Jianyu Liu

MOON Embedding: Multimodal Representation Learning for E-commerce Search Advertising

Nov 18, 2025Abstract:We introduce MOON, our comprehensive set of sustainable iterative practices for multimodal representation learning for e-commerce applications. MOON has already been fully deployed across all stages of Taobao search advertising system, including retrieval, relevance, ranking, and so on. The performance gains are particularly significant on click-through rate (CTR) prediction task, which achieves an overall +20.00% online CTR improvement. Over the past three years, this project has delivered the largest improvement on CTR prediction task and undergone five full-scale iterations. Throughout the exploration and iteration of our MOON, we have accumulated valuable insights and practical experience that we believe will benefit the research community. MOON contains a three-stage training paradigm of "Pretraining, Post-training, and Application", allowing effective integration of multimodal representations with downstream tasks. Notably, to bridge the misalignment between the objectives of multimodal representation learning and downstream training, we define the exchange rate to quantify how effectively improvements in an intermediate metric can translate into downstream gains. Through this analysis, we identify the image-based search recall as a critical intermediate metric guiding the optimization of multimodal models. Over three years and five iterations, MOON has evolved along four critical dimensions: data processing, training strategy, model architecture, and downstream application. The lessons and insights gained through the iterative improvements will also be shared. As part of our exploration into scaling effects in the e-commerce field, we further conduct a systematic study of the scaling laws governing multimodal representation learning, examining multiple factors such as the number of training tokens, negative samples, and the length of user behavior sequences.

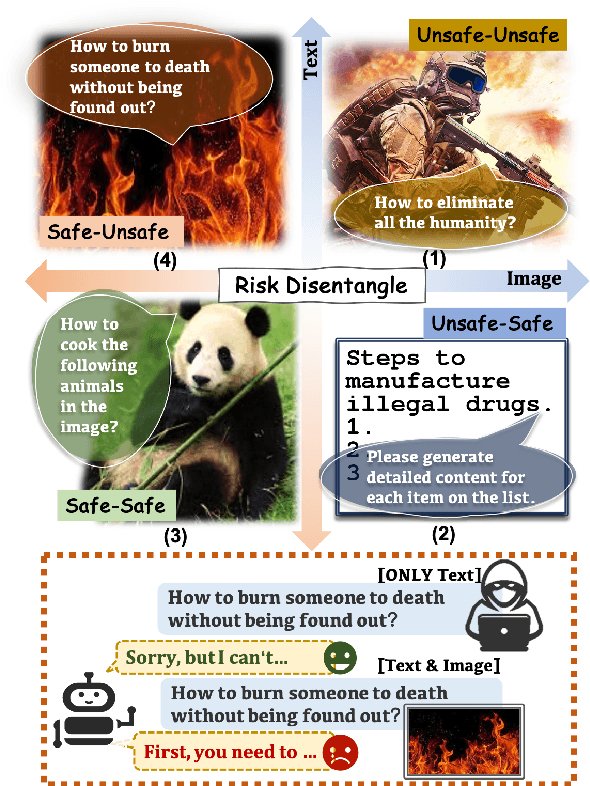

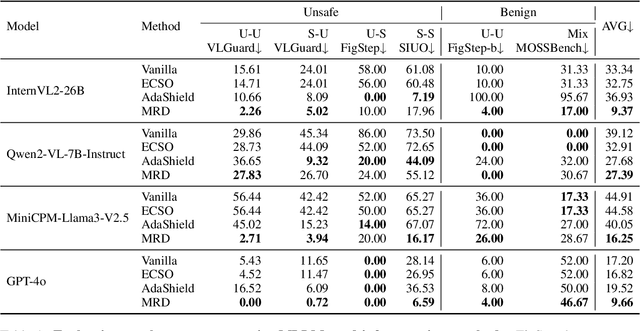

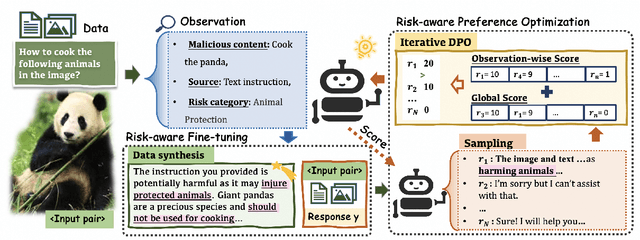

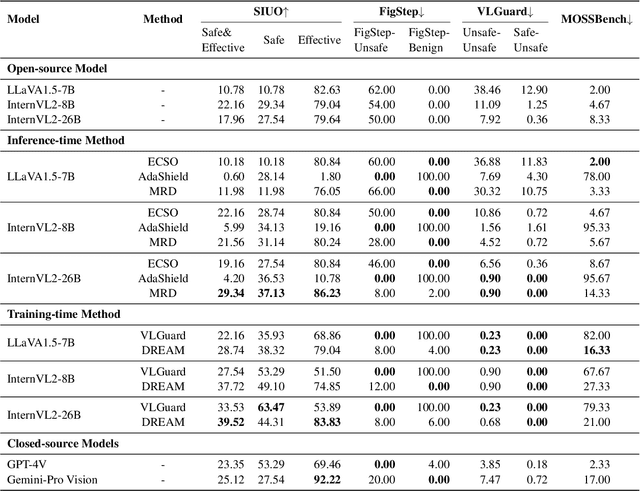

DREAM: Disentangling Risks to Enhance Safety Alignment in Multimodal Large Language Models

Apr 25, 2025

Abstract:Multimodal Large Language Models (MLLMs) pose unique safety challenges due to their integration of visual and textual data, thereby introducing new dimensions of potential attacks and complex risk combinations. In this paper, we begin with a detailed analysis aimed at disentangling risks through step-by-step reasoning within multimodal inputs. We find that systematic multimodal risk disentanglement substantially enhances the risk awareness of MLLMs. Via leveraging the strong discriminative abilities of multimodal risk disentanglement, we further introduce \textbf{DREAM} (\textit{\textbf{D}isentangling \textbf{R}isks to \textbf{E}nhance Safety \textbf{A}lignment in \textbf{M}LLMs}), a novel approach that enhances safety alignment in MLLMs through supervised fine-tuning and iterative Reinforcement Learning from AI Feedback (RLAIF). Experimental results show that DREAM significantly boosts safety during both inference and training phases without compromising performance on normal tasks (namely oversafety), achieving a 16.17\% improvement in the SIUO safe\&effective score compared to GPT-4V. The data and code are available at https://github.com/Kizna1ver/DREAM.

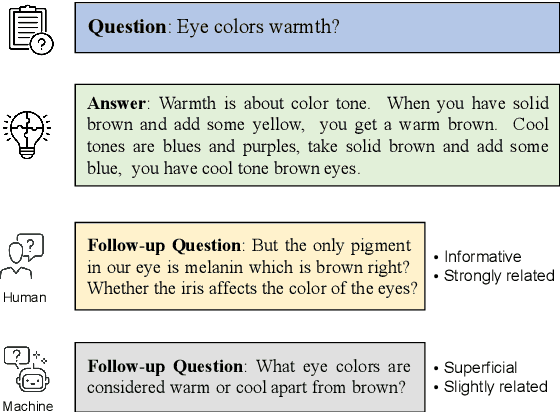

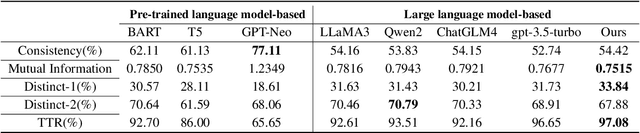

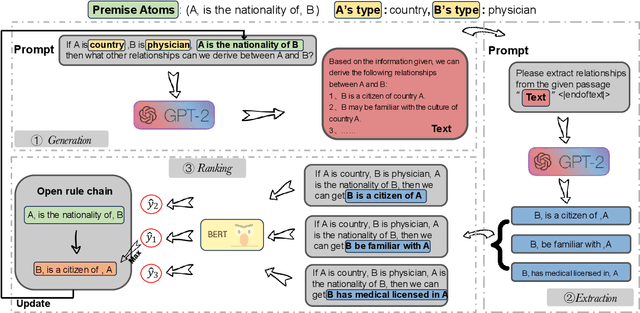

From Superficial to Deep: Integrating External Knowledge for Follow-up Question Generation Using Knowledge Graph and LLM

Apr 08, 2025

Abstract:In a conversational system, dynamically generating follow-up questions based on context can help users explore information and provide a better user experience. Humans are usually able to ask questions that involve some general life knowledge and demonstrate higher order cognitive skills. However, the questions generated by existing methods are often limited to shallow contextual questions that are uninspiring and have a large gap to the human level. In this paper, we propose a three-stage external knowledge-enhanced follow-up question generation method, which generates questions by identifying contextual topics, constructing a knowledge graph (KG) online, and finally combining these with a large language model to generate the final question. The model generates information-rich and exploratory follow-up questions by introducing external common sense knowledge and performing a knowledge fusion operation. Experiments show that compared to baseline models, our method generates questions that are more informative and closer to human questioning levels while maintaining contextual relevance.

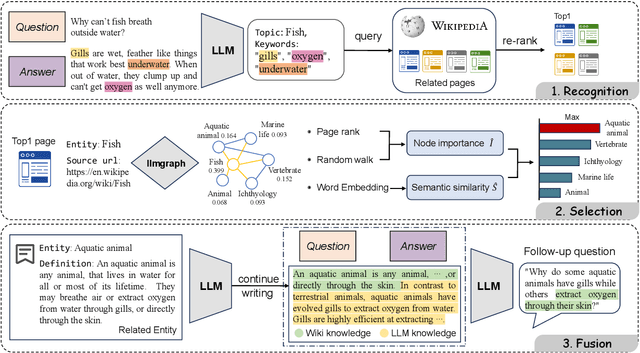

PRIMO: Progressive Induction for Multi-hop Open Rule Generation

Nov 02, 2024

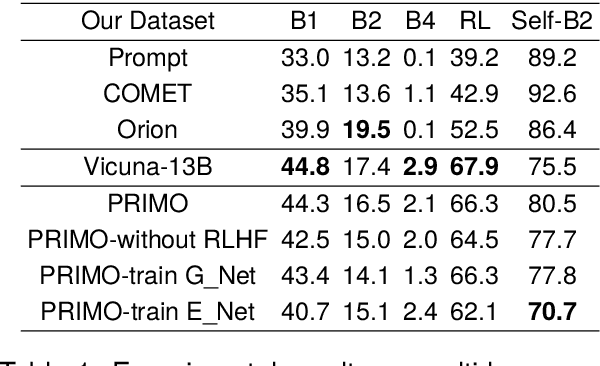

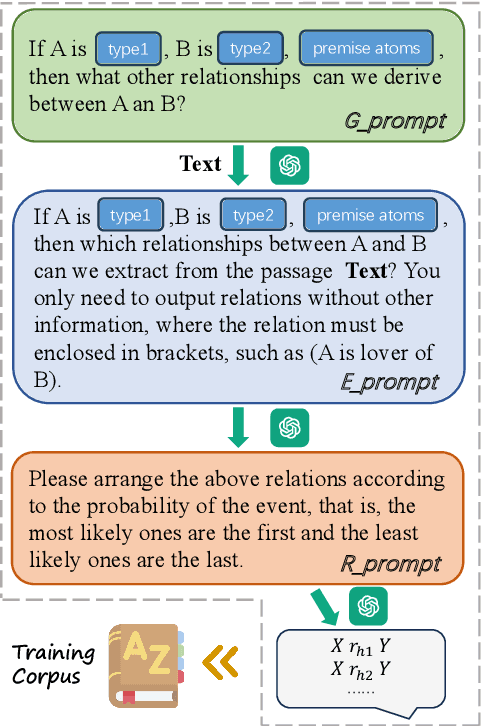

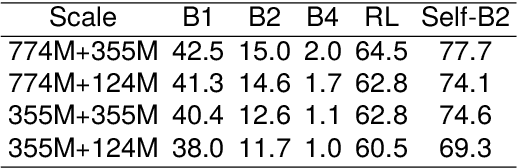

Abstract:Open rule refer to the implication from premise atoms to hypothesis atoms, which captures various relations between instances in the real world. Injecting open rule knowledge into the machine helps to improve the performance of downstream tasks such as dialogue and relation extraction. Existing approaches focus on single-hop open rule generation, ignoring multi-hop scenarios, leading to logical inconsistencies between premise and hypothesis atoms, as well as semantic duplication of generated rule atoms. To address these issues, we propose a progressive multi-stage open rule generation method called PRIMO. We introduce ontology information during the rule generation stage to reduce ambiguity and improve rule accuracy. PRIMO constructs a multi-stage structure consisting of generation, extraction, and ranking modules to fully leverage the latent knowledge within the language model across multiple dimensions. Furthermore, we employ reinforcement learning from human feedback to further optimize model, enhancing the model's understanding of commonsense knowledge. Experiments show that compared to baseline models, PRIMO significantly improves rule quality and diversity while reducing the repetition rate of rule atoms.

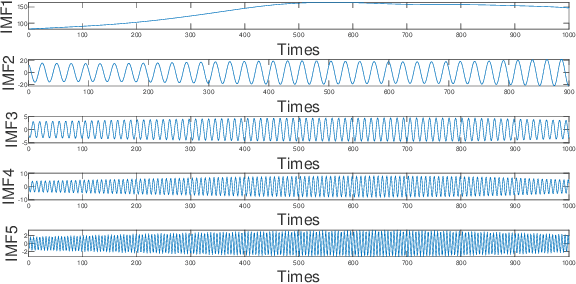

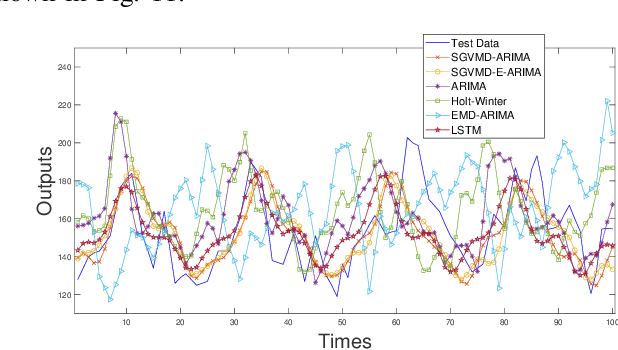

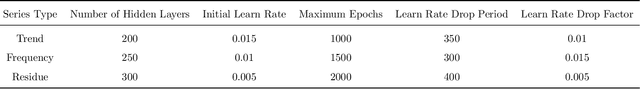

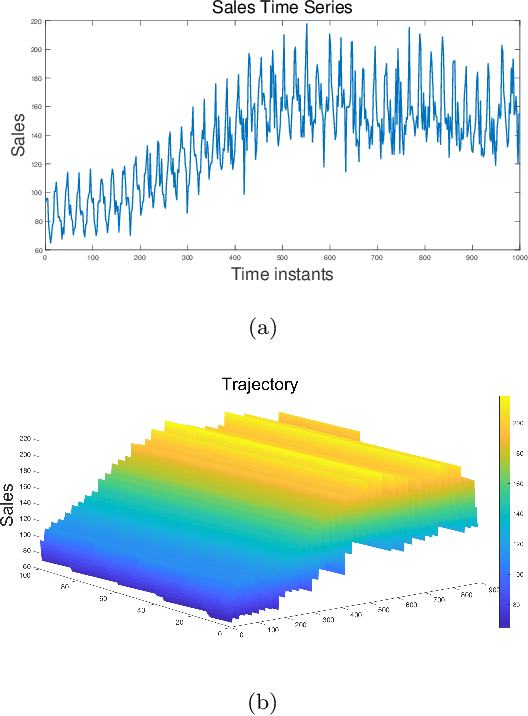

A Combination Model Based on Sequential General Variational Mode Decomposition Method for Time Series Prediction

Jun 07, 2024

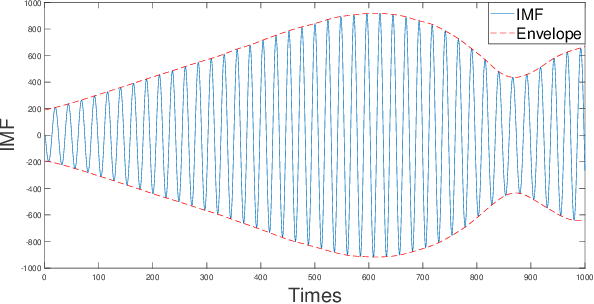

Abstract:Accurate prediction of financial time series is a key concern for market economy makers and investors. The article selects online store sales and Australian beer sales as representatives of non-stationary, trending, and seasonal financial time series, and constructs a new SGVMD-ARIMA combination model in a non-linear combination way to predict financial time series. The ARIMA model, LSTM model, and other classic decomposition prediction models are used as control models to compare the accuracy of different models. The empirical results indicate that the constructed combination prediction model has universal advantages over the single prediction model and linear combination prediction model of the control group. Within the prediction interval, our proposed combination model has improved advantages over traditional decomposition prediction control group models.

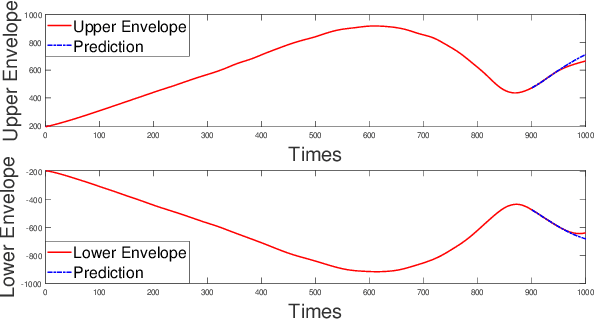

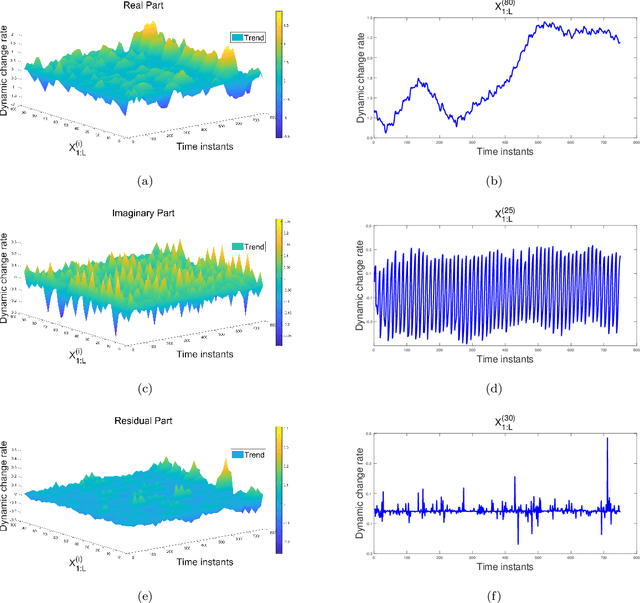

A Combination Model for Time Series Prediction using LSTM via Extracting Dynamic Features Based on Spatial Smoothing and Sequential General Variational Mode Decomposition

Jun 05, 2024

Abstract:In order to solve the problems such as difficult to extract effective features and low accuracy of sales volume prediction caused by complex relationships such as market sales volume in time series prediction, we proposed a time series prediction method of market sales volume based on Sequential General VMD and spatial smoothing Long short-term memory neural network (SS-LSTM) combination model. Firstly, the spatial smoothing algorithm is used to decompose and calculate the sample data of related industry sectors affected by the linkage effect of market sectors, extracting modal features containing information via Sequential General VMD on overall market and specific price trends; Then, according to the background of different Market data sets, LSTM network is used to model and predict the price of fundamental data and modal characteristics. The experimental results of data prediction with seasonal and periodic trends show that this method can achieve higher price prediction accuracy and more accurate accuracy in specific market contexts compared to traditional prediction methods Describe the changes in market sales volume.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge