Alok Lal

KnowGraph: Knowledge-Enabled Anomaly Detection via Logical Reasoning on Graph Data

Oct 10, 2024

Abstract:Graph-based anomaly detection is pivotal in diverse security applications, such as fraud detection in transaction networks and intrusion detection for network traffic. Standard approaches, including Graph Neural Networks (GNNs), often struggle to generalize across shifting data distributions. Meanwhile, real-world domain knowledge is more stable and a common existing component of real-world detection strategies. To explicitly integrate such knowledge into data-driven models such as GCNs, we propose KnowGraph, which integrates domain knowledge with data-driven learning for enhanced graph-based anomaly detection. KnowGraph comprises two principal components: (1) a statistical learning component that utilizes a main model for the overarching detection task, augmented by multiple specialized knowledge models that predict domain-specific semantic entities; (2) a reasoning component that employs probabilistic graphical models to execute logical inferences based on model outputs, encoding domain knowledge through weighted first-order logic formulas. Extensive experiments on these large-scale real-world datasets show that KnowGraph consistently outperforms state-of-the-art baselines in both transductive and inductive settings, achieving substantial gains in average precision when generalizing to completely unseen test graphs. Further ablation studies demonstrate the effectiveness of the proposed reasoning component in improving detection performance, especially under extreme class imbalance. These results highlight the potential of integrating domain knowledge into data-driven models for high-stakes, graph-based security applications.

EDoG: Adversarial Edge Detection For Graph Neural Networks

Dec 27, 2022Abstract:Graph Neural Networks (GNNs) have been widely applied to different tasks such as bioinformatics, drug design, and social networks. However, recent studies have shown that GNNs are vulnerable to adversarial attacks which aim to mislead the node or subgraph classification prediction by adding subtle perturbations. Detecting these attacks is challenging due to the small magnitude of perturbation and the discrete nature of graph data. In this paper, we propose a general adversarial edge detection pipeline EDoG without requiring knowledge of the attack strategies based on graph generation. Specifically, we propose a novel graph generation approach combined with link prediction to detect suspicious adversarial edges. To effectively train the graph generative model, we sample several sub-graphs from the given graph data. We show that since the number of adversarial edges is usually low in practice, with low probability the sampled sub-graphs will contain adversarial edges based on the union bound. In addition, considering the strong attacks which perturb a large number of edges, we propose a set of novel features to perform outlier detection as the preprocessing for our detection. Extensive experimental results on three real-world graph datasets including a private transaction rule dataset from a major company and two types of synthetic graphs with controlled properties show that EDoG can achieve above 0.8 AUC against four state-of-the-art unseen attack strategies without requiring any knowledge about the attack type; and around 0.85 with knowledge of the attack type. EDoG significantly outperforms traditional malicious edge detection baselines. We also show that an adaptive attack with full knowledge of our detection pipeline is difficult to bypass it.

Explainable Deep Behavioral Sequence Clustering for Transaction Fraud Detection

Jan 12, 2021

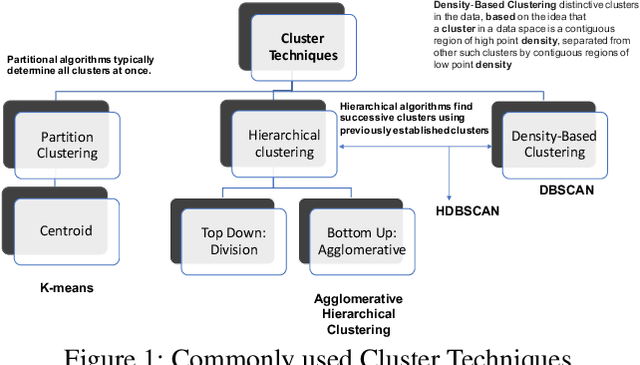

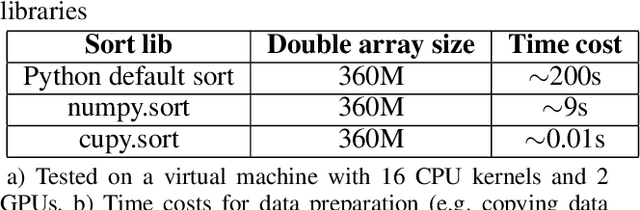

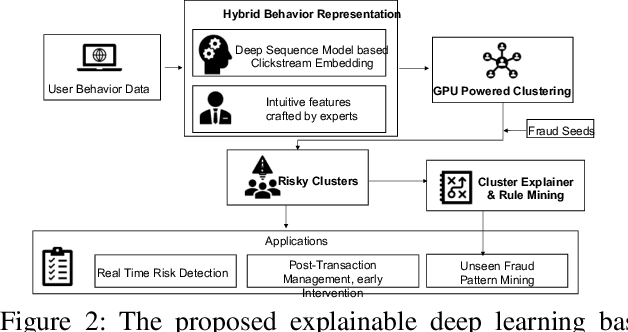

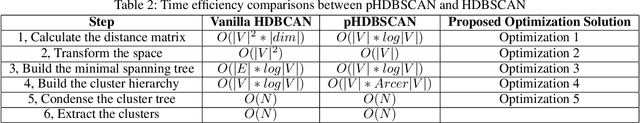

Abstract:In e-commerce industry, user behavior sequence data has been widely used in many business units such as search and merchandising to improve their products. However, it is rarely used in financial services not only due to its 3V characteristics - i.e. Volume, Velocity and Variety - but also due to its unstructured nature. In this paper, we propose a Financial Service scenario Deep learning based Behavior data representation method for Clustering (FinDeepBehaviorCluster) to detect fraudulent transactions. To utilize the behavior sequence data, we treat click stream data as event sequence, use time attention based Bi-LSTM to learn the sequence embedding in an unsupervised fashion, and combine them with intuitive features generated by risk experts to form a hybrid feature representation. We also propose a GPU powered HDBSCAN (pHDBSCAN) algorithm, which is an engineering optimization for the original HDBSCAN algorithm based on FAISS project, so that clustering can be carried out on hundreds of millions of transactions within a few minutes. The computation efficiency of the algorithm has increased 500 times compared with the original implementation, which makes flash fraud pattern detection feasible. Our experimental results show that the proposed FinDeepBehaviorCluster framework is able to catch missed fraudulent transactions with considerable business values. In addition, rule extraction method is applied to extract patterns from risky clusters using intuitive features, so that narrative descriptions can be attached to the risky clusters for case investigation, and unknown risk patterns can be mined for real-time fraud detection. In summary, FinDeepBehaviorCluster as a complementary risk management strategy to the existing real-time fraud detection engine, can further increase our fraud detection and proactive risk defense capabilities.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge