident in the comparison with benchmarks such as GPT-4. We specifically highlight the efficacy of the llama-3-8b-Instruct-4bit model, which showcases significant improvements over baseline models. The paper also discusses the potential of expanding the output capabilities to include a 'Hold' option and extending the prediction horizon, aiming to accommodate various investment styles and time frames. This study not only demonstrates the power of integrating cutting-edge AI with fine-tuned financial data but also paves the way for future research in enhancing AI-driven financial analysis tools.

Evaluating Modern Approaches in 3D Scene Reconstruction: NeRF vs Gaussian-Based Methods

Aug 08, 2024Abstract:Exploring the capabilities of Neural Radiance Fields (NeRF) and Gaussian-based methods in the context of 3D scene reconstruction, this study contrasts these modern approaches with traditional Simultaneous Localization and Mapping (SLAM) systems. Utilizing datasets such as Replica and ScanNet, we assess performance based on tracking accuracy, mapping fidelity, and view synthesis. Findings reveal that NeRF excels in view synthesis, offering unique capabilities in generating new perspectives from existing data, albeit at slower processing speeds. Conversely, Gaussian-based methods provide rapid processing and significant expressiveness but lack comprehensive scene completion. Enhanced by global optimization and loop closure techniques, newer methods like NICE-SLAM and SplaTAM not only surpass older frameworks such as ORB-SLAM2 in terms of robustness but also demonstrate superior performance in dynamic and complex environments. This comparative analysis bridges theoretical research with practical implications, shedding light on future developments in robust 3D scene reconstruction across various real-world applications.

Hybrid Quantum-inspired Resnet and Densenet for Pattern Recognition with Completeness Analysis

Mar 09, 2024Abstract:With the contemporary digital technology approaching, deep neural networks are emerging as the foundational algorithm of the artificial intelligence boom. Whereas, the evolving social demands have been emphasizing the necessity of novel methodologies to substitute traditional neural networks. Concurrently, the advent of the post-Moore era has spurred the development of quantum-inspired neural networks with outstanding potentials at certain circumstances. Nonetheless, a definitive evaluating system with detailed metrics is tremendously vital and indispensable owing to the vague indicators in comparison between the novel and traditional deep learning models at present. Hence, to improve and evaluate the performances of the novel neural networks more comprehensively in complex and unpredictable environments, we propose two hybrid quantum-inspired neural networks which are rooted in residual and dense connections respectively for pattern recognitions with completeness representation theory for model assessment. Comparative analyses against pure classical models with detailed frameworks reveal that our hybrid models with lower parameter complexity not only match the generalization power of pure classical models, but also outperform them notably in resistance to parameter attacks with various asymmetric noises. Moreover, our hybrid models indicate unique superiority to prevent gradient explosion problems through theoretical argumentation. Eventually, We elaborate on the application scenarios where our hybrid models are applicable and efficient, which paves the way for their industrialization and commercialization.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge