Latent Bayesian Inference for Robust Earnings Estimates

Paper and Code

Apr 14, 2020

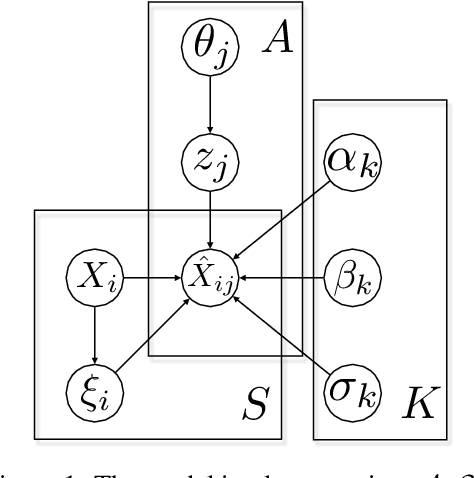

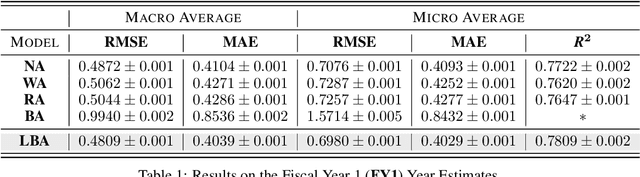

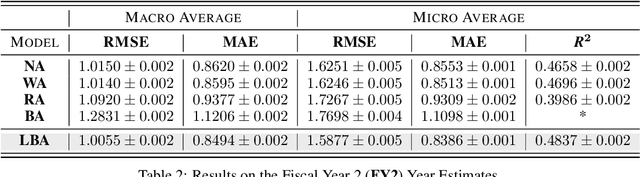

Equity research analysts at financial institutions play a pivotal role in capital markets; they provide an efficient conduit between investors and companies' management and facilitate the efficient flow of information from companies, promoting functional and liquid markets. However, previous research in the academic finance and behavioral economics communities has found that analysts' estimates of future company earnings and other financial quantities can be affected by a number of behavioral, incentive-based and discriminatory biases and systematic errors, which can detrimentally affect both investors and public companies. We propose a Bayesian latent variable model for analysts' systematic errors and biases which we use to generate a robust bias-adjusted consensus estimate of company earnings. Experiments using historical earnings estimates data show that our model is more accurate than the consensus average of estimates and other related approaches.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge