Michael Krumdick

On Finding Inconsistencies in Documents

Dec 21, 2025Abstract:Professionals in academia, law, and finance audit their documents because inconsistencies can result in monetary, reputational, and scientific costs. Language models (LMs) have the potential to dramatically speed up this auditing process. To understand their abilities, we introduce a benchmark, FIND (Finding INconsistencies in Documents), where each example is a document with an inconsistency inserted manually by a domain expert. Despite the documents being long, technical, and complex, the best-performing model (gpt-5) recovered 64% of the inserted inconsistencies. Surprisingly, gpt-5 also found undiscovered inconsistencies present in the original documents. For example, on 50 arXiv papers, we judged 136 out of 196 of the model's suggestions to be legitimate inconsistencies missed by the original authors. However, despite these findings, even the best models miss almost half of the inconsistencies in FIND, demonstrating that inconsistency detection is still a challenging task.

Complexity Scaling Laws for Neural Models using Combinatorial Optimization

Jun 15, 2025Abstract:Recent work on neural scaling laws demonstrates that model performance scales predictably with compute budget, model size, and dataset size. In this work, we develop scaling laws based on problem complexity. We analyze two fundamental complexity measures: solution space size and representation space size. Using the Traveling Salesman Problem (TSP) as a case study, we show that combinatorial optimization promotes smooth cost trends, and therefore meaningful scaling laws can be obtained even in the absence of an interpretable loss. We then show that suboptimality grows predictably for fixed-size models when scaling the number of TSP nodes or spatial dimensions, independent of whether the model was trained with reinforcement learning or supervised fine-tuning on a static dataset. We conclude with an analogy to problem complexity scaling in local search, showing that a much simpler gradient descent of the cost landscape produces similar trends.

BLEUBERI: BLEU is a surprisingly effective reward for instruction following

May 16, 2025

Abstract:Reward models are central to aligning LLMs with human preferences, but they are costly to train, requiring large-scale human-labeled preference data and powerful pretrained LLM backbones. Meanwhile, the increasing availability of high-quality synthetic instruction-following datasets raises the question: can simpler, reference-based metrics serve as viable alternatives to reward models during RL-based alignment? In this paper, we show first that BLEU, a basic string-matching metric, surprisingly matches strong reward models in agreement with human preferences on general instruction-following datasets. Based on this insight, we develop BLEUBERI, a method that first identifies challenging instructions and then applies Group Relative Policy Optimization (GRPO) using BLEU directly as the reward function. We demonstrate that BLEUBERI-trained models are competitive with models trained via reward model-guided RL across four challenging instruction-following benchmarks and three different base language models. A human evaluation further supports that the quality of BLEUBERI model outputs is on par with those from reward model-aligned models. Moreover, BLEUBERI models generate outputs that are more factually grounded than competing methods. Overall, we show that given access to high-quality reference outputs (easily obtained via existing instruction-following datasets or synthetic data generation), string matching-based metrics are cheap yet effective proxies for reward models during alignment. We release our code and data at https://github.com/lilakk/BLEUBERI.

No Free Labels: Limitations of LLM-as-a-Judge Without Human Grounding

Mar 07, 2025Abstract:LLM-as-a-Judge is a framework that uses an LLM (large language model) to evaluate the quality of natural language text - typically text that is also generated by an LLM. This framework holds great promise due to its relative low-cost, ease of use, and strong correlations with human stylistic preferences. However, LLM Judges have been shown to exhibit biases that can distort their judgments. We evaluate how well LLM Judges can grade whether a given response to a conversational question is correct, an ability crucial to soundly estimating the overall response quality. To do so, we create and publicly release a human-annotated dataset with labels of correctness for 1,200 LLM responses. We source questions from a combination of existing datasets and a novel, challenging benchmark (BFF-Bench) created for this analysis. We demonstrate a strong connection between an LLM's ability to correctly answer a question and grade responses to that question. Although aggregate level statistics might imply a judge has high agreement with human annotators, it will struggle on the subset of questions it could not answer. To address this issue, we recommend a simple solution: provide the judge with a correct, human-written reference answer. We perform an in-depth analysis on how reference quality can affect the performance of an LLM Judge. We show that providing a weaker judge (e.g. Qwen 2.5 7B) with higher quality references reaches better agreement with human annotators than a stronger judge (e.g. GPT-4o) with synthetic references.

Are Language Model Logits Calibrated?

Oct 21, 2024Abstract:Some information is factual (e.g., "Paris is in France"), whereas other information is probabilistic (e.g., "the coin flip will be a [Heads/Tails]."). We believe that good Language Models (LMs) should understand and reflect this nuance. Our work investigates this by testing if LMs' output probabilities are calibrated to their textual contexts. We define model "calibration" as the degree to which the output probabilities of candidate tokens are aligned with the relative likelihood that should be inferred from the given context. For example, if the context concerns two equally likely options (e.g., heads or tails for a fair coin), the output probabilities should reflect this. Likewise, context that concerns non-uniformly likely events (e.g., rolling a six with a die) should also be appropriately captured with proportionate output probabilities. We find that even in simple settings the best LMs (1) are poorly calibrated, and (2) have systematic biases (e.g., preferred colors and sensitivities to word orderings). For example, gpt-4o-mini often picks the first of two options presented in the prompt regardless of the options' implied likelihood, whereas Llama-3.1-8B picks the second. Our other consistent finding is mode-collapse: Instruction-tuned models often over-allocate probability mass on a single option. These systematic biases introduce non-intuitive model behavior, making models harder for users to understand.

An Analysis of Multilingual FActScore

Jun 20, 2024Abstract:FActScore has gained popularity as a metric to estimate the factuality of long-form texts generated by Large Language Models (LLMs) in English. However, there has not been any work in studying the behavior of FActScore in other languages. This paper studies the limitations of each component in the four-component pipeline of FActScore in the multilingual setting. We introduce a new dataset for FActScore on texts generated by strong multilingual LLMs. Our evaluation shows that LLMs exhibit distinct behaviors in both fact extraction and fact scoring tasks. No LLM produces consistent and reliable FActScore across languages with varying levels of resources. We also find that the knowledge source plays an important role in the quality of the estimated FActScore. Using Wikipedia as the knowledge source may hinder the true FActScore of long-form text due to its limited coverage in medium- and low-resource languages. We also incorporate three mitigations to our knowledge source that ultimately improve FActScore estimation across all languages.

SEC-QA: A Systematic Evaluation Corpus for Financial QA

Jun 20, 2024Abstract:The financial domain frequently deals with large numbers of long documents that are essential for daily operations. Significant effort is put towards automating financial data analysis. However, a persistent challenge, not limited to the finance domain, is the scarcity of datasets that accurately reflect real-world tasks for model evaluation. Existing datasets are often constrained by size, context, or relevance to practical applications. Moreover, LLMs are currently trained on trillions of tokens of text, limiting access to novel data or documents that models have not encountered during training for unbiased evaluation. We propose SEC-QA, a continuous dataset generation framework with two key features: 1) the semi-automatic generation of Question-Answer (QA) pairs spanning multiple long context financial documents, which better represent real-world financial scenarios; 2) the ability to continually refresh the dataset using the most recent public document collections, not yet ingested by LLMs. Our experiments show that current retrieval augmented generation methods systematically fail to answer these challenging multi-document questions. In response, we introduce a QA system based on program-of-thought that improves the ability to perform complex information retrieval and quantitative reasoning pipelines, thereby increasing QA accuracy.

BizBench: A Quantitative Reasoning Benchmark for Business and Finance

Nov 11, 2023Abstract:As large language models (LLMs) impact a growing number of complex domains, it is becoming increasingly important to have fair, accurate, and rigorous evaluation benchmarks. Evaluating the reasoning skills required for business and financial NLP stands out as a particularly difficult challenge. We introduce BizBench, a new benchmark for evaluating models' ability to reason about realistic financial problems. BizBench comprises 8 quantitative reasoning tasks. Notably, BizBench targets the complex task of question-answering (QA) for structured and unstructured financial data via program synthesis (i.e., code generation). We introduce three diverse financially-themed code-generation tasks from newly collected and augmented QA data. Additionally, we isolate distinct financial reasoning capabilities required to solve these QA tasks: reading comprehension of financial text and tables, which is required to extract correct intermediate values; and understanding domain knowledge (e.g., financial formulas) needed to calculate complex solutions. Collectively, these tasks evaluate a model's financial background knowledge, ability to extract numeric entities from financial documents, and capacity to solve problems with code. We conduct an in-depth evaluation of open-source and commercial LLMs, illustrating that BizBench is a challenging benchmark for quantitative reasoning in the finance and business domain.

A Graphical Approach to Document Layout Analysis

Aug 03, 2023Abstract:Document layout analysis (DLA) is the task of detecting the distinct, semantic content within a document and correctly classifying these items into an appropriate category (e.g., text, title, figure). DLA pipelines enable users to convert documents into structured machine-readable formats that can then be used for many useful downstream tasks. Most existing state-of-the-art (SOTA) DLA models represent documents as images, discarding the rich metadata available in electronically generated PDFs. Directly leveraging this metadata, we represent each PDF page as a structured graph and frame the DLA problem as a graph segmentation and classification problem. We introduce the Graph-based Layout Analysis Model (GLAM), a lightweight graph neural network competitive with SOTA models on two challenging DLA datasets - while being an order of magnitude smaller than existing models. In particular, the 4-million parameter GLAM model outperforms the leading 140M+ parameter computer vision-based model on 5 of the 11 classes on the DocLayNet dataset. A simple ensemble of these two models achieves a new state-of-the-art on DocLayNet, increasing mAP from 76.8 to 80.8. Overall, GLAM is over 5 times more efficient than SOTA models, making GLAM a favorable engineering choice for DLA tasks.

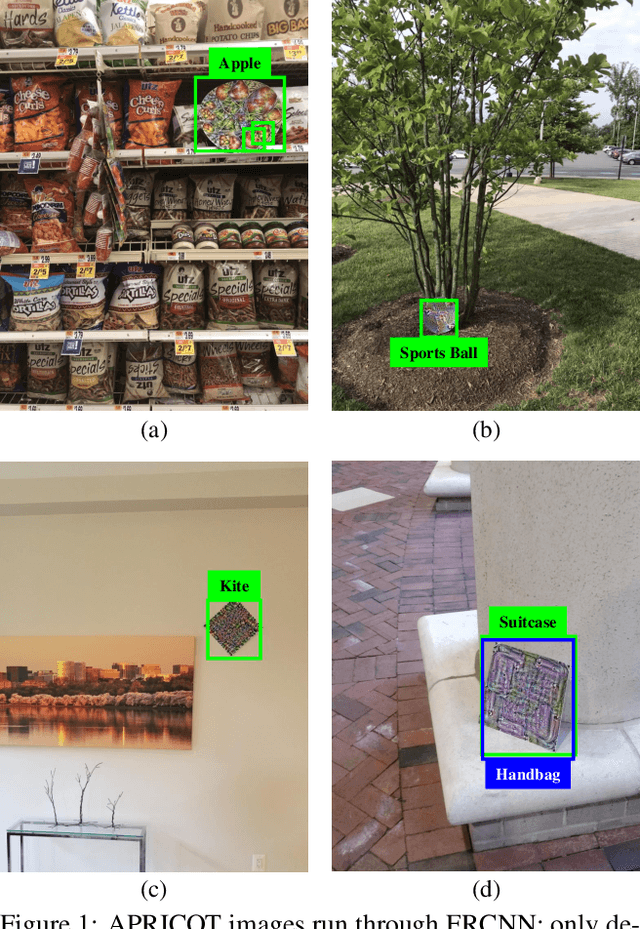

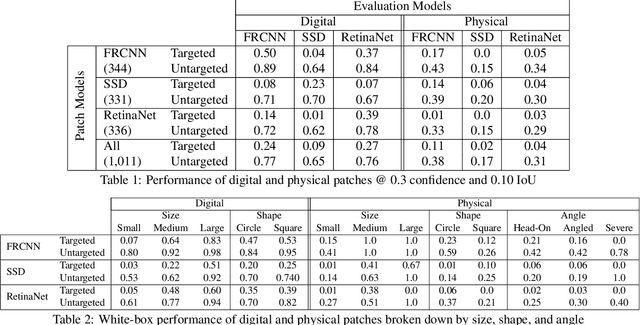

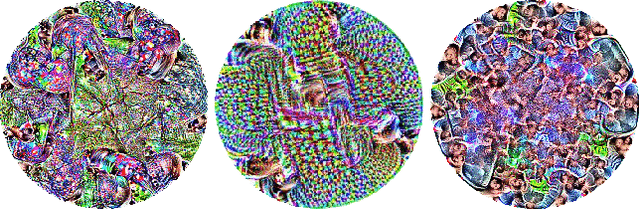

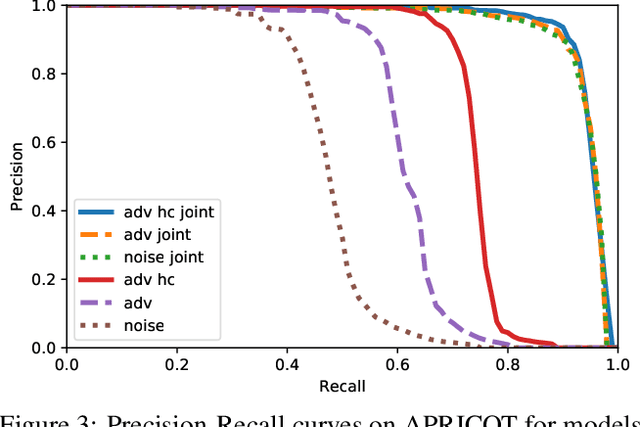

APRICOT: A Dataset of Physical Adversarial Attacks on Object Detection

Dec 17, 2019

Abstract:Physical adversarial attacks threaten to fool object detection systems, but reproducible research on the real-world effectiveness of physical patches and how to defend against them requires a publicly available benchmark dataset. We present APRICOT, a collection of over 1,000 annotated photographs of printed adversarial patches in public locations. The patches target several object categories for three COCO-trained detection models, and the photos represent natural variation in position, distance, lighting conditions, and viewing angle. Our analysis suggests that maintaining adversarial robustness in uncontrolled settings is highly challenging, but it is still possible to produce targeted detections under white-box and sometimes black-box settings. We establish baselines for defending against adversarial patches through several methods, including a detector supervised with synthetic data and unsupervised methods such as kernel density estimation, Bayesian uncertainty, and reconstruction error. Our results suggest that adversarial patches can be effectively flagged, both in a high-knowledge, attack-specific scenario, and in an unsupervised setting where patches are detected as anomalies in natural images. This dataset and the described experiments provide a benchmark for future research on the effectiveness of and defenses against physical adversarial objects in the wild.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge