Jiali Xu

EgoPAT3Dv2: Predicting 3D Action Target from 2D Egocentric Vision for Human-Robot Interaction

Mar 08, 2024

Abstract:A robot's ability to anticipate the 3D action target location of a hand's movement from egocentric videos can greatly improve safety and efficiency in human-robot interaction (HRI). While previous research predominantly focused on semantic action classification or 2D target region prediction, we argue that predicting the action target's 3D coordinate could pave the way for more versatile downstream robotics tasks, especially given the increasing prevalence of headset devices. This study expands EgoPAT3D, the sole dataset dedicated to egocentric 3D action target prediction. We augment both its size and diversity, enhancing its potential for generalization. Moreover, we substantially enhance the baseline algorithm by introducing a large pre-trained model and human prior knowledge. Remarkably, our novel algorithm can now achieve superior prediction outcomes using solely RGB images, eliminating the previous need for 3D point clouds and IMU input. Furthermore, we deploy our enhanced baseline algorithm on a real-world robotic platform to illustrate its practical utility in straightforward HRI tasks. The demonstrations showcase the real-world applicability of our advancements and may inspire more HRI use cases involving egocentric vision. All code and data are open-sourced and can be found on the project website.

Improving the Robustness of Trading Strategy Backtesting with Boltzmann Machines and Generative Adversarial Networks

Jul 09, 2020

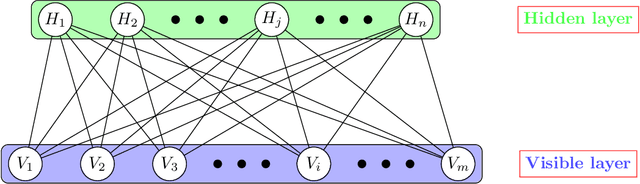

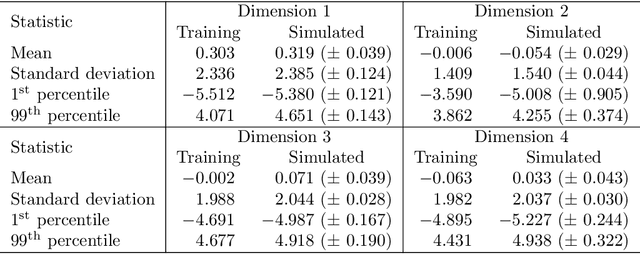

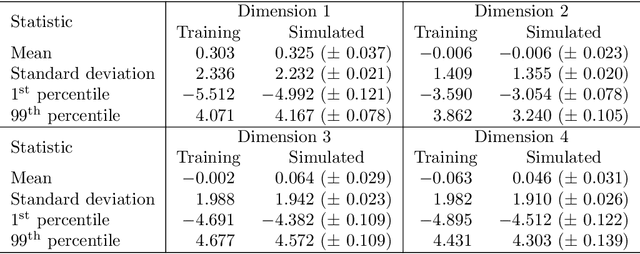

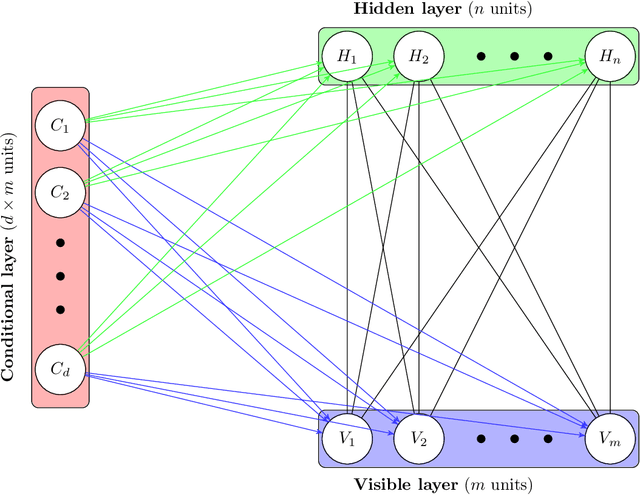

Abstract:This article explores the use of machine learning models to build a market generator. The underlying idea is to simulate artificial multi-dimensional financial time series, whose statistical properties are the same as those observed in the financial markets. In particular, these synthetic data must preserve the probability distribution of asset returns, the stochastic dependence between the different assets and the autocorrelation across time. The article proposes then a new approach for estimating the probability distribution of backtest statistics. The final objective is to develop a framework for improving the risk management of quantitative investment strategies, in particular in the space of smart beta, factor investing and alternative risk premia.

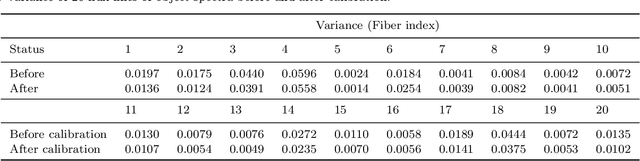

Two-dimensional Multi-fiber Spectrum Image Correction Based on Machine Learning Techniques

Feb 16, 2020

Abstract:Due to limited size and imperfect of the optical components in a spectrometer, aberration has inevitably been brought into two-dimensional multi-fiber spectrum image in LAMOST, which leads to obvious spacial variation of the point spread functions (PSFs). Consequently, if spatial variant PSFs are estimated directly , the huge storage and intensive computation requirements result in deconvolutional spectral extraction method become intractable. In this paper, we proposed a novel method to solve the problem of spatial variation PSF through image aberration correction. When CCD image aberration is corrected, PSF, the convolution kernel, can be approximated by one spatial invariant PSF only. Specifically, machine learning techniques are adopted to calibrate distorted spectral image, including Total Least Squares (TLS) algorithm, intelligent sampling method, multi-layer feed-forward neural networks. The calibration experiments on the LAMOST CCD images show that the calibration effect of proposed method is effectible. At the same time, the spectrum extraction results before and after calibration are compared, results show the characteristics of the extracted one-dimensional waveform are more close to an ideal optics system, and the PSF of the corrected object spectrum image estimated by the blind deconvolution method is nearly central symmetry, which indicates that our proposed method can significantly reduce the complexity of spectrum extraction and improve extraction accuracy.

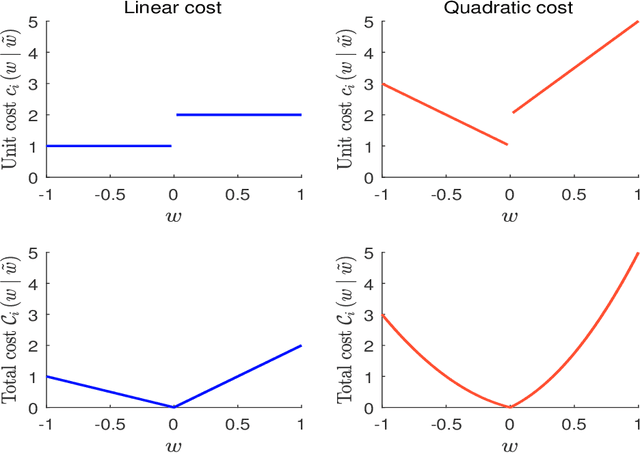

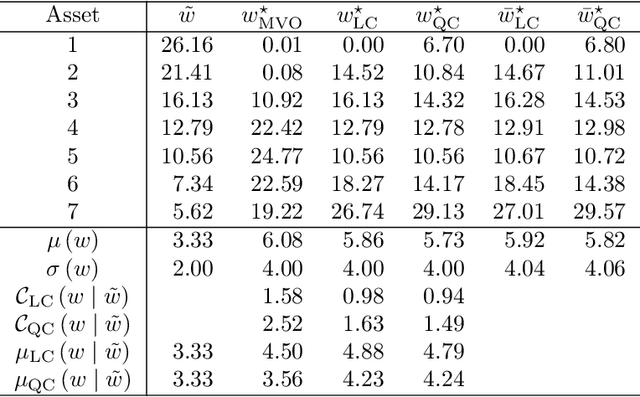

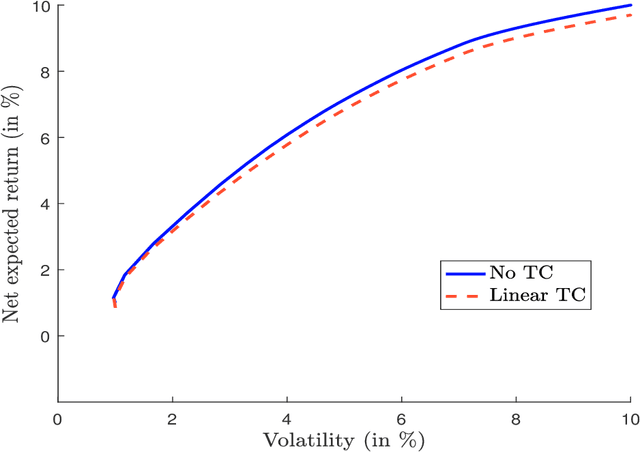

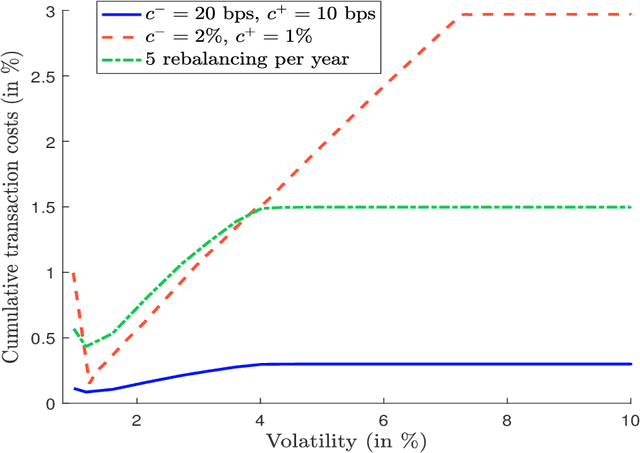

A Note on Portfolio Optimization with Quadratic Transaction Costs

Jan 06, 2020

Abstract:In this short note, we consider mean-variance optimized portfolios with transaction costs. We show that introducing quadratic transaction costs makes the optimization problem more difficult than using linear transaction costs. The reason lies in the specification of the budget constraint, which is no longer linear. We provide numerical algorithms for solving this issue and illustrate how transaction costs may considerably impact the expected returns of optimized portfolios.

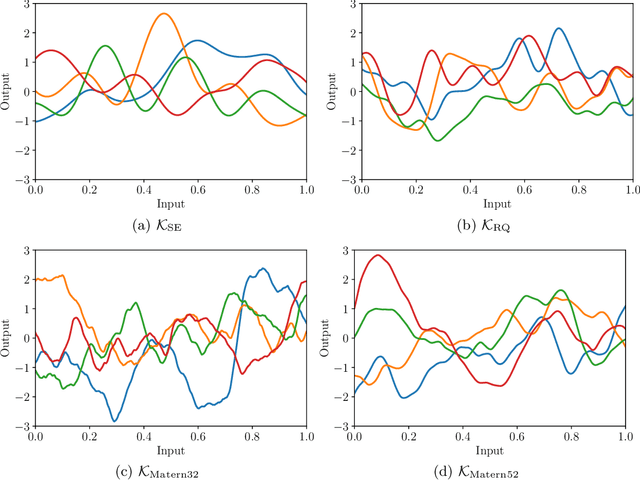

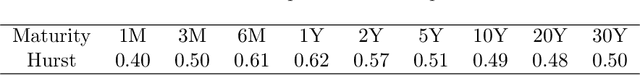

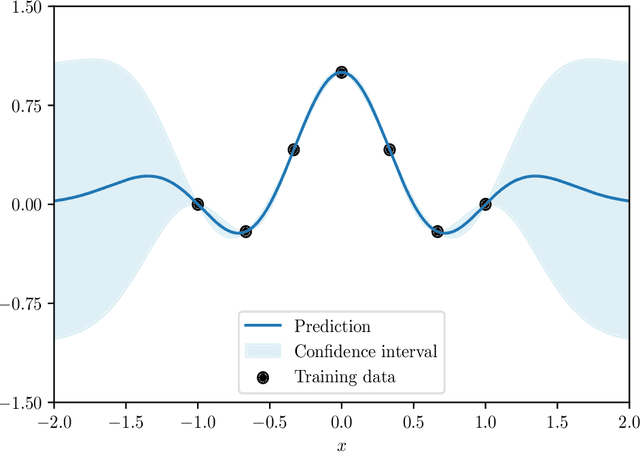

Financial Applications of Gaussian Processes and Bayesian Optimization

Mar 12, 2019

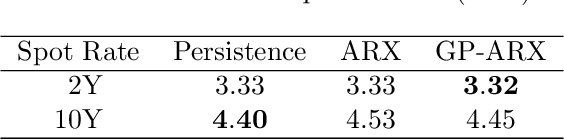

Abstract:In the last five years, the financial industry has been impacted by the emergence of digitalization and machine learning. In this article, we explore two methods that have undergone rapid development in recent years: Gaussian processes and Bayesian optimization. Gaussian processes can be seen as a generalization of Gaussian random vectors and are associated with the development of kernel methods. Bayesian optimization is an approach for performing derivative-free global optimization in a small dimension, and uses Gaussian processes to locate the global maximum of a black-box function. The first part of the article reviews these two tools and shows how they are connected. In particular, we focus on the Gaussian process regression, which is the core of Bayesian machine learning, and the issue of hyperparameter selection. The second part is dedicated to two financial applications. We first consider the modeling of the term structure of interest rates. More precisely, we test the fitting method and compare the GP prediction and the random walk model. The second application is the construction of trend-following strategies, in particular the online estimation of trend and covariance windows.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge