Yuji Watanabe

IBM

Representing Prompting Patterns with PDL: Compliance Agent Case Study

Jul 08, 2025Abstract:Prompt engineering for LLMs remains complex, with existing frameworks either hiding complexity behind restrictive APIs or providing inflexible canned patterns that resist customization -- making sophisticated agentic programming challenging. We present the Prompt Declaration Language (PDL), a novel approach to prompt representation that tackles this fundamental complexity by bringing prompts to the forefront, enabling manual and automatic prompt tuning while capturing the composition of LLM calls together with rule-based code and external tools. By abstracting away the plumbing for such compositions, PDL aims at improving programmer productivity while providing a declarative representation that is amenable to optimization. This paper demonstrates PDL's utility through a real-world case study of a compliance agent. Tuning the prompting pattern of this agent yielded up to 4x performance improvement compared to using a canned agent and prompt pattern.

ITBench: Evaluating AI Agents across Diverse Real-World IT Automation Tasks

Feb 07, 2025

Abstract:Realizing the vision of using AI agents to automate critical IT tasks depends on the ability to measure and understand effectiveness of proposed solutions. We introduce ITBench, a framework that offers a systematic methodology for benchmarking AI agents to address real-world IT automation tasks. Our initial release targets three key areas: Site Reliability Engineering (SRE), Compliance and Security Operations (CISO), and Financial Operations (FinOps). The design enables AI researchers to understand the challenges and opportunities of AI agents for IT automation with push-button workflows and interpretable metrics. ITBench includes an initial set of 94 real-world scenarios, which can be easily extended by community contributions. Our results show that agents powered by state-of-the-art models resolve only 13.8% of SRE scenarios, 25.2% of CISO scenarios, and 0% of FinOps scenarios. We expect ITBench to be a key enabler of AI-driven IT automation that is correct, safe, and fast.

NP4G : Network Programming for Generalization

Dec 08, 2022Abstract:Automatic programming has been actively studied for a long time by various approaches including genetic programming. In recent years, automatic programming using neural networks such as GPT-3 has been actively studied and is attracting a lot of attention. However, these methods are illogical inference based on experience by enormous learning, and their thinking process is unclear. Even using the method by logical inference with a clear thinking process, the system that automatically generates any programs has not yet been realized. Especially, the inductive inference generalized by logical inference from one example is an important issue that the artificial intelligence can acquire knowledge by itself. In this study, we propose NP4G: Network Programming for Generalization, which can automatically generate programs by inductive inference. Because the proposed method can realize "sequence", "selection", and "iteration" in programming and can satisfy the conditions of the structured program theorem, it is expected that NP4G is a method automatically acquire any programs by inductive inference. As an example, we automatically construct a bitwise NOT operation program from several training data by generalization using NP4G. Although NP4G only randomly selects and connects nodes, by adjusting the number of nodes and the number of phase of "Phased Learning", we show the bitwise NOT operation programs are acquired in a comparatively short time and at a rate of about 7 in 10 running. The source code of NP4G is available on GitHub as a public repository.

Towards Federated Graph Learning for Collaborative Financial Crimes Detection

Oct 02, 2019

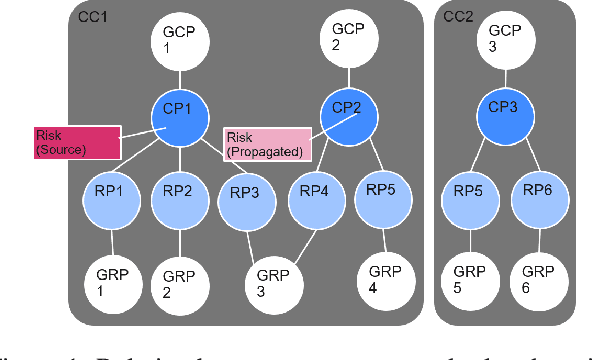

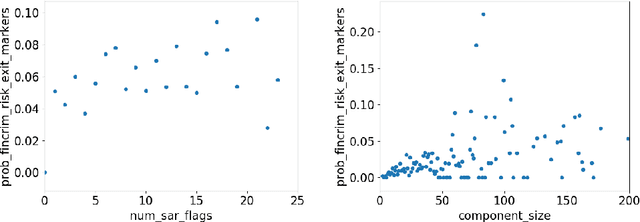

Abstract:Financial crime is a large and growing problem, in some way touching almost every financial institution. Financial institutions are the front line in the war against financial crime and accordingly, must devote substantial human and technology resources to this effort. Current processes to detect financial misconduct have limitations in their ability to effectively differentiate between malicious behavior and ordinary financial activity. These limitations tend to result in gross over-reporting of suspicious activity that necessitate time-intensive and costly manual review. Advances in technology used in this domain, including machine learning based approaches, can improve upon the effectiveness of financial institutions' existing processes, however, a key challenge that most financial institutions continue to face is that they address financial crimes in isolation without any insight from other firms. Where financial institutions address financial crimes through the lens of their own firm, perpetrators may devise sophisticated strategies that may span across institutions and geographies. Financial institutions continue to work relentlessly to advance their capabilities, forming partnerships across institutions to share insights, patterns and capabilities. These public-private partnerships are subject to stringent regulatory and data privacy requirements, thereby making it difficult to rely on traditional technology solutions. In this paper, we propose a methodology to share key information across institutions by using a federated graph learning platform that enables us to build more accurate machine learning models by leveraging federated learning and also graph learning approaches. We demonstrated that our federated model outperforms local model by 20% with the UK FCA TechSprint data set. This new platform opens up a door to efficiently detecting global money laundering activity.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge