Huiwen Liu

TransparentGS: Fast Inverse Rendering of Transparent Objects with Gaussians

May 01, 2025

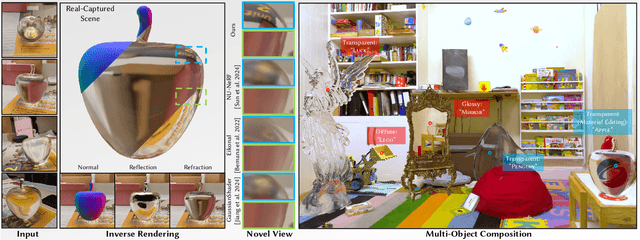

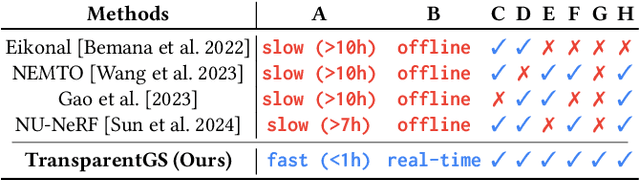

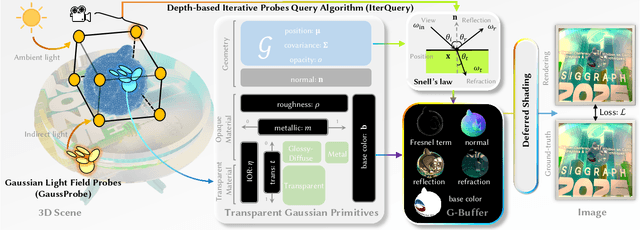

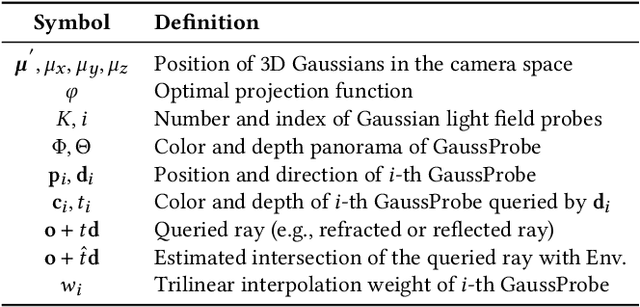

Abstract:The emergence of neural and Gaussian-based radiance field methods has led to considerable advancements in novel view synthesis and 3D object reconstruction. Nonetheless, specular reflection and refraction continue to pose significant challenges due to the instability and incorrect overfitting of radiance fields to high-frequency light variations. Currently, even 3D Gaussian Splatting (3D-GS), as a powerful and efficient tool, falls short in recovering transparent objects with nearby contents due to the existence of apparent secondary ray effects. To address this issue, we propose TransparentGS, a fast inverse rendering pipeline for transparent objects based on 3D-GS. The main contributions are three-fold. Firstly, an efficient representation of transparent objects, transparent Gaussian primitives, is designed to enable specular refraction through a deferred refraction strategy. Secondly, we leverage Gaussian light field probes (GaussProbe) to encode both ambient light and nearby contents in a unified framework. Thirdly, a depth-based iterative probes query (IterQuery) algorithm is proposed to reduce the parallax errors in our probe-based framework. Experiments demonstrate the speed and accuracy of our approach in recovering transparent objects from complex environments, as well as several applications in computer graphics and vision.

Proof-of-Data: A Consensus Protocol for Collaborative Intelligence

Jan 06, 2025

Abstract:Existing research on federated learning has been focused on the setting where learning is coordinated by a centralized entity. Yet the greatest potential of future collaborative intelligence would be unleashed in a more open and democratized setting with no central entity in a dominant role, referred to as "decentralized federated learning". New challenges arise accordingly in achieving both correct model training and fair reward allocation with collective effort among all participating nodes, especially with the threat of the Byzantine node jeopardising both tasks. In this paper, we propose a blockchain-based decentralized Byzantine fault-tolerant federated learning framework based on a novel Proof-of-Data (PoD) consensus protocol to resolve both the "trust" and "incentive" components. By decoupling model training and contribution accounting, PoD is able to enjoy not only the benefit of learning efficiency and system liveliness from asynchronous societal-scale PoW-style learning but also the finality of consensus and reward allocation from epoch-based BFT-style voting. To mitigate false reward claims by data forgery from Byzantine attacks, a privacy-aware data verification and contribution-based reward allocation mechanism is designed to complete the framework. Our evaluation results show that PoD demonstrates performance in model training close to that of the centralized counterpart while achieving trust in consensus and fairness for reward allocation with a fault tolerance ratio of 1/3.

From Asset Flow to Status, Action and Intention Discovery: Early Malice Detection in Cryptocurrency

Sep 26, 2023

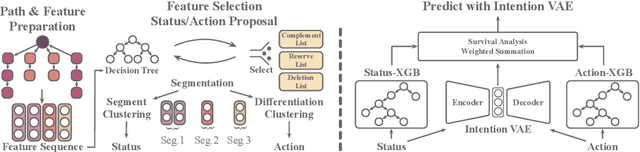

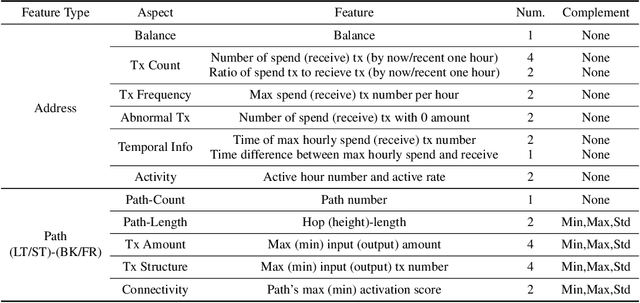

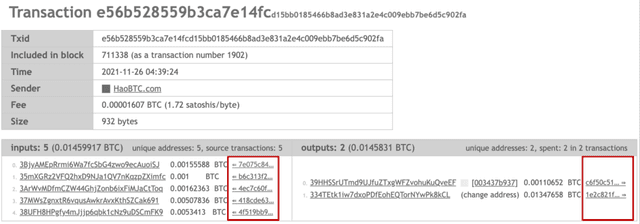

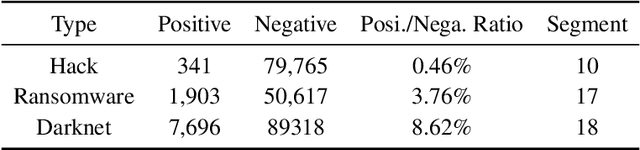

Abstract:Cryptocurrency has been subject to illicit activities probably more often than traditional financial assets due to the pseudo-anonymous nature of its transacting entities. An ideal detection model is expected to achieve all three critical properties of (I) early detection, (II) good interpretability, and (III) versatility for various illicit activities. However, existing solutions cannot meet all these requirements, as most of them heavily rely on deep learning without interpretability and are only available for retrospective analysis of a specific illicit type. To tackle all these challenges, we propose Intention-Monitor for early malice detection in Bitcoin (BTC), where the on-chain record data for a certain address are much scarcer than other cryptocurrency platforms. We first define asset transfer paths with the Decision-Tree based feature Selection and Complement (DT-SC) to build different feature sets for different malice types. Then, the Status/Action Proposal Module (S/A-PM) and the Intention-VAE module generate the status, action, intent-snippet, and hidden intent-snippet embedding. With all these modules, our model is highly interpretable and can detect various illegal activities. Moreover, well-designed loss functions further enhance the prediction speed and model's interpretability. Extensive experiments on three real-world datasets demonstrate that our proposed algorithm outperforms the state-of-the-art methods. Furthermore, additional case studies justify our model can not only explain existing illicit patterns but can also find new suspicious characters.

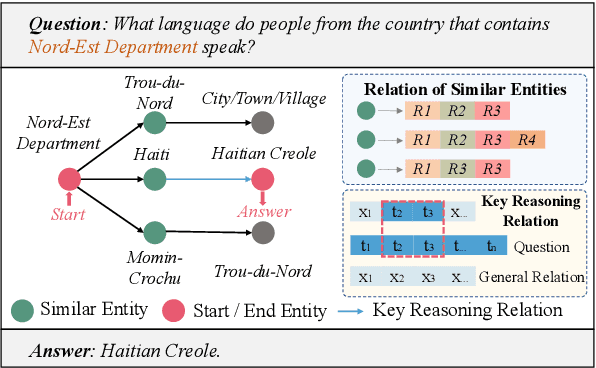

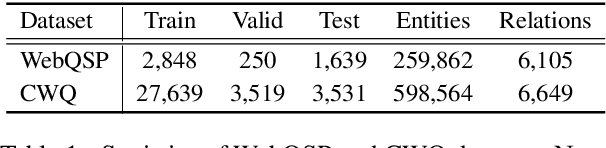

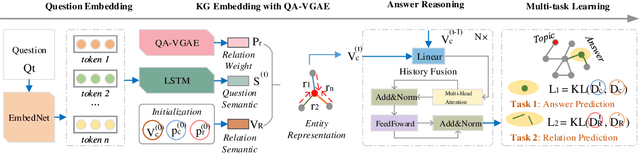

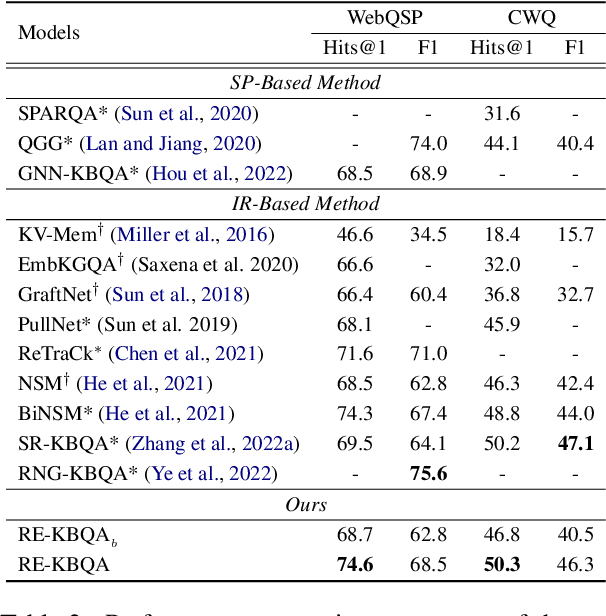

Pay More Attention to Relation Exploration for Knowledge Base Question Answering

May 03, 2023

Abstract:Knowledge base question answering (KBQA) is a challenging task that aims to retrieve correct answers from large-scale knowledge bases. Existing attempts primarily focus on entity representation and final answer reasoning, which results in limited supervision for this task. Moreover, the relations, which empirically determine the reasoning path selection, are not fully considered in recent advancements. In this study, we propose a novel framework, RE-KBQA, that utilizes relations in the knowledge base to enhance entity representation and introduce additional supervision. We explore guidance from relations in three aspects, including (1) distinguishing similar entities by employing a variational graph auto-encoder to learn relation importance; (2) exploring extra supervision by predicting relation distributions as soft labels with a multi-task scheme; (3) designing a relation-guided re-ranking algorithm for post-processing. Experimental results on two benchmark datasets demonstrate the effectiveness and superiority of our framework, improving the F1 score by 5.7% from 40.5 to 46.3 on CWQ and 5.8% from 62.8 to 68.5 on WebQSP, better or on par with state-of-the-art methods.

Evolve Path Tracer: Early Detection of Malicious Addresses in Cryptocurrency

Jan 13, 2023

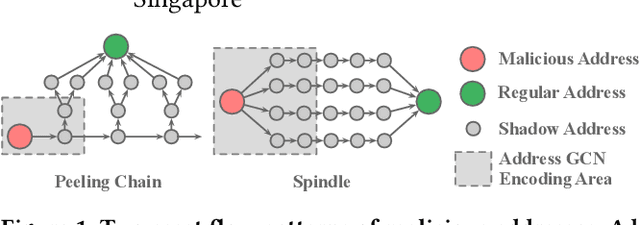

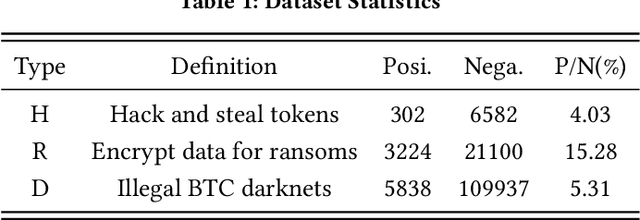

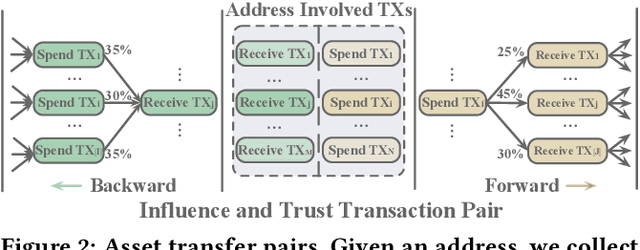

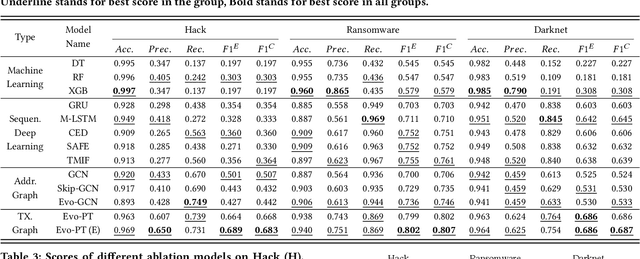

Abstract:With the ever-increasing boom of Cryptocurrency, detecting fraudulent behaviors and associated malicious addresses draws significant research effort. However, most existing studies still rely on the full history features or full-fledged address transaction networks, thus cannot meet the requirements of early malicious address detection, which is urgent but seldom discussed by existing studies. To detect fraud behaviors of malicious addresses in the early stage, we present Evolve Path Tracer, which consists of Evolve Path Encoder LSTM, Evolve Path Graph GCN, and Hierarchical Survival Predictor. Specifically, in addition to the general address features, we propose asset transfer paths and corresponding path graphs to characterize early transaction patterns. Further, since the transaction patterns are changing rapidly during the early stage, we propose Evolve Path Encoder LSTM and Evolve Path Graph GCN to encode asset transfer path and path graph under an evolving structure setting. Hierarchical Survival Predictor then predicts addresses' labels with nice scalability and faster prediction speed. We investigate the effectiveness and versatility of Evolve Path Tracer on three real-world illicit bitcoin datasets. Our experimental results demonstrate that Evolve Path Tracer outperforms the state-of-the-art methods. Extensive scalability experiments demonstrate the model's adaptivity under a dynamic prediction setting.

Toward Intention Discovery for Early Malice Detection in Bitcoin

Sep 24, 2022

Abstract:Bitcoin has been subject to illicit activities more often than probably any other financial assets, due to the pseudo-anonymous nature of its transacting entities. An ideal detection model is expected to achieve all the three properties of (I) early detection, (II) good interpretability, and (III) versatility for various illicit activities. However, existing solutions cannot meet all these requirements, as most of them heavily rely on deep learning without satisfying interpretability and are only available for retrospective analysis of a specific illicit type. First, we present asset transfer paths, which aim to describe addresses' early characteristics. Next, with a decision tree based strategy for feature selection and segmentation, we split the entire observation period into different segments and encode each as a segment vector. After clustering all these segment vectors, we get the global status vectors, essentially the basic unit to describe the whole intention. Finally, a hierarchical self-attention predictor predicts the label for the given address in real time. A survival module tells the predictor when to stop and proposes the status sequence, namely intention. % With the type-dependent selection strategy and global status vectors, our model can be applied to detect various illicit activities with strong interpretability. The well-designed predictor and particular loss functions strengthen the model's prediction speed and interpretability one step further. Extensive experiments on three real-world datasets show that our proposed algorithm outperforms state-of-the-art methods. Besides, additional case studies justify our model can not only explain existing illicit patterns but can also find new suspicious characters.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge