Yaxuan Kong

Fusing Narrative Semantics for Financial Volatility Forecasting

Oct 23, 2025Abstract:We introduce M2VN: Multi-Modal Volatility Network, a novel deep learning-based framework for financial volatility forecasting that unifies time series features with unstructured news data. M2VN leverages the representational power of deep neural networks to address two key challenges in this domain: (i) aligning and fusing heterogeneous data modalities, numerical financial data and textual information, and (ii) mitigating look-ahead bias that can undermine the validity of financial models. To achieve this, M2VN combines open-source market features with news embeddings generated by Time Machine GPT, a recently introduced point-in-time LLM, ensuring temporal integrity. An auxiliary alignment loss is introduced to enhance the integration of structured and unstructured data within the deep learning architecture. Extensive experiments demonstrate that M2VN consistently outperforms existing baselines, underscoring its practical value for risk management and financial decision-making in dynamic markets.

Position: Empowering Time Series Reasoning with Multimodal LLMs

Feb 03, 2025

Abstract:Understanding time series data is crucial for multiple real-world applications. While large language models (LLMs) show promise in time series tasks, current approaches often rely on numerical data alone, overlooking the multimodal nature of time-dependent information, such as textual descriptions, visual data, and audio signals. Moreover, these methods underutilize LLMs' reasoning capabilities, limiting the analysis to surface-level interpretations instead of deeper temporal and multimodal reasoning. In this position paper, we argue that multimodal LLMs (MLLMs) can enable more powerful and flexible reasoning for time series analysis, enhancing decision-making and real-world applications. We call on researchers and practitioners to leverage this potential by developing strategies that prioritize trust, interpretability, and robust reasoning in MLLMs. Lastly, we highlight key research directions, including novel reasoning paradigms, architectural innovations, and domain-specific applications, to advance time series reasoning with MLLMs.

Decision-informed Neural Networks with Large Language Model Integration for Portfolio Optimization

Feb 02, 2025Abstract:This paper addresses the critical disconnect between prediction and decision quality in portfolio optimization by integrating Large Language Models (LLMs) with decision-focused learning. We demonstrate both theoretically and empirically that minimizing the prediction error alone leads to suboptimal portfolio decisions. We aim to exploit the representational power of LLMs for investment decisions. An attention mechanism processes asset relationships, temporal dependencies, and macro variables, which are then directly integrated into a portfolio optimization layer. This enables the model to capture complex market dynamics and align predictions with the decision objectives. Extensive experiments on S\&P100 and DOW30 datasets show that our model consistently outperforms state-of-the-art deep learning models. In addition, gradient-based analyses show that our model prioritizes the assets most crucial to decision making, thus mitigating the effects of prediction errors on portfolio performance. These findings underscore the value of integrating decision objectives into predictions for more robust and context-aware portfolio management.

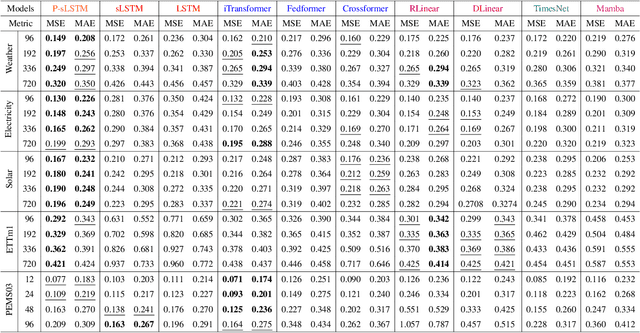

Unlocking the Power of LSTM for Long Term Time Series Forecasting

Aug 19, 2024

Abstract:Traditional recurrent neural network architectures, such as long short-term memory neural networks (LSTM), have historically held a prominent role in time series forecasting (TSF) tasks. While the recently introduced sLSTM for Natural Language Processing (NLP) introduces exponential gating and memory mixing that are beneficial for long term sequential learning, its potential short memory issue is a barrier to applying sLSTM directly in TSF. To address this, we propose a simple yet efficient algorithm named P-sLSTM, which is built upon sLSTM by incorporating patching and channel independence. These modifications substantially enhance sLSTM's performance in TSF, achieving state-of-the-art results. Furthermore, we provide theoretical justifications for our design, and conduct extensive comparative and analytical experiments to fully validate the efficiency and superior performance of our model.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge