Yateng Tang

Rethinking Time Encoding via Learnable Transformation Functions

May 01, 2025Abstract:Effectively modeling time information and incorporating it into applications or models involving chronologically occurring events is crucial. Real-world scenarios often involve diverse and complex time patterns, which pose significant challenges for time encoding methods. While previous methods focus on capturing time patterns, many rely on specific inductive biases, such as using trigonometric functions to model periodicity. This narrow focus on single-pattern modeling makes them less effective in handling the diversity and complexities of real-world time patterns. In this paper, we investigate to improve the existing commonly used time encoding methods and introduce Learnable Transformation-based Generalized Time Encoding (LeTE). We propose using deep function learning techniques to parameterize non-linear transformations in time encoding, making them learnable and capable of modeling generalized time patterns, including diverse and complex temporal dynamics. By enabling learnable transformations, LeTE encompasses previous methods as specific cases and allows seamless integration into a wide range of tasks. Through extensive experiments across diverse domains, we demonstrate the versatility and effectiveness of LeTE.

Unifying Text Semantics and Graph Structures for Temporal Text-attributed Graphs with Large Language Models

Mar 18, 2025Abstract:Temporal graph neural networks (TGNNs) have shown remarkable performance in temporal graph modeling. However, real-world temporal graphs often possess rich textual information, giving rise to temporal text-attributed graphs (TTAGs). Such combination of dynamic text semantics and evolving graph structures introduces heightened complexity. Existing TGNNs embed texts statically and rely heavily on encoding mechanisms that biasedly prioritize structural information, overlooking the temporal evolution of text semantics and the essential interplay between semantics and structures for synergistic reinforcement. To tackle these issues, we present \textbf{{Cross}}, a novel framework that seamlessly extends existing TGNNs for TTAG modeling. The key idea is to employ the advanced large language models (LLMs) to extract the dynamic semantics in text space and then generate expressive representations unifying both semantics and structures. Specifically, we propose a Temporal Semantics Extractor in the {Cross} framework, which empowers the LLM to offer the temporal semantic understanding of node's evolving contexts of textual neighborhoods, facilitating semantic dynamics. Subsequently, we introduce the Semantic-structural Co-encoder, which collaborates with the above Extractor for synthesizing illuminating representations by jointly considering both semantic and structural information while encouraging their mutual reinforcement. Extensive experimental results on four public datasets and one practical industrial dataset demonstrate {Cross}'s significant effectiveness and robustness.

Financial Risk Assessment via Long-term Payment Behavior Sequence Folding

Nov 22, 2024

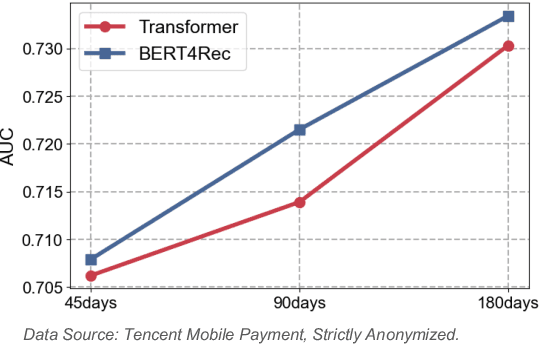

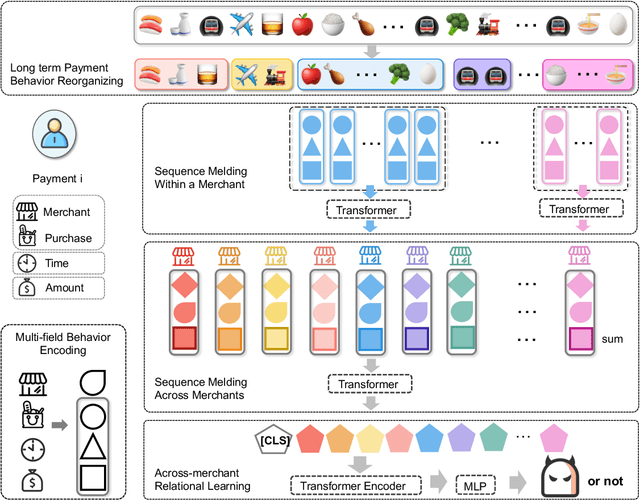

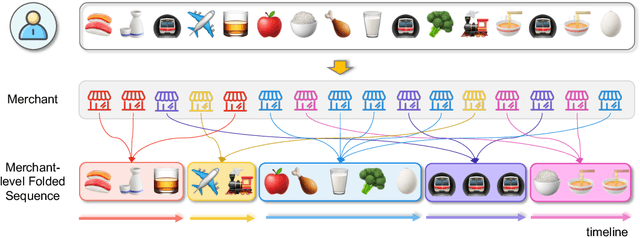

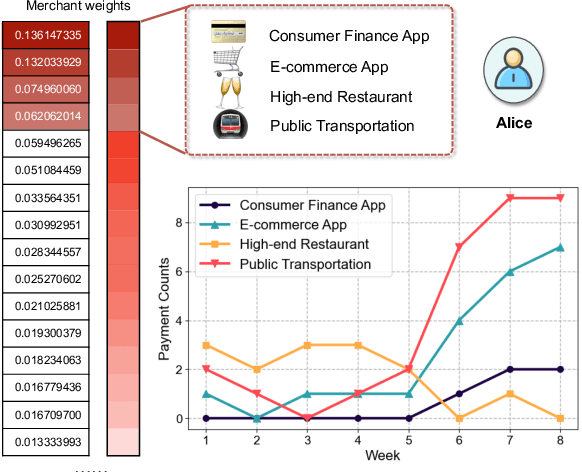

Abstract:Online inclusive financial services encounter significant financial risks due to their expansive user base and low default costs. By real-world practice, we reveal that utilizing longer-term user payment behaviors can enhance models' ability to forecast financial risks. However, learning long behavior sequences is non-trivial for deep sequential models. Additionally, the diverse fields of payment behaviors carry rich information, requiring thorough exploitation. These factors collectively complicate the task of long-term user behavior modeling. To tackle these challenges, we propose a Long-term Payment Behavior Sequence Folding method, referred to as LBSF. In LBSF, payment behavior sequences are folded based on merchants, using the merchant field as an intrinsic grouping criterion, which enables informative parallelism without reliance on external knowledge. Meanwhile, we maximize the utility of payment details through a multi-field behavior encoding mechanism. Subsequently, behavior aggregation at the merchant level followed by relational learning across merchants facilitates comprehensive user financial representation. We evaluate LBSF on the financial risk assessment task using a large-scale real-world dataset. The results demonstrate that folding long behavior sequences based on internal behavioral cues effectively models long-term patterns and changes, thereby generating more accurate user financial profiles for practical applications.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge