Keith Houck

Privacy-Preserving Federated Learning over Vertically and Horizontally Partitioned Data for Financial Anomaly Detection

Oct 30, 2023Abstract:The effective detection of evidence of financial anomalies requires collaboration among multiple entities who own a diverse set of data, such as a payment network system (PNS) and its partner banks. Trust among these financial institutions is limited by regulation and competition. Federated learning (FL) enables entities to collaboratively train a model when data is either vertically or horizontally partitioned across the entities. However, in real-world financial anomaly detection scenarios, the data is partitioned both vertically and horizontally and hence it is not possible to use existing FL approaches in a plug-and-play manner. Our novel solution, PV4FAD, combines fully homomorphic encryption (HE), secure multi-party computation (SMPC), differential privacy (DP), and randomization techniques to balance privacy and accuracy during training and to prevent inference threats at model deployment time. Our solution provides input privacy through HE and SMPC, and output privacy against inference time attacks through DP. Specifically, we show that, in the honest-but-curious threat model, banks do not learn any sensitive features about PNS transactions, and the PNS does not learn any information about the banks' dataset but only learns prediction labels. We also develop and analyze a DP mechanism to protect output privacy during inference. Our solution generates high-utility models by significantly reducing the per-bank noise level while satisfying distributed DP. To ensure high accuracy, our approach produces an ensemble model, in particular, a random forest. This enables us to take advantage of the well-known properties of ensembles to reduce variance and increase accuracy. Our solution won second prize in the first phase of the U.S. Privacy Enhancing Technologies (PETs) Prize Challenge.

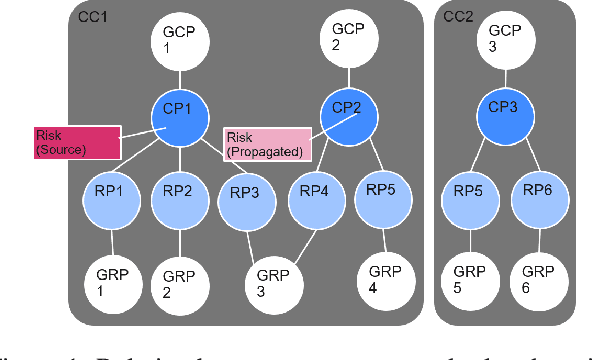

Towards Federated Graph Learning for Collaborative Financial Crimes Detection

Oct 02, 2019

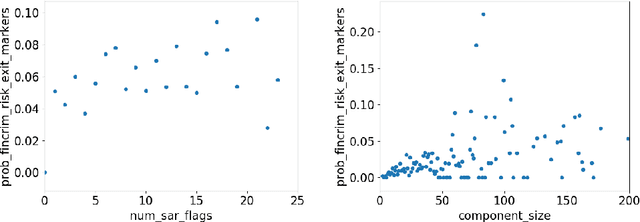

Abstract:Financial crime is a large and growing problem, in some way touching almost every financial institution. Financial institutions are the front line in the war against financial crime and accordingly, must devote substantial human and technology resources to this effort. Current processes to detect financial misconduct have limitations in their ability to effectively differentiate between malicious behavior and ordinary financial activity. These limitations tend to result in gross over-reporting of suspicious activity that necessitate time-intensive and costly manual review. Advances in technology used in this domain, including machine learning based approaches, can improve upon the effectiveness of financial institutions' existing processes, however, a key challenge that most financial institutions continue to face is that they address financial crimes in isolation without any insight from other firms. Where financial institutions address financial crimes through the lens of their own firm, perpetrators may devise sophisticated strategies that may span across institutions and geographies. Financial institutions continue to work relentlessly to advance their capabilities, forming partnerships across institutions to share insights, patterns and capabilities. These public-private partnerships are subject to stringent regulatory and data privacy requirements, thereby making it difficult to rely on traditional technology solutions. In this paper, we propose a methodology to share key information across institutions by using a federated graph learning platform that enables us to build more accurate machine learning models by leveraging federated learning and also graph learning approaches. We demonstrated that our federated model outperforms local model by 20% with the UK FCA TechSprint data set. This new platform opens up a door to efficiently detecting global money laundering activity.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge