Wenfang Xue

Corporate Credit Rating: A Survey

Sep 19, 2023

Abstract:Corporate credit rating (CCR) plays a very important role in the process of contemporary economic and social development. How to use credit rating methods for enterprises has always been a problem worthy of discussion. Through reading and studying the relevant literature at home and abroad, this paper makes a systematic survey of CCR. This paper combs the context of the development of CCR methods from the three levels: statistical models, machine learning models and neural network models, summarizes the common databases of CCR, and deeply compares the advantages and disadvantages of the models. Finally, this paper summarizes the problems existing in the current research and prospects the future of CCR. Compared with the existing review of CCR, this paper expounds and analyzes the progress of neural network model in this field in recent years.

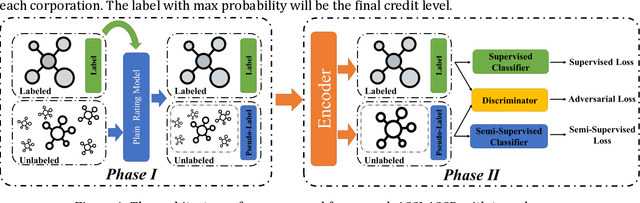

Adversarial Semi-supervised Learning for Corporate Credit Ratings

Apr 12, 2021

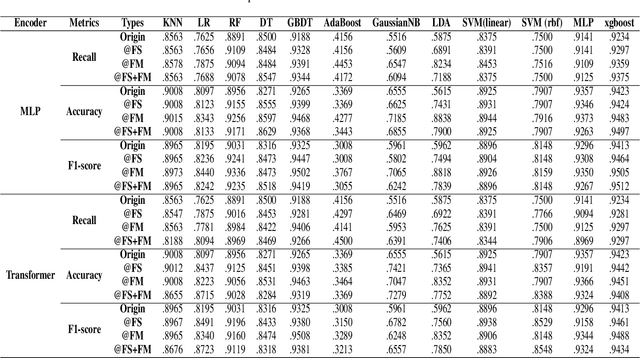

Abstract:Corporate credit rating is an analysis of credit risks within a corporation, which plays a vital role during the management of financial risk. Traditionally, the rating assessment process based on the historical profile of corporation is usually expensive and complicated, which often takes months. Therefore, most of the corporations, which are lacking in money and time, can't get their own credit level. However, we believe that although these corporations haven't their credit rating levels (unlabeled data), this big data contains useful knowledge to improve credit system. In this work, its major challenge lies in how to effectively learn the knowledge from unlabeled data and help improve the performance of the credit rating system. Specifically, we consider the problem of adversarial semi-supervised learning (ASSL) for corporate credit rating which has been rarely researched before. A novel framework adversarial semi-supervised learning for corporate credit rating (ASSL4CCR) which includes two phases is proposed to address these problems. In the first phase, we train a normal rating system via a normal machine-learning algorithm to give unlabeled data pseudo rating level. Then in the second phase, adversarial semi-supervised learning is applied uniting labeled data and pseudo-labeled data. To demonstrate the effectiveness of the proposed ASSL4CCR, we conduct extensive experiments on the Chinese public-listed corporate rating dataset, which proves that ASSL4CCR outperforms the state-of-the-art methods consistently.

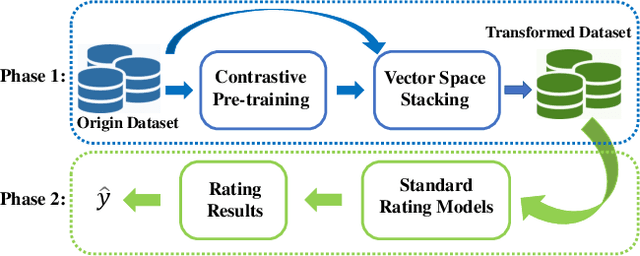

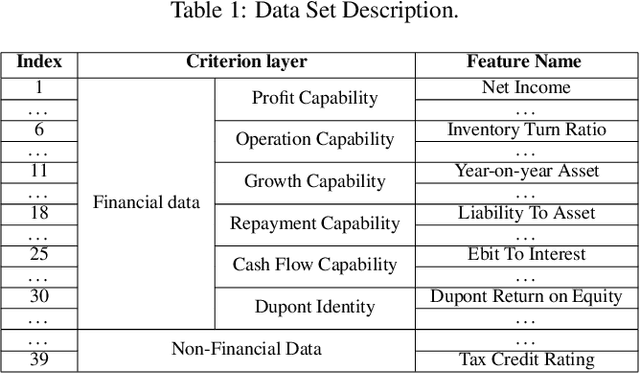

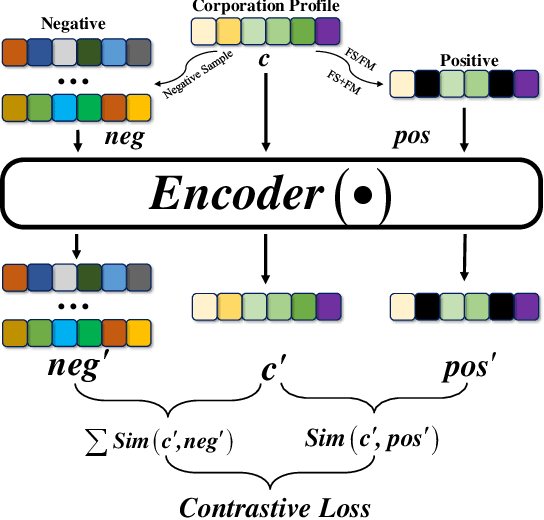

Contrastive Pre-training for Imbalanced Corporate Credit Ratings

Feb 18, 2021

Abstract:Corporate credit rating reflects the level of corporate credit and plays a crucial role in modern financial risk control. But real-world credit rating data usually shows long-tail distributions, which means heavy class imbalanced problem challenging the corporate credit rating system greatly. To tackle that, inspried by the recent advances of pre-train techniques in self-supervised representation learning, we propose a novel framework named Contrastive Pre-training for Corporate Credit Rating (CP4CCR), which utilizes the self-surpervision for getting over class imbalance. Specifically, we propose to, in the first phase, exert constrastive self-superivised pre-training without label information, which want to learn a better class-agnostic initialization. During this phase, two self-supervised task are developed within CP4CCR: (i) Feature Masking (FM) and (ii) Feature Swapping(FS). In the second phase, we can train any standard corporate redit rating model initialized by the pre-trained network. Extensive experiments conducted on the Chinese public-listed corporate rating dataset, prove that CP4CCR can improve the performance of standard corporate credit rating models, especially for class with few samples.

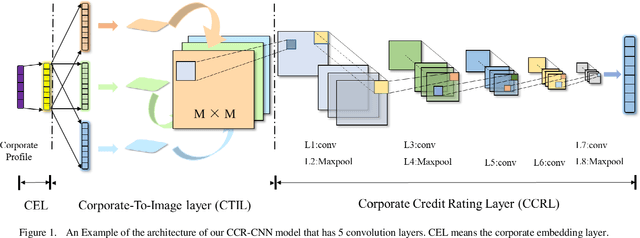

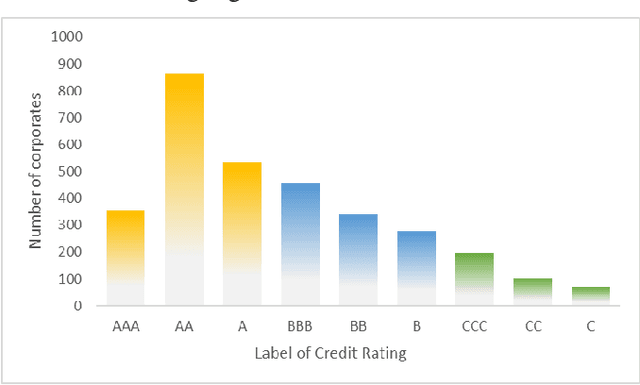

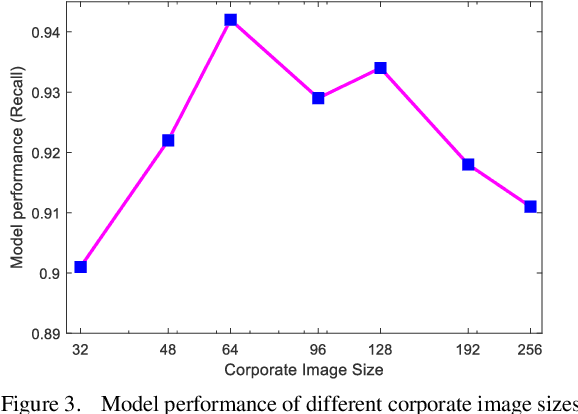

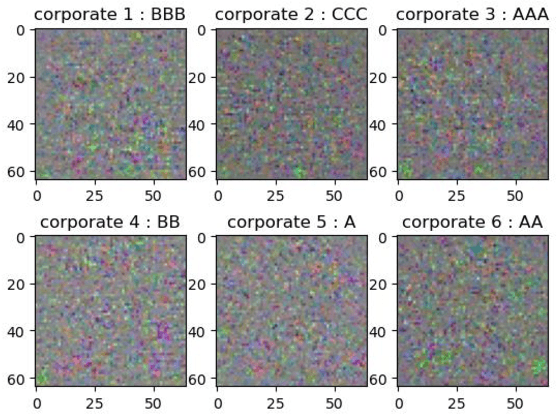

Every Corporation Owns Its Image: Corporate Credit Ratings via Convolutional Neural Networks

Dec 03, 2020

Abstract:Credit rating is an analysis of the credit risks associated with a corporation, which reflect the level of the riskiness and reliability in investing. There have emerged many studies that implement machine learning techniques to deal with corporate credit rating. However, the ability of these models is limited by enormous amounts of data from financial statement reports. In this work, we analyze the performance of traditional machine learning models in predicting corporate credit rating. For utilizing the powerful convolutional neural networks and enormous financial data, we propose a novel end-to-end method, Corporate Credit Ratings via Convolutional Neural Networks, CCR-CNN for brevity. In the proposed model, each corporation is transformed into an image. Based on this image, CNN can capture complex feature interactions of data, which are difficult to be revealed by previous machine learning models. Extensive experiments conducted on the Chinese public-listed corporate rating dataset which we build, prove that CCR-CNN outperforms the state-of-the-art methods consistently.

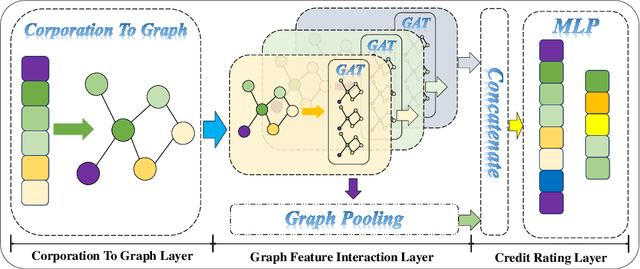

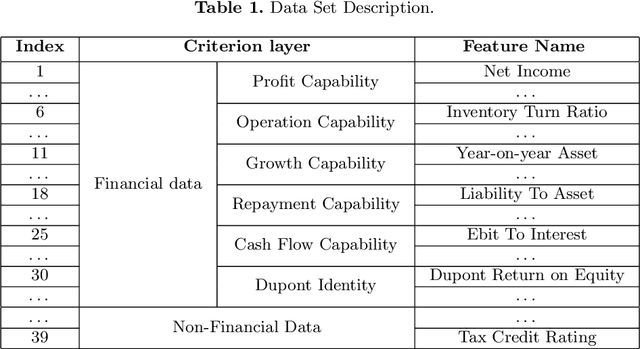

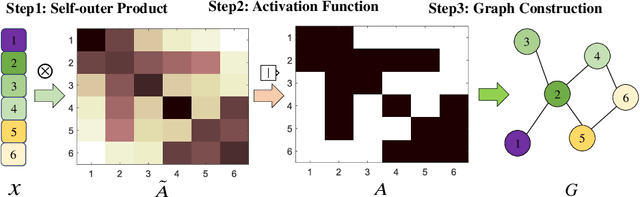

Every Corporation Owns Its Structure: Corporate Credit Ratings via Graph Neural Networks

Nov 27, 2020

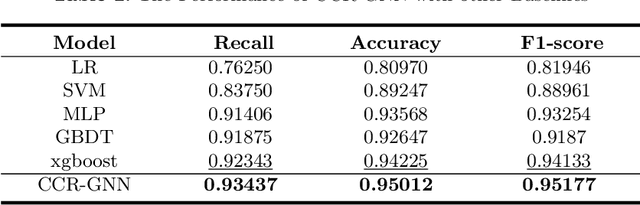

Abstract:Credit rating is an analysis of the credit risks associated with a corporation, which reflects the level of the riskiness and reliability in investing, and plays a vital role in financial risk. There have emerged many studies that implement machine learning and deep learning techniques which are based on vector space to deal with corporate credit rating. Recently, considering the relations among enterprises such as loan guarantee network, some graph-based models are applied in this field with the advent of graph neural networks. But these existing models build networks between corporations without taking the internal feature interactions into account. In this paper, to overcome such problems, we propose a novel model, Corporate Credit Rating via Graph Neural Networks, CCR-GNN for brevity. We firstly construct individual graphs for each corporation based on self-outer product and then use GNN to model the feature interaction explicitly, which includes both local and global information. Extensive experiments conducted on the Chinese public-listed corporate rating dataset, prove that CCR-GNN outperforms the state-of-the-art methods consistently.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge