Edmond Lezmi

Improving the Robustness of Trading Strategy Backtesting with Boltzmann Machines and Generative Adversarial Networks

Jul 09, 2020

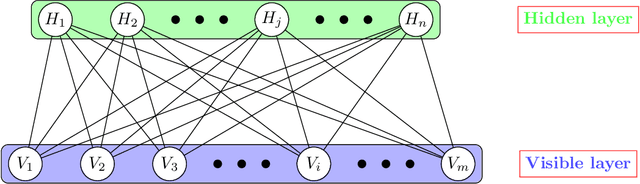

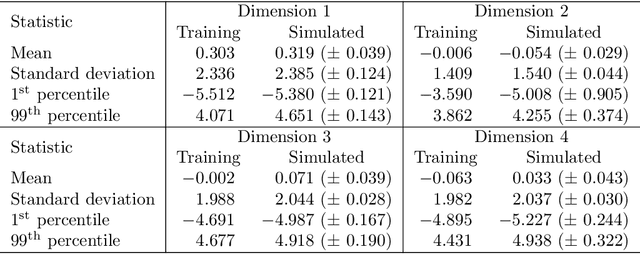

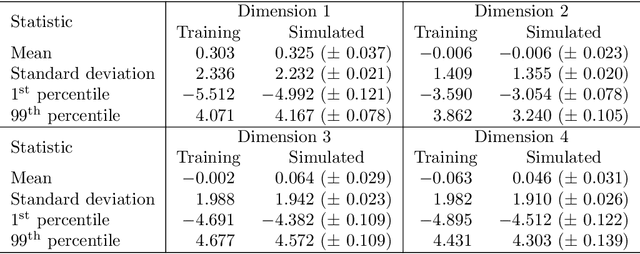

Abstract:This article explores the use of machine learning models to build a market generator. The underlying idea is to simulate artificial multi-dimensional financial time series, whose statistical properties are the same as those observed in the financial markets. In particular, these synthetic data must preserve the probability distribution of asset returns, the stochastic dependence between the different assets and the autocorrelation across time. The article proposes then a new approach for estimating the probability distribution of backtest statistics. The final objective is to develop a framework for improving the risk management of quantitative investment strategies, in particular in the space of smart beta, factor investing and alternative risk premia.

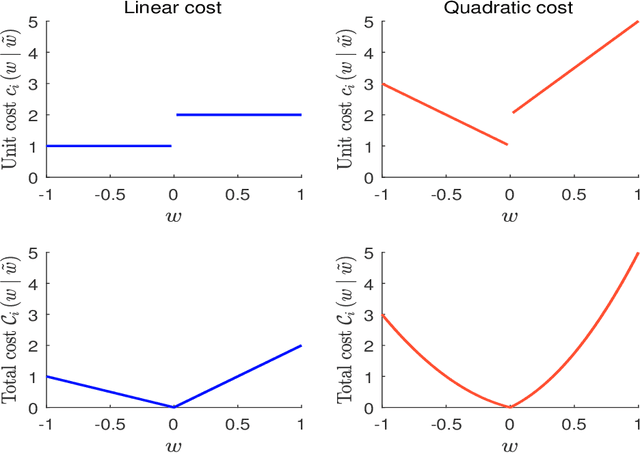

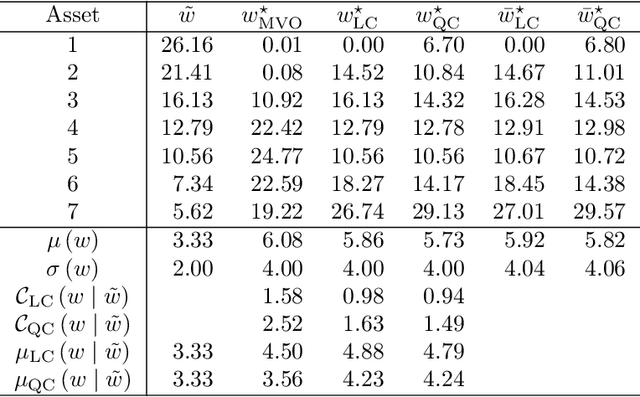

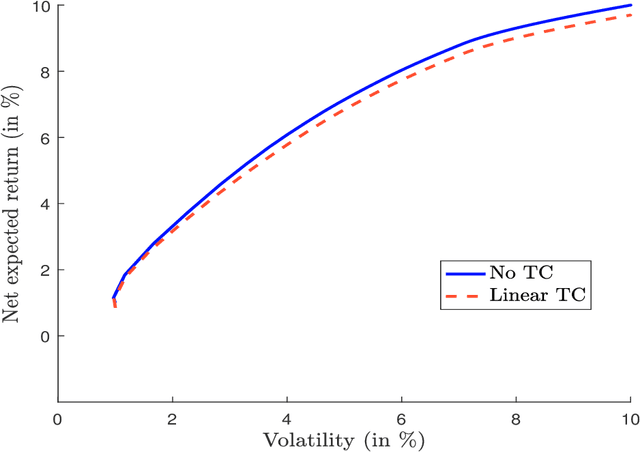

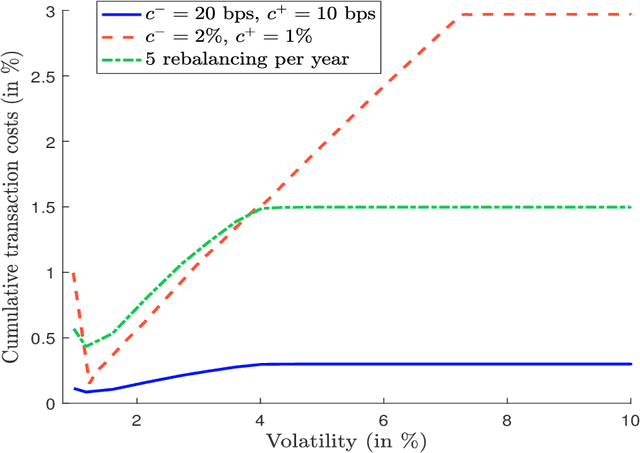

A Note on Portfolio Optimization with Quadratic Transaction Costs

Jan 06, 2020

Abstract:In this short note, we consider mean-variance optimized portfolios with transaction costs. We show that introducing quadratic transaction costs makes the optimization problem more difficult than using linear transaction costs. The reason lies in the specification of the budget constraint, which is no longer linear. We provide numerical algorithms for solving this issue and illustrate how transaction costs may considerably impact the expected returns of optimized portfolios.

Financial Applications of Gaussian Processes and Bayesian Optimization

Mar 12, 2019

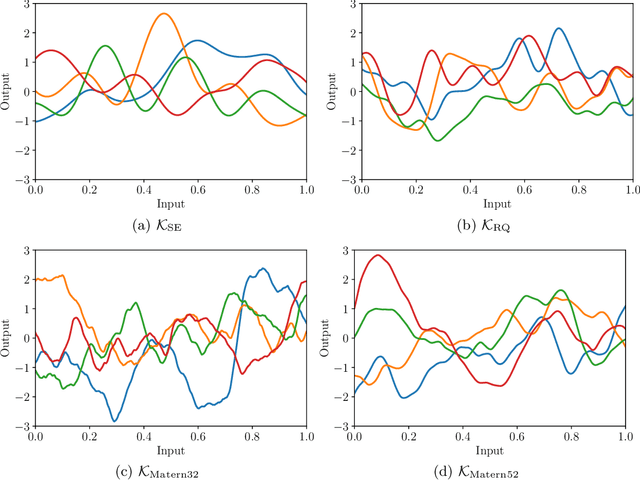

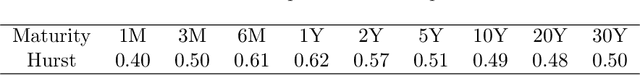

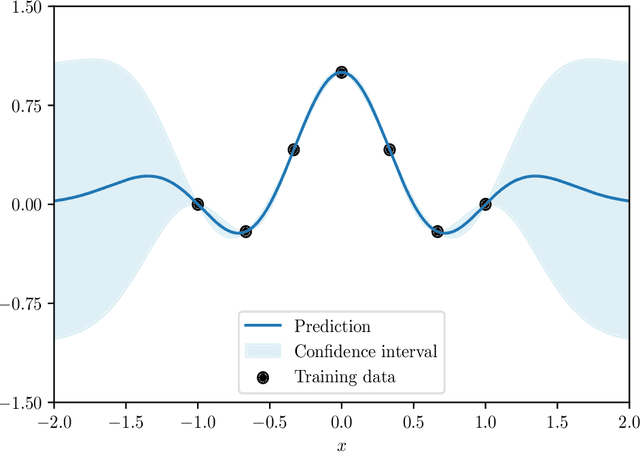

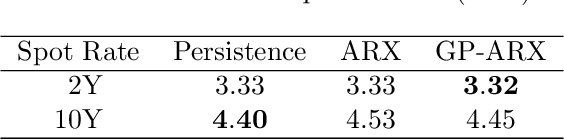

Abstract:In the last five years, the financial industry has been impacted by the emergence of digitalization and machine learning. In this article, we explore two methods that have undergone rapid development in recent years: Gaussian processes and Bayesian optimization. Gaussian processes can be seen as a generalization of Gaussian random vectors and are associated with the development of kernel methods. Bayesian optimization is an approach for performing derivative-free global optimization in a small dimension, and uses Gaussian processes to locate the global maximum of a black-box function. The first part of the article reviews these two tools and shows how they are connected. In particular, we focus on the Gaussian process regression, which is the core of Bayesian machine learning, and the issue of hyperparameter selection. The second part is dedicated to two financial applications. We first consider the modeling of the term structure of interest rates. More precisely, we test the fitting method and compare the GP prediction and the random walk model. The second application is the construction of trend-following strategies, in particular the online estimation of trend and covariance windows.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge