Adversarial Semi-supervised Learning for Corporate Credit Ratings

Paper and Code

Apr 12, 2021

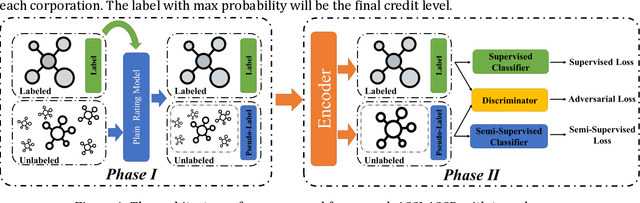

Corporate credit rating is an analysis of credit risks within a corporation, which plays a vital role during the management of financial risk. Traditionally, the rating assessment process based on the historical profile of corporation is usually expensive and complicated, which often takes months. Therefore, most of the corporations, which are lacking in money and time, can't get their own credit level. However, we believe that although these corporations haven't their credit rating levels (unlabeled data), this big data contains useful knowledge to improve credit system. In this work, its major challenge lies in how to effectively learn the knowledge from unlabeled data and help improve the performance of the credit rating system. Specifically, we consider the problem of adversarial semi-supervised learning (ASSL) for corporate credit rating which has been rarely researched before. A novel framework adversarial semi-supervised learning for corporate credit rating (ASSL4CCR) which includes two phases is proposed to address these problems. In the first phase, we train a normal rating system via a normal machine-learning algorithm to give unlabeled data pseudo rating level. Then in the second phase, adversarial semi-supervised learning is applied uniting labeled data and pseudo-labeled data. To demonstrate the effectiveness of the proposed ASSL4CCR, we conduct extensive experiments on the Chinese public-listed corporate rating dataset, which proves that ASSL4CCR outperforms the state-of-the-art methods consistently.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge