Robert E. Tillman

POET: Protocol Optimization via Eligibility Tuning

Jan 30, 2026Abstract:Eligibility criteria (EC) are essential for clinical trial design, yet drafting them remains a time-intensive and cognitively demanding task for clinicians. Existing automated approaches often fall at two extremes either requiring highly structured inputs, such as predefined entities to generate specific criteria, or relying on end-to-end systems that produce full eligibility criteria from minimal input such as trial descriptions limiting their practical utility. In this work, we propose a guided generation framework that introduces interpretable semantic axes, such as Demographics, Laboratory Parameters, and Behavioral Factors, to steer EC generation. These axes, derived using large language models, offer a middle ground between specificity and usability, enabling clinicians to guide generation without specifying exact entities. In addition, we present a reusable rubric-based evaluation framework that assesses generated criteria along clinically meaningful dimensions. Our results show that our guided generation approach consistently outperforms unguided generation in both automatic, rubric-based and clinician evaluations, offering a practical and interpretable solution for AI-assisted trial design.

Health-SCORE: Towards Scalable Rubrics for Improving Health-LLMs

Jan 26, 2026Abstract:Rubrics are essential for evaluating open-ended LLM responses, especially in safety-critical domains such as healthcare. However, creating high-quality and domain-specific rubrics typically requires significant human expertise time and development cost, making rubric-based evaluation and training difficult to scale. In this work, we introduce Health-SCORE, a generalizable and scalable rubric-based training and evaluation framework that substantially reduces rubric development costs without sacrificing performance. We show that Health-SCORE provides two practical benefits beyond standalone evaluation: it can be used as a structured reward signal to guide reinforcement learning with safety-aware supervision, and it can be incorporated directly into prompts to improve response quality through in-context learning. Across open-ended healthcare tasks, Health-SCORE achieves evaluation quality comparable to human-created rubrics while significantly lowering development effort, making rubric-based evaluation and training more scalable.

OrdShap: Feature Position Importance for Sequential Black-Box Models

Jul 16, 2025Abstract:Sequential deep learning models excel in domains with temporal or sequential dependencies, but their complexity necessitates post-hoc feature attribution methods for understanding their predictions. While existing techniques quantify feature importance, they inherently assume fixed feature ordering - conflating the effects of (1) feature values and (2) their positions within input sequences. To address this gap, we introduce OrdShap, a novel attribution method that disentangles these effects by quantifying how a model's predictions change in response to permuting feature position. We establish a game-theoretic connection between OrdShap and Sanchez-Berganti\~nos values, providing a theoretically grounded approach to position-sensitive attribution. Empirical results from health, natural language, and synthetic datasets highlight OrdShap's effectiveness in capturing feature value and feature position attributions, and provide deeper insight into model behavior.

Guided Discrete Diffusion for Electronic Health Record Generation

Apr 18, 2024

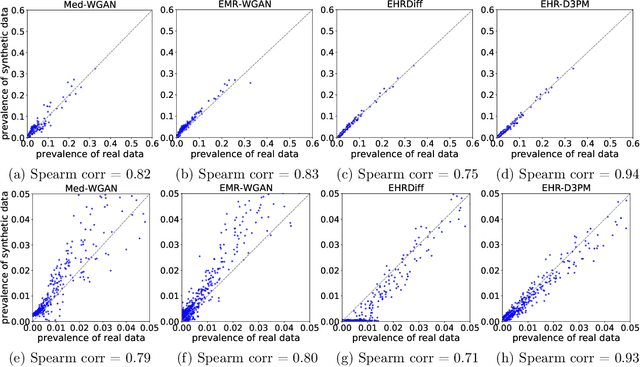

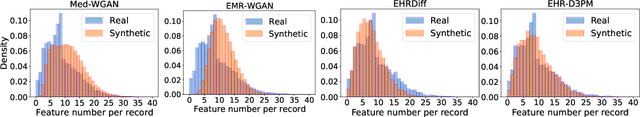

Abstract:Electronic health records (EHRs) are a pivotal data source that enables numerous applications in computational medicine, e.g., disease progression prediction, clinical trial design, and health economics and outcomes research. Despite wide usability, their sensitive nature raises privacy and confidentially concerns, which limit potential use cases. To tackle these challenges, we explore the use of generative models to synthesize artificial, yet realistic EHRs. While diffusion-based methods have recently demonstrated state-of-the-art performance in generating other data modalities and overcome the training instability and mode collapse issues that plague previous GAN-based approaches, their applications in EHR generation remain underexplored. The discrete nature of tabular medical code data in EHRs poses challenges for high-quality data generation, especially for continuous diffusion models. To this end, we introduce a novel tabular EHR generation method, EHR-D3PM, which enables both unconditional and conditional generation using the discrete diffusion model. Our experiments demonstrate that EHR-D3PM significantly outperforms existing generative baselines on comprehensive fidelity and utility metrics while maintaining less membership vulnerability risks. Furthermore, we show EHR-D3PM is effective as a data augmentation method and enhances performance on downstream tasks when combined with real data.

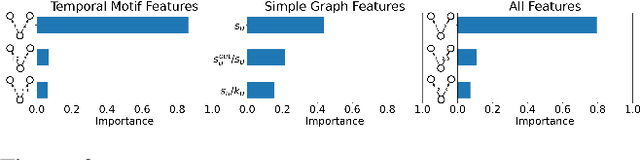

Temporal Motifs for Financial Networks: A Study on Mercari, JPMC, and Venmo Platforms

Jan 18, 2023

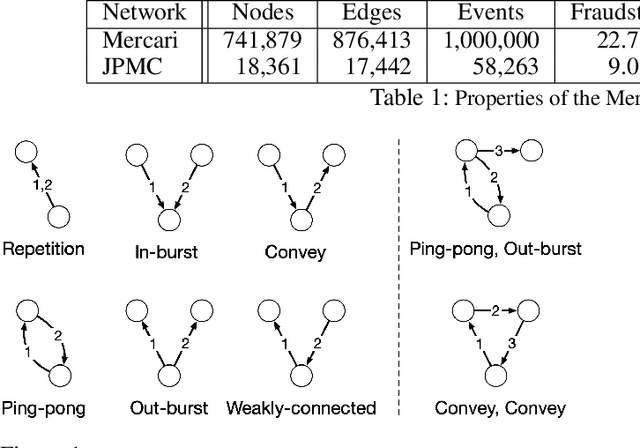

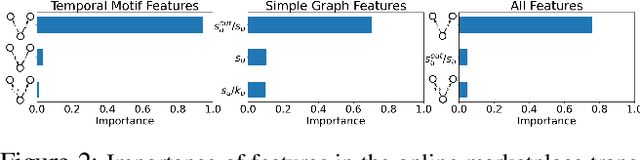

Abstract:Understanding the dynamics of financial transactions among people is critically important for various applications such as fraud detection. One important aspect of financial transaction networks is temporality. The order and repetition of transactions can offer new insights when considered within the graph structure. Temporal motifs, defined as a set of nodes that interact with each other in a short time period, are a promising tool in this context. In this work, we study three unique temporal financial networks: transactions in Mercari, an online marketplace, payments in a synthetic network generated by J.P. Morgan Chase, and payments and friendships among Venmo users. We consider the fraud detection problem on the Mercari and J.P. Morgan Chase networks, for which the ground truth is available. We show that temporal motifs offer superior performance than a previous method that considers simple graph features. For the Venmo network, we investigate the interplay between financial and social relations on three tasks: friendship prediction, vendor identification, and analysis of temporal cycles. For friendship prediction, temporal motifs yield better results than general heuristics, such as Jaccard and Adamic-Adar measures. We are also able to identify vendors with high accuracy and observe interesting patterns in rare motifs, like temporal cycles. We believe that the analysis, datasets, and lessons from this work will be beneficial for future research on financial transaction networks.

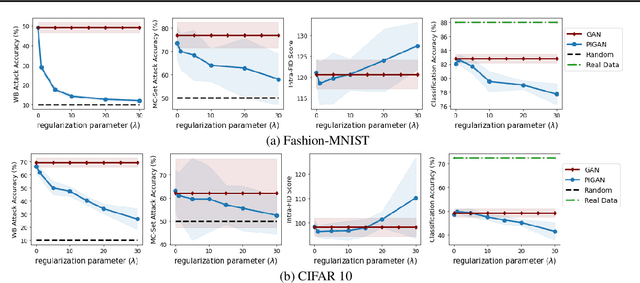

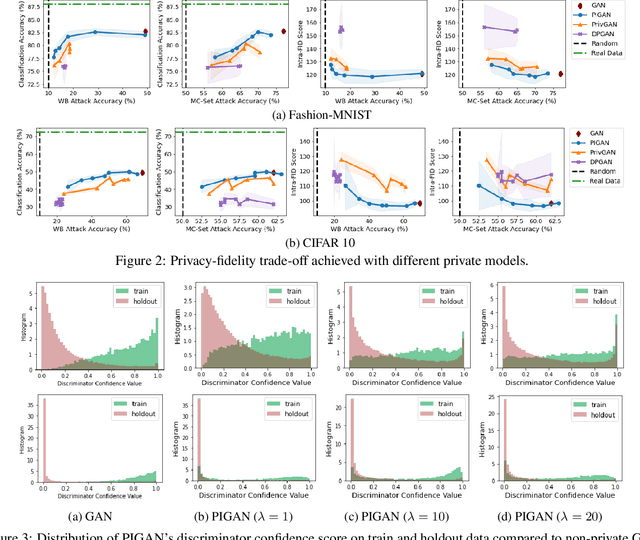

Generative Models with Information-Theoretic Protection Against Membership Inference Attacks

May 31, 2022

Abstract:Deep generative models, such as Generative Adversarial Networks (GANs), synthesize diverse high-fidelity data samples by estimating the underlying distribution of high dimensional data. Despite their success, GANs may disclose private information from the data they are trained on, making them susceptible to adversarial attacks such as membership inference attacks, in which an adversary aims to determine if a record was part of the training set. We propose an information theoretically motivated regularization term that prevents the generative model from overfitting to training data and encourages generalizability. We show that this penalty minimizes the JensenShannon divergence between components of the generator trained on data with different membership, and that it can be implemented at low cost using an additional classifier. Our experiments on image datasets demonstrate that with the proposed regularization, which comes at only a small added computational cost, GANs are able to preserve privacy and generate high-quality samples that achieve better downstream classification performance compared to non-private and differentially private generative models.

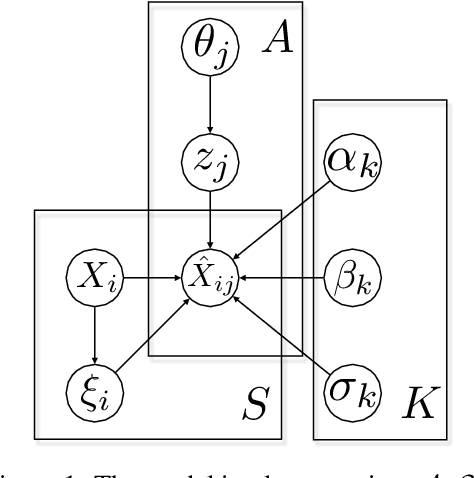

Latent Bayesian Inference for Robust Earnings Estimates

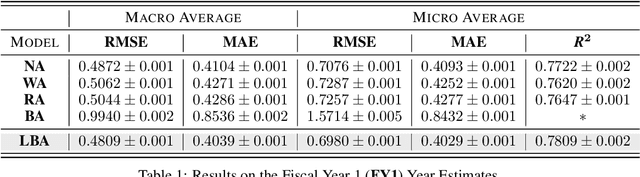

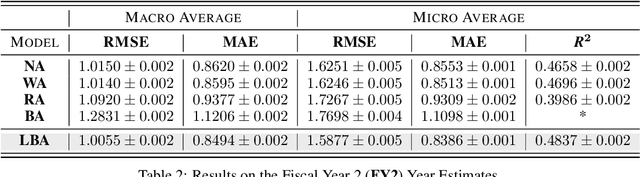

Apr 14, 2020

Abstract:Equity research analysts at financial institutions play a pivotal role in capital markets; they provide an efficient conduit between investors and companies' management and facilitate the efficient flow of information from companies, promoting functional and liquid markets. However, previous research in the academic finance and behavioral economics communities has found that analysts' estimates of future company earnings and other financial quantities can be affected by a number of behavioral, incentive-based and discriminatory biases and systematic errors, which can detrimentally affect both investors and public companies. We propose a Bayesian latent variable model for analysts' systematic errors and biases which we use to generate a robust bias-adjusted consensus estimate of company earnings. Experiments using historical earnings estimates data show that our model is more accurate than the consensus average of estimates and other related approaches.

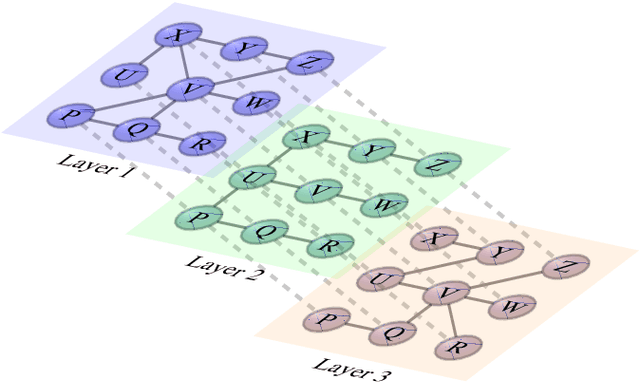

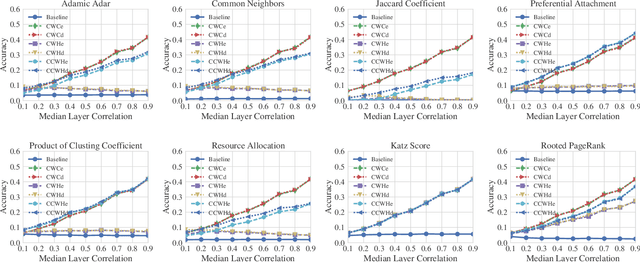

Heuristics for Link Prediction in Multiplex Networks

Apr 09, 2020

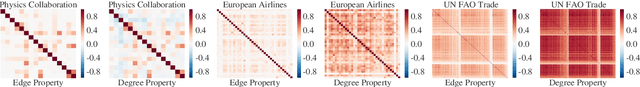

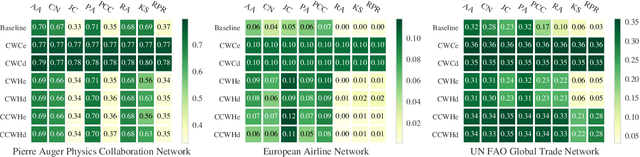

Abstract:Link prediction, or the inference of future or missing connections between entities, is a well-studied problem in network analysis. A multitude of heuristics exist for link prediction in ordinary networks with a single type of connection. However, link prediction in multiplex networks, or networks with multiple types of connections, is not a well understood problem. We propose a novel general framework and three families of heuristics for multiplex network link prediction that are simple, interpretable, and take advantage of the rich connection type correlation structure that exists in many real world networks. We further derive a theoretical threshold for determining when to use a different connection type based on the number of links that overlap with an Erdos-Renyi random graph. Through experiments with simulated and real world scientific collaboration, transportation and global trade networks, we demonstrate that the proposed heuristics show increased performance with the richness of connection type correlation structure and significantly outperform their baseline heuristics for ordinary networks with a single connection type.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge