Bindang Xue

Every Corporation Owns Its Image: Corporate Credit Ratings via Convolutional Neural Networks

Dec 03, 2020

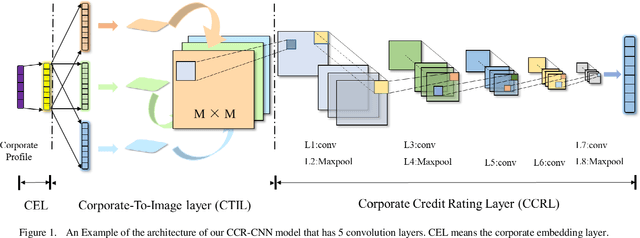

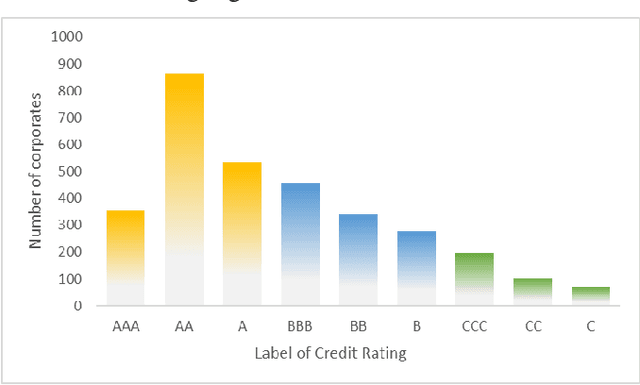

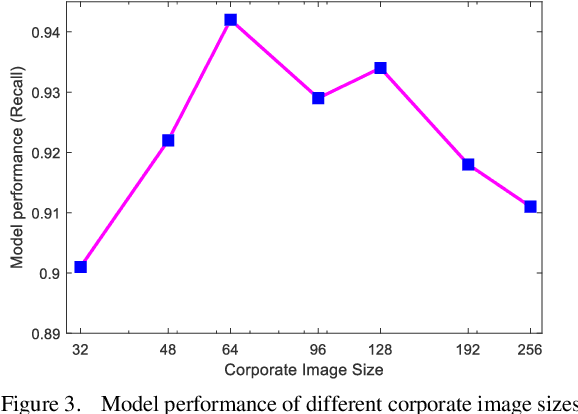

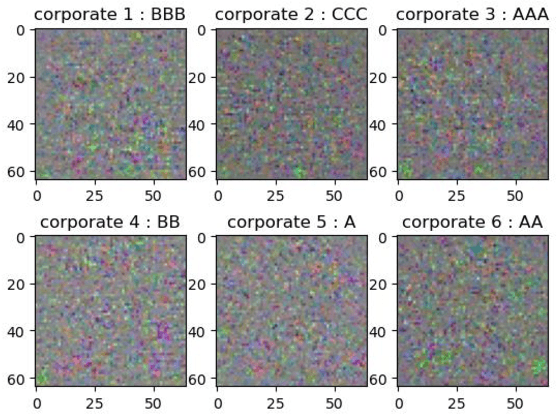

Abstract:Credit rating is an analysis of the credit risks associated with a corporation, which reflect the level of the riskiness and reliability in investing. There have emerged many studies that implement machine learning techniques to deal with corporate credit rating. However, the ability of these models is limited by enormous amounts of data from financial statement reports. In this work, we analyze the performance of traditional machine learning models in predicting corporate credit rating. For utilizing the powerful convolutional neural networks and enormous financial data, we propose a novel end-to-end method, Corporate Credit Ratings via Convolutional Neural Networks, CCR-CNN for brevity. In the proposed model, each corporation is transformed into an image. Based on this image, CNN can capture complex feature interactions of data, which are difficult to be revealed by previous machine learning models. Extensive experiments conducted on the Chinese public-listed corporate rating dataset which we build, prove that CCR-CNN outperforms the state-of-the-art methods consistently.

Every Corporation Owns Its Structure: Corporate Credit Ratings via Graph Neural Networks

Nov 27, 2020

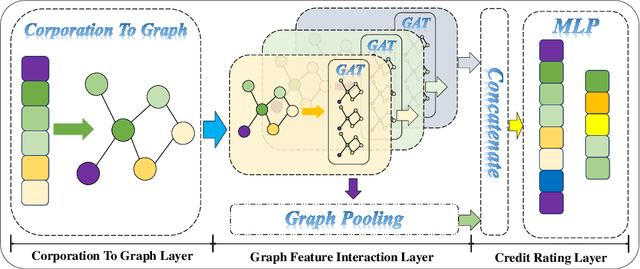

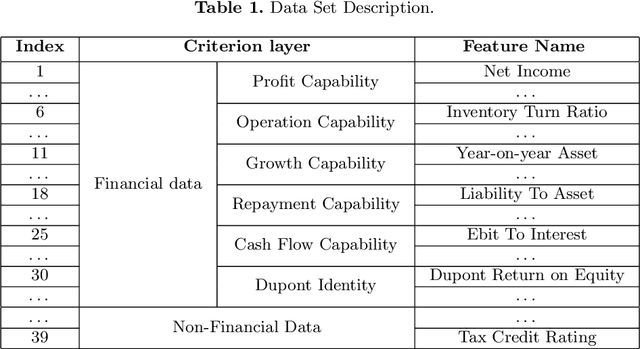

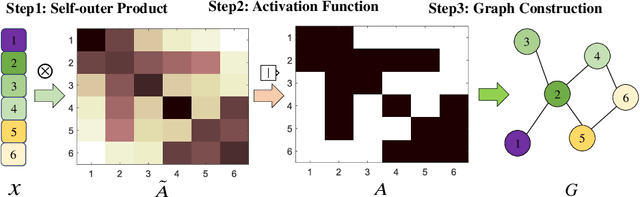

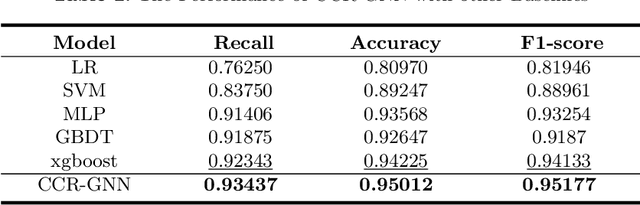

Abstract:Credit rating is an analysis of the credit risks associated with a corporation, which reflects the level of the riskiness and reliability in investing, and plays a vital role in financial risk. There have emerged many studies that implement machine learning and deep learning techniques which are based on vector space to deal with corporate credit rating. Recently, considering the relations among enterprises such as loan guarantee network, some graph-based models are applied in this field with the advent of graph neural networks. But these existing models build networks between corporations without taking the internal feature interactions into account. In this paper, to overcome such problems, we propose a novel model, Corporate Credit Rating via Graph Neural Networks, CCR-GNN for brevity. We firstly construct individual graphs for each corporation based on self-outer product and then use GNN to model the feature interaction explicitly, which includes both local and global information. Extensive experiments conducted on the Chinese public-listed corporate rating dataset, prove that CCR-GNN outperforms the state-of-the-art methods consistently.

Add to Chrome

Add to Chrome Add to Firefox

Add to Firefox Add to Edge

Add to Edge