A Combination Model Based on Sequential General Variational Mode Decomposition Method for Time Series Prediction

Paper and Code

Jun 07, 2024

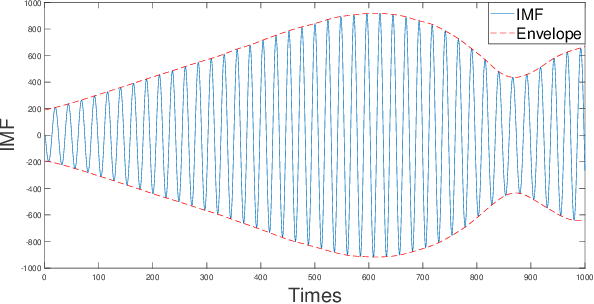

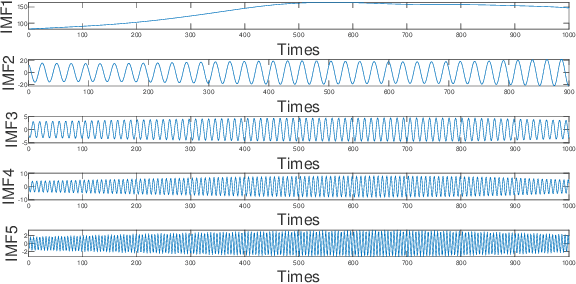

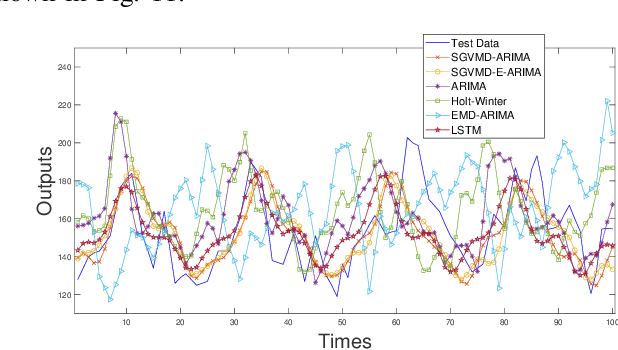

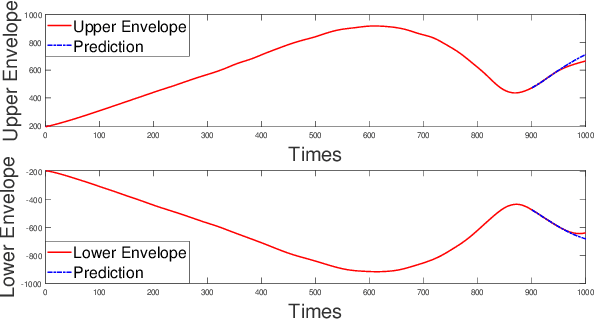

Accurate prediction of financial time series is a key concern for market economy makers and investors. The article selects online store sales and Australian beer sales as representatives of non-stationary, trending, and seasonal financial time series, and constructs a new SGVMD-ARIMA combination model in a non-linear combination way to predict financial time series. The ARIMA model, LSTM model, and other classic decomposition prediction models are used as control models to compare the accuracy of different models. The empirical results indicate that the constructed combination prediction model has universal advantages over the single prediction model and linear combination prediction model of the control group. Within the prediction interval, our proposed combination model has improved advantages over traditional decomposition prediction control group models.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge