Contrastive Pre-training for Imbalanced Corporate Credit Ratings

Paper and Code

Feb 18, 2021

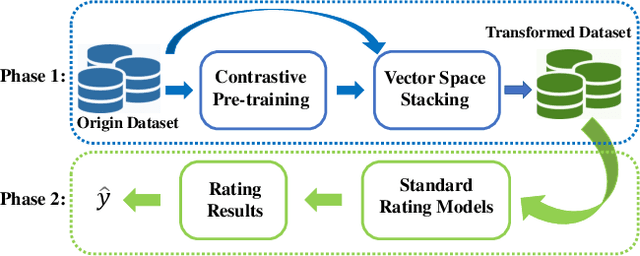

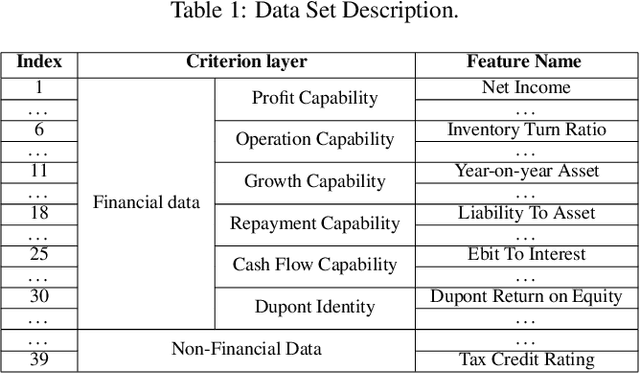

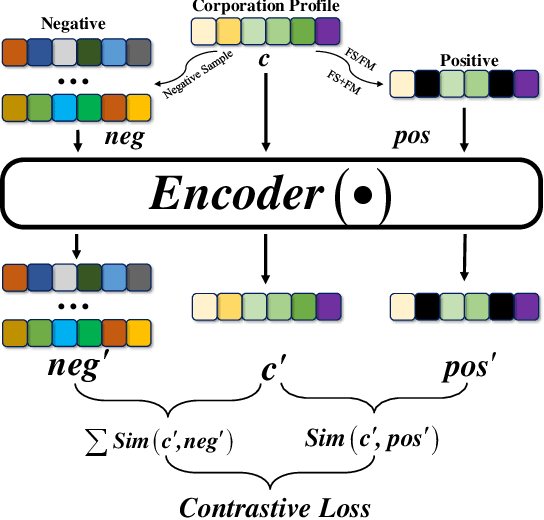

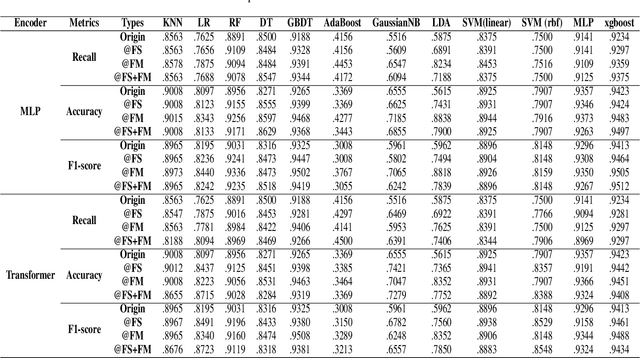

Corporate credit rating reflects the level of corporate credit and plays a crucial role in modern financial risk control. But real-world credit rating data usually shows long-tail distributions, which means heavy class imbalanced problem challenging the corporate credit rating system greatly. To tackle that, inspried by the recent advances of pre-train techniques in self-supervised representation learning, we propose a novel framework named Contrastive Pre-training for Corporate Credit Rating (CP4CCR), which utilizes the self-surpervision for getting over class imbalance. Specifically, we propose to, in the first phase, exert constrastive self-superivised pre-training without label information, which want to learn a better class-agnostic initialization. During this phase, two self-supervised task are developed within CP4CCR: (i) Feature Masking (FM) and (ii) Feature Swapping(FS). In the second phase, we can train any standard corporate redit rating model initialized by the pre-trained network. Extensive experiments conducted on the Chinese public-listed corporate rating dataset, prove that CP4CCR can improve the performance of standard corporate credit rating models, especially for class with few samples.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge