Lucia Larise Stavarache

IBM Global Business Services

Exploring Multi-Banking Customer-to-Customer Relations in AML Context with Poincaré Embeddings

Dec 04, 2019

Abstract:In the recent years money laundering schemes have grown in complexity and speed of realization, affecting financial institutions and millions of customers globally. Strengthened privacy policies, along with in-country regulations, make it hard for banks to inner- and cross-share, and report suspicious activities for the AML (Anti-Money Laundering) measures. Existing topologies and models for AML analysis and information sharing are subject to major limitations, such as compliance with regulatory constraints, extended infrastructure to run high-computation algorithms, data quality and span, proving cumbersome and costly to execute, federate, and interpret. This paper proposes a new topology for exploring multi-banking customer social relations in AML context -- customer-to-customer, customer-to-transaction, and transaction-to-transaction -- using a 3D modeling topological algebra formulated through Poincar\'e embeddings.

Towards Federated Graph Learning for Collaborative Financial Crimes Detection

Oct 02, 2019

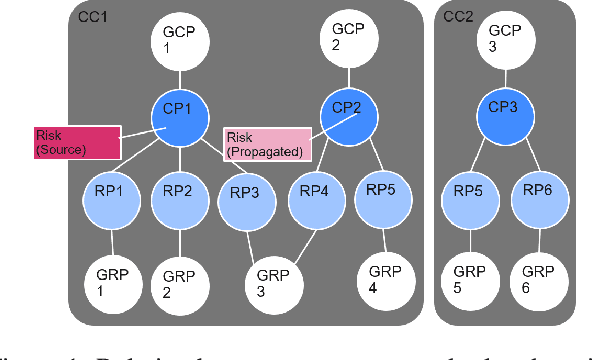

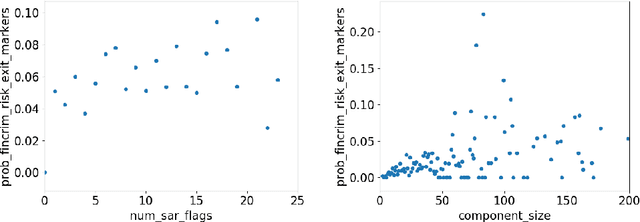

Abstract:Financial crime is a large and growing problem, in some way touching almost every financial institution. Financial institutions are the front line in the war against financial crime and accordingly, must devote substantial human and technology resources to this effort. Current processes to detect financial misconduct have limitations in their ability to effectively differentiate between malicious behavior and ordinary financial activity. These limitations tend to result in gross over-reporting of suspicious activity that necessitate time-intensive and costly manual review. Advances in technology used in this domain, including machine learning based approaches, can improve upon the effectiveness of financial institutions' existing processes, however, a key challenge that most financial institutions continue to face is that they address financial crimes in isolation without any insight from other firms. Where financial institutions address financial crimes through the lens of their own firm, perpetrators may devise sophisticated strategies that may span across institutions and geographies. Financial institutions continue to work relentlessly to advance their capabilities, forming partnerships across institutions to share insights, patterns and capabilities. These public-private partnerships are subject to stringent regulatory and data privacy requirements, thereby making it difficult to rely on traditional technology solutions. In this paper, we propose a methodology to share key information across institutions by using a federated graph learning platform that enables us to build more accurate machine learning models by leveraging federated learning and also graph learning approaches. We demonstrated that our federated model outperforms local model by 20% with the UK FCA TechSprint data set. This new platform opens up a door to efficiently detecting global money laundering activity.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge