Every Corporation Owns Its Image: Corporate Credit Ratings via Convolutional Neural Networks

Paper and Code

Dec 03, 2020

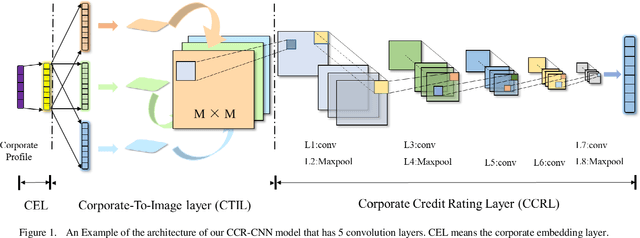

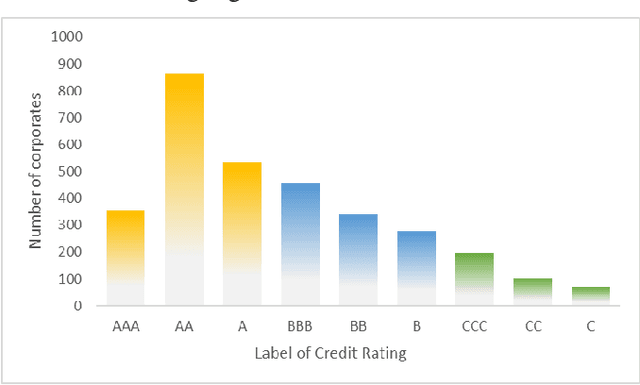

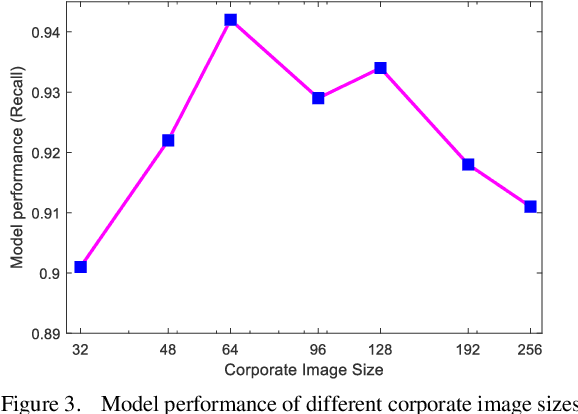

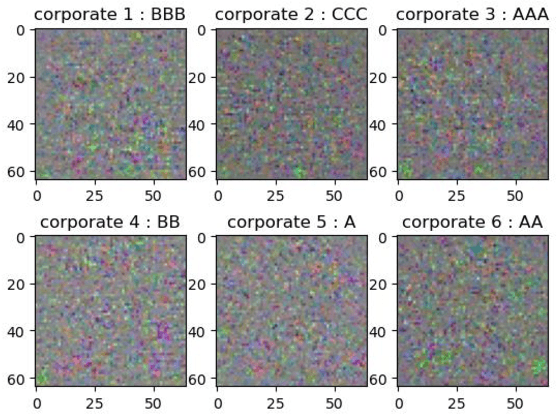

Credit rating is an analysis of the credit risks associated with a corporation, which reflect the level of the riskiness and reliability in investing. There have emerged many studies that implement machine learning techniques to deal with corporate credit rating. However, the ability of these models is limited by enormous amounts of data from financial statement reports. In this work, we analyze the performance of traditional machine learning models in predicting corporate credit rating. For utilizing the powerful convolutional neural networks and enormous financial data, we propose a novel end-to-end method, Corporate Credit Ratings via Convolutional Neural Networks, CCR-CNN for brevity. In the proposed model, each corporation is transformed into an image. Based on this image, CNN can capture complex feature interactions of data, which are difficult to be revealed by previous machine learning models. Extensive experiments conducted on the Chinese public-listed corporate rating dataset which we build, prove that CCR-CNN outperforms the state-of-the-art methods consistently.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge